Read this article to learn how to determine the Trade Balance in a Large Open Economy!

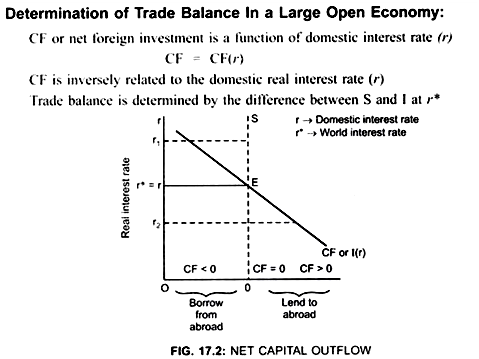

Saving curve (S) is vertical line because it is independent of the interest rate CF or I curve is negatively sloped because interest rate and investment are inversely related.

As savers are the lenders and the investors are the borrowers, therefore saving curve represents supply of loanable fund while investment curve represents demand for loanable fund.

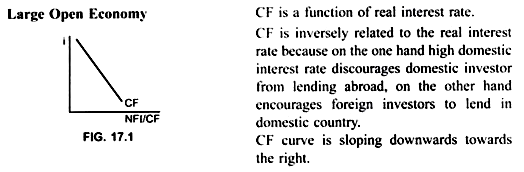

CF can be either positive or negative depending on whether the economy is a lender or borrower in the world financial market.

When the domestic interest rate is r

S = I

CF = 0 Figure. (17.2)

ADVERTISEMENTS:

When the domestic interest rate rises to r1|(r1 > r*)

Since the interest is the return which he earns on his investment, the domestic investors will find it more profitable to invest domestically. High domestic interest rate discourages domestic investors from lending abroad and encourages foreign investors to lend here.

Thus, if domestic interest rate rises:

Borrowing from abroad will be more and foreign investors will lend/invest in the domestic country

ADVERTISEMENTS:

... CF = amount that the domestic investors lend abroad – amount that the foreign investors lend here

... CF is negative

That is, CF < 0

Similarly, if domestic interest rate falls to r2.

r2 < r*

Domestic investors will lend more to other countries.

They will invest abroad because they can earn a higher interest rate

CF > 0