Three Alternative Definitions of Money Supply:

There are various definitions of money supply. This is why measuring money supply is difficult. In fact, measurement problems stand in the way of smooth conduct of monetary policy.

M1:

The most important concept of money is narrow (transactions) money or M1, which is the sum of coins and paper currency in circulation outside the bank. Plus deposit withdrawable by cheques. Coins and paper currency are called fiat (legal tender) money.

This means that the money supply is determined not only by the monetary policy of the central bank, but also by the behaviour of households (which hold money) and of banks (in which money is held). In India, the money supply, in a narrow sense, includes both currency in the hands of the public and deposits at banks that households can use on demand for transactions, such as chequing accounts. It can be expressed as

M1 = C + D

ADVERTISEMENTS:

This means that money supply = currency + demand deposits (withdrawable by cheques).

M2:

Another important monetary aggregate is broad money (called M2) which equals M1, + near-monies — such as savings deposit and small denominations of time deposit and non-institutional holdings of money market mutual funds (MMMFs). All of the assets in M2 earn much lower interest rates than the next liquid assets such as certificates of deposits (CDs) and are much more liquid. So there is now a natural separation between M2 as a liquid asset that is generally acceptable as a means of payments and earns low or no interest, and broader money concepts that include CDs.

Within M2, the deposits in M1 are most liquid and earn the lowest return. Historically, analysis of money supply has been done in terms of M1; now the emphasis is shifting towards M2.

The broader definition M2 adds money market funds, savings deposits and small- denomination time deposits to M1. In order to understand money supply, we have to note the interaction between currency and demand deposits and see how the central bank’s monetary policy influences these two components of money supply.

M3:

ADVERTISEMENTS:

An additional monetary aggregate is called M3 It contains M2 and other assets, such as large-denomination time deposits, MMMFs held by institutions and repurchase (repo) agreements. In a repo agreement a bank borrows from a non-bank customer by selling a security, such as a government bond, to the customer and promising to buy the security back.

Many of the assets included in both M2 and M3 are not money in the strict sense of being directly acceptable in payment. For example, repo agreements, which are part of M3, cannot be used directly for making purchases. However, because these assets can be quickly and cheaply converted into currency or chequable deposits, they are included in the broader measures of money.

The Determinants of Money Supply:

The money supply of a country refers to the total stock of money in circulation. It has two Inroad components: (1) currency in circulation, called primary money, and (2) bank (deposits) money, called secondary money. Banks, especially commercial banks, create money due to the prevalence of fractional (proportional) reserve system.

Since commercial banks keep only a portion (fraction) of their total deposits as reserves, they can lend the excess reserves which, in their turn, add to the country’s money supply. Under 100% reserve system, it is not possible for commercial banks to create money. Similarly, money creation is not possible in a cashless society.

ADVERTISEMENTS:

There are different concepts of money supply. The key concept is high-powered money or base money.

High-powered Money:

High-powered money or base money consists of currency in circulation (notes and coins) and banks’ reserves at the central bank. Currency in circulation consists of that part of currency held by the public. This is also known as legal tender money (fiat money).

Two points may be noted in this context:

(i) The larger the reserve-deposit ratio (r) is, the smaller the money multiplier.

(ii) The larger the currency-deposit ratio (c) is, the smaller the money multiplier currency- deposit ratio, c. The reason is that the smaller the c, the smaller the proportion of the high- powered money that is being used as currency (which translates high-powered money only one-for-one into money) and the larger the proportion that is available to be held as reserves (which translates much more than one-for-one into money).

We may now refer to the determinants of the reserve-deposit and currency-deposit ratios:

1. The currency-deposit ratio:

The main determinant of the amount of currency held relative to deposits depends on the payment habit of the people. The currency-deposit ratio is very high in the busy season, and low during the slack season. This ratio is affected by transactions cost, i.e., the cost and convenience of obtaining cash.

ADVERTISEMENTS:

2. The reserve-deposit ratio:

Bank reserves consist of deposits banks hold at the central bank and ‘vault cash’, notes and coins held by banks. In India as also in the USA banks hold reserves primarily at the insistence of the central bank. In addition to these required (legal) reserves, banks hold some excess reserves in order to meet unexpected demand for cash withdrawals.

Banks have to keep reserves in the form of notes and coins because their customers often demand currency for spending purposes. They keep accounts at the RBI mainly to make payments among themselves. The RBI acts as the clearing house of banks. Banks often use their deposits at the RBI to obtain cash.

Suppose in country SLR is 25% and CRR is 6%. So 31% of total bank deposits remains unproductive. These are sterile assets in the banks’ balance sheets. Since reserves earn no interest, banks try to keep as less excess reserves as possible. When market interest rates are high, banks try to keep their excess reserves to a minimum, especially in countries like Canada and the UK where reserve requirements are not set by regulation.

ADVERTISEMENTS:

Banks also keep a portion of their deposits as reserves with the central bank. They also keep a portion of their deposits as cash reserves in their vaults. These are used to back individual and business deposits at banks. The central bank’s control over the base money is the main route through which it determines the money supply.

Money Supply:

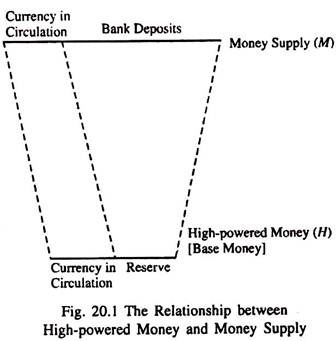

The money supply (M) is related to Currency in high-powered money (H), as shown in Circulation Bank Deposits Fig. 20.1. At the top of Fig. 20.1 we show the quantity of money in circulation (M). At the bottom we show base (high-powered) money.

Money Multiplier:

Money supply (M) and high- powered money (H) are linked through the money multiplier (mm). The money multiplier is the ratio of the stock of money to the stock of high-powered money, and is always greater than one.

ADVERTISEMENTS:

From Fig. 20.1 it is clear that the larger the deposits are as a fraction of the money supply, the higher is the value of the multiplier. The reason is that currency uses up a rupee of high-powered money per rupee of money. In contrast, deposits use up only a fraction (or a proportion) of a rupee of high-powered money (in reserves) per rupee of money stock. For example, if the reserve ratio is 10%, every rupee of the money stock in the form of deposits uses up only 10 paise of high-powered money. Alternatively stated, each rupee of high-powered money held as bank reserves can support Rs. 10 of deposits.

For the sake of simplicity, we ignore the distinction between various kinds of deposits (and, thus, the distinction between different definitions of money supply). We consider the money supply process assuming that there is only one class of deposits — D.

In this case the money supply consists of currency in circulation plus deposits:

M = C + D … (1)

High-powered money consists of currency plus reserves

H = C + R … (2)

ADVERTISEMENTS:

Milton Friedman and A. Schwatz have summarised the behaviour of the public, the banks and the central bank in the money supply process by three variables : the currency deposit ratio : c = C/D; the reserve deposit ratio, r = R/D; and the stock of high-powered money (H). Rewriting equations (1) and (2) as M = C + D and H = C + R, we can express the money supply in terms of its three proximate determinants: r, c and H.

A Model of the Money Supply:

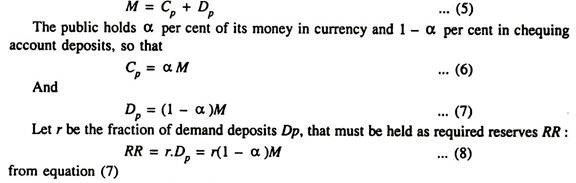

The money supply M is currency held by the public Cp plus demand deposits held by the public in the commercial banking system Dp:

Total reserves can be divided on the one hand into the sources of reserves, and on the other hand into the uses of reserves. The central bank provides un-borrowed reserves, RU, mainly by buying government securities in the bond market. It also supplies borrowed reserves, RB, by lending to the commercial banks through the discount mechanism.

These reserves are allocated to three uses: The banks can allocate their resources (funds) to required reserves RR or to excess reserves (loanable funds) RE, which is defined as total bank reserves less RR. In addition, some of the reserves provided by the central bank through open market purchases of bonds will end up as currency in the hands of the public Cp. Since both sources and uses must sum to total reserves R, this gives us the basic reserves identity

The reserves identity also gives us an expression for the policy instrument that the central bank directly controls through open market operations:

where net free reserves, RF, is defined as RE – RB. Free reserves are very much sensitive to the interest rate changes.

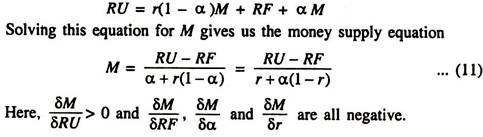

Equations (6) for Cp and (8) for RR can be combined with equation (10) for un-borrowed reserves to yield an equation giving the money supply as a function of un-borrowed reserves, controlled by the central bank; and free reserves, controlled by the commercial banks. Substituting from equations (6) and (8) for Cp and RR, respectively, into the right-hand side of (10) we have

The money supply rises as the central bank provides more un-borrowed reserves and falls as free reserves increase, the public liquidity preference rises, or the central bank increases the reserve ratio. The banks, through decisions on excess reserves and borrowing at the discount window, determine RF; the central bank determines r directly and RU by open market operations, and the public’s tastes between currency and cheqeing deposits determine a. These variables taken together determine the money supply M.

ADVERTISEMENTS:

Next, we can separate the right-hand term in (11) into two parts:

The RU term in (12) gives the portion of the money supply determined mainly at the initiative of the central bank, which might be considered the exogenous portion of the money supply.

The RF term in (12) gives the portion of the money supply which is largely, if not completely, endogenously determined by the banking system in response to loan opportunities and interest rates. In tight credit conditions, when demand for loan is high relative to the supply of un-borrowed reserves from the central bank, free reserves are likely to be negative, with banks reducing excess reserves as much as possible and borrowing substantially at the discount rate. When credit is cheap and readily available, RF will be positive.

Interest Elasticity of the Supply of Money:

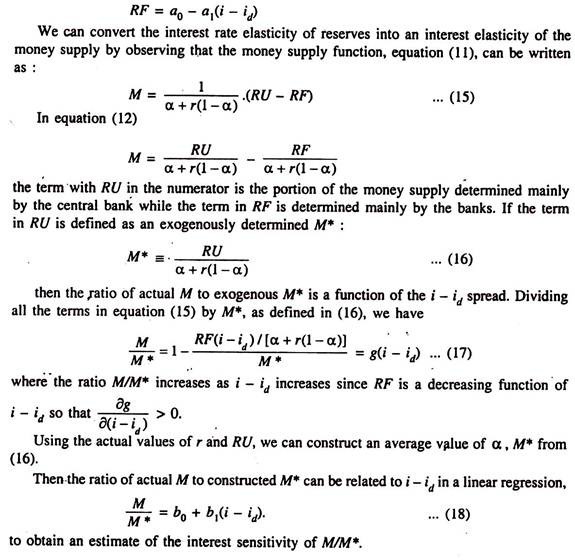

The response of excess reserves to changes in credit conditions, which might be measured by interest rates, gives the money supply a positive elasticity with respect to the interest rate.

Banks lend at market (nominal) interest rates, represented by i, and borrow reserves at the central bank’s discount window at the discount rate, id. As the market rate rises relative to the discount rate, banks will reduce excess reserves and increase their borrowings at the discount window to take advantage of the widening i – id differential. Since free reserves RF equal excess reserves RE minus borrowed reserves RB, both of these effects tend to reduce free reserves as the differential increases.

ADVERTISEMENTS:

Thus, we can write RF as a function of the i – id differential:

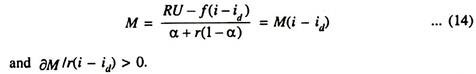

When un-borrowed reserves RU and the reserve ratio r are determined exogenously by the central bank, and with a as a parameter depending on the public’s preferences between currency and demand deposits, the free reserves function in (13) makes the money supply also a function of i – id given RU, r and α:

The most direct way to estimate the interest elasticity of the money supply is to estimate a version of the free reserve equation (13), and then calculate the effect of an i change on the money supply M through the money supply equation (14).

The following linear version of (13) was actually used by most researchers for estimation purposes:

The Central Bank’s Control over the Money Supply:

The central bank controls the level of the money supply first by setting reserve requirements against deposits, and then by changing the amount of reserves it supplies, both on its own initiative and on the initiative of the member banks.

The reserve requirements state that commercial banks and other depository institutions like savings and loan associations must hold as reserves some fraction r, say 10% of their total demand (currency) deposit liabilities, that is, of their customers’ total chequing account balances. These reserves are held in the form of deposits at the central bank.

The central bank has three ways of changing the money supply, all operating through the reserve mechanism. First, it can increase reserves by open market operations. The RFT can buy, say Rs. 1 million in central government bonds in the market in Mumbai, paying with cheque drawn on itself.

The sellers of the bonds will then deposit the cheques drawn on the central bank in their banks. These cheques become the banks’ claim on the central bank, or reserves from the banks’ point of view. The banking system can expand its demand deposit liabilities by Rs. 10 million = Rs. 1 million / 0.1).

Open market operations are used for making day-to-day changes in the money supply, or in credit conditions. If interest rates are rising faster or higher than the central bank desires, given the position of the economy, the manager of the open market account can buy bonds, raising bond prices and keeping interest rates down.

This operation increases the money supply. Or, focusing on the money supply, if it is growing less rapidly than the central bank wishes, the manager can also buy bonds. These operations are conducted every-day by the manager and provide the central bank with a continuing, relatively un-publicised, way of controlling the money supply.

Secondly, banks can obtain additional reserves by borrowing from the central bank at the discount rate id, usually set somewhat below short-term market rates such as the rate on three-month Treasury Bills. When a bank borrows at the central bank’s discount window, a deposit at the central bank, in the amount of the borrowed reserves, is created in the bank’s name. This is essentially the same procedure that a bank follows in making a loan to a private person; it credits his (or her) chequing account with the amount of the loan.

It should be noted here that, whereas reserve creation by open market operations comes at the central bank’s initiative, an increase in borrowed reserves at the discount window comes at the bank’s initiative. Discount window operations give banks the opportunity to acquire reserves, subject to the overall credit conditions set by the central bank. Discount operations, thus, contribute to the degree of control over the money supply exercised by the. banks.

Both open market and discount window operations affect the money supply by changing the level of reserves with a given reserve ratio r. The third way to operate on the money supply is through changes in the reserve ratio itself. With r at 0.1, Rs. 30 million in reserves will support a Rs. 300 million money supply (300 = 30/0.1). An increase in the reserve ratio r to 0.15 would reduce the money supply supported by the Rs. 30 billion reserve base to Rs 200 million (= 30 / 0.15). Thus, reserve ratio increases amount to what is called effective reserve changes, changing the money supply that can be supported by a given amount of reserves.

Finally, the central bank uses reserve ratio changes as an overt, well-publicised move to change effective reserves in a major way, as opposed to the normal, more continuous changes generated by open market operations. Thus, changes in the reserve ratio signal a major shift in the monetary policy and serve as a warning of the change to the financial community.

Policy Implication of Interest Elasticity of Money Supply:

We have already seen that interest elasticity of money supply has the effect of making the LM curve flatter. This would mean that a given increase in Y can be secured with a small rise in the rate of interest. The implication of this for fiscal policy can be illustrated with the help of Fig. 20.9.

Let us start with IS-LM equilibrium at point E when money supply is fairly interest inelastic. Fiscal expansion shifts the IS curve to IS1. As a result IS-LM equilibrium shifts from E to E’, resulting in the rise in output from Y0 to Y1 and the rate of interest from i0 to i1. The rise in i causes crowding out and makes fiscal policy less effective.

Let LM1 be the LM curve when money supply is interest elastic. Thus the same fiscal expansion shifts the IS-LM equilibrium from E to E”. Compared to the previous rise in rate of interest from i0 to i1 we now have a moderate rise in the rate of interest from i0 to i2.

The smaller rise in i means less fall in autonomous investment and hence less crowding out. This explains why the rise in equilibrium output is now from Y0 to Y2 compared to the rise from Y0 to Y1, when money supply was completely interest inelastic.

Thus interest elasticity of money supply has the effect of making fiscal policy more effective. The fiscal policymakers can take note of this important implication of the policy variable, namely, money supply — which is controlled by the central bank.