The below mentioned article provides a Beginner’s Guide to the Quantity Theory of Money. After reading this article you will learn about: 1. Introduction to the Quantity Theory of Money 2. Assumptions of the Quantity Theory of Money 3. Versions 4. Limitations.

Introduction to the Quantity Theory of Money:

How is the general price level determined? Why does price level change? Classical or pre- Keynesian economists answered all these questions in terms of quantity theory of money.

In its simplest form, it states that the general price level (P) in an economy is directly dependent on the money supply (M):

P = f(M)

ADVERTISEMENTS:

If M doubles, P will double. If M is reduced to half, P will decline by the same amount. This is the essence of the quantity theory of money.

Though the theory was first stated in 1586, it received its full-fledged popularity at the hands of Irving Fisher in 1911. Later, an alternative approach was given by a group of Cambridge economists. However, the basic conclusion of these two theories is the same price level varies directly with and proportionally to money supply.

Assumptions of the Quantity Theory of Money:

The classical quantity theory of money is based on two fundamental assumptions:

First is the operation of the Say’s Law of Market. Say’s law states that “Supply creates its own demand.” This means that the sum of values of all goods produced is equivalent to the sum of values of all goods bought.

ADVERTISEMENTS:

Thus, by definition, there cannot be deficiency of demand or underutilization of resources. There will always be full employment in the economy. Second is the assumption of full employment that follows from the Say’s Law.

Versions of the Quantity Theory of Money:

1. The Quantity Theory of Money- Fisher’s Version:

Like the price of a commodity, value of money is determined by the supply of money and demand for money. In his theory of demand for money, Fisher attached emphasis on the use of money as a medium of exchange. In other words, money is demanded for transaction purposes.

As a truism, in a given time period, total money expenditure is equal to the total value of goods traded in the economy. In other words, national expenditure, i.e., the value of money, must be identically equal to national income or total value of the goods for which money is exchanged, i.e.,

ADVERTISEMENTS:

MV = ∑piqi = PT …(11.1)

Where,

M = total stock of money in an economy;

V = velocity of circulation of money, that is, the number of times a unit of money changes hand;

Pi = prices of individual goods;

∑P = p1q1 + p2q2 +……….. + pnqn are the prices and outputs of all individual goods;

qi = quantities of individual goods transacted;

P = average or general price level or index of prices;

T = total volume of goods transacted or index of physical volume of transactions.

ADVERTISEMENTS:

This equation is an identity3 that always holds true: it tells us that the total stock of money used for transactions must equal to the value of goods sold in the economy. In this equation, supply of money consists of nominal quantity of money multiplied by the velocity of circulation.

The average number of times that a unit of money changes hands is called velocity of circulation of money. The concept that provides the link between M and P × T is also called the velocity of money. V is thus defined as total expenditure, P × T, divided by the amount of money, M, i.e.,

V = P × T/M

If P × T in a year is Rs. 5 crore and the quantity of money is Rs. 1 crore then V = 5. This means that a unit of money is spent 5 times in buying goods and services in the economy. Thus, the supply of money or the total expenditure on national income is MV. On the other hand, total value of all transactions or money demand comprises P multiplied by T.

ADVERTISEMENTS:

Fisher assumed fixity in V in the short run. V is determined by:

(i) The payment habits of the people

(ii) The nature of the banking system

(iii) General factors (e.g., density of population, rapidity of transportation). As far as T is concerned, Say’s Law suggests that it would remain fixed because of full employment.

ADVERTISEMENTS:

With V and T constant, the above identity is modified as:

MV = PT …(11.2)

Or, P = V/T. M …(11.3)

where the bar sign over the heads of V and “T” indicates that these two are fixed. It now follows that an increase in M leads to an equi-proportional increase in P.

Suppose M = Rs. 1,000, V = 4, P = Rs. 2 and T = 2,000.

Thus, MV = PT

ADVERTISEMENTS:

Rs. 1,000(4) = Rs. 2(2,000)

Rs. 4,000 = Rs. 4,000

If M increases by 50%, i.e., M rises to Rs. 1,500 then P will rise by 50% from Rs. 2 to Rs. 3.

Rs. 1,500(4) = Rs. 3(2,000)

Rs. 6,000 =Rs. 6,000

Or, P = MV/T

ADVERTISEMENTS:

Rs. 3 = 1,500(4)/2,000

M ↑ V̅ → MV ↑→ P ↑, T̅

The stock of money thus determines the price level. People hold money more than their need for transactions when money supply increases. Holding of money is useless. So they spend money. This additional expenditure, given full employment, raises the price level.

Obviously, a rise in the price level means an increase in the value of transactions and, hence, demand for money rises. The process will continue until the equality between demand for and supply of money is re-established.

Fisher’s cash transaction version can be extended by including bank deposits in the definition of money supply. Now money supply comprises not only legal tender money, M, but also bank money, M’. This bank money has also a stable velocity of circulation, V’.

Thus the above equation can be written as:

ADVERTISEMENTS:

MV + M’V’ = PT …(11.4)

Or, P = MV + M’V’/T …(11.5)

Assuming V, V’, T and the ratio of M and M’ constant, an increase in M and M’, say by 5%, will cause P to rise also by the same percentage.

It is, however, not easier to measure the number of transactions T. Let us replace T by Y. Thus P.Y is the nominal income or output where Y is the total income.

Now the quantity theory equation becomes:

PY = MV.

ADVERTISEMENTS:

This is known as the ‘income version’ of quantity theory of money.

2. The Quantity Theory of Money: Cambridge Version:

An alternative version, known as cash balance version, was developed by a group of Cambridge economists like Pigou, Marshall, Robertson and Keynes in the early 1900s. These economists argue that money acts both as a store of wealth and a medium of exchange. Here, by cash balance and money balance we mean the amount of money that people want to hold rather than savings.

According to Cambridge economists, people wish to hold cash to finance transactions and for security against unforeseen needs. They also suggest that an individual’s demand for cash or money balances is proportional to his income. Obviously, larger the incomes of the individual, greater are the demand for cash or money balances.

Thus the demand for cash balances is specified by

Md = kPY …(11.6)

Where, Y is the physical level of aggregate or national output, P is the average price and k is the proportion of national output or income that people want to hold. Let us assume that the supply of money, MS, is determined by the monetary authority, i.e.

MS = M …(11.7)

Equilibrium requires that the supply of money must equal the demand for money, or

MS =Md. …(11.8)

Md = kPY …(11.9)

M = kPY

Or, P = M/kY …(11.10)

k and Y are determined independently of the money supply.

With k constant given by the transaction demand for money and Y constant because of full employment, an increase or decrease in money supply leads to a proportional increase and decrease in price level. This conclusion holds for the Fisherian version also. Note that Cambridge ‘k’ and Fisherian ‘V’ are reciprocals of one another, that is, 1/k is the same as V in Fisher’s equation.

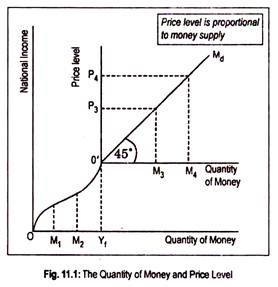

The classical relationship between money supply and price level can be illustrated in terms of Fig. 11.1. This diagram is interesting in the sense that it first establishes the relationship between money supply and national output or national income below the full employment. For this relationship, the origin ‘O’ is important.

Now the relationship between money supply and price level after the full employment state can be established assuming O’ as the origin. Before the attainment of full employment state (Yf), an increase in money supply (from OM1 to OM2 and to OYf) causes national income shown by the steep output curve to rise more rapidly than the price level.

By utilizing its resources efficiently and fully, an economy can increase its output level by increasing the volume of investment consequent upon an increase in money supply. Since there is a limit to output expansion due to full employment (i.e., beyond which output will not increase), an increase in money supply from (M3 to M4) will cause price level to rise from (P3 to P4) proportionally (shown in the upper panel).

For stability in price level money supply should grow in proportion to increases in output.

Limitations of the Quantity Theory of Money:

This theory has been criticized on several grounds:

(a) Inoperative below Full Employment:

It is alleged that the quantity theory of money comes into its own only during periods of full employment of resources. Assuming constancy in V, V’, T, Y etc., a change in money supply will bring about a change in price level. During periods of full employment, T or Y remains unchanged. In such a time, even if money supply rises, T or Y will not change.

On the other hand, price level will rise. But, in reality, full employment of resources is a rare possibility. What we find in reality is unemployment or underemployment of resources. During underemployment an increase in money supply will tend to raise output level and, hence, T, but not P. So, quantity theory of money breaks down when resources remain below full employment.

(b) V, T, etc., do not Remain Fixed:

In a dynamic economy V, V’, T, the ratio of M to M’, never remain constant. In such an economy, a change in any of the variables may cause a change in price level, even if money supply does not change. In this sense, these are not independent variables, although the authors of this theory assumed quantity of money as independent of other elements of the equation.

(c) It is an Identity that is Always True:

Fisher’s equation is an identity. MV and PT are always equal. In fact, the quantity theory of money is a hypothesis and not an identity which is always true.

(d) Aggregate Demand, and not M, Influences Price Level:

Keynes argued that price level in an economy is not influenced by money supply. The important determinant of money supply is the income level and the total expenditure of the country. According to Keynes, an increase in money supply is tantamount to an increase in effective demand.

After the stage of full employment, an increase in effective demand (which is the sum of consumption expenditure, investment expenditure and government expenditure) will raise the price level, but not proportionately.

(e) Too much Emphasis on Money Supply:

Change in price level is caused by various factors, besides money supply. For example, an increase in cost of production has an important bearing on the price level.

For instance, an increase in wage rate following a revision in the pay scale of employees or increase in the price of raw materials (say, hike in the price of petroleum products) will definitely push the price level up, whether the economy stays on or below the full employment level. The quantity theory attaches too much importance on money supply.

(f) M Influences P via Interest Rate:

The classical theory establishes a direct and proportional relationship between money supply and price level. Critics say that the relationship is not a direct one. Fisher ignored the influence of the rate of interest on the price level. Supply of bank money or credit money is influenced largely by the interest rate.

It is argued that an increase in money supply first affects the rate of interest which influences total output and price level in the ultimate analysis.

The causal relationship is as follows:

Change in the stock of money → change in interest rate → change in investment → change in income, employment and output → change in general prices.

Despite these criticisms, the quantity theory of money has certain merits. Whenever money supply rose abnormally in the past in an economy, inflationary situation developed there. May be the relationship is not a proportional one, but excessive increase in money supply leads to inflation.

In the 1950s, Milton Friedman came out with a thesis that ‘inflation is always and everywhere a monetary phenomenon’. These Friedmanian words are enough to establish the essence of the quantity theory of money: inflation is largely caused by the excessive growth of money supply—and by nothing else.