1. Meaning of Money Market:

Money market is the “collective name given to the various firms and institutions that deal in the various grades of near money.”

It is a market for short-term loans in the sense that it provides money for working capital or circulatory capital.

Most important short-term instruments with different degrees of maturity that are used in the money market often are: inter-bank call money, short-notice deposits, Treasury Bills of 91 days and 364 days, commercial bills, certificate of deposits and commercial paper.

A well-developed money market is essential for the efficient functioning of a central bank. Money market is an institution through which surplus funds move to the deficit areas so that temporary liquidity crisis can be tackled. Money market enables inter-bank transactions of short-term funds. A well-knit money market acts as a ‘barometer’ for central banking operations. It enables the central bank to implement its monetary policy efficiently.

ADVERTISEMENTS:

In the absence of a well-coordinated banking system and other constituents of money market, the central bank may not be able to achieve its desired goals. Above all, government deficits are financed in a non-inflationary way through the money market institutions. Thus, the existence of a well-developed money market is essential for an economy.

2. India’s Money Market:

A country’s financial market deals in financial assets and instruments of various types such as currency, bank deposits, bills, bonds, etc. Such financial market consists of both the money market and the capital market.

A money market is one where money is bought and sold. Technically, a money market is one where money is borrowed and lent. It deals in borrowing and lending of short- term funds. In the money market, the short- term funds of banking institutions and individuals are bid by borrowers and the Government.

The main building blocks of money market are:

ADVERTISEMENTS:

(i) Central bank,

(ii) Commercial banks, and

(iii) Indigenous banks and village moneylenders.

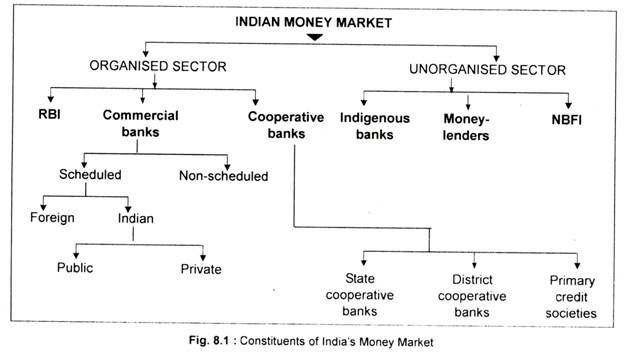

India’s short-term credit market or money market has, invariably, a dichotomy. It consists of two sectors: (i) organised sector comprising the Reserve Bank of India and commercial banks, and (ii) unorganised sector having an indigenous stint. The organised market comprises the RBI, the State Bank of India, commercial banks, the Life Insurance Corporation of India, the General Insurance Corporation of India, and the Unit Trust of India.

ADVERTISEMENTS:

These are the organised components of money market since the functions and activities of these institutions are systematically coordinated by the RBI and the Government. Also, cooperative banks fall in this category. In India, we have three-tier cooperative credit structure: State cooperative banks, District or Central cooperative banks, and primary credit societies. Except the last one, the other two types of cooperative banks lie in the organised compartment of the money market.

The organised sector of the Indian money market can be divided into sub-markets:

(i) Call Money Market:

The call money market—an important sub-market of India’s money market is the market for very short- term funds such as overnight call money and notice money (14 days’) known as ‘money at call’. The rate at which the funds are borrowed in this market are called ‘call money rate’. Such rate is market-determined—influenced by demand for and supply of short-term funds.

(ii) Treasury Bill Market:

By treasury bill we mean short-term liability of the Union Government. The treasury bill market deals in treasury bills to meet the short-term financial needs of the Central Government. But by issuing treasury bills, the Central Government raises funds almost uninterruptedly. Treasury bills are of two types: ad hoc, and regular. Ad hoc treasury bills are sold to the state governments and foreign central banks and, therefore, these are not marketable. Regular treasury bills are sold to the banks and to the public and, therefore, are freely marketable.

At present the following types of treasury bill are in use:

(i) 14-day intermediate treasury bills,

(ii) 91-day treasury bills,

(iii) 182-day treasury bills,

(iv) 364-day treasury bills.

(iii) Repo Market:

ADVERTISEMENTS:

Repo—a money market instrument—helps in collateralised short-term borrowing and lending through purchase-sale operations in debt instruments.

(iv) Commercial Bill Market:

Trade bills or commercial bills are traded in this market. It is a bill drawn by one trader on another. Traders get money by discounting such bills in a commercial bank so as to avail financial accommodation.

(v) Certificate of Deposits:

It is a certificate issued by a bank of depositors of funds that remain deposited at the bank for a specified period. These are tradeable and negotiable in the short-term money markets.

(vi) Commercial Paper:

It is a short-term instrument of raising funds by corporate houses at cheaper cost. It was introduced in January 1990. Its maturity period ranges from 3 months to 6 months.

(vii) Money Market Mutual Funds:

ADVERTISEMENTS:

This instrument was introduced in April 1992 to provide additional short-term revenue to the individual investors.

The unorganised market is largely made up of indigenous bankers and non-bank financial intermediaries like chit funds, nidhis, etc. It is unorganised since these institutions are not systematically coordinated by the RBI. Like commercial banks, these financial institutions are not subject to reserve requirements. Nor do these institutions strictly depend on the RBI or banks for financial accommodation. Different components of money market have been shown in a treelike diagram (Fig. 8.1).

3. Characteristics of India’s Money Market:

The Indian money market is peculiar. It has several important features:

1. Dichotomised:

ADVERTISEMENTS:

In the first place, the Indian money market has invariably a dichotomy—commercial banking developed on Western or European lines, and an unorganised sector doing business on traditional lines. However, these two sectors are loosely connected to each other.

Every sector conducts its business independently having different style of functioning. Over the years, the importance of the unorganised sector of the Indian money market has been shrinking. Even then its share in providing rural finance is still not unimportant.

2. Scattered:

Secondly, India’s money market is scattered. The two important money market centres in India are in Kolkata and Mumbai. These two markets are dubbed National Money Market. However, Delhi and Ahmedabad are coming to the ambit of the National Money Market. The National Money Markets are related to the local money markets.

3. Unorganised Sector Virtually Free from the RBI’s Control:

Thirdly, the unorganised sector of the money market is practically insulated from the central banking control mechanism. Monetary flexibility and monetary control of the RBI gets somehow choked because of the existence of the unorganised money market which is practically outside the purview of the RBI’s control.

This is because these institutions do not rely on financial accommodation from the RBI in times of liquidity crisis. Nor are they subject to reserve requirements. Obviously, in such a set up, RBI’s credit control instruments cannot be applied on them even if they deserve punishment on the ground of national interest.

4. Before 1969, Commercial Banks Lacked Discipline:

Fourthly, we also notice the absence of a well-organised banking system in India. Commercial banks habitually maintain an excess cash reserve. Their lending policies are often harsh if we compare it with the lending policies of unorganised component of the market. Banks are hesitant in opening branches in unbanked or underbanked areas.

ADVERTISEMENTS:

However, this canard against commercial banks in the present situation is not justified. Particularly after nationalisation, banking system in India has gained enough strength. It is now one of the disciplined sectors of the money market. One has enough reason to be sceptic regarding the RBI’s control and monitoring over the organised commercial banking sector. Because of the absence of an effective control of the

RBI, the country experienced the two infamous banking scams one was Harshad Mehta Scam of 1992 and the other was the Ketan Parekh Scam in 2002.

5. Absence of a Bill Market before 1971:

Fifthly, to integrate the organised and unorganised sectors of the money market, establishment of a bill market is a necessary condition. It is said that a steady supply of trade bills freely negotiable in both sectors would ensure link or integration between them. But such was consciously absent in India before 1971 when ‘real’ bill market scheme was introduced by the RBI.

6. Problems Associated with Seasonal Fluctuations in Money Supply:

Finally, Indian money market is characterised by the seasonal stringency of money supply during the busy season when demand for money shoots high. With high demand for liquid money and its consequent shortage, interest rates rise in the busy season from November to June. But in the slack season, an opposite situation arises when interest rates go down.

These seasonal fluctuations in the rates of interest create uncertainty in the money market. However, the RBI being the watchdog of the country’s monetary situation controls such fluctuations in the market rate of interest successfully.

7. RBI and Unorganised Component of the Money Market:

Being the leader of the money market, the central bank must have a final say on a country’s financial system. To make its monetary policy an effective instrument, the character of the money market is important. Usually, money market of LDCs is underdeveloped. India is, of course, not the exception. Unorganised components of India’s money market like the banking system do not depend on the RBI for any sort of financial accommodation since these institutions deal with their own funds and do not accept deposits from the public.

ADVERTISEMENTS:

Obviously, these sectors of the money market are not within the ambit of the RBI’s direction and control. On the other hand, the organised components of the money market can never remain isolated from the RBI’s control and guidance. But the RBI has no control over the quality and composition of credit allocated by the unorganised components of the money market.

As a result, the RBI’s monetary policy or the weapons of credit control—tend to become less effective. For instance, the RBI occasionally employs its credit control instruments to check inflation (or deflation). Truly speaking, commercial banks are in the shackles of regulatory processes of the RBI.

On the other hand, indigenous bankers are free from these control instruments. As a result, the objective of controlling inflation or deflation gets frustrated. Above all, these institutions are important providers of black money in the economy. But their behaviour virtually remains unchecked.

However, with the passage of time, the organised sector of the money market has been developed by the RBI. It has developed a bill market in India. Consequently, we notice the contraction of businesses of unorganised sector of the money market. Still then, this sector occupies an important place. Hence the necessity of integration.

The eventual integration of the organised and unorganised sectors will make the money market sensitive and responsive to the monetary policy. Once integration is made, the RBI’s control, regulation, directive and guidance will touch every facet of the money market. Let us hope for the advent of a developed money market in India under the able guidance of

4. Constituents of the Indian Money Market:

It has been said that the Indian money market is dichotomised. There exists both organised and unorganised components of money market. As far as the money market is concerned, the Reserve Bank of India lies at the top. In addition, we have Indian joint stock banks— scheduled and non-scheduled banks. Commercial banks not included in the Second Schedule of the RBI Act, 1934, are called non- scheduled banks.

ADVERTISEMENTS:

Some cooperative banks are scheduled commercial banks but not all cooperative banks enjoy the ‘scheduled’ status. At present (January 2009) the number of non- scheduled banks is 30. The two most important scheduled commercial banks are commercial banks (both public and private) and cooperative banks.