In general terms, national income can be defined as the total money value of goods and services produced by a country in a particular period of time.

The duration of this period is usually one year.

Some of the management experts have defined national income as follows:

According to National Committee appointed by the Government of India in 1949, “A national income estimate measures the volume of commodities and services turned out during a given period of time counted without duplication.”

ADVERTISEMENTS:

According to Dr. Alfred Marshall “labor and capital of a country acting on its natural resources, produce annually a certain net aggregate of commodities, material and immaterial, including services of all kinds. The word net means that from the gross value of the output depreciation of capital must be deducted.”

According to Pigou, “national income is that part of the objective income of the community including of course, income derived from abroad, which can be measured in money.”

According to Prof. Fisher, “National income refers solely to services received by ultimate consumers, whether from material or human environment.”

From the aforementioned definitions, it can be concluded that national income is the aggregate income that is generated from the production of goods and services by using different factors of production, such as labor and land. National income constitutes an important part in the growth of an economy.

ADVERTISEMENTS:

The significance of national income is explained in the following points:

a. Reflects the overall performance of an economy

b. Represents the standard of living of people in an economy

c. Helps in determining the contribution of different sectors in an economy

ADVERTISEMENTS:

d. Helps in determining total consumption, saving, and investment in an economy

e. Helps in comparing the standard of living with different countries

National income comprises a number of interrelated concepts, such as gross national product, gross domestic product, and net national product. These concepts form the basis of understanding the theory’ of national income.

Gross National Product:

Gross National Product (GNP) is defined as the total market value of all final goods and services produced in a country during a specific period of time, usually one year. It measures the output generated by a country’s organizations located domestically or abroad.

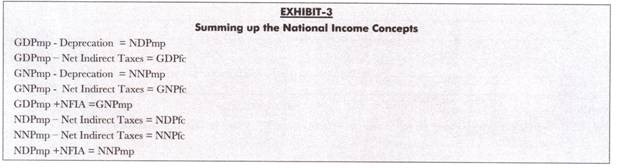

Therefore, it can be said that national income is the measure of the current output of economic activity of the country. In GNP, the word gross indicates total national product including depreciation. Depreciation indicates a decrease in the value of an asset with time. It is also called consumption of fixed capital.

As we know, during a production process, a good undergoes a series of stages before it is converted as a final good GNP only includes the market value of final goods, whereas it ignores the value of goods processing in initial and medium stages o the production process.

In other words, the sale of final goods is included in GNP, while the sale of intermediate goods is excluded from GNP. This is because the value of intermediate goods is already included in the value of final goods.

For example, cloth is a final good, while cotton is an intermediate good used in the production of cloth. In such a case, while measuring the contribution of garment industry in total GNP, the value of cloth is taken into account, while the value of cotton is ignored.

ADVERTISEMENTS:

This is because the value of cotton is added in the value of cloth while calculating GNP. Therefore, if the value of the cotton is included in GNP, this would lead to double counting and inaccuracy in the estimate of GNP.

Gross Domestic Product:

Gross Domestic Product (GDP) refers to the market value of final goods and services produced in a country in a given time period. It includes income earned by foreign players locally minus income earned by national players in abroad.

GDP shows the standard of living of the country. The term domestic in GDP indicates its relevance within the domestic economic territory. On the other hand, the word gross in GDP indicates the inclusion of depreciation of fixed capital.

ADVERTISEMENTS:

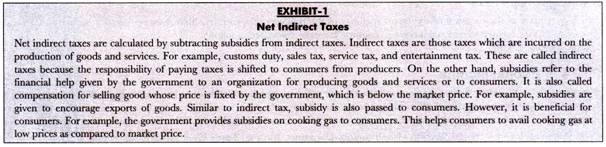

GDP is calculated at the market price (GDPmp), which signifies that the value of production is calculated by multiplying the price that buyers pay and not the price which producing units actually receive. The price received by the production units equals market price less indirect taxes. Thus, GDPmp indicates that the value of domestic product is undiminished by net indirect taxes.

GDP is almost similar to GNP; however, there is a significant procedural difference in their calculation. GNP includes the income earned by local players in abroad and excludes the income earned by foreign players in national boundaries. On the other hand, in case of GDP, it is reversed because the income earned by foreign players in national boundaries is added and the income earned by local players in abroad is deducted.

The GNP can be calculated with the help of the following formula:

ADVERTISEMENTS:

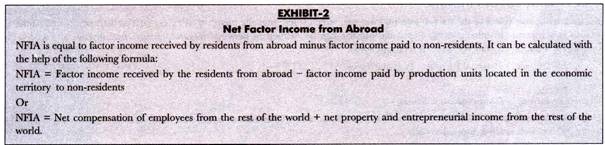

GNP = GDP +Net Factor Income from Abroad (NFIA)

From the aforementioned formula, we can calculate GDP as follows:

Net Domestic Product:

Net Domestic Product (NDP) is equal to GDP minus deprecation. GDP indicates the gross availability of final goods whereas NDP shows the net availability of final goods after deducting depreciation. Therefore, NDP indicates the real picture of an economy’s health.

ADVERTISEMENTS:

A large difference between GDP and NDP indicates the increasing obsolescence of capital goods; whereas a small difference reflects an improvement in the condition of capital goods. NDP can be calculated at market price (NDPmp) as well as at factor cost (NDPfc).

NDPmp refers to the market value of final goods and services produced by all the production units in the domestic territory of a country during a given time period. It excludes depreciation and includes indirect taxes. It is equal to the net value added at market price.

NDPmp can be calculated as follows:

NDPmp = GDPmp – depreciation

On the other hand, NDPfc refers to the market value of final goods and services produced by all the production units in the domestic territory of a country during a given time period excluding depreciation and net indirect taxes. NDPfc is also known as Net Domestic Income (NDI).

It can be calculated as follows:

ADVERTISEMENTS:

NDPfc = GDPmp – depreciation – Net Indirect taxes

Or

NDPfc = NDPmp – Net Indirect Taxes = NDPmp – Indirect Taxes + Subsidies

Net National Product:

Net National Product (NNP) is equal to GNP minus depreciation. It indicates the net output available for the consumption by society where society includes consumers, producers and government. NNP is the actual measure of the national income. If NNP is divided by the population of the country, then it gives per capita income in an economy. Similar to NDP, NNP can also be calculated at market price (NNPmp) as well as at factor cost (NNPfc). NNPmp can be defined as the value of contribution by the residents of a country’ in economic production excluding depreciation but including net indirect taxes.

It can be calculated as follows:

ADVERTISEMENTS:

NNPmp = NDPmp + NFIA

NNPfc is defined as the measure of the factor earnings of the residents of a country, both from economic territory and abroad. Therefore, NNPfc is equal to national income of country.

It can be calculated as follows:

NNPfc = NDPfc + NFIA

Personal Income:

Personal Income (PI) can be defined as the sum of income actually received by individuals or households from different sources in an economy during a given time period. PI includes income earned through wages, salaries, fees, commissions, dividends, and interests. It also includes transfer income, such as pensions, sickness allowances, and old age benefits.

ADVERTISEMENTS:

PI can be calculated as follows:

PI = National Income- Social Security Contributions – Corporate Income Taxes – Undistributed Corporate Profits + Transfer Payments

NNP is also calculated by making some additions to PI, which is as follows:

NNP = PI + UDP-(-SPU+ RPP)

Where,

UDP = Undistributed Company Profits

SPU = Surplus of Public Undertakings

RPP = Rentals of Public Properties

Disposable Income:

Disposable income refers to the part of personal income, which is left after the payment of taxes, such as income tax and property tax, to government. In other words, disposable income can be defined as personal income left for consumption and saving by individuals after the payment of taxes.

It is calculated as:

Disposable Income = Personal Income – Personal Taxes

Or

Disposable income = Consumption + Saving

Disposable income can be saved or consumed by individuals. Here, it should be noted that what remains after saving is personal outlay, which is also called disposable outlay.

Thus, Disposable Outlay = Disposable Income – Savings

Transfer Payments:

While measuring national income of a country, all incomes are not considered as factor income payments or receipts For example gifts received by employees are not added as remuneration for the work.On the other hand, paying taxes to government is also not considered as factor income payment because there is no as such agreement between the government and the producer to exchange goods or services.

The producer has to pay taxes, irrespective of whether the government provides services or not. Other examples of transfer payments are donations, charity, scholarships, pocket money, lotteries, and prizes. A transfer can be defined as a transaction in which the payers provide a good, service, or asset without receiving any good, service or asset in return from the recipient. In simple words, it is a payment without getting any good or service in return.

All the types of transfer incomes are kept out of the national income estimates. For recipients of transfer payment, it is called transfer income, while for payers; it is termed as transfer expenditures. There are two types of transfers namely current and capital transfers.

Current transfers refer to transfers made out of the current income of the payer. These transfers are added to the current income of recipients. These transfers take place within the same country or between different countries.

The following are some of the examples of current transfers:

a. Tax payments to the government

b. Donations to non-profit institutions

c. Scholarship to students

d. Old age pensions

e. Unemployment allowances

f. Gifts and lottery prizes

g. Aid provided by one country to another country in case of emergencies

h. Transfer of money by resident of one country to relatives residing in other country

On the other hand, capital transfers are the transfers made out of the wealth or capital of the payer and added to the wealth or capital of the recipient.

The example of capital transfers are as follows:

a. Capital grants from government to organizations

b. Lump-sum payments to households in case of natural disasters

c. Payment of taxes on capital and wealth

Numerical Illustrations-l:

Problem 1:

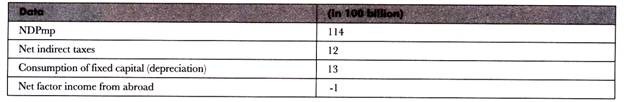

Calculate notional income and GNP from the given data.

Solution:

We know that NNPfc = National Income

It can be calculated as:

NDPfc = NDPmp – Net Indirect Taxes

NDPfc = 114-12 = 102

NDPfc + NFIA = NNPfc

NNPfc =102+ (-1) = 101

GNPmp = NDPmp +Consumption of Fixed Capital+ NFIA

GNPmp = 114+13+ (-1) = 126

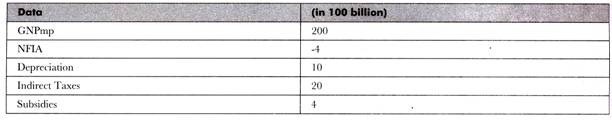

Problem-2:

Calculate NDPfc and NNPfc from the given data.

Solution:

NDPfc = GNPmp – Depreciation – NFIA – Indirect Taxes + Subsidies

= 200 – 10 – (-4) -20 + 4

NDPfc = 178

NNPfc = NDPfc +NFIA = 178 + (-4) = 174

(NNPfc can also be calculated as = GNPmp Depreciation-Indirect Faxes +Subsides)

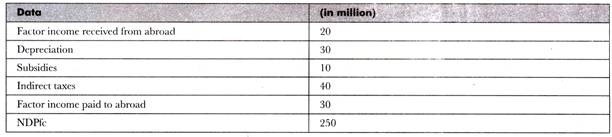

Problem 3:

Calculate GNPfc and NDPmp from the given data.

Solution:

GNPfc = NDPfc + Depreciation+ Factor income received from abroad – Factor income paid to abroad

= 250 + 30 + 20 – 30

= 270

NDPmp = NDPfc + Indirect taxes – Subsidies

= 250 + 40 – 10

= 280.