Under Fixed ER, the Central Bank buys or sells the domestic currency for foreign currency at a pre-determined price.

For example:

1$ = Rs. 100 → Announced/Fixed ER in India

1$ = RS. 150 → Equilibrium ER → ER in Forex Market

ADVERTISEMENTS:

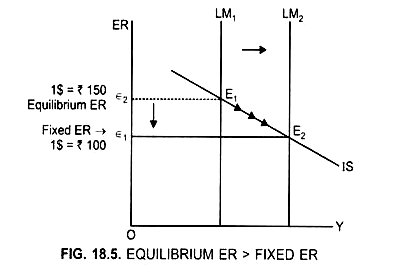

Equilibrium ER is at point E1

Reason: at point E1 : IS = LM1 Equilibrium

ER => 1 $ = RS. 150

But Central Bank fixed ER at => 1$ = RS. 100

ADVERTISEMENTS:

... (i) Equilibrium ER > Fixed ER

In such a situation the arbitrageur will buy Rupee in Forex market and then sell it in India and earn a profit.

He will buy Rs. 300 for $ 2 in Forex market and sell Rs. 300 in India for $ 3, and earn profit = $1.

When Central Bank buys Rs. from arbitrageur, that is,

ADVERTISEMENTS:

When he sells Rs. 300 in India, to the Central Bank the money supply in India will increase,

Result:

LM curve will shift to the right from LM1 to LM2 and ER will fall to the fixed ER, that is from є2 to є1 (Fig. 18.5)

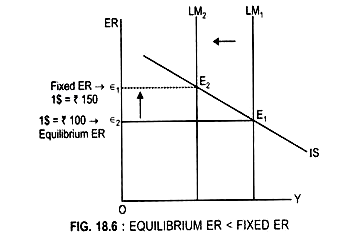

(ii) Similarly, if Equilibrium ER < Fixed ER vice versa will happen. (Fig. 18.6)

Arbitrageur will buy rupee Rs. 100 from India from Central Bank for $ 1 and sell it in the world market.

Result:

Money supply in India will fall.

LM curve will shift to the left from LM1 to LM2.

ER will increase and become equal to Fixed ER (є1) (Fig. 18.6)