1. Perfect Competition:

In perfect competition there is a very large number of firms in the industry and the product is homogeneous.

Competition is perfect in the sense that every firm considers that it can sell any amount of output it wishes at the going market price, which cannot be affected by the individual producer whose share in the market is very small.

Thus although competition is perfect, there is no rivalry among the individual firms.

Each one firm acts atomistically, that is, it decides its level of output ignoring the others in the industry. The products of the firms are perfect substitutes for one another so that the price-elasticity of the demand curve of the individual firm is infinite. Entry is free and easy.

2. Monopoly:

ADVERTISEMENTS:

In a monopoly situation there is only one firm in the industry and there are no close substitutes for the product of the monopolist. The demand of the monopolist coincides with the industry demand, which has a finite price elasticity. Entry is blockaded.

3. Monopolistic Competition:

In a market of monopolistic competition there is a very large number of firms, but their product is somewhat differentiated. Hence the demand of the individual firm has a negative slope, but its price elasticity is high due to the existence of the close substitutes produced by the other firms in the industry. Despite the existence of close substitutes each firm acts atomistically, ignoring the competitors’ reactions, because there are too many of them and each one would be very little affected by the actions of any other competitor.

Thus each seller thinks that he would keep some of his customers if he raised his price, and he could increase his sales, but not much, if he lowered his price: his demand curve has a high price elasticity, but is not perfectly elastic because of the attachment of customers to the slightly differentiated product he offers. Entry is free and easy in the industry.

4. Oligopoly:

In an oligopolistic market there is a small number of firms, so that sellers are conscious of their interdependence. Thus each firm must take into account the rivals’ reactions. The competition is not perfect, yet the rivalry among firms is high, unless they make a collusive agreement. The products that the oligopolists produce may be homogeneous (pure oligopoly) or differentiated (differentiated oligopoly).

ADVERTISEMENTS:

In the latter case the elasticity of the individual market demand is smaller than in the case of the homogeneous oligopoly. The sellers must ‘guess’ at the rivals’ reactions (as well as at the consumers’ reactions). Their decisions depend on the ease of entry and the time lag which they forecast to intervene between their own action and the rivals’ reactions. Given that there is a very large number of a possible reaction of competitors, the behaviour of firms may assume various forms. Thus there are various models of oligopolistic behaviour, each based on different reaction patterns of rivals.

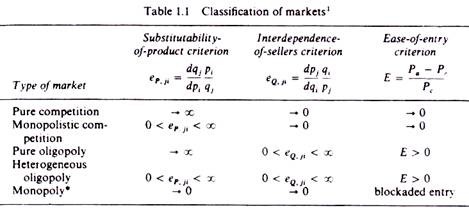

From the above brief description of the characteristics of the various markets we may present a scheme of market classification using the following measures for the degree of product substitutability, sellers’ interdependence and ease of entry. The degree of substitutability of products may be measured by the conventional price cross-elasticity (ep) for the commodities produced by any two firms

ep,ji= dqj / dpi. Pi /qj

This measures the degree to which the sales of the jth firm are affected by changes in the price charged by the ith firm in the industry. If this elasticity is high, the products of the jth and the ith firms are close substitutes. If the substitutability of products in a market is perfect (homogeneous products) the price cross-elasticity between every pair of producers approaches infinity, irrespective of the number of sellers in the market. If the products are differentiated but can be substituted for one another the price cross- elasticity will be finite and positive (will have a value between zero and infinity).

ADVERTISEMENTS:

If the products are not substitutes their price cross-elasticity will tend to zero. The degree of interdependence of firms may be measured by an unconventional quantity cross-elasticity for the products of any two firms

eq,ji =dqj/ dqi. qi /pj

This measures the proportionate change in the price of the jth firm resulting from an infinitesimally small change in the quantity produced by the ith firm. The higher the value of this elasticity is, the stronger the interdependence of the firms will be. If the number of sellers in a market is very large, each one will tend to ignore the reactions of competitors, irrespective of whether their products are close substitutes; in this case the quantity cross-elasticity between every pair of producers will tend to zero. If the number of firms is small in a market (oligopoly), interdependence will be noticeable even when products are strongly differentiated; in this case the quantity cross-elasticity will be finite.

For a monopolist both cross-elasticity will approach zero, since ex hypothesis there are no other firms in the industry and there are no close substitutes for the product of the monopolist. The ease of entry may be measured by Bain’s concept of the condition of entry, which is defined by the expression

E = Pa – Pc / Pc

Where E = condition of entry

Pc = price under pure competition

Pa = price actually charged by firms.

The condition of entry is a measure of the amount by which the established firms in an industry can raise their price above Pc without attracting entry.

ADVERTISEMENTS:

The market classification which emerges from the application of the above three criteria is shown in table 1.1.

It should be noted that the dividing lines between the different market structure’s are to a great extent arbitrary. However, markets should be classified in one way or another for analytical purposes.