This is the basic equation for the equilibrium condition in an open economy.

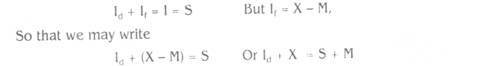

The diagram illustrating this equilibrium is shown in Fig. 6. In this diagram the investment to give a + function are added to give M + S. At E, the intersection point of X + and M + S, X is equal to M and is equal to S.

The increase in income as a result of X is determined by the foreign trade multiplier K1 and the amount of X.

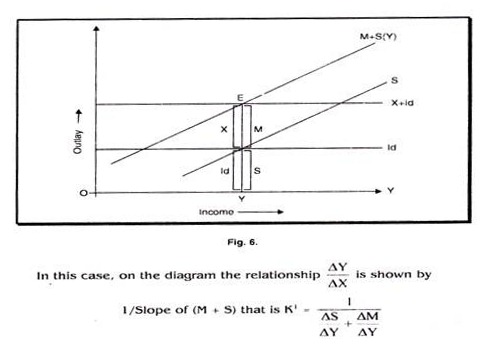

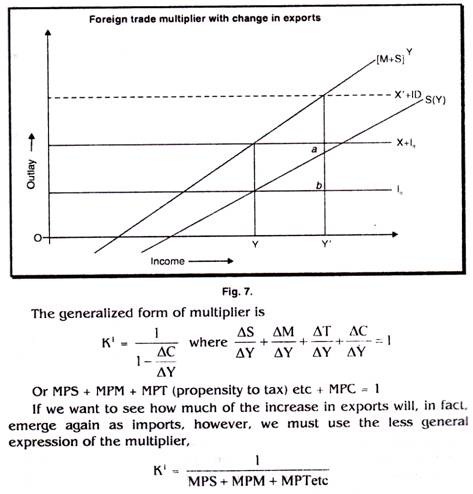

The diagram has been drawn in Fig.6., so that Id = S and X =M, at the equilibrium level of national income Y. It is perfectly possible, however, to take account of the cases where these variables are not equal individually, although the basic equilibrium condition that M + S = X + Id is still satisfied. If long term lending takes place, X can exceed M provided that S exceed Id by an equal amount sufficient to maintain the equation Id + X = S+M. With a higher level of exports than X, say X1 in Fig.7, exports will exceed imports by the amount ab, the amount by which savings will exceed domestic investment. If exports were to fall to X1 in Fig. 8, however, imports would exceed exports and domestic.

Investment would exceed savings. The export surplus in the first case can be regarded as a deduction from savings; generally, however, it is thought of as positive foreign investment. In the second case the import surplus may be regarded either as a supplement to savings or as negative investment to be subtracted from 1d.

The increase in exports leads to an Increase in national income. When X + I rises to X1 + I, Y moves to Y1.

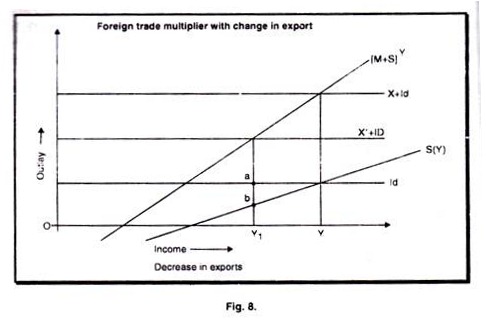

In this case the multiplier is readily seen to be determined by the sum of the slopes of S and M. Without a positive slope to the savings curve, the multiplier would have been higher and the increase in national income greater. But the increase in income is dampened down by the leakage of income at each income period, not only into Imports but into savings as well.

Investment and Imports:

It makes little difference to national income whether the increase in spending, which leads to the increase in income, occurs in exports or in domestic investment. In Fig. 7, the line X1 I1d could be relabeled X and give the same new level of national income Y1. But it makes considerable difference to the BOP. Since domestic inflation is a prime source of BOP difficulties in the world, it may be worthwhile to spend a moment on the matter.

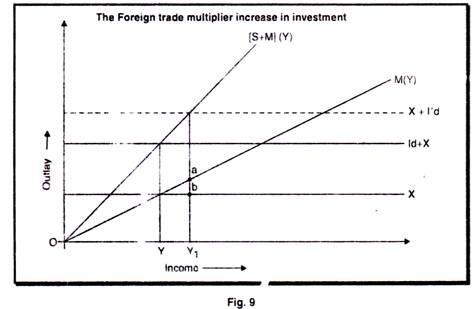

Fig. 7 is not a particularly useful one for reading off what happens to the BOP if X1 + Id, becomes X1+ I1d. Let us reverse the order of exports and investment and of savings and imports. This is done in Fig. 9. Now let us assume that domestic investment expands in a country with a balanced international position: X + Id expands to X + I1d. Exports remain unchanged. Imports increase. The BOP becomes adverse by the amount a-b which is as also the amount by which domestic investment exceeds domestic savings.

ADVERTISEMENTS:

The higher the marginal propensity to import, the more quickly will income spill over into imports. It is not the average propensity to import that counts; it is the marginal rate. The possible changes are not limited to X + Id, as Keynesian analysis tend to assume A shift of the M or S schedules will produce changes in national income and in the balance of trade. An increase in the propensity to save or import will lower national income.

The analysis will be affected if we relax the simplifying assumptions. Suppose, for example, the government expenditure is added to exports and investment and a schedule of tax receipts to the propensities to save and import. Government expenditure may be a constant or in a more complex world, may decline as income rises. Transfer payments which increase consumption without adding to national income can add a further complication.

An important assumption for foreign trade analysis is linked to the elasticity of supply of exports. Suppose that the supply of exports is inelastic and that exports are an income elastic item of domestic expenditure. This will alter the assumptions we have been using, both of exports constant at all levels of national income and of constant prices. As income increases, domestic consumers will bid exports away from foreign consumers. Exports will probably decline in volume as a function of increasing income. The inelasticity of supply, moreover, will probably drive prices up.

In our analysis we have left out at least two important factors: the reaction of the changes in foreign trade on income abroad and their repercussion on the affected country and the possibility that a change in exports may lead to a change in investment.

The Foreign Trade Accelerator:

“The acceleration theory has to do with the expanded demand for capital goods derived from the net change in the demand for consumption goods”. The multiplier, showing how every increase in investment leads to a limited increase in income as the injection into the system is siphoned off into savings, imports, taxes etc. is vastly different from the accelerator. This latter show why, on occasion, an increase in income leads to an increase in investment and a new increase in income by means of the multiplier. In foreign trade there may on occasion be an effect comparable to the domestic accelerator. We may call in the “foreign-trade-accelerator”. An increase in exports leads through increases in investment to an import surplus.

The increase in investment may take place in the export industries themselves: an increase in American tourist expenditure in Delhi may lead to the construction of more hotels. Or the general prosperity created by expanded exports may lead to new investment in industries producing for home consumption.

This accelerator effect may be demonstrated in successive steps. In the first period there will be an increase in exports; in the second, an expansion of investment. David Hume’s law that exports equal imports is valid only under conditions of no savings. In the absence of savings, an increase in exports will increase income to point where sufficient additional imports are created to offset exports. The amount by which national income will increase is the increase in exports times a multiplier equal to 1/MPM.

ADVERTISEMENTS:

But, if savings takes place, the increase in exports will be balanced by increases in imports and in savings, provided that investment is unchanged. In this case the multiplier is 1/ MPM + MPS an accelerator is at work so that an increase in income due to a rise in exports leads to an increase in investment the increase in exports may produce a larger increase in imports and turn the balance of trade unfavorably. The foreign trade multiplier expresses the change in income caused by a change in exports or in investments in an open economy in which income spills over into imports. If the effect of the change in imports on income abroad is significant and if the effect of income change abroad on a country’s exports is again appreciable, there is a foreign repercussion.

Foreign trade may affect national income in other ways than through the multiplier and accelerator, under which exports are income creating and imports income destroying. If imports are a key to investment, for example, reduced imports may lower national income by requiring a reduction in investment or if producers or consumers suffer from money illusion, a change in export or import prices may induce changes in domestic spending which affect national income.