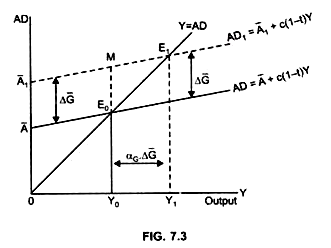

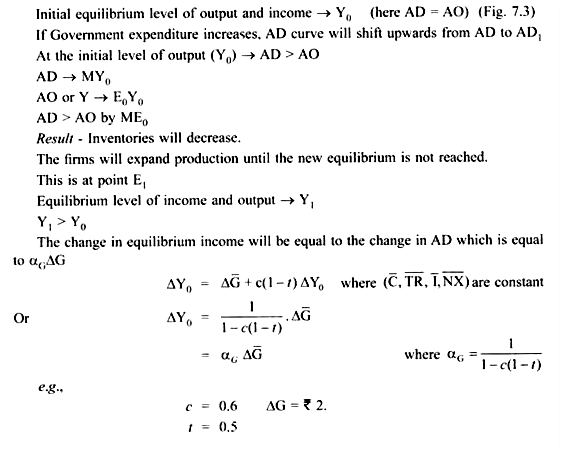

(a) A change in Government Purchases (∆G):

Assume: Government purchases increase

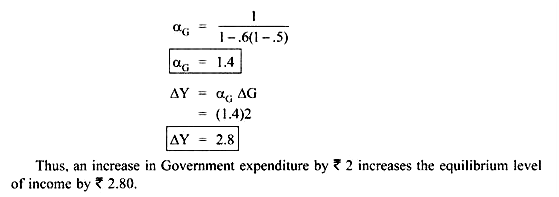

(b) A change in Transfer Payments (∆TR):

Assume:

The Government increases transfer payments

The increase in income due to increase in transfer payments is less than increase in income due to Government spending (by a factor c). This is because a part of TR is saved.

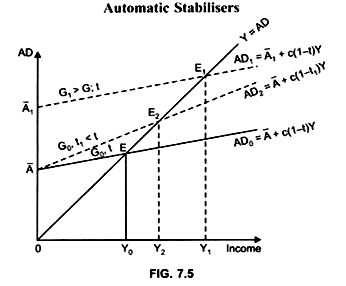

(c) Determination of equilibrium output when there is a change in Marginal Tax Rates/proportional income tax ‘t’:

Income tax decreases the value of multiplier because they decrease the induced increase in consumption out of change in income and thus acts as automatic stabilizers. Automatic stabilizer is that mechanism which automatically decreases the amount by which there is a change in output in response to a change in the autonomous demand. This implies that automatic stabilizer reduces the value of multiplier. As a result output will fluctuate less than it would without stabilizer, thus, output level will be more stable.