Everything you need to know about the techniques of control used by the management. Control has a regulating effect. There are a number of techniques (or tools) that help a manager in effective controlling.

It is important for a manager to know the areas of control and tools and techniques of control. Proper use of controlling techniques helps an organization to survive in the highly changing economic world.

Techniques of control can be studied under the following heads:

I. Accounting:- i. Break Even Analysis ii. Standard Costing iii. ABC Costing iv. Budgetary Control v. Inventory Control vi. Responsibility Accounting

ADVERTISEMENTS:

II. Control through Audit:- i. Management Audit ii. External Audit iii. Internal Audit

III. Quality Control:- i. Inspection ii. Statistical Quality Control (SQC) iii. Total Quality Management (TQM) iv. Six Sigma v. Quality Circle (QC) vi. Benchmarking vii. Economic Value Addition (EVA) viii. International Quality Standards

IV. Control through Network:- i. Programme Evaluation and Review Technique (PERT) ii. Critical Path Method (CPM)

V. Management Information System (MIS)

ADVERTISEMENTS:

VI. Overall Control System:- i. Control through Financial Statement ii. Return On Investment (ROI) iii. P&L Statement iv. Balance Sheet v. Ratio Analysis vi. Personal Observation

Additionally, some other techniques of control are:

1. Statistical Control Reports 2. Personal Observation 3. Cost Accounting and Cost Control 4. Break-Even Analysis 5. Special Control Reports 6. Management Audit 7. Standard Costing 8. Return on Investments 9. Internal Audit 10. Responsibility Accounting

11. Managerial Statistics 12. Performance Evaluation and Review Technique (PERT) 13. Critical Path Method (CPM) 14. Gantt Milestone Chart 15. Production Control 16. Management Information System 17. External Audit Control 18. Zero-Base Budgeting 19. Standing Orders 20. Budgetary Control.

Tools and Techniques of Control Used by Management: Accounting, Quality Control, Overall Control System and a Few Others

Techniques of Control – The Nature and Use of Managerial Control Techniques

Various methods are used by the management for controlling the various deviations in the organisation. Let us study them briefly.

ADVERTISEMENTS:

The nature and use of managerial control techniques are discussed below:

Technique # 1. Statistical Control Reports:

These types of reports are prepared and used in large organisations. Reports are prepared in quantitative terms. Then, the variations from standards are easily measured. In this way, control is exercised by the management. A periodical report of sales volume is an example of statistical control reports.

Technique # 2. Personal Observation:

Using this technique, the manager personally observes the operations in the work place. The manager corrects the operations whenever the need arises. This is the oldest method of control. Employees work cautiously to get better performance. The reason is that they are personally observed by their supervisor.

Personal observation is a time-consuming technique and the supervisor does not have enough time to afford personal observation. Personal observation technique is disliked by the honest and efficient employee. The observer may be biased in performance evaluation.

Technique # 3. Cost Accounting and Cost Control:

Profit of any business depends upon the cost incurred to run a business. Profit is maximised by reducing the cost of operation or production, so, the business concern gives much importance to the cost accounting and cost control. Management uses a number of systems for determining the cost of products and services. The cost accounting procedures and methods differ from one industry to another according to the nature of industry. They are used for effective cost control and cost reduction.

Technique # 4. Break-Even Analysis:

It is otherwise called as – ‘cost volume profit analysis.’ It analyses relationship among cost of production, volume of production, volume of sales and profits. Here, total costs are divided into two i.e., fixed cost and variable cost. Fixed cost will never change according to the changes in the volume of production. Variable cost varies according to the volume of production. This analysis helps in determining the volume of production or sales and the total cost which is equal to the revenue.

The excess of revenue over total cost is termed as profit. The point at which sales is equal to the total cost is known as ‘Break Even Point’ (BEP). In other words, the break-even point is the point at which there is no profit or loss.

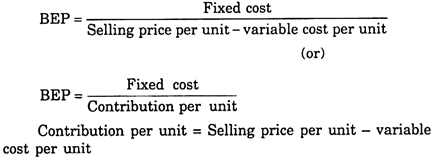

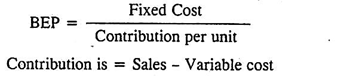

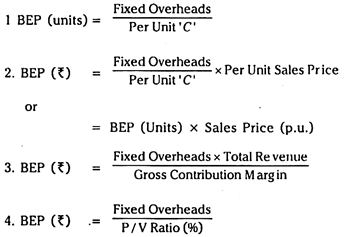

The break-even point is calculated with the help of the following formulae:

The break-even point analysis helps in managerial control in several ways.

Technique # 5. Special Control Reports:

This report may or may not contain statistical data. Using this technique, a particular operation is investigated at a specified time for a particular purpose. This is done according to the requirements of management but not in regular basis. The deviations from standards are paid additional attention and corrective action is taken. Handling complaints of damage is an example of this type of control technique.

Technique # 6. Management Audit:

Management audit is an independent process. It aims at pointing out the inefficiency in the performance of management functions such as planning, organising, staffing, directing, controlling and suggesting possible improvements. It helps the management to handle the operations in an effective manner. Management audit is not a compulsory audit and not enforced by law.

Technique # 7. Standard Costing:

Standard costing is used to control the cost.

ADVERTISEMENTS:

The following are the steps involved in standard costing:

i. Determination of cost standards for various components such as material, labour and overhead.

ii. Measurement of actual performance.

iii. Comparison of actual cost with standard cost to find variations.

ADVERTISEMENTS:

iv. Finding the causes of variations.

v. Taking measures to avoid the variations in future.

Technique # 8. Return on Investments:

Return on investment is also known as return on the capital employed. Using this technique, the rate of profitability is identified by the management. The amount of profits earned by the company is different from the rate of profitability of the company.

The difference between the cost and revenue is profit. The rate of profitability is the earning capacity of the company. Return on investments is calculated by dividing the net profit with the total investment or capital employed in the business organisation.

Technique # 9. Internal Audit:

Internal audit report is prepared at regular intervals, normally by months. It covers all the area of operations. This report is sent to the top management. The management takes steps to control the performance on the basis of the report. Internal audit report emphasises the degree of deviations from the expectations. It is very useful to attain the objectives on timely basis.

Technique # 10. Responsibility Accounting:

The performance of various people is judged by assessing how far they have achieved pre-determined objectives. The objectives are framed section-wise, department-wise and division-wise and assessed similarly. Costs are allocated department-wise rather than product-wise. Each department, section or division, is fixed as responsible centres. An individual is responsible for his area of operation in a particular section, department or division.

Technique # 11. Managerial Statistics:

ADVERTISEMENTS:

Using the managerial statistics technique, the manager compares the past results with current results in order to know the causes for changes. These are very useful to the management in planning and decision-making for the future. According to Kenit O. Hauson, “Managerial statistics deal with data and methods which are useful to management executives in planning and controlling of organisation activities.”

Technique # 12. Performance Evaluation and Review Technique (PERT):

This technique is used to solve the problem which crops up once or a few times. It is not useful in tackling the problems which come up continuously. The PERT was developed by Booz, Allen and Hamilton. They used this technique in Polaris Submarine Project under the sponsorship of U.S. Navy. The PERT technique is very useful for construction projects, publication of books etc.

Technique # 13. Critical Path Method (CPM):

This technique also follows the principle of PERT. The technique concentrates on cost rather than duration. CPM assumes that duration of every activity is constant. Time estimate is made for each activity. CPM technique was developed by a group of employees of DU de Nemours Company.

Technique # 14. Gantt Milestone Chart:

This technique was an old one and at present, it is not in use. The reason is that this technique emphasises only on production scheduling but not on product quality. This technique was propounded by Henry I. Gantt.

Technique # 15. Production Control:

The production control technique is necessary for smooth functioning of an organisation. Production control involves planning of production, determination of stock level of raw materials, finished goods, selection of process, selection of tools in production, etc.

According to Spreigel, “Production control is the process of planning in advance of operations, establishing the exact route of each individual item, part or assembly, setting, starting and finishing dates for each important item, assembly and the finished product and releasing the necessary orders as well as initiating the required follow up to effectuate the smooth functioning of the enterprise.”

Technique # 16. Management Information System:

ADVERTISEMENTS:

Relevant information is collected and transferred to all the persons who are responsible to take decisions. A communication system is developed through which all levels of persons are informed about the growth of the organisation. Whenever the deviation is found, the corrective or control action is taken by the responsible person.

The management information system emphasises the need for adequate information in time for taking the best decision. Thus, management information system helps the management in managerial decision-making by giving the right information at the right time and in the right form.

Technique # 17. External Audit Control:

External audit is a must to all the joint-stock companies under the purview of statutory control. So, it is otherwise known as statutory audit control. This type of audit protects the interests of the shareholders and creditors of the company.

The external auditor certifies that all the books of accounts are kept as per the requirements of law and supplies all the necessary information for the purpose of audit and the balance sheet presents a true and fair view. The external audit is conducted by the qualified auditor. The qualifications of such type of auditor are fixed by the Central Government.

Technique # 18. Zero-Base Budgeting:

This is a new technique and has become popular within a short period. It is a new approach to budgeting. Zero base budget is prepared without considering the previous year’s figures. This technique requires the recalculation of all organisational activities to ascertain which should be eliminated or reduced or increased. In other words, the funds are estimated at current requirements. It means finding out how much amount is necessary to complete an ongoing project.

Technique # 19. Standing Orders:

Standing order covers rules and regulations, discipline, procedure and the like. Rules and regulations are framed according to the requirements of administration. For example, no employee should leave the office before office time without getting prior permission in writing.

Technique # 20. Budgetary Control:

ADVERTISEMENTS:

The preparation of budget is also one of the control techniques followed by the management.

Techniques of Control – Accounting, Control through Audit, Quality Control, Control through Network, Management Information System and Overall Control System

There are many control techniques in the realm of management. It is difficult to draw up a complete list of control techniques emerging in management arena. However they can be broadly divided into two groups’ namely traditional techniques and contemporary techniques.

I. Accounting:

Break even analysis is an analysis of inter-relationship between cost of production, volume of operation and profits. Hence, it is called cost volume profit analysis. The break-even point is the point at which total costs are equal to total revenue. At break-even point there is neither profit nor loss for the business. Under this approach, the costs are split into two categories namely fixed cost and variable costs.

ADVERTISEMENTS:

Material and labour are of variable nature while rent, insurance, salaries and wages, interest etc., are of fixed nature. Fixed costs remain the same irrespective of volume of output while variable costs vary with output. Variable per unit is same whereas fixed cost per unit is varying.

Break Even Point is found out by the formula given below:

2. Standard Costing:

Costing is concerned with determining the cost of product under the existing conditions. Cost control is effected through pre-determined cost called standard cost. This standard cost is pre-determined to reflect quantity price and level of operations. This standard cost is set for material, labour and overheads. The actual cost is compared with standard cost to figure out the variations from the standard cost.

If the standard cost and actual cost are equal, no action is envisaged. Where the deviation is deep, an attempt is made to probe into it. Well thought out action is initiated to synchronize the actual cost with the standard cost.

The main logic behind ABC is that only the product or customers for whom costs are incurred should bear the cost but no other products and other customers. It provides accurate cause and effect based allocation of cost. Hence, the relation between material and labour has changed in contemporary context.

This was propounded by Johnson and Kaplan. ABC costing denotes activity based costing. This is a control system which identifies various activities needed to provide a product and determines the cost of those activities. Under conventional costing only two components i.e., material and labour account for major share of product cost.

Budget is a tool that helps the management in planning and controlling exercises. Budget refers to the quantitative statement prepared and approved prior to a defined period of time. It stands for the policy to be pursued during the period for accomplishing the objective.

(i) Functional budget – There are various functional budgets prepared for different purposes.

They have been listed below:

a. Sales budget – Estimate of expected sales in the budget period.

b. Production budget – Estimate of production for the year.

c. Material budget – Estimate of raw materials required for product-wise production.

d. Labour budget – Forecast of labour required for manufacturing a product.

e. Manufacturing overheads – Forecast of manufacturing overhead needed for products.

f. Administrative overheads – Estimate of administrative overhead required in the budget period.

g. Distribution overheads – Indicates selling and distribution overhead to be incurred for the budget period.

h. Cash budget – Estimate of cash receipts and cash payment for future period of time.

i. Capital expenditure budget – Estimate of capital expenditure required to be made in fixed assets in the budget period.

(ii) Master budget – This is the summary of all functional budgets.

(iii) Fixed budget – It is a budget prepared for a given level of activity.

(iv) Flexible budget – This budget represents budget prepared for various levels of activity.

(v) Zero based budgeting – Under this budgeting, beginning is taken as zero and the activities are evaluated afresh in the light of fresh conditions. Thus, the inefficiency of the past is not carried forward to the current year. This is a systematic way of evaluating different operations and programmes. It helps in controlling wasteful expenditure.

It enables the management to reallocate resources according to current importance. It does not allow an activity just because it was allowed in the previous year. Thus it forces the management to review the activities before deciding on fund allocation. This type of budgeting promotes operational efficiency.

Benefits of Budgetary Control:

i. Clear Cut Planning:

Budgetary control enables the manager to plan activities to be carried out in a crystal clear manner. There is no role for ambiguity in budgeting environment.

ii. Target Clarity:

Since budgetary control is closely associated with numerical goal, it does not leave any ambiguity as to the targets. Every manager gets clarity about what he/she is supposed to do in a given year. This provides a basis for performance evaluation.

iii. Efficient Utilization of Resources:

It leads to cautious utilization of resources. It spurs efforts to accomplish goals and at the same time forces the department to operate within the budget. Thus it promotes rational use of organization’s resources.

iv. Practice of MBE Concept:

Managers are able to focus their attention sole on deviations from the budget. In other words, the performance gap may be explained by faulty planning, flawed policies or managerial inefficiencies. Management can take appropriate action to address the gap. Thus it enables the practice of Management by Exception concept (MBE).

v. Delegation of Authority:

It provides an effective means by which managers can delegate authority without forgoing ultimate control over subordinates.

vi. Controlling Expenses:

It keeps the expenses in check by reminding the operating manager of budgetary limits. No one is allowed to overshoot the budget. It serves just like a brake to the wheel of vehicles.

vii. Fixing Accountability:

Budgeting is an important device for fixing accountability for results. Budget serves as a job description and define the task to be accomplished. There is no room for buck passing in budgetary environment.

viii. Co-Ordination:

All departments are involved in the budgeting exercise. As departments are inter-dependent and related to one another, they are forced to consult one another in framing their respective budgets. Finally, top management consolidates all the functional budgets and prepares a single midget called master budget. This process of integration aids in co-ordination.

5. Inventory Control:

Control over inventory is exercised through:

Importance:

Inventory accounts for higher proportion of current assets. The term inventory refers to raw materials, work in progress and finished goods. Maintenance of excessive, inventory implies blocking of capital in inventories, warehousing cost, insurance of goods stored, rent to the building where it is stored, spoilage, salaries to staff engaged in storage of goods, risk of obsolescence, etc.

On the other hand maintenance of too low inventory implies the danger of stock out situation and the stoppage of production process. In this context, maintenance of optimum inventory assumes significance to strike a balance between too much and too low inventory levels.

i. ABC analysis

ii. Economic Order Quantity (EOQ)

iii. Just in time

iv. Fixation of stock levels.

i. ABC Analysis:

Under ABC analysis, the inventory items are categorized into three groups. Based on this criterion, items of high consumption value which are critical to production process come under ‘A’ category; items of moderate consumption value fall under ‘B’ category and category ‘C’ contains items of low consumption value. According to this concept, maximum attention should be paid to category A as they are most critical in terms of monetary value followed by B and C.

Inventory manager has to ensure that they do not remain in stock for long time. The main advantages of ABC analysis is that huge economy is achieved in inventory carrying cost and investment in inventory is regulated and kept under control. The criticality of any item is judged not in terms of its monetary value but in terms of its importance in the production process.

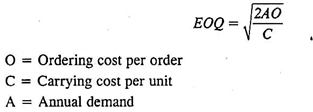

ii. Economic Order Quantity:

This is one of the inventory control methods used to find out the size of the quantity to be ordered so that cost of carrying the inventory and cost of ordering the inventory are equalized. This is the optimum quantity to be ordered. There are two costs involved in determining economic order quantity, namely ordering cost and carrying cost.

They have been tabulated as under:

Ordering Cost:

a. Cost of processing purchase order

b. Transportation

c. Inspection of quality

d. Expediting overdue order

e. Stationery and postage

f. Telephone

Carrying Cost:

a. Store keeper salary

b. Racking & pulverization

c. Heating and lighting

d. Depreciation on racks and furniture

e. Interest capital invested in inventory

f. Obsolescence

g. Deterioration

h. Damage by insects and cost of disinfectant

Where the frequency of order is more, the ordering cost could be higher and the enterprise may lose volume discount. In short, the smaller the order size the greater the ordering cost. Next important component is carrying cost. The cost of carrying is proportionate to size of inventory held in stores and time of storage. These costs are expressed as rate per unit.

Once these two costs are calculated, the economic order quantity is arrived at by the following formula:

By applying the formula, the economic order quantity is found out. This quantity equalizes the cost of ordering and cost of storing the materials. In other words, investment in inventory is optimized.

iii. Just in Time (JIT):

This is a Japanese concept which took birth in the mid-1970. In Japanese language it is known as Kanban. Through this concept, investment in inventory is brought to the barest minimum. The logic behind the JIT concept is that organizations should manufacture the products only when customers need it and to the quantity required. This minimizes cost of carrying and cost of ordering.

JIT concept is applicable to concerns manufacturing standardized product which enjoy consistent demand. This concept is of little application to enterprises which produce seasonal and non-standardized goods. They face irregular purchase of raw materials, uneven production cycle and greater accumulation of inventory.

To practice JIT concept, there should be perfect coordination between organization and supply chain members. Even concerns practicing JIT face the problem when they get a spate of orders and supply chain is disturbed by disputes with suppliers. Therefore a buffer stock needs to be maintained, to keep the facility operating.

iv. Fixation of Stock Levels:

Fixation of stock levels like minimum order level, maximum order level and reorder level enable the store keeper to maintain the optimum size of inventory obviating overstocking and under stocking of inventory thereby saving inventory cost.

6. Responsibility Accounting:

Responsibility accounting is a system of accounting whereby the performance of various people is judged by assessing how far they have achieved the predetermined target set for the divisions/departments/sections for which they are responsible. Each person is accountable for his area of operation. Costs are assigned to each centre rather than to products. The costs allocated to cost centres fall into two categories: uncontrollable and controllable costs. The head of each responsibility centre is responsible for cost control of his segment.

There are four types of responsibility centres.

They are:

a. Cost Centre:

Cost is one of the responsibility centres wherein the manager is held responsible for controlling the cost. He/she is responsible for salaries, supplies and other costs required for functioning of the centre. For example, R&D, human resources, accounting, etc., represent cost centres.

b. Revenue Centres:

It is a centre wherein the manager is held responsible for income. The performance of his centre is appraised in terms of profits earned in relation to targeted profit. Marketing and sales department stand for revenue centres.

c. Profit Centres:

This is a self-contained unit. It incurs the costs and earns revenue. It can control its own costs. Many large corporations have multiple product divisions. Each division is called a profit centre with each division making a profit for its products.

d. Investment Centre:

In this centre, the manager in charge is held responsible for earning a given return on the investment made on it from time to time. Return on investment is used as basis for judging the performances of the centre.

II. Control through Audit:

The success or failure of an organization depends on the quality of management in general. But unfortunately none of the control techniques judges the quality of management. Management audit is an answer to this issue. It is an evaluation of management as a whole. It is an independent and critical examination of the entire management process.

This audit examines the total managerial functions as well as policies, procedures, controls, etc., to advise the top management for necessary adjustment. The scope of management audit is wide. In the year 1962, Jaikson Martindell of American Institute of Management architected the concept of management audit. He identified ten areas for management audit.

They Include:

i. Organizational structure

ii. Executive appraisal

iii. Functioning of the management board

iv. Soundness of earnings

v. Economic function

vi. Service to stakeholders

vii. Research and development

viii. Fiscal policy

ix. Production efficiency

x. Sales vigor

W.T. Green wood divided management audit into two parts: Audit of management function and management decision audit dealing with quality of decisions in areas like planning, marketing, production, finance, accounting and HR.

An external audit is an examination and evaluation of the organization’s financial accounts and transactions by professional auditors who are not employees of an enterprise. They examine whether accounts have been prepared as per accepted accounting principles, accepted standards and as per the provisions of the Act. They certify that accounts reveal the true profit or loss and exhibit fair view of assets and liabilities on a particular date.

It is conducted once a year. It is conducted by an independent person who is not at the mercy of the management. Hence the report given by him enjoys higher reliability among the stakeholders of an organization.

This audit is conducted by the staff of an organization on behalf of top management. The scope of audit is determined by top management. It is conducted mainly to ensure that existing controls are effective and adequate e.g., system of wage payment, system of purchasing materials, system of guarding the assets, system of making payments, system of quality control, etc.

They ensure whether policies and procedures prescribed for various aspects are followed; whether resources are utilized economically and efficiently; whether wastages are within the permitted limit – whether there are adequate safe guards to protect asset and so on. The findings are presented to the top management which uses them to evaluate the organization control mechanism.

III. Quality Control:

Quality Control Implies – (a) Determining the tolerance i.e., deviations allowable, (b) Conducting inspection and test of units, (c) Isolating acceptable from those not conforming to the contemplated quality, and (d) Bringing causes of deviation to quality management.

The different techniques of quality control are:

Inspection is that component of quality control programme that is concerned with checking the conformance of units produced to prescribed standards. The inspection may be centralized or decentralized. Under centralized inspection, the entire work is directed to centralized location for checking the quality infused while decentralized inspection envisages sending inspector to the shop floor for checking the quality. Inspection is done mainly through sampling. Sample size is determined scientifically.

2. Statistical Quality Control (SQC):

This is a statistical process control for maintenance of quality standards. It uses periodic random sampling drawn during the actual production to determine whether acceptable quality standard is maintained. If not, production is stopped for remedial action. This method informs the management whether things are going the way they should. This method makes use of control chart and acceptance sampling to ensure quality.

i. Control Chart:

This is a graphic device revealing the deviation from the prescribed quality standard by establishing upper and lower control limits.

As long as sample points fall within the upper and lower limits, the process is said to be in control. If they fall outside the limits, it indicates malfunction in the system.

ii. Acceptance Sampling:

SQC procedures which check the products already completed are known as acceptance sampling. A limit for the number of defectives is set down. A sample is taken on a random basis. Where the sample is within the limit, the lot is accepted. Thus its acceptance or rejection depends on the predetermined level.

3. Total Quality Management (TQM):

Dr. Edward Deming is the architect of the TQM concept. Total quality management signifies a total system approach aimed at creating an organization committed to continuous quality improvement in all spheres of its functioning. Thus quality improvement is not confined to products or process. It permeates the entire organization.

This approach envisages involving all those across the departments in improving the quality of various aspects of organizational functioning. Continuous improvement is core to TQM. This requires integrative mechanisms that help group problem solving, information sharing and cooperation across all organizational units. Thus the entire organization has to operate like a closely knit team.

It is of recent origin. Six-sigma is a unit of statistical measurement and prescribes standard deviation from a given norm of defects. The higher the number of sigma’s, the fewer the deviations from the norm. According to this concept, the production process should be 99.99966 per cent accurate, creating just 3.4 defects per million units. Though it is impossible to achieve it, it requires every organization to achieve it. This approach was used by Motorola and General Electric (GE) during late 1980s.

Quality Circle is a group of 6 to 12 employees who meet regularly to address problems affecting work areas. This group works as a part of the organization continuously in the work place. The group meets at a set time during the work week. The members identify the problem and seek to find solution. The circle members are empowered to collect data to solve any problem.

The members receive training in problem solving, team building statistical quality control and group process. QC generally recommends solution for quality and productivity problems which may or may not be implemented by the management. It is not merely a suggestion system or just quality control group. It is not a task force a but permanent feature of the organization. The reason for using QC is to push the decision-making to an organization level at which recommendations can be made by people who do the job and know it better than anyone else.

This concept was introduced by Mr. Xerox in 1979. This is a continuous process of measuring the products, services and practices against the toughest competitors or those companies recognized as industry leaders. As per this concept, company should honestly analyze its current procedures, and determine areas for improvement. It should carefully choose the competitor worthy of emulation.

For example, Xerox studied the order filling techniques of L.L. Beon and learned the way to but warehouse cost by 10%. Thus companies can emulate best internal processes and procedures of competitors if they are worth emulating.

7. Economic Value Addition (EVA):

Hundreds of companies including AT&T, Quaker Oats, Coca-Cola, Philips etc., have set EVA measurement system as a new metric to gauge financial performance. EVA is defined as a company’s net (after-tax) operating profit minus the cost of capital invested or capital employed in business.

Measuring performance in terms of EVA is to capture all the things a company can do to add value from its activities such as running business efficiently, satisfying customers, rewarding shareholders and the like. Each department or process in the organization is measured by EVA. Stern Stewart architected the EVA concept in the 1990s.

The use of EVA is a complex one. Enterprises must select from more than 150 possible accounting adjustments to bring about EVA measure. For example, Whirlpool Corporation examined 150 adjustments and finally arrived at the ones thought to make the most difference. The technique is fraught with problems because of differences in the ways EVA measurements are adjusted. Hence companies find it difficult to compare their performance in terms of EVA parameters.

8. International Quality Standards:

A set of international standards for quality management was adopted in the late 1980s by more than 50 nations including the USA. These standards set uniform guidelines as to what manufacturing organizations should do to ensure that their products conform to high quality requirements.

These standards do not specify the input and output in this regard but prescribes some process specifications like training, design, marketing, testing, packaging, record keeping, refining waste disposal, etc. Federal Express, Xerox, GE, Exxon, etc., are some of the companies holding these certificates.

Companies which have put in place a quality management system can successfully negotiate and meet the desired specification. Companies whose facilities pass an independent audit may obtain ISO 1000 standard certificates.

IV. Control through Network:

Network analysis is being widely as a tool of management planning and control. Under this approach, a project is split into small activities or operations to be arranged in a logical sequence. The sequence in which various activities or operations involved in a project are executed and the time limit within which they are to be executed is predetermined. A network diagram is drawn to highlight the inter-dependence and inter-relationship among the various operations involved in the project.

The construction of network diagram requires in-depth knowledge about each and every component of a project. Every project is time bound and therefore each activity is to be optimally timed. Every activity is called an operation required to accomplish the goal. It is denoted by an arrow in the diagram. Every activity needs to be completed in a specific time span. An event is a point of time when an activity is begun or completed.

Two most well-known techniques are:

1. PERT, and

2. CPM.

1. Programme Evaluation and Review Technique (PERT):

PERT is a visual network most appropriate to a managing complex project.

Steps involved in PERT are:

i. Breaking down the project into clearly identifiable activities.

ii. Constructing a networking diagram showing sequence of activities with a start and end point.

iii. Preparing three time estimates for the project namely, optimistic time (short times), pessimistic time (longer time) and normal time (likely time).

iv. Determining the critical part. It represents the longest path through network in terms of time. Critical path represents the sequence of activities. Sometimes critical factors may intervene and disturb the sequence thereby delaying the project.

v. Modifying the initial plan to minimize the impact of delay.

Characteristics/Time Estimates of PERT:

Various time estimates calculated in PERT techniques are:

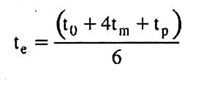

a. Optimistic time (t0) – It is the shortest possible time in which an activity can be completed if everything is favourable.

b. Most likely time (tm) – It is the time in which the activity is normally expected to be completed under normal contingencies.

c. Pessimistic time (tp) – It is the time which an activity will take to complete in case of difficulty i.e., if most of the things go wrong. It is the longest time among all the three times.

d. Expected or average time (te) – The expected time (te) for each activity can be calculated as –

2. Critical Path Method (CPM):

Basic principles governing PERT and CPM are one and the same. Critical Path Method (CPM) is applicable to both small and large projects. CPM is a technique, used for planning and controlling the logical sequence of operations for accomplishing a project. This technique involves breaking projects down into various activities and determining the required length of time for each activity.

i. The CPM planning technique involves the following steps-

a. Specify all activities in the projects clearly.

b. Arrange activities in logical sequence.

c. An arrow diagram reflecting the sequence relationships must be developed, event and activities are numbered.

d. Calculate the time for each activity, mark activity time on arrow diagram. Estimate early, late, start and finishing times.

e. Calculate total float for each activity.

f. Mark the critical path on the diagram.

g. Estimate the project completion time.

ii. An activity is referred to as critical when there is no loss of time in determining its start and finish times.

iii. When there is slight advancement or delay of activities without affecting completion date of the entire project, it is referred as non-critical activity.

iv. A node is termed as event, where one activity is finished and next the activity is started.

Differences between PERT and CPM:

PERT:

1. It is a probabilistic model of project planning.

2. Expected project completion time is determined by t0,tm and tp.

3. This is an event oriented approach.

4. Network diagram is drawn.

5. Dummy activities are inserted to represent sequencing.

6. Critical and non-critical activities are not distinguished.

7. PERT is suited for major projects.

8. Resources may not be used fully.

CPM:

1. It is a deterministic model of planning.

2. Actual time taken is considered as expected project completion time.

3. This is an activity oriented approach.

4. An arrow diagram is drawn.

5. Dummy activities are out of place here.

6. Critical and non-critical activities are clearly defined.

7. This is suited for minor projects.

8. This ensures better utilization of resources.

They are applied in the following areas:

i. Large weapon system.

ii. Construction project.

iii. Ship building.

iv. Airport infrastructure.

v. New plant construction.

vi. New product launch.

vii. Computer installation.

viii. Creation of road facilities.

ix. Creation of village/model town/satellite housing.

x. Construction of Olympic site.

Advantages of PERT and CPM:

i. Tool to Meet Uncertainties:

All critical factors affecting smooth flow of project are analyzed and provided for under PERT and CPM. Hence managers of the project are well equipped to meet possible uncertainties.

ii. Tool of Prediction:

It provides a tool for predicting the impact of schedule of changes. Potential trouble spots are detected earlier enough to undertake proactive and preventive measures.

iii. Practice of MBE Concept:

It facilitates practice of management by exception concept by focusing on critical factors.

iv. Facilitating Co-Ordination:

The network needs to be constantly reviewed and updated on the basis of feedback from lower levels. This ensures attention and vigilance at all levels. It is helpful in securing coordination of all departments.

v. Improving Quality of Communication:

Each individual knows what he/she is to do. Task relationships are graphically exhibited. Hence it improves the quality of communication.

i. Errors arising in the network concept make the chart unreliable as a control-aid.

ii. PERT is to be applied to onetime, non-repetitive project. It is unsuited for continuous processes.

iii. It is time consuming and expensive to implement PERT and CPM, as lot of data need to be collected in this regard.

iv. It is unduly emphasizing on time and not on cost.

V. Management Information System (MIS):

MIS is a network established within an organization to provide managers with timely and accurate information to assist them in decision-making and effectively carrying out the organization’s planning, control and other functions. The role of MIS is crucial to control functions. MIS provides information input to practice control system. MIS provides information in fixing standards, measuring actual performance, identifying the performance gap, analyzing the deviations and initiating corrective action. Hence, most of information tools managers’ use emerge from MIS.

MIS aids in operation control. Operation control is exercised at two levels namely post action control and steering control. Post action control is aimed at making corrective action after an exercise is completed while steering control envisages making correction during the process of completing an action itself.

VI. Overall Control System:

1. Control through Financial Statement:

The financial statement is one of the prime indicators of its overall effectiveness. It is a summary of the major aspects of an organization’s financial status. The information contained in the financial statement is essential in exercising financial control over the organization.

2. Return On Investment (ROI):

Return on Investment is another technique of overall control. It is also known as Return on Capital Employed (ROCE). It represents the relationship between net profit after interest and tax and the proprietor’s funds.

It is calculated as follows:

It is calculated as a percentage. This technique was adopted by the Dupont Company, USA in the year 1919. Now it is used as one of control techniques.

i. Comparison of Performance:

This technique provides solid basis for inter-firm comparisons and intra-departmental comparisons. It lays emphasis on efficient and effective utilization of resources. It mirrors the operating dimension of an enterprise.

ii. Channelizing Resources in Right Direction:

This technique indicates the areas where the resources are fruitfully utilized and where it is not, so that an organization can channelize the resources in the right direction. In short, it is helpful in resource allocation decision. Managers are forced to justify their claim for higher resources allocation in terms of positive performance.

iii. Decentralization of Authority:

This technique facilitates decentralization of authority. Each department is accountable for certain rate of return while enjoying autonomy in its functioning.

iv. Measuring Overall Performance:

This serves as overall control technique in that it reflects the objective of the organization. If this ROI is satisfactory, one can take other measures like costing, ratios, budgeting and reports for granted.

i. Determining the optimum rate of return is a difficult exercise.

ii. Another basis in evaluating the asset centres around at what cost the asset should be valued i.e., whether at original cost or at depreciated cost or replacement cost. In an inflationary economic trend, the problem of price adjustment is more acute whatever valuation method is adopted.

iii. It lays too much emphasis on financial factors and non-financial factors, like executive skill, public relations, research and development, employee morale, etc., are ignored under ROI measurement.

iv. It discourages risk taking as it tends to encourage conservatism.

This statement lists all revenues, incomes, gains, loss and expenses the enterprise earned or incurred during the accounting period. The difference between the total of revenues plus gains and the total of expenses plus losses is either net profit or net plus. This is called bottom line.

Controlling by P&L a/c involves comparison of profit and loss of each division or department with one another of the organization or comparison of P&L of the organization over the years or comparison of P&L of the organization with other players in the same industry or comparison of P&L of the organization with other players in the related industry which provides vital information about the areas of strength and weakness and takes appropriate measures to address the weakness and strengthen the strong areas.

This statement lists the organization’s assets and claims against those assets during a given period at a particular date. It contains information about current assets and fixed assets. The claims against the company include current liability and long term liability. The comparison of balance sheet over the year enables the company to track the trend of growth of assets and liabilities. This helps the analyst get insight into overall performance and areas of weakness.

Similarly, the comparison of balance sheet of the enterprise with similar units in the industry or comparison of balance sheet of the enterprise with the industry leader would expose much insight into its strength and weakness on financial dimension and the enterprise can take measures accordingly.

Usually comparative statements, common size statements and trend percentage calculated on figures in P&L account and balance Sheet enable the enterprise to find out the trend of growth of financial factors (both positive and negative) or trend of certain financial factors over the years. The insight in enterprise gets by analyzing financial statement though the financial tools help in initiating appropriate measures to fine tune it’s financial and operating performance.

This is one of the financial tools commonly applied by any enterprise. A ratio is a proportional relationship between two numerically expressed factors. Ratios are expressed in percentages. Analysis of financial statements through ratios helps the organization spot out the problem areas (diagnosis) and helps in predicting the performance of the organization (prognosis). The various ratios calculated are grouped under four major groups, i.e., liquidity ratios, leverage ratios, activity ratios and profitability ratios.

Ratio Analysis Groups:

a. Liquidity Ratios:

i. Current ratios – Indicates firm’s ability to meet short term obligations using current assets. The norm of current ratio is 2:1.

ii. Liquidity ratios – Adequacy of liquidity to meet the short term obligations. The norm of liquid ratios is 1:1.

b. Leverage Ratios:

This ratio indicates the firm’s ability to meet its debt obligations of short term or long term nature. In short, the ratios under this group indicate financial solvency of a firm.

i. Leverage ratios – Indicates the extent to which an organization is using external public’s money to purchase assets.

ii. Interest coverage ratios – Indicates sufficiency of funds to pay fixed financial charges.

iii. Debt equity ratios – This indicates the proportion of debt component to equity and indicates the financial power of an organization to meet its debt obligations.

c. Activity Ratios:

These ratios show how the funds of an organization are used.

They take the following forms:

i. Inventory ratios – Indicates the extent to which an organization is using external public’s money to purchase assets.

ii. Receivables turnover – Shows the collection efficiency of an enterprise.

iii. Debt equity ratios – Shows how effectively the assets are used to generate sales.

d. Profitability Ratios:

The ratios under this category indicate the firm’s ability to earn profit in relation to sales/investment. Two commonly used ratios are profit margin on sales and profit margin on investment.

i. Net profit after interest and taxes – Helps the management avoid the common pitfall of investing heavily in activities that generate the greatest sales volume rather than on those which are genuinely most profitable.

ii. ROI – This ratio measures the overall performance of an organization. This helps the management and owners to know how business’ is doing in comparison to the investment.

i. The various ratios of the enterprise need to be compared over the years to know the trend of certain financial factors.

ii. The ratios of the enterprise can be compared with ratios of industry leader.

iii. The ratios of the enterprise can be compared with those of similar units in the industry.

All these exercises may help the company to identify its strength and weakness. Of course, one should understand that ratios serve the function of thermometer which indicates what is what at a given point. No company can entirely base its decisions entirely on ratios.

Personal observation of employees engaged in activities at work spot by superiors or supervisors has lost its luster. In contemporary context, video cameras installed in work place does what some several years back the superior officers did on the organization daily rounds. Now they are better placed to monitor the entire mobility of human resources through Internal Close Circuit Television.

(ICCT) Personal observation enables the superior to gain first-hand information and impression about the flow of work at various work points. Mechanization of observation saves the manager’s time and energy. Besides, it facilitates 24×7 monitoring which is not possible through physical observation on rounds. Employees at work tend to be eternally alert. Idle talk and gossip can be eliminated through direct observation.

Techniques of Controlling – Budget and Cost-Volume-Profit/Break-Even Analysis: With Definitions, Concept, Importance, Presentation, Explanation and Mechanics

Technique # 1. Budget:

Business Budgeting and Break-Even Analysis:

Budgeting is a tool of control. It is a synthesis of the past, present and future. It is an instrument used by management in planning its future activities. It is a periodical statement covering the course of one month or six months, or one year or five years.

In this statement, the management charts out its course for any given period and includes an estimate of sales or production or the expenses involved. It takes due notice of the requirements of the period, including working capital, buildings and equipment, raw material and labour.

Definitions:

According to Harry L. Wylia, a budget is the finished product in the form of final programmes for future operations and expected results. He thinks that a budget results from forward thinking and planning.

In the view of George R. Terry, a budget is the estimate of future needs, whereas, according to Professor Landers, “it is a detailed plan of operations for some specified future period”. The Institute of Works and Cost Accountants of England considers a budget to be a quantitative statement of the policy to be pursued for the purpose of attaining a given objective.

Salient Features of an Effective Budget:

The budget should have the following characteristics:

1. It should be flexible so as to become a tool of cost control.

2. It should plan for the future on the basis of the past belt at the same time, it should not neglect the present and the probable future.

3. It should be made after pooling the efforts of various departmental heads.

4. It should have specificity.

5. It should involve the top management in its planning and in its implementation.

Preparatory Steps for Budgeting:

1. Sound forecasting

2. Well-organised accounting system.

3. Well-organised cost accounting system.

4. Organisation with clearly-defined lines of authority and responsibility.

5. Formation of budget committee.

6. Clearly-defined business policies.

7. Feedback in the form of statistical information and reports.

8. Top management patronage.

9. Length of the budget period.

Technique # 2. Cost-Volume-Profit/Break-Even Analysis:

Concept and Importance:

These days a great deal of importance is attached to cost-volume-profit relationship which, as its name itself implies, is an analysis of three distinct factors — cost, volume and profit. In a scheme of cost-volume-profit analysis, an attempt is made to study the general effect of the different levels of activity upon total revenue and total cost with the help of revenue-output function and cost-output function respectively. Ultimately, this technique measures profits corresponding to the different levels of output.

The study of cost-volume-profit relationship is frequently referred to as “Break-even Analysis”. In the opinion of some, it is a mere misnomer, since the break-even analysis is just incidental to the cost-volume-profit analysis. Contrary to this view, others interpret the term “break-even analysis” in two senses, narrow and broad.

In its narrow sense, it refers to a system of determining that level of operations where total revenue exactly equals total expenses, i.e., the level of operation where the undertaking neither earns a profit nor incurs a loss. Considered in its broad sense, break-even analysis denotes a system of analysis that can be used to determine the probable profits at any level of activity.

In a nutshell, break-even analysis is a technique that represents the relationship of costs and revenues to output. An understanding of the interrelationship between these three forces, and of the likely effect that any change in sales volume would generate upon the business is extremely helpful to management in a broad variety of problems involving planning and control. Through the knowledge and information obtained from the break-even analysis, complicated budgeting and profit-planning issues can be made easy and possible.

Thus, the break-even analysis is a vital tool of financial planning and control. However, the accuracy of results would largely depend upon the reliability of the data and validity of the assumptions on which the technique functions.

Assumptions:

Unless some conditions prevail in the undertaking, the break-even analysis cannot be expected to create significant results.

Therefore, the break-even analysis to be a vital and meaningful aid in management decision making requires the following basic assumptions:

1. The total cost can be divided into two watertight components — fixed cost and variable cost. That is to say, as costs are either perfectly variable or absolutely fixed over the entire range of volume of production.

2. Fixed cost remains constant for a specified level of activity. Although the total volume of production may vary from zero to the projected full capacity, the fixed cost does not change in amount.

3. The variable cost varies directly and proportionately with the volume of production. Thus, double the level of activity, the variable cost would be twice that before.

4. The selling price does not change with a change in the volume that of sales. Since all revenue techniques assume a single price for all the units of production, it is variable with the physical volume of production. The revenue assumed from the first unit and from the last unit is equal. This gives a straight-line to the total revenue curve.

5. The firm deals in only one product or in the case of multiple products, all the products have the same contribution margin or the sales mix remains unchanged.

6. There is perfect synchronization between production and sales. This assumes that everything produced is sold and so there is no change in the inventory of finished goods.

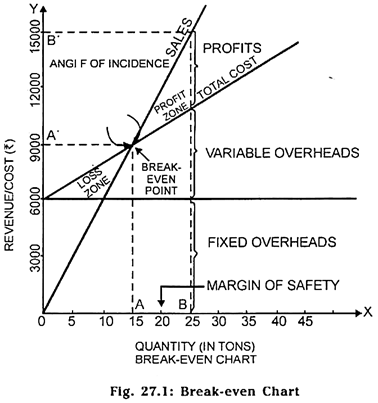

Presentation of Break-Even Analysis:

Usually, a break-even analysis is presented graphically, as this method of visual presentation is particularly well-suited to the need of managers to appraise the situation at a cursory glance. The graphical representation of this technique avoids the danger of unnecessary details cropping up in the representation and presents the data and information in the most lucid simplified manner. When presented graphically, the break-even analysis takes the shape of a break-even chart. (See. Fig. 27.1).

A break-even chart shows the profitability or otherwise of an undertaking, corresponding to the different levels of activity and as a result, depicts the point at which total revenues meet total costs exactly. This point is known as the break-even point. The break-even point is the level of activity, where the undertaking neither earns profits nor incurs losses. Hence, it is, also known as “no-profit-no-loss point”.

Given the following information a break-even chart for ABC CO. Ltd., may be presented follows:

(i) Fixed overheads remain constant at Rs.6,000.

(ii) Variable cost Rs.200 per unit.

(iii) Selling price Rs.600 per ton,

(iv) The tonnage produced and sold is 25.

Explanation:

In the graph, the following information is summarised:

1. Quantity (sold and produced) has been plotted along the horizontal (x-axis).

2. Revenue and costs have been plotted along the vertical (y-axis).

3. Fixed overheads being constant from zero to projected capacity have been shown by a parallel line to the horizontal axis (Rs.6,000).

4. The line representing variable costs shows from the point where fixed costs end so as to constitute the total cost curve.

5. Break-even point has been obtained the intersection of the lines representing sales and total cost.

6. At the point of intersection perpendiculars, it drawn on vertical and horizontal axes, is given the break-even point in terms of sales revenue (Rs.9,000) and quantity produced 05 tons respectively.

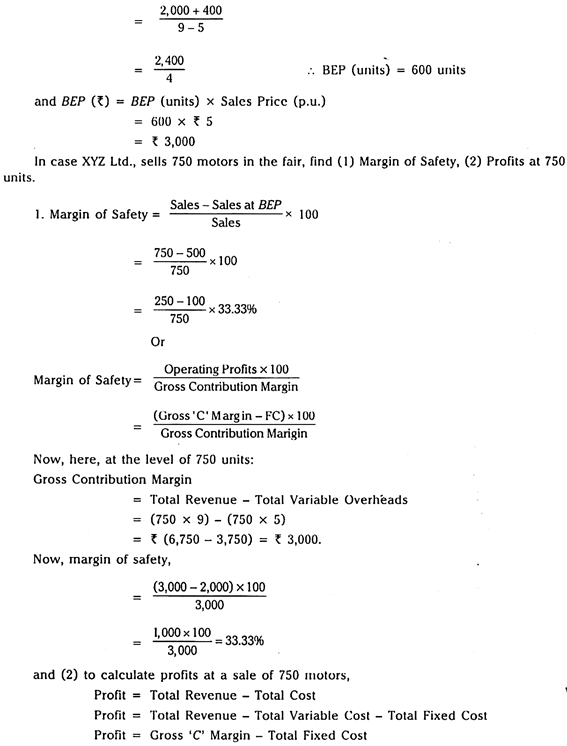

7. The margin of safety is the difference between the existing level of output and the level at the break-even point (here it is 10 tons, 25 tons – 15 tons) between A and B.

Mechanics of Break-Even Analysis:

Here it is required that certain items frequently used in this technique be introduced and the calculations of break-even point made with the derivation of various formulas.

1. Break-even Point- The break-even point is at which the total cost line and the sales line (i.e., total revenue line) intersect one another on the graph. The spread to the right of point, the point shows the profit potential while that to the left represents the loss potential. This is the level of activity where the undertaking neither earns profits nor incurs losses. Since total revenue and total cost are exactly equal, the break-even point is also the “no-profit-no- loss point”.

2. Angle of Incidence- This is the angle at which the sales line cuts the total cost line. The larger the angle, the higher the rate of profit would be. A narrow, angle shows that even though fixed overheads are recovered, the profit accrued shows a low rate of return. This indicates larger part of variable costs in total cost. In all, the management aims at widening the angle of incidence and improve the rate of profitability.

3. Contribution Margin- Contribution margin refers to the difference between the sales and variable overheads. If both the items are on unit basis, it is Unit Contribution Margin, otherwise it is known as Gross Contribution Margin.

The contribution margin is the fund or pool out of which fixed overheads are to be met and if that leaves any sum, it would be the profit. So, the contribution margin is the excess of unit sales price over the unit variable overheads that contributes to the recovery of fixed overheads and state of profit.

Then, again, profits realised on one individual product cannot be compared with that of other products since apportionment of fixed overheads is not possible for each product. A comparison of the relative contribution margin of each product serves the purpose. Higher the contribution margin in percentage, the product would be more profitable. This concept helps determine the profitability of different products or departments in an undertaking arriving at the best possible sales mix.

Contribution Margin (unit) = Unit Sales Price – Unit Variable Costs.

Gross Contribution Margin = Total Revenue – Total Variable Costs.

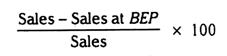

4. Margin of Safety- This represents the amount by which the volume of sales exceeds one at break-even point. The margin of safety in a way connotes the extent to which the undertaking can afford to lose the sales or lower the prices and yet remain in business. So it is very important that variable levels margin of safety should be there, otherwise at reduced level of activity may prove disastrous and even endanger the very existence of business.

A high margin of safety usually connotes a low level of fixed overheads. So firms with such a situation are invulnerable in times of reduced level of activities especially in a recessionary period. On the other hand, a low margin of safety is not sufficient to absorb, even fixed overheads in most recessions. This puts the firms out of business.

Algebraically, the margin of safety is-

5. P/V Ratio- Profit Volume Ratio (P/V Ratio) measures the profitability in relation to sales. So it is a measure to compare profitability of different products. Higher the P/V ratio, the high yielding is the product.

Algebraic Representation of BEA:

Basically, there are two approaches two the break-even analysis:

1. Equation technique, and

2. Contribution margin technique.

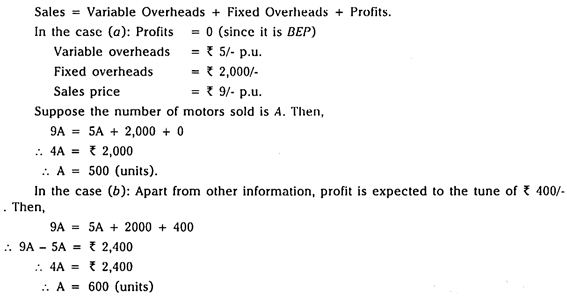

1. Equation Technique:

A simple equation that represents the relationship of income statement is considered here. For any break-even or profit estimate situation, the equation reads-

Sales = Variable Overheads + Fixed Overheads – Profits.

2. Contribution Margin Technique:

Here, with the help of the concept of contribution margin, the break-even point is calculated. The unit contribution is divided into total fixed expenses to arrive at the number of units to be sold to break-even. So, the equation reads-

Unit Sales Price – Unit Variable Overheads = Unit Contribution.

With this, we compute the break-even point as under-

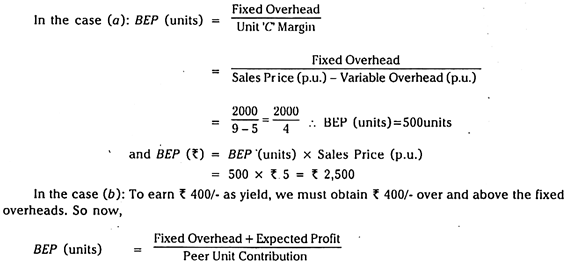

To take a simple illustration, XYZ Ltd., plans to sell a toy motor at the Gujarat Diwali Fair.

The motors are purchased at Rs.5/- each, on the express condition that all unsold motors shall be returned. The booth rent at the fair is Rs.2,000/-, payable in advance. The motors will be sold at Rs.9/- each. Determine the number of motors which must be sold-

(а) To break-even

(b) To earn Rs. 400/- as profits.

We shall solve it with both the aforesaid methods.

1. Equation Technique-

Here,

2. Contribution Marginal Technique –

Here,