Neo Classical Model of Obtaining the Simultaneous Equilibrium in Goods and Money Market!

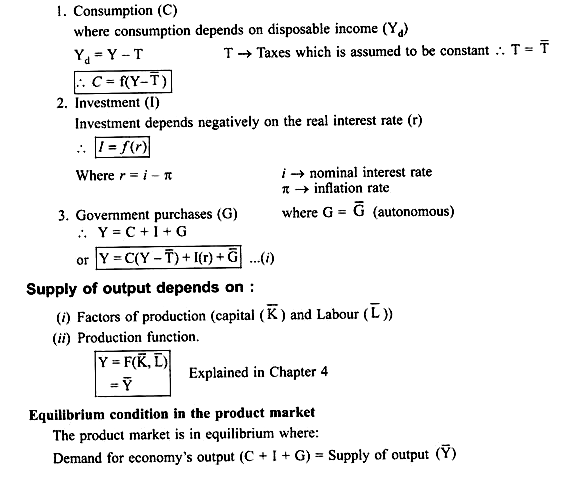

It is the market for goods and services. In the goods market demand for economy’s output (Y) comes from;

As G and T are constant, it is the interest rate which determines the demand for goods and services.

ADVERTISEMENTS:

(i) If interest rate increases, Investment will decrease because the cost of borrowing increases. Therefore demand for goods and services (C + I + G) will decrease.

Result:

Demand for output < Supply of output.

ADVERTISEMENTS:

(ii) Similarly, if interest rate decreases, cost of borrowing will decrease, therefore demand for goods and services will increase.

Thus, demand for output > supply of output.

It is only at the equilibrium rate of interest that:

Demand for Output = Supply for Output

ADVERTISEMENTS:

Money/Financial Market:

Equilibrium in the financial market is obtained where:

Supply of Loanable Funds = Demand of Loanable Funds

where:

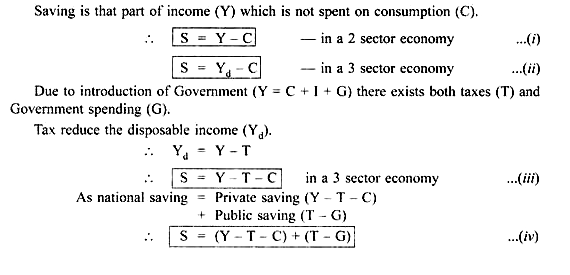

i. Saving is the supply of loanable fund.

ii. Investment is the demand for loanable fund.

Saving is the supply of loanable funds because people keep their savings in the bank which uses this saving to give loans or funds to the investors. For the savers interest rate is the return on saving.

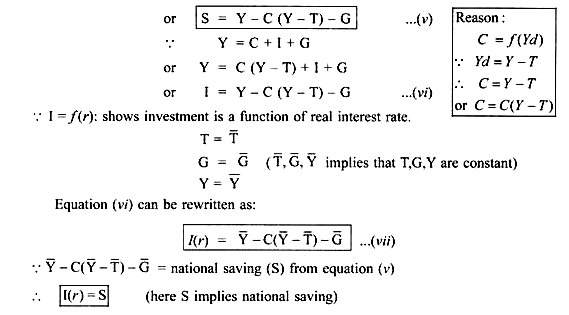

Investment is the demand for loanable funds because the investors borrow money either from the public or from the banks for investment and pay interest rate. Therefore, for the investors, interest rate is the cost of borrowing.

As investment depends inversely on the interest rate, demand for loanable funds depends inversely on the interest rate.

Equation (v) shows that national saving (S) depends on:

(i) Income (Y)

(ii) Fiscal policy variables — Government spending (G) and Taxes (T).

ADVERTISEMENTS:

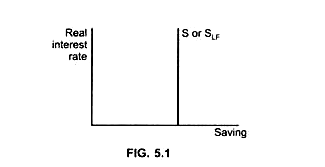

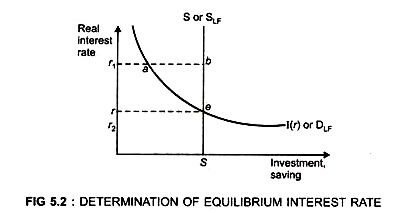

As saving (S) does not depend on the real interest rate (r).

... S curve is vertical straight line (SS).

It implies whether interest rate increases or decreases, saving remains constant. Thus, saving curve is a vertical straight line parallel to Y-axis.

ADVERTISEMENTS:

As investment (I) is inversely related to the real interest rate (r).

... Investment curve is downward sloping.

It shows when interest rate increases, cost of borrowing increases, therefore, investment decreases.

Equilibrium interest rate is determined where:

Supply of loanable funds = demand for loanable fund

ADVERTISEMENTS:

Or

households desire to save = firms desire to invest

Or

I < S because an increase in the interest rate will lead to decrease in investment. As investment is a component of aggregate demand (Y = C + I + G), decrease in investment means decrease in AD. Decrease in AD in turn will lead to a decrease in the income level which in turn will decrease the saving and thus investment will become equal to saving.

(I ↓→↓ AD →↓Y →↓S because saving is positively related to the income level)

ADVERTISEMENTS:

Thus I = S

Similarly if interest rate is low (r2) →

Demand for loanable funds > Supply of loanable funds

As (I > S), interest rate will rise, investment will decrease and thus I = S

Thus, it is only at equilibrium rate of interest where

Savings = Investment, that is,

ADVERTISEMENTS:

Supply of loanable funds = Demand for loanable funds.