Demand for money means demand for holding cash.

Unlike demand for consumer goods, money is not demanded for its own sake.

Money performs two important functions:

(i) Medium of exchange

ADVERTISEMENTS:

(ii) Store of value

It is due to these two functions that money is considered as indispensable by the society. Therefore, demand for money is a derived demand. Demand for money is a very crucial concept as the value of money depends on the demand for money. There are different concepts of the demand for money.

Classical View:

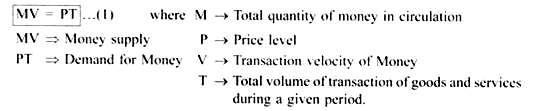

I. The Classical economists viewed that money does not have any inherent utility of its own but is demanded for transaction motive. Money serves as a medium of exchange. Irving Fisher’s version of the quantity theory of money which he developed in his book “Purchasing Power of Money” is the most famous version and represents the Classical approach to the analysis of the relationship between the quantity of money and the price level.

With V and T remaining constant, P changes proportionately to the changes in M, such that if M is doubled, P is also doubled but the value of money is halved.

Limitations:

1. It does not explain how a change in M changes P

2. P is regarded as a passive factor which is unrealistic

ADVERTISEMENTS:

3. Not only M determines P but also P determines M.

Neo-Classical Theory/Cambridge Version:

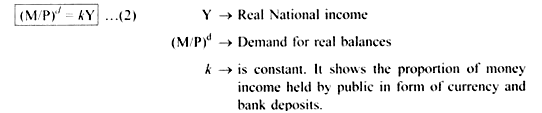

II. According to the neo-classical theory given by Marshall, Pigou, etc., money does not serve only as a medium of exchange but also as a store of value. The price level is affected only by that part of money which people hold in form of cash for transaction purpose and not by MV as suggested by the Classical theory. The theory assumes that the demand for real balances is proportional to the income level.

Limitation:

Although the Cambridge version links the demand for money to the money income, and recognizes that the other variables like rate of interest influences the value of k, it failed to incorporate it systematically in the analysis. The most sadly neglected part of pre-Keynesian analysis is the relationship between the asset demand for money and the interest rate.

Keynesian Concept of Demand for Money/Liquidity Preference Theory of Demand for Money:

III. Credit goes to Keynes for discussing the relationship between the interest rate and demand for real balances. He in his book “The General Theory of Employment and Money (1936)” uses a different term for demand for money and called it Liquidity Preference.

He does not disagree with the classical and neo-classical concept that money is demanded as a medium of exchange but he differs on the point that money is demanded only as a medium of exchange. Keynes viewed that money has a ready purchasing power and can be converted into any commodity when desired, then why to prefer liquidity or cash balance. The Neoclassical economists failed to recognize this.

ADVERTISEMENTS:

Keynes viewed that money is demanded due to three main motives:

1. Transaction Motive (Lt):

It is the demand for money to meet daily transactions. It depends directly on the level of income.

Lt =f(Y) …(3i)

ADVERTISEMENTS:

2. Precautionary motive (Lp):

It is the demand for money for meeting future contingencies. This depends directly on the level of income.

Lp = f(Y) …(3ii)

Since both Lt and Lp depend directly on the income level, Keynes called it as L1.

ADVERTISEMENTS:

L1 = f (Y) …(3iii)

L1 is interest inelastic.

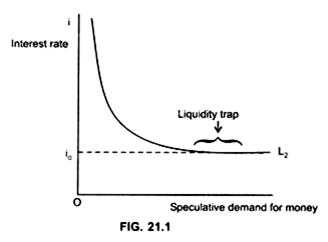

IV. Speculative Motive (L2): In a dynamic society there is no certainty regarding future. In such a situation, the store of value function is more important. This leads to speculative motive for hoarding money, a new approach discussed by Keynes.

It is termed as speculative motive because it depends on the hopes of gains and fears of loss in future. It relates to the desire to hold one’s resources in liquid form in order to take advantage of the market movements regarding future change in the interest rate. The amount of money held for speculative motive will depend on the interest rate.

L2 = f (i) …(4)

L2 indirectly depends on i

ADVERTISEMENTS:

L2 curve shows an inverse relationship between L2 and the interest rate (Fig. 21.1).

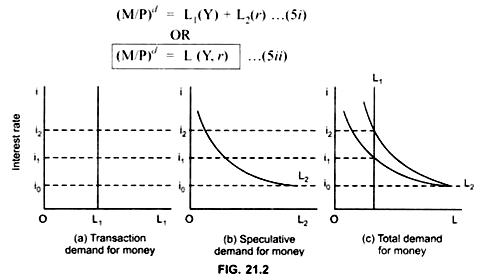

Total demand for money (M/P)d:

Total demand for money is a function of both income level and the interest rate.

L1 is interest inelastic (Fig. 21.2a)

ADVERTISEMENTS:

L2 is inversely related to the interest rate (Fig. 21.2b)

L is the total demand for money which is a horizontal summation of L1 and L2 (Fig. 21.2c)

Limitations:

Tobin criticized Keynesian view on demand for money, held for transaction and speculative motive.

1. Keynes viewed that L1 is interest inelastic but Tobin argued that when interest rate is very high, even in the short run, the demand for money starts responding. He explained this in his Portfolio theory of money demand (Para 22.1).

2. Tobin criticized Keynes’ view on speculative demand for money. According to Keynes, people will hold the asset either in form of money or bonds depending on the expectations regarding the future interest rate.

ADVERTISEMENTS:

Tobin in his Portfolio Optimization theory showed that people will hold a combination of money and bonds which is based on uncertainty. (Paras 22.2, 22.3).