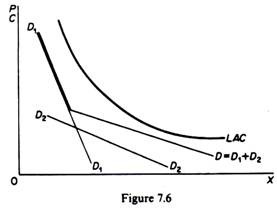

In some cases the various sectors of a market may have demand curves which, when added together, give a total market demand which lies at all levels of output below the LAC of the firm.

Under these circumstances it is clear that production cannot take place at all if a uniform price is charged, no matter how high this price is set (figure 7.6).

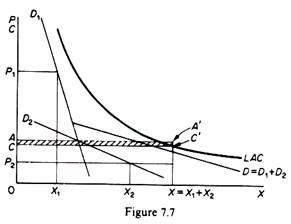

However, if price discrimination is adopted with a sufficiently high price P1 charged for the inelastic sector of the market and a sufficiently low price P2 set for the elastic section of the market, the total revenue may be sufficient to cover the total costs (and even allow excess profits) so that production can take place.

For example, assume that the AC takes the following values for the corresponding levels of output:

at X = 100, the AC = 30

at X = 400, the AC = 13

ADVERTISEMENTS:

at X = 500, the AC = 11

If the firm can sell to the high-income market 100 units of X at P1 – 20, and to the low-income market 400 units at P2 = 10, the firm’s total revenue is

R = R1 + R2 = X1P1 + X2P2 = (100) (20) + (400) (10) = 6000

and its total cost is

ADVERTISEMENTS:

TC = (AC). (X) = (AC). (X1 + X2) = (11)-(500) = 5500

Thus, with price discrimination not only does the firm cover its total cost, but also it realizes an excess profit of 500 units.