The demand for money comes from the desire to hold liquid assets of which money is the only perfect example. It may be noted that money is not demanded for its own sake but because it can be used to purchase economic goods and services.

Keynes argued that there are three motives for holding money. First, individuals will demand money to finance their daily purchases of goods and services. This is known as the transactions motive. Secondly, people will demand money as a contingency against unforeseen expenditures. This is known as the precautionary motive. Thirdly, people will hold money as a store of wealth.

This is known as the speculative motive. In particular, people hold money for speculative purposes because they are unsure about the returns from the alternative financial assets in which they could hold their wealth, i.e., bonds. The returns from holding bonds has two components, viz., the interest payments and the possibility of a capital gain or loss.

If the expected loss is greater than the interest payments the net return is negative and the individual concerned will hold no bonds, only money. Bond prices are inversely related to the interest rate and, therefore, if an individual expects a sharp rise in the interest rate, this is the same as expecting a corresponding sharp fall in bond prices and again he will hold only money.

ADVERTISEMENTS:

Keynes supposed at the aggregate level that individuals hold a wide variety of different views about expected rates of interest in future and therefore as the current rate of interest fell more and more people would expect that eventually it would rise again — the price of bonds would fall — and therefore more people would hold only money.

In this manner, Keynes argued that in aggregate the demand for money for speculative purposes, L(r), would be inversely related to the interest rate, r In contrast, the amount of money demanded for transactions and precautionary purposes, kPY, was determined by the individuals’ level of income Y and the general price level (P).

Thus, in Keynes’ theory the demand for money is expressed as:

Md = kPY + L (r)

ADVERTISEMENTS:

where Md is the total demand for money, kPY is transactions and precautionary demand and L(r) is speculative demand. Here Y is national income, P is the price level and k is the fraction or proportion of income held in the form of liquid balance (0<k<1).

If V increases, k remaining the same, people will require more money to spend. Likewise, if P increases people will require more money to buy the same amount of goods and services. Here, L is liquidity preference (or speculative demand) which is a function of the rate of interest (r) L varies inversely with r. vanes inversely with r.

An individual’s preference for liquidity, money, therefore arises because of his uncertainty about the exact point in time when he will need money – the precautionary motive -and his uncertainty about future interest rates – the speculative motive. Liquidity preference in the Keynesian analysis is therefore largely a function of uncertainty.

The demand for money refers to the desire to hold money in liquid form as an alternative to purchasing income-earning assets like bonds. Money can be used for any purpose immediately and therefore people desire to hold money either as cash in hand or in the form of readily withdrawable demand deposits in banks. J.M. Keynes calls this desire as “liquidity preference”.

ADVERTISEMENTS:

According to Keynes, people hold money for three purposes, viz., transactions, precautionary and speculative.

The motives lying behind liquidity preference (or why people desire to hold money) can be analysed as follows:

(1) The transactions motive:

Liquid balances are necessary to bridge the interval between receipt of income and outlay. Income is received periodically. A man who gets his wages once a month must keep enough cash in his hands or in his current account to carry on his day-to-day purchases between one pay day and another.

The same considerations apply to businesspeople and industrialists. They also must keep some money in hand for their day-to-day transactions. The amount of money, required for this purpose, depends upon the general level of business activity.

(2) The precautionary motive:

Liquid balances are required to be kept in hand to provide for emergencies like sickness or accident. Everyone likes to keep some money in hand by way of precaution against such contingent liabilities and unforeseen expenses.

(3) The speculative motive:

Liquid balances are held with the expectation of finding better uses for them in the future. Opportunities for the purchase of goods or of bonds, on favourable terms, may come any time and everyone likes to keep some money at hand to avail himself of such opportunities. Money kept as a store of wealth comes within this category. (Keynes)

ADVERTISEMENTS:

Balances held from the transactions or the precautionary motives are little affected by the rate of interest. But those held for the speculative purposes are particularly sensitive to it.

The demand for money depends on three main factors: national income, the price level and the rate of interest. Transactions demand and precautionary demand vary directly with the first two factors but speculative demand for money vary inversely with the market rate of interest.

Monetary Equilibrium:

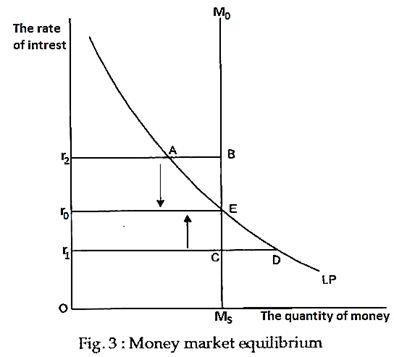

Monetary equilibrium occurs when the demand for money equals the supply of money. In fact, the rate of interest does the job of equating the quantity of money demanded to the available supply, i.e., it does the job of producing monetary equilibrium. In Fig. 3 we see how the rate of interest ensures monetary equilibrium.

ADVERTISEMENTS:

The money supply is fixed by the central bank at Mo. Since (by assumption) the money supply does not change with the rate of interest the supply curve of money Mo is completely inelastic — a vertical straight line. The curve LP is the demand curve for money or the liquidity preference curve. It slopes downward from left to right because of the speculative component. Speculative demand for money varies inversely with the market rate of interest.

So, the LP curve shows how the total demand for money varies with the rate of interest and it is drawn for a specific level of national income. Constancy of national income implies fixed demand for money for transactions and precautionary purposes. The money market reaches equilibrium at the interest rate r0, where the LP and the M0 curves intersect. At this rate of interest, households and business firms are just willing to hold all of the money that is available to be held.

If, however, the actual rate of interest deviates from its equilibrium level (r0) there will be disequilibrium in the money market. If it falls below the equilibrium level (r1) there will be excess demand for money. People will satisfy this demand by selling bonds. This excess demand for money implies excess supply of bonds. This, in its turn, will depress the price of bonds.

ADVERTISEMENTS:

And, a fall in the price of bonds implies a rise in the rate of interest. The converse is also true. If the rate of interest goes up (to r2) there will be excess supply of money. This implies excess demand for bonds. The price of bonds will rise as a consequence.

So, this is equivalent to a fall in the market rate of interest. Thus, we see that the rate of interest rises when there is excess demand for money and falls when there is an excess supply of money. So the condition for monetary equilibrium is that the rate of interest will be such that the community, as a whole, is just willing to hold the existing stock of money.