There are similarities and dissimilarities between the two approaches of the quantity theory of money, i.e, the Fisherian transaction approach and the Cambridge cash-balance approach.

Similarities between the Two Approaches:

The similarities between the Fisherian and the Cambridge approaches are discussed below:

1. Similar Equations:

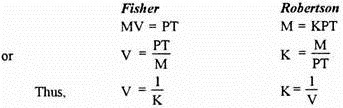

Robertson’s cash-balance equation, P = M/KT is quite similar to that given by Fisher; P = MV/T. Both the equations use the same symbols with same meanings. The only difference lies in V and K which are, in fact, reciprocal to each other; V refers to rate of spending and K refers to the extent of holding or not spending.

It means when people want to hold more money (higher the K), they want to spend less or the velocity of circulation of money will be less (lower the V). Thus, by substituting 1/V for K and 1/K for V, the two equations can be reconciled.

2. Same Conclusions:

Both the approaches lead to the same conclusions, i.e., the price level or the value of money depends upon the money supply. In other words, there is direct proportionate relationship between the money supply and the price level and inverse proportionate relationship between money supply and the value of money. If the money supply is doubled, the price level is also doubled and the value of money is halved.

3. Same Phenomenon of Money:

ADVERTISEMENTS:

MV + M’V’ of Fisher’s equation, M of Robertson’s and Pigou’s equation and n of Keynes’ equation, all refer to the same thing, i.e., the total supply of money.

4. V and K-Two Sides of the Same Phenomenon:

Fisherian and Cambridge approaches are not fundamentally different from each other because they represent two sides of the same phenomenon. The Fisherian approach emphasises money as a stock, while the Cambridge approach stresses money as flow.

Dissimilarities between the Two Approaches:

In spite of similar conclusions and implications of the two approaches, they have some notable differences. As Hansen has pointed out- “The Marshallian version of the quantity theory, M = KY, represents a fundamentally new approach to the problem of money and prices. It is not true; as is often alleged, that the cash-balance equation is merely the quantity theory in new algebraic dress. To assert this is to miss entirely the significance of K in the Marshallian equation.”

ADVERTISEMENTS:

Important dissimilarities between the two approaches are discussed below:

1. Relative Stress of Supply and Demand for Money:

Fisher’s approach stresses the supply of money, whereas, the Cambridge approach lays more emphasis on the demand for money to hold cash.

2. Definition of Money:

The two approaches use different definitions of money. The Fisherian approach emphasises the medium of exchange function of money, whereas the Cambridge approach stresses the store of value function of money.

3. Flow and Stock Concepts:

The Fisherian approach regards money as a flow concept; money is considered in terms of flow of money expenditures. The Cambridge version regards money as a stock concept; money supply refers to a given stock at a particular point of time.

4. Transaction and Income Velocities:

Fisherian approach emphasises the importance of the transaction velocity of circulation (i.e., V). The Cambridge Version, on the contrary, lays stress on the income velocity of the part of income which is held in the cash balance (i.e., K).

ADVERTISEMENTS:

5. Nature of P:

In both approaches, the price level (P) is not used identically. In Fisher’s version, P is the average price level of all goods. On the contrary, in Cambridge version. P refers to the price of consumer goods.

6. Factors Affecting V and K:

Fisher is concerned about the institutional and technological factors governing how fast individuals can spend their money (i.e., V). The Cambridge School, on the other hand, is concerned about the economic factors determining what portion of their wealth the public desires to hold in the form of money (i.e., K).

ADVERTISEMENTS:

7. Relationship between M and P:

The Fisherian approach maintains that any change in the money supply produces proportional changes in the price level. This is because Fisher believes that both velocity and real income are in the long run independent of each other and of supply of money.

In the Cambridge approach, the price level may change by more or less than the money supply; it depends upon what happens to the stock of non-monetary assets and their expected yields on which the Cambridge economists believed the desired cash balances depend.

8. Different Approaches to Monetary Theory:

ADVERTISEMENTS:

Both Fisher and Cambridge School led to the development of two different approaches to the monetary theory. Fisher’s approach has given rise to an inventory theory of money holding largely for transactions purposes. On the other hand, the Cambridge approach has been developed into portfolio, or capital theoretic approach to monetary demand.

Superiority of Cash Balance Approach:

The Cambridge version is superior to the Fisherian version on the following grounds:

1. Realistic Theory:

The Fisherian approach is mechanical in the sense that it maintains a mechanical, i.e., direct and proportional relationship between the supply of money and the price level. The Cambridge approach, on the contrary, provides a realistic analysis. By emphasising K, it introduced the role of human motives in the determination of the price level.

2. Complete Theory:

Fisher’s approach is one-sided because it considers quantity of money to be the only determinant of the value of money or the price level. In the Cambridge approach, both the demand for and the supply of money are recognised as real determinants of the value of money.

ADVERTISEMENTS:

3. Broader Theory:

The Cambridge approach is broader and comprehensive because it takes into account income level as well as changes in it as important determinant of the price level. The Fisherian approach ignored income level and makes the price level dependent upon the quantity of money and the total number of transactions.

4. More Useful:

According to Kurihara, the Cambridge equation, P = M/KT, is analytically more useful than the Fisherian equation, P = MV/T, in explaining money value. It is easier to know the amount of cash balances of an individual than to know his expenditure on various types of transactions.

5. Causal Process:

According to Fisher, changes in the price level are caused by the changes in the quantity of money. But according to the Cambridge economists, the price level may change even without a change in the quantity of money, if K changes. Given the quantity of money, a desire to keep less money balances will raise the price level and vice versa.

ADVERTISEMENTS:

6. Explanation of Cyclical Fluctuations:

The variable K in the Cambridge equation is more significant in explaining the trade cycles than the variable V in Fisher’s equation. During inflation, people decrease their cash balances (K) and as a result, the value of money falls and the price level rises. On the contrary, during depression, the desire to hold money (K) rises and, as a consequence, the value of money rises and the price level falls.

7. Basis of Liquidity Preference Theory:

The Cambridge approach, by stressing on the motives for the demand for holding money, provided a foundation for the development of Keynes ‘liquidity preference theory of interest, Liquidity preference theory is a significant constituent of the modem theory of income and employment and its emergence has raised the importance of fiscal policy in controlling business cycles.

8. Nature of Variables:

Various variables in the Cambridge equation are defined in a better and more realistic manner than those in the Fisherian equation. T in Fisher’s version refers to the total transactions, whereas in the Cambridge equation, T refers to only the final goods and services. Similarly, P in Fisher’s version stands for the average price level of all goods transacted in a period of time, but in Cambridge version, P is the general price level of only final goods.

ADVERTISEMENTS:

9. General Demand Analysis:

The Cambridge approach is preferred by the economists because it applies the general demand analysis to the special case of money. It enquires into the utility of money, the nature of the budget constraint facing the individual and the opportunity cost of holding money as against the other assets.