Macroeconomic Apparatus of the Keynes’ General Theory:

The fundamental equation, Y = C + I explains the central idea of Keynes’, macroeconomic thesis; Keynes says that as income (output) increases, employment also increases.

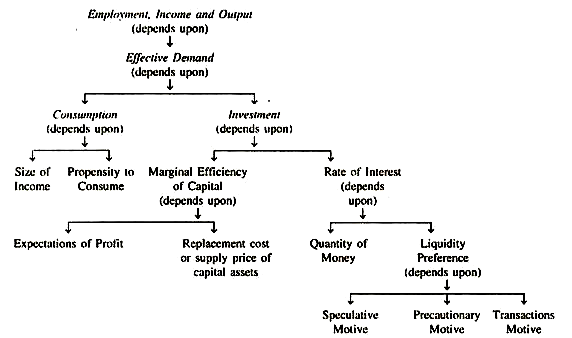

His theory is built up on the basic idea of ‘Effective Demand’ which determines employment.

The effective demand in turn depends upon (i) consumption, and (ii) investment, which depends upon marginal efficiency of capital and the rate of interest. These main factors further depend on a large number of other influences in the economy.

The general macroeconomic apparatus of the Keynesian theory of employment can be briefly summarized in the form given below:

ADVERTISEMENTS:

From the description given, it may be seen that there are several factors on which employment depends. We see that total income depends upon the volume of total employment, which depends upon effective demand (D), which in turn, depends upon consumption expenditure (D1) and investment expenditure (D2); therefore, D = D1 + D2.

Consumption depends upon the size of income and the propensity to consume. Investment depends upon marginal efficiency of capital and the rate of interest, the rate of interest depends upon the quantity of money and liquidity preference, while the marginal efficiency of capital depends upon the replacement cost of capital assets. These propositions, in essence, contain the essentials of the general macroeconomic theory of employment.

Methods of Approach:

There are two methods of approach to the study of economic theory. One may start with the study of individual units and then may shift from individual units to aggregates by summing up the various individual conclusions. But this type of approach has serious limitations. Firstly, in the calculation, say of total agricultural production or total national income, it is very difficult to obtain correct figures of production or income (and expenditure) of all production units or individuals. Lot of guess work creeps in and a good deal of uncertainty is introduced.

ADVERTISEMENTS:

Again, in matters of analysis, it may be found that what is true of a single individual may not be true of the whole community. On the theoretical level, it is again true that what may be relevant in a specific instance is not true of sum total. If we assume the economy as a whole to be only one big firm, there may be no need to study or to develop the theories of macroeconomic behaviour. “But macroeconomics is set apart as a separate discipline with its own rules because aggregate economic behaviour does not correspond to the summation of individual activities”.

To understand the idea fully, a few examples may be in order. An individual may become rich by finding a few currency notes but no country will become rich by printing few more notes. Further, one man by willingness to work for less may overcome his own unemployment, but the general unemployment problem cannot be solved in this way. Again, wage cutting in a particular firm may promote employment, but the general wage cutting in the economy as a whole may actually diminish the volume of employment.

Thus, what is prudent behaviour for an individual or single business firm may at times be a folly for a nation or a state. Examples could be multiplied.

ADVERTISEMENTS:

Most of these cases, which seem paradoxical at first, stem from the fact that what is true for an individual is true only if other things remain equal. It is a legitimate assumption in microeconomic (partial equilibrium) analysis. In macroeconomics, however, such a presumption (ceteris paribus) is not justified; therefore, quite a different approach to the analysis of macroeconomic problems must be developed. Prof. Samuelson calls above instances the ‘fallacy’ of composition and Prof. Boulding calls them ‘Macroeconomic Paradoxes’.

“Macroeconomic Paradoxes”, according to Prof. Boulding, “are those propositions which are true when applied to a single individual but which are untrue when applied to the economic system as a whole”. There is little scope for the blind application of conclusions regarding individuals to the economic system as a whole. Therefore, great caution and care is needed for the application of microeconomic conclusions to the field of macroeconomics. Hence, there is a perfect justification for evolving and developing macroeconomics as a separate branch of economic analysis.

Another method of approach consists in the direct study of macroeconomics by passing at the same time the study of individual units and directing the investigations with reference to the economy as a whole. This method, too, has its limitations. It studies the economy as a whole while ignoring the individual units, for what holds true of the economy as a whole may not be so in the case of individual units; for example, a study of the aggregates may lead us to the conclusion that no change is needed in the general price level, as with a fall in agricultural prices in the economy, other prices may have risen and the two offset each other but in reality steps may have to be taken to stabilize agricultural prices.

Micro Foundations for Macroeconomics:

An equilibrium in microeconomics is defined in terms of aggregate output and employment and is determined by the principle of aggregate demand and supply. Aggregate supply may be smaller or greater than aggregate demand indicating disequilibrium. This situation will give rise to changes in product and factor prices, quantities etc. to move the system towards equilibrium and to clear the market. This is true at micro as well as at macro level.

But how equilibrium in a microeconomic system (where partial equilibrium is established) is possible without equilibrium at macro level? Equilibrium in microeconomic system assumes the condition where there is no tendency in prices of other goods and wages to change. It implies that equilibrium in microeconomic system cannot actually settle down unless there is equilibrium at macro level; so that prices and wages may remain constant. This is to provide macroeconomic foundation to microeconomics. But not much heed is given to the need for macroeconomic foundations to microeconomics except implicit references in the writings of institutionalist writers.

In contrast, many leading economists considered micro-foundation for macroeconomic theories as essential. According to them every macroeconomic theory must be grounded or founded on microeconomic principles. So much so that they, particularly the neoclassical economists wanted that existence of micro-foundations for macroeconomics must be capable of demonstration.

J.M. Keynes did not feel the necessity of micro-foundations for macroeconomics. Rather he realized that micro-theory lacked macro-foundations because, the assumptions of microeconomics that prices of other goods, income, population etc. remains constant, in order to find partial equilibrium, are false. Hence, the microeconomics is false because these factors never remain constant. An individual may be maximising while in equilibrium but only when others are also in equilibrium. If others are not in equilibrium then the individuals equilibrium cannot remain stable.

It means microeconomics assumes existence of general or macro-equilibrium. But at macro level there is always di-equilibrium in the real world as income and other factors always undergo a change. Hence microeconomics is false and therefore cannot provide sound foundation to macroeconomics. Then, why do we feel concerned for the micro-foundations of macro-theory? The reason is that Keynes and many others accepted microeconomics as a correct method of analysis. Once microeconomics is accepted as true in terms of methodology then it can be argued that macro-theory—the theory of aggregate demand and supplies of products and factors—must have micro-foundation.

Methodological Micro-foundation to Macroeconomics:

In microeconomics, market consists of demand and supply functions of single product. Market is said to be in equilibrium if the sum of all planned quantities demanded and supplied are equal to each other. Quantities demanded and supplied in terms of the money value of goods and services produced can he extended to the entire economy to have a macro view. Keynes applied the direct aggregate demand and supply analysis. Alternatively, Hicks used ISLM analysis. These analyses indicate that the aggregated demand and supply curves imitate micro-principles of demand and supply.

ADVERTISEMENTS:

Hence, the basis of macroeconomics is the view that all of macroeconomic analysis is methodologically fully similar to microeconomic analysis. All principles of microeconomics can be transferred to macroeconomics. For instance, whenever aggregate demand exceeds aggregate supply price level must rise in the same way as the individual market price rises in case when market’s demand exceeds the supply. Of course this analysis presumes that microeconomics is true.

Nature of Micro-Foundations to Macroeconomics:

Does macroeconomics have some exogenous variables which do not matter while taking decisions at micro level? Yes, there are some constraints in the form of exogenous variables which appear at the aggregate or macro level but they do not exist or are not taken care of individualistically or in microanalysis.

Some of such exogenous variables are examined as under:

1. Emergence of Competition:

If macroeconomic conclusions differ from planned actions at micro level then it is better to start macroeconomic analysis from the beginning. This is very much feasible due to the presence of what may be called as social constraint. For instance, every producer at micro level competes with others lo maximize his profit, but, this very competition may lower the profit for all.

ADVERTISEMENTS:

Because the domain of profit has much relevance to monopoly and competition is an enemy to profit. Karl Marx pointed out that, “the attempt e.g., by each and every entrepreneur to increase his sum total of profits by investment may by its macroeconomic consequences (over investment) lower the profits for all. This is called ‘Paradox of competition”. In another similar case, under monopolistic competition each entrepreneur may find it advantageous to lower the price of his product separately so as to increase his market share. But when all cut their prices, profits is reduced for the whole industry or for them all as the demand for their output will not rise as much as they have planned. All these contradictions at macro level appear due to the presence of social constraint which was not realized individually.

2. Quantitative Constraint:

Hayek’s model of Business cycle displays that during inflation every firm tries to expand its economic activities by using more and more credit. In the process excessive demand for credit creates its non availability. Economic activities start shrinking at macro level due to the quantitative credit constraint and set the downward trend which was not realized or may not be fell individually. Hence, individuals’ behaviour cannot become a basis for aggregate behaviour.

3. Legal Constraint:

Sometimes judicial system or governments enact certain laws for the society as a whole and does not allow the principle of demand and supply to prevail. For instance, the government may fix the prices of certain products and factors (like wages) in the economy.

An Integration of the Two Approaches:

Actually, no hard and fast line of demarcation can be drawn between macroeconomic and microeconomic theory. A truly ‘general’ theory of the economy would clearly embrace both. Microeconomics would explain individual behaviour, output, incomes and the sums or these individual results would constitute the aggregates with which macroeconomics is concerned. Neither approach by itself is complete without the other.

ADVERTISEMENTS:

As a matter of fact, no serious student of economic analysis can help studying both the approaches in an unbiased manner. Both micro and macro approaches are needed for complete understanding and solution of economic problems. What particular approach will be best suited for a scientific understanding of a given economic situation depends on the object we have in mind. For example, the ‘macro and ‘micro’ models of thinking may, at times, lead to conflicting conclusions, but by themselves they are neatly logical tools of analysis and need not come in conflict with each other.

In actual practice, the analysis of the economy is not, in fact, cannot be conducted separately in two watertight compartments. The two approaches overlap and are not mutually exclusive. As one analyses macroeconomic variables and their relationships, he must also allow for changes in microeconomic variables that may have an impact on the macroeconomic variables and vice versa.

From the macroeconomic point of view, the nation’s material welfare will be greater, the closer the economy comes to full utilization of its total resources, taking as given the allocation, good to bad, of the amount of these resources that are actually employed in the production of economy’s output. From the microeconomic viewpoint, material well-being will be greater the closer the economy comes to optimum allocation of its resources, taking as given the degree of utilisation, partial to full, of its total resources.

The basic goal is the same in both the cases—the maximum welfare of the nation— this goal can be attained only when there is both full utilization and optimum allocation of all available resources.

The classical economists had always adopted the micro approach. This was a grave mistake on their part, which led to the neglect of the most important problems of income, output and employment in the economy. Microeconomic approach proved quite inadequate for solving the problems of an economy. Comparing neo-classical price theory with neo-classical macroeconomic theory, Keynes noted, ‘So long as economists are concerned with what is called the theory of value, they have been accustomed to leach, that prices are governed by the conditions of supply and demand; and in particular changes in marginal costs and the elasticity of short-period supply have played a prominent part.

But when they pass in volume II, or more often in a separate treatise, to the theory of money and prices, we hear no more of these homely but intelligible concepts and move into a world where prices are governed by the quantity of money, by its income velocity… and little or no attempt is made to relate these… phrases to our former notions of the elasticities of supply and demands”. What is, therefore, needed is a harmonious integration of both the approaches, as we cannot entirely depend upon one to the exclusion of the other.

ADVERTISEMENTS:

If we do so, our conclusions may not only be entirely wrong and misleading but also may prove highly harmful if adopted for practical policy matters. Just as the right and the left foot are needed for swift walking, we need ‘micro’ and macro’ approaches for an efficient analysis of the economic problems of the day. Once a bridge between ‘micro’ and ‘macro’ economics is erected, all the theoretical concepts and laws of micro-theory will help us to understand price level and employment phenomena more clearly.