This article provides full proof formulas to calculate the Marginal Efficiency of Capital (MEC).

The marginal efficiency of capital along with rate of interest determines the amount of new investment, which in turn, determines the volume of employment, given the propensity to consume.

In the fundamental equation Y = C + I, given by Keynes, we have seen that income at a time depends upon consumption and investment, consumption being stable in the short-run and less than unity—a gap comes to exist which can be wiped off only by an increase in investment.

“Investment (in this way) is an essential requirement for full employment and the key to prosperity in a capitalistic economy.

ADVERTISEMENTS:

This is so widely and generally recognized by all economic schools and sects that it may be regarded as an axiom of modern economics. Not only net investment, but an increasing rate of net investment is necessary to assure continued full employment.”

Marginal efficiency of capital refers to the anticipated rate of profitability of a new capital asset. It is the expected rate of return over cost from the employment of an additional unit of capital asset. Marginal efficiency of capital depends upon the expected rates of return of a capital asset over its life time (called prospective yield by Keynes) and the supply price of the capital asset. It must be remembered that a businessman while investing in a new capital asset will always weigh the expected rates of net return (profitability) over the life time of the capital asset (say a machine) against its supply price (cost) also called the “replacement cost.” If the former is greater than the later, the businessmen will invest, otherwise not.

Prospective Yield:

Prospective yield refers to total net return (net of all costs, such as maintenance expenses, depreciation, raw material except interest charges) expected from the asset over its life time. If we divide the total expected life of the new capital asset into a series of periods, say years, we may refer to annual returns as a series of annuities represented by Q1, Q2, Q3, …, Qn.

We have to add the net return for all these years to arrive at the prospective yield. It is, however, very difficult to estimate correctly the expected return from a capital asset over its life time (because, it is difficult to estimate correctly the life of the capital asset). At best, we can guess, intelligently perhaps, but only guess. “An estimate of what an investment will earn in five, ten or twenty years hence is based largely on guesswork, on animal spirits, on adapting estimates to the average estimate, which in turn, is based on uninformed guesses”. Moreover, the expected return each year is not the same (except in static society).

ADVERTISEMENTS:

In a changing world, the returns from the capital asset are likely to vary from year to year. Besides, Keynes considers the supply price, which means the cost of the asset (not of the existing asset but of the new asset), also called the replacement cost. Thus, MEC is the ratio of these two elements (prospective yield and the supply price). In other words, marginal efficiency of capital refers to the rate of discount at which the prospective yield of an asset is discounted so as to make it just equal to the supply price of the asset.

Keynes says, “More precisely, I define the marginal efficiency of capital as being equal to that rate of discount which would make the present value of the series of annuities given by the return expected from the capital asset during its life just equal to its supply price”.

An example will make it clear:

Suppose an investor feels that a given investment in new capital asset (say a machine) will cost him Rs. 10,000. Suppose this machine (unit of capital asset) is expected to yield over its life time a net return (net of all costs like maintenance, depreciation, raw material except interest charges) of Rs. 500 per annum.

ADVERTISEMENTS:

To find out MEC of the new capital asset, we would simply calculate the ratio (expressed as a per cent) of the expected annual net return [Rs. 500 (prospective yield) divided by Rs. 10,000]. Here, Rs. 500 (prospective yield) divided by Rs. 10,000 (supply price), results in a value of 5% (500/10,000 x 100/1 = 5%)*. The MEC is 5%, i.e., the expected annual net return on the investment of Rs. 10,000 is 5%. It may, however, be noted that in a dynamic economy it is not so easy to find out the rate of expected return. Thus,

Supply Price = Discounted Prospective Yield.

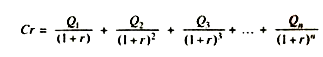

The formula for its calculation is:

where Cr stands for supply price (replacement cost) of the new capital asset, Q1, Q2, Q3, …, Qn denote expected annual rate of return each year from the capital asset (also called series of the prospective annual yields), r stands for the rate of discount which will make the present value of the series of annual returns just equal to supply price of the capital asset. Thus, r denotes the rate of discount of the marginal efficiency of capital.

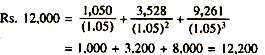

To take a concrete illustration, let us suppose that the prospective annual yields from the use of the new capital asset whose lives in 3 years only are as follows:

1st year 2nd year 3rd year

Rs. 1,050 Rs. 3,528 Rs. 9,261

Suppose that current supply price of the replacement cost of the capital asset is Rs. 12,200. Now 5% must be that unique rate of discount which will equate the sum of the discounted values of the prospective annual yields to the current supply price of the capital asset.

The unique rate of discount (5%) is called the marginal efficiency of capital.

In this equation the current supply price is known (Rs. 12,200) whereas the present value V,, is unknown. In this equation the unknown (MEC or r) or discount rate has been found out which makes the present value of the expected income stream, Q1, Q2, Q3, …, Qn equal to supply price (Cr). But there also exists a mathematical formula for finding the present value Vp of an expected future income. It involves discounting the some expected at some future date.

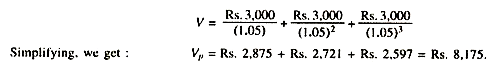

The process of discounting is just the opposite of compounding. It means shrinkage at a constant rate, just as compounding means growth at a constant rate. The usual procedure for determining the present value of some expected income stream is to discount it at the current rate of interest. To see how it works, let us assume that there is an asset that yields an income of Rs. 3,000 per year for a period of three years (Rs. 9,000 over its total life span).

We want to know that the present value of this asset, the discount formula for finding the present value of a future income is:

ADVERTISEMENTS:

It this equation, Vp, is the present value R1, R2, …, Rn is the expected income stream in absolute amount, and i is the current rate of interest.

If we assume, the current rate of interest is 5%, we can apply the above formula to find the present value of our asset:

ADVERTISEMENTS:

Thus, we find that the present value of the asset is Rs. 8,175, an amount less than the sum of the absolute amounts to be received in three years. It shows that more remote the date in the future at which the income is expected, the less its present value—Rs. 3,000 due in three years, for example, has a lower present value than Rs. 3,000 due in one year.

Even, otherwise, we see that if we lend a sum of Rs. 2,857 for one year and Rs. 2,721 for two years and Rs. 2,597 for three years at 5% rate of interest, we will get Rs. 3,000 after one, two or three years, respectively. Thus, there is some rate of discount which makes the present value of prospective returns from a capital good equal to its supply price. This is the rate of discount (r) which Keynes calls MEC of capital.

The marginal efficiency of a particular type of capital asset is the highest rate of return over cost expected from an additional, or marginal unit of that type of asset. The marginal efficiency of capital in general is “the highest rate of return over cost expected from producing an additional or marginal unit of the most profitable of all types of capital asset.” In other words, the marginal efficiency of capital in general is the marginal efficiency of that particular asset, of which the economy finds it most worthwhile to produce another or additional unit.

The Investment Demand Schedule:

The above analysis of the behaviour of investors in respect of new investment is conceived in the context of the schedule of the marginal efficiency of capital or Investment Demand Schedule. It shows a functional relationship between the MEC and the amount of investment indicating that the demand for capital asset of any given type is a downward sloping function of the marginal efficiency of capital.

For “if there is an increased investment in any given type of capital during any period of time, the marginal efficiency of that type of capital will diminish as the investment in it is increased partly because the prospective yield will fall as the supply of that type of capital is increased, and partly because, as a rule, pressure on the facilities for producing that type of capital will cause its supply price to increase.”

In other word, as investment in a particular capital asset increases, its marginal efficiency decreases. The marginal efficiencies of all types of capital assets which may be made during a given period of time represent the schedule of the marginal efficiency of capital (also called the investment demand schedule). The position and shape of the investment demand schedule are of major significance in determining the volume of employment.

ADVERTISEMENTS:

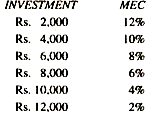

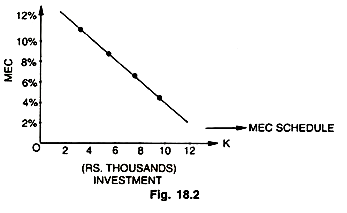

The diagram and the table given below give us the shape of the investment demand schedule:

We find that when the investment is Rs. 2,000, the MEC is 12%. As the investment increases, the MEC declines and finally it is 2% at Rs. 12,000. The MEC curve is downward sloping, showing that the MEC declines with an increase in investment. Figure 18.2 depicts the investment demand curve or what is also called the MEC schedule and shows the inverse relationship between investment and the MEC.

Marginal Productivity of Capital and Marginal Efficiency of Capital (MPC and MEC):

Keynes condemned the use of the marginal productivity of capital (MPC) and instead used the term marginal efficiency of capital (MEC).

The difference between the two is as follows:

ADVERTISEMENTS:

1. The term MPC is used by the economists to denote an increment of physical product per unit of time on account of the employment of one more physical unit of capital. In other words, MPC is related with an increment of value due to the employment of one more value unit of capital. On the other hand, Keynes used the term MEC to denote the rate of return over cost, using the term ‘prospective yields’ for the series of absolute prospective returns from a capital good. The marginal product of capital can be gross or net. It is gross if estimated before deducting depreciation otherwise it is net; while MEC is the rate of discount which equates the gross marginal product with replacement cost of the capital asset.

2. MPC is related with the increment of value obtained by using an additional quantity of capital in the existing situation. MEC relates to the series of increments which it is expected to obtain over the whole life of the additional capital assets. Symbolically, the MPC is concerned with Q and the MEC with complete series Q1, Q2, Q3, …, Qr. Thus, MEC involves the significance of expectations.

3. In defining the MPC, attention is given to the current marginal product, i.e., that absolute annual product, after deducting running expenses and depreciation allowances, while Keynes estimated the MEC as the net return over cost throughout the whole expected life of the capital good—the net aggregate return is obtained after deducting the running expenses only and not depreciation. Thus, while the term MPC refers to the expected current product, the later refers to the anticipations with respect to the whole series of prospective yields from a capital asset.