Consumption Function of Money: Meaning and Relationship with Income!

(a) Meaning:

The functional relationship between consumption and income is called consumption function (or propensity to consume). Consumption is related to income.

Simply put, consumption function means proportion of income spent on consumption goods.

Two noteworthy features of consumption functions are:

ADVERTISEMENTS:

(i) A zero or very low level of income, consumption expenditure is higher than income as minimum consumption is necessary for survival and (ii) As income increases, consumption expenditure also increases but increase in consumption is less than the increase in income. Simply put, propensity to consume means proportion of income spent on consumption. Consumption, being a part of income, directly depends upon income itself. Thus, consumption (C) is a function (f) of income (Y).

Symbolically:

C = f (Y)

We may bifurcate consumption in two parts:

ADVERTISEMENTS:

(i) First part relates to consumption when income is zero, i.e., when minimum level of consumption has to be maintained for survival. This is called autonomous consumption (denoted by C).

(ii) Second part of consumption is when income increases, consumption also increases but by a lesser amount, i.e., additional consumption (∆C) is less than additional income (∆Y) or ∆C/∆Y is less than 1. This may be represented by b (i.e., marginal propensity to consume).

Consumption function equation:

Consumption function (linear, i.e., straight line consumption function) is represented by the following equation.

ADVERTISEMENTS:

C = C + bY

Where C represents total consumption, C represents autonomous consumption (i.e., minimum consumption for survival when income is zero), b shows marginal propensity to consume (i.e., consumption increases by b for every rupee increase in income. Thus, 0 < b < 1). Y stands for level of income. Clearly, C is assumed to be positive (+) because for survival there has to be some consumption even when there is no income.

Thus, total consumption (C) comprises two components:

(i) Autonomous consumption (C) not influenced by income and

(ii) Induced consumption (bY) influenced by income.

For example, the consumption equation C = 30 + 0.75Y means Rs 30 is autonomous consumption (C) and 0.75 is marginal propensity to consume (b). Further, as income increases, 75% of addition income (indicating 0.75Y) is spent on consumption. In short, consumption equation C = C + bY shows that consumption (C) at a given level of income (Y) is equal to autonomous consumption (C) + b times of given level of income.

Some numerical sums for further clarification are given below:

Numerical 1

Calculate consumption level for Y = Rs 1,000 crores if consumption function is C = 300 + 0.5Y.

ADVERTISEMENTS:

Ans.

Consumption level C = = 300 + 5/10 x 1000 = 300 + 500 = Rs 800crore.

Numerical 2

Find out income level when consumption = Rs 1200 crores and consumption function is C = 100 + 0.5Y.

ADVERTISEMENTS:

Ans.

1200 = 100 +5/10 Y= 100 + 1/2 Y

= 1200 -100 = 1100

Y = 1100 x 2 = Rs 2200crore

ADVERTISEMENTS:

Since for survival, there has to be autonomous consumption, therefore, C is greater than zero (C > 0). According to Keynes, as income increases, it is human tendency to increase consumption (0 < b) but increase in consumption is not as much as increase in income, i.e., b is less than 1 (b < 1). Thus, we can show the interrelationship in this way.

C > 0, 0 < b < l

(b) Consumption Function Schedule and Curve:

The concept of consumption function is further clarified with the help of following schedule and diagram.

| National Income (Y) (Rs in crore) | Consumption (C) (Rs in crore) |

| 0 | 60 |

| 100 | 140 |

| 200 | 220 |

| 300 | 300 |

| 400 | 380 |

| 500 | 460 |

Comments:

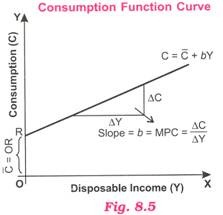

A consumption function curve indicating C = C + bY is drawn in Fig. 8.5.

ADVERTISEMENTS:

(i) Consumption can never be zero even if income is zero because some minimum level of consumption has to be maintained for survival. Such subsistence consumption is called autonomous consumption. That is why consumption curve starts from positive point C on Y-axis. In the above Fig. 8.5, consumption expenditure equal to OC is the minimum level of consumption which represents autonomous consumption.

(ii) Slope of consumption curve slopes upward which shows direct relationship, i.e., when income rises, consumption expenditure also rises but in a lesser proportion.

(ii) The rising slope of consumption curve is b (i.e., MPC = AC/AY).

(iv) Since slope of curve is constant, we get a straight line consumption curve.

(c) Relationship between Income and Consumption expenditure:

Remember, consumption expenditure is the function of income, i.e., it depends upon income as shown below:

(i) According to Keynes, as income increases, consumption expenditure also increases but by less than the increase in income. In other words, when income increases, consumption expenditure does not increase at the same rate as income. This is called Keynesian Psychological law of consumption. There is tendency of people not to spend on consumption the whole of incremental income, i.e., additional consumption is less than additional income. In other words, MPC is less than 1 (MPC< 1).

ADVERTISEMENTS:

For instance, if income increases by Rs 100, the tendency is to spend a part, say, Rs 75, on consumption and save the remaining part, i.e., Rs 25. This is known as induced consumption. It should be kept in mind that when income is zero, consumption is still positive (+) because a person has to spend a minimum amount to keep his body and soul together. This is called autonomous consumption.

(ii) When income is very low, consumption expenditure is higher than income. Its reason is that some minimum level of consumption has to be maintained irrespective of low level of income. In such a situation, value of APC (i.e., relationship between income and consumption C/Y) becomes higher than 1.

For example, if at the income level of Rs 2000, consumption expenditure is Rs 2400, then APC = 24000/2000 = 12, i.e., higher than 1. When current consumption exceeds current Income, people draw upon their past saving, i.e., there is dissaving.

Break-even point:

When consumption expenditure becomes equal to income and there is no saving, it is called break-even point.

Propensity to consume is of two types—Average Propensity to Consume (APC) and Marginal Propensity to Consume (MFC).