Get the answer of: What is Monopoly?

‘Mono’ means one and ‘poly’ means seller. Thus monopoly refers to a market situation in which there is only one seller of a particular product. This means that the firm itself is the industry and the firm’s product has no close substitute. The monopolist is not bothered about the reaction of rival firms since it has no rival. So the demand curve faced by the monopoly firm is the same as the industry demand curve.

Three features characterise monopoly — market in which there is only one supplier. First, the firm is in its in motivated by profits. Secondly, it stands alone and barriers prevent new firms from entering the industry; and thirdly, the actions of the monopolist itself affect the market price of its output—it is not a price-taker.

Can there be complete monopoly in the real commercial world? Some economists feel that by maintaining some barriers to entry a firm can act as the single seller of a product in a particular industry. Others feel that all products compete for the limited budget of the consumer. Therefore, no firm, even if it is the only seller of a particular product, is free from competition from the sellers of other products. Thus complete monopoly does not exist in reality.

ADVERTISEMENTS:

The monopolist is the sole seller of a particular product. Therefore, if the monopolist is to enjoy excess profit in the long run that must exist certain barriers to the entry of new firms into the industry. Such barriers may refer to any force which prevents rival firms (competing producers) from entering the industry.

Such barriers which protect the monopolist from the encroachment of other firms may be either natural or artificial (legal). In fact, entry barrier may take different forms.

Some of the important one are the following:

(a) Natural Barriers:

ADVERTISEMENTS:

There are three sources of natural barriers.

(i) Absolute cost advantage:

If production in an industry is subject to increasing return to scale or decreasing cost, long-run average cost will tend to fall with an increase in the size of the firm. Thus an increase in the size of the firm is desirable. In this context we may refer to the concept of natural monopoly. Natural monopoly exists when it is possible to produce at minimum efficient scale.

Thus natural monopoly refers to an industry in which technical factors provide the efficient existence of more than one producer. As R. G. Lipsey and C. Harbury have rightly commented: “In such an industry, competition among firms will lead to the emergence of one large firm serving the whole market—since the largest firm always has lower costs, and hence can undersell any small competitors.” Examples are the public utilities such as water, gas and electricity where there is acquirement for a network of pipes or cables.

ADVERTISEMENTS:

(ii) Sole control over a basic raw material:

A prime cause of cost advantages seems to be the possession of a critical raw material. This is another natural barrier to entry. For example, a cement manufacturing company may have sole access to a basic raw material, viz., limestone and may thus enjoy monopoly position in the industry. Similarly, a company may own a small piece of land beneath which oil is found.

(iii) Locational advantages:

Some locations offer special advantages than others. This fact discriminates in favour of certain firms and against others. This, in its turn, makes it impossible on the part of potential new entrants to compete on equal terms with an established firm. For example, a restaurant adjacent to a bus junction can expect more sales than those situated in remote places.

A book shop in Dariaganj area of Delhi can expect more sales than another shop situated near the Delhi airport. Such locational advantages also give rise to cost advantages. For example, Hindustan Lever’s soap factory near the Kidder-pore area of Calcutta is situated on the bank of river Hooghly. This proximity to a river lowers HL’s costs of waste disposal, compared to other firms.

(b) Artificial Barriers:

Artificial barriers are those which are created by human beings and not by nature. Some of these are created by individuals and business firms, while others are created by governments.

Such barriers are of three types:

(i) Product differentiation:

ADVERTISEMENTS:

This is an important feature of monopoly because it implies absence of close substitutes. Product differentiation enables a firm to deter the entry of new firms in the industry. This is often achieved through advertising and sales promotion. For example the Reckitt and Colman of India Ltd. is enjoying a virtual monopoly position as far as its main product, viz., Dettol is concerned. In spite of introduction of Savlon by Johnson and Jhonson Ltd., Dettol continues to be the most popular antiseptic germicidal in the country.

(ii) Legal barriers:

By using patents on production processes (as in the case of Coca Cola) and copyrights on publications (as in the case of Sampat Mukherjee’s Economics Theory by New Delhi’s Wiley Eastern Ltd.) legal restrictions may be imposed on the entry of new firms in an industry. Such legal devices are often used for preventing the entry of new firms in an industry.

(iii) Barriers created by government:

ADVERTISEMENTS:

The government of a country can also create monopoly by giving the legal right to a company to produce a particular product or render a particular service. For example, the Acts of Parliament protect India’s nationalised industries such as the Coal India Ltd., or the LIC, at least partly, from competition of private firms. The State Governments also grant monopoly rights to private firm’s suah as Roy’s Wine Shop in Salt Lake area of Calcutta, the only duty free shop in an airport, or the only service station in a particular locality.

Short-Run vs. Long-Run Barriers:

Thus for monopoly to exist and monopoly profit not to disappear there must exist certain barriers to entry. Some of these barriers are permanent, others are temporary in nature. For example, cost advantages, arising from increasing returns to scale, create permanent barriers to entry. On the other hand, copyrights or patents cannot prevent the entry of new firms in the industry in the long run. Similarly, differentiated products are likely to be copied out in the long run.

Output and Price Determination:

ADVERTISEMENTS:

By pure or absolute or a single-firm monopoly we mean that one firm is the only seller or the dominant seller of a given commodity for which there is close substitute.

A monopoly market has the following distinguishing features:

1. A single producer or seller:

In a monopoly market there is only one single or dominant producer or seller in the industry producing or selling a particular product.

2. Absence of close substitutes:

A monopolist produces or supplies a particular commodity which is not produced or sold by any other firms. Theoretically speaking, there cannot be any substitute for the product of a monopoly firm. But, in reality, every commodity has more or less some substitutes, near or distant. However, in monopoly the substitutes available are not close.

ADVERTISEMENTS:

3. Absolute control over the market supply:

As a single firm produces or supplies the commodity, a monopolist, unlike a competitor, has an absolute control over the market supply. This is considered to be foundation of monopoly power.

4. A price-maker, not a price-taker:

As the monopoly firm has an absolute control over the market supply, any increase of supply raises it. It is, indeed, a price-maker, not a price-taker. If it reduces the supply in the market, the price will rise; and vice-versa. So its demand (average revenue) curve is downward sloping from left to right. It is obvious that in such a situation marginal revenue will be less than its average revenue.

5. No entry of new firms:

In monopoly there is no entry of new firms into the industry because of legal or natural barriers. As a result excess profit, if any, does not disappear in the long run as under perfect competition.

ADVERTISEMENTS:

6. Absence of competitive advertisements:

As there are no competitors, a monopoly firm is not required to spend money on competitive advertisements. Sometimes it, however, spends some amount of money on informative advertisements for better publicity and for maintaining good relation with its customers.

7. Equilibrium of firm and industry:

Since there is only one firm in the industry, under monopoly the equilibrium of firm is the same as the equilibrium of industry.

It is to be noted that the cases of pure monopoly are nearly as rare as examples of pure competition as no firm has complete monopoly power. In the field of public utilities like the supply of electricity, telephone operations, water supplies and railway services we find the presence of monopolies. The Calcutta Electric Supply Corporation (India) Ltd. is also an instance of a monopoly firm.

Output and Price Determination under Monopoly:

ADVERTISEMENTS:

A monopolist, like other producers, is also guided by the chief consideration of the maximisation of net gains or the minimisation of losses. For determining the optimal output, he is required to make a comparison between marginal cost and marginal revenue. The output of the monopolist will be set at the point at which marginal revenue is equated with marginal cost.

If marginal revenue were any higher it would pay the monopolist to increase production because the additional costs generated would be lower than the revenue, and profits would rise. The reverse would be true if marginal revenue were any lower than marginal cost. The price of the monopolist is determined by demand as the firm cannot set both output and price.

For its chosen output, the monopolist can read price off a market demand curve, which will lie above the marginal revenue curve. The total profits of a monopolist become, as in other cases, the maximum at the output where marginal cost becomes equal to marginal revenue.

If marginal revenue is greater than marginal cost, the monopolist will be able to increase his total profits by producing more. If, on the other hand, marginal cost is greater than marginal revenue at any level of output, he gets losses and so will reduce the output, where MC=MR. By fixing his output at the optimal level, he will fix the price of his product, which he determines from his average revenue curve.

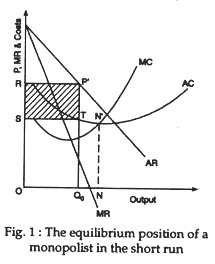

The equilibrium position of a monopolist in the short run is shown in Fig. 1, where he produces OQ0 output because at the output MC=MR. For OQ0 equilibrium output he charges Q0P0 price—the monopoly equilibrium price.

His supernormal or excess profit is represented by the area RSTP0. This excess profit does not disappear in the long run due to entry restrictions. So there is no fundamental difference between the short-run and the long-run in a monopoly as situation, imperfect competition.

ADVERTISEMENTS:

But the fact remains that if a monopolist operates a profit in the short run, he will operate on a much larger scale in the long run. In other wards, a single plant monopolist prices become a multi-plant one in the long run. However, there is an important point to note in this context. Since increasing of scale becomes relevant in the long run a monopolist may operate under alternative cost conditions.

Long-Run Monopoly Equilibrium:

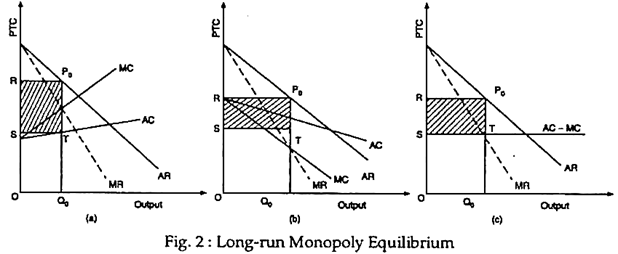

In the long run a monopolist may produce under increasing cost or under decreasing cost or under constant cost. Equilibrium situations of a monopolist under three such cost situations can be shown in Fig. 2.

Fig. 2(a) illustrates the equilibrium under increasing cost and so both AC and MC curves are rising here. Fig. 2(b) illustrates the equilibrium under decreasing cost and so both AC and MC curves have been falling. Fig. 2(c) shows the equilibrium under constant cost when AC-MC.

In all the three figures the equilibrium output is OQ0 and the equilibrium price is Q0P0. The area OQ0P0R is total revenue and O0TS is total cost of the monopolist. So, the area RSTP0 in all the three figures indicates the excess profit of the monopolist in the long run. It shows that a monopolist is required to take into account some more factors in fixing output and price.

These factors are as under:

(a) Short-run and long-run pricing:

In the short rim, the monopolist, like the completive firm, is to keep an eye on the variable costs. The equation MR = MC is the condition of the short-run equilibrium for the monopolist as it is for the competitive firm. But with a low short-run demand, the monopoly price may fail to cover total costs; it may equal variable cost or exceed it to some extent, but it cannot go below the average variable cost.

But in the long run the monopolist can change the size of the plant in response to a change in demand or in costs. In such a situation the marginal revenue equals the long run marginal cost. In the long run a monopolist does not sell at losses. This mean that his price will be greater than or at least equal to average cost. He makes excessive profits through his power to restrict output.

(b) Demand conditions or the elasticity of demand for the product:

A monopolist is to consider the demand conditions while fixing the price of his product. If the demand for his product is elastic, he will not charge a high price, because at such time the demand for his product will be low. In such a situation he will fix the price at a low level for maximising his total profits by selling as larger a quantity of his product as possible.

If, on the other hand, the monopolist’s product has an inelastic demand, he will fix the price at a high level; because the sale of such a product will not fall in spite of its high price. In such a situation he will help to maximise profits by selling less units but getting larger profit per unit sold.

(c) Cost conditions:

A monopolist has also to take into consideration the cost conditions of the industry. If he produces under decreasing cost, he can reduce the average cost by producing more; so here he will produce more and sell at a low price. But, if he produces under increasing cost, he will be compelled to restrict the output to keep down the average cost: in this case he will charge a high price.

(d) Other factors:

Besides, a monopolist is to take into account other factors like the prices of the substitutes of his product, potential competition, consumers’ resistance, government’s regulations and interference, etc. in fixing his price, so as to be able to maintain his monopoly position.