Relationship between Inflation Rate and Output Level in Short Run!

Inflation can be caused either due to:

(i) Increase in demand → called demand pull inflation, or

(ii) Decrease in supply caused due to increase in cost of production → called cost push inflation.

ADVERTISEMENTS:

In Short Run:

Inflation rate and output level is determined at the point, where DAD = SAS

SAS → Short run Aggregate Supply

DAD → Dynamic AD

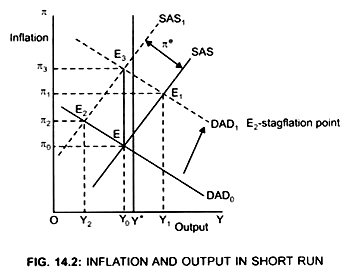

Initially, the economy is in equilibrium at point E (Fig. 14.2).

At point E → DAD0 = SAS

Inflation Rate → π0; Output level → Y0

I. Increase in DAD due to demand pull inflation:

ADVERTISEMENTS:

(a) Assume there is an increase in the growth rate of money:

DAD curve will shifts upwards by the same amount as the increase in growth

rate of money from DAD0 to DAD1.

With SAS constant, Equilibrium is at point E1.

At point E1 → DAD1 = SAS.

Inflation rate increases → from π0 to π1.

Output level increases → from Y0to Y1.

Thus, when DAD increases, inflation rate increases. However, the increase in inflation rate is less than the growth rate of money (m) which is equal to EE3 because some of the increase in money stock leads to an increase in output.

π0π1 < EE3

ADVERTISEMENTS:

II. Shift in SAS with DAD constant:

Inflation is due to cost push inflation – Output level will decrease and inflation rate will increase.

SAS curve shifts upwards from SAS to SAS1 due to

(i) Increase in the expected rate of inflation or

ADVERTISEMENTS:

(ii) Due to adverse supply shock.

Shift in SAS = increase in expected inflation rate, that is, ∆πe.

Equilibrium moves up from E to E2.

Inflation rate increases from π0 to π2.

ADVERTISEMENTS:

But output level decreases from Y0 to Y2.

Thus, increase in expected rate of inflation (πe) or adverse supply shock causes higher inflation and lower output level known as stagflation.

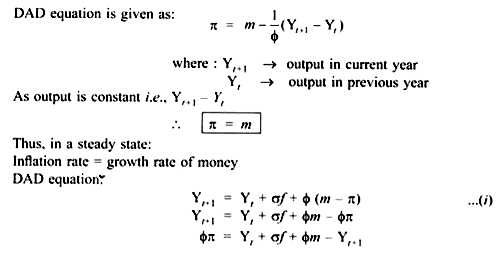

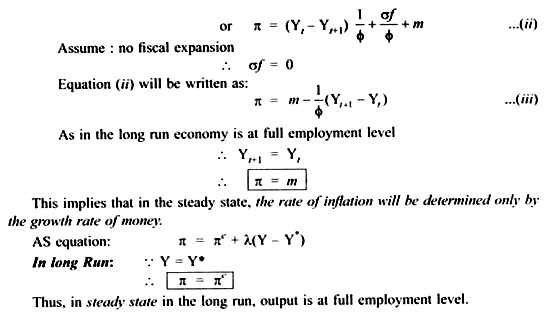

III. In Long Run:

In the long run, growth rate of money is constant because expectations have adjusted to actual inflation (πe= π) and output and inflation are constant. The economy is in a Steady-State. This is because due to increase in expected level of inflation, wages will increase, which will lead to a more rapid increase in inflation and thus decrease in output level.

ADVERTISEMENTS:

Limitations:

Economy never reaches a Steady State because there are always some changes occurring, which prevent the economy to reach the Steady State which affect AS and AD, like:

(i) Change in expectation, or

(ii) Change in Labour force, or

(iii) Change in prices of other factors of production, etc.

However, Steady State relationships are useful in indicating long run tendency of the economy.

ADVERTISEMENTS:

How does an economy moves towards the long-run equilibrium when a shock or disturbance affects AS or AD?

When the economy reaches full employment output Y* with an increase in Government spending, there is crowding out of private demand. It implies that fiscal expansion cannot permanently raise output above the normal.