Here we detail about the three alternative methods used for measuring national income.

The three methods are: (1) Value Added Method, (2) Income Method, and (3) Expenditure Method.

Method 1# Value Added Method:

This is also called output method or production method. In this method the contribution of each enterprise to the generation of flow of goods and services is measured. Under this method, the economy is divided into different industrial sectors such as agriculture, fishing, mining, construction, manufacturing, trade and commerce, transport, communication and other services.

Then, the net value added at factor cost (NVAFC) by each productive enterprise as well as by each industry or sector is estimated. Measuring net value added at factor cost (NVAFC) by each industry requires first to find out the value of output. Value of output of an enterprise is found out by multiplying the physical output with market prices of the goods produced.

ADVERTISEMENTS:

In order to arrive at the net value added at factor cost by an enterprise we have to subtract the following from the value of output of an enterprise:

a. Intermediate consumption which is the value of goods such as raw materials, fuels purchased from other firms.

b. Consumption of fixed capital (i.e., depreciation)

c. Net indirect taxes.

ADVERTISEMENTS:

Summing up the net values added at factor cost (NVAFC) by all productive enterprises of an industry or sector gives us the net value added at factor cost of each industry or sector. We then add up net values added at factor cost by all industries or sectors to get net domestic product at factor cost (NDPFC). Lastly, to the net domestic product we add the net factor income from abroad to get net national product at factor cost (NNPFC) which is also called national income. Thus,

NI or NNPFC = NDPFC + Net factor income from abroad

This method of calculating national income can be used where there exists a census of production for the year. In many countries, the data of production of only important industries are known. Hence this method is employed along with other methods to arrive at the national income. The one great advantage of this method is that it reveals the relative importance of the different sectors of the economy by showing their respective contributions to the national income.

Precautions:

ADVERTISEMENTS:

The following precautions should be taken while measuring national income of a country through value added method:

a. Imputed rent values of self-occupied houses should be included in the value of output. Though these payments are not made to others, their values can be easily estimated from prevailing values in the market.

b. Sale and purchase of second-hand goods should not be included in measuring value of output of a year because their values were counted in the year of output of the year of their production. Of course, commission or brokerage earned in their sale and purchase has to be included because this is a new service rendered in the current year.

c. Value of production for self-consumption are be counted while measuring national income. In this method, the production for self-consumption should be valued at the prevailing market prices.

d. Value of services of housewives are not included because it is not easy to find out correctly the value of their services.

e. Value of intermediate goods must not be counted while measuring value added because this will amount to double counting.

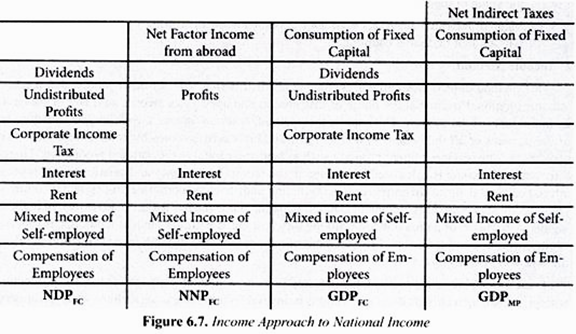

Method 2# Income Method:

This method approaches national income from distribution side. In other words, this method measures national income at the phase of distribution and appears as income paid and or received by individuals of the country. Thus, under this method, national income is obtained by summing up of the incomes of all individuals of a country. Individuals earn incomes by contributing their own services and the services of their property such as land and capital to the national production.

Therefore, national income is calculated by adding up the rent of land, wages and salaries of employees, interest on capital, profits of entrepreneurs (including undistributed corporate profits) and incomes of self-employed people. This method of estimating national income has the great advantage of indicating the distribution of national income among different income groups such as landlords, owners of capital, workers, entrepreneurs.

Measurement of national income through income method involves the following main steps:

ADVERTISEMENTS:

1. Like the value added method, the first step in income method is also to identify the productive enterprises and then classify them into various industrial sectors such as agriculture, fishing, forestry, manufacturing, transport, trade and commerce, banking, etc.

2. The second step is to classify the factor payments.

The factor payments are classified into the following groups:

a. Compensation of employees which includes wages and salaries, employers’ contribution to social security schemes.

ADVERTISEMENTS:

b. Rent and also royalty, if any.

c. Interest.

d. Profits:

Profits are divided into three sub-groups:

ADVERTISEMENTS:

(i) Dividends

(ii) Undistributed profits

(iii) Corporate income tax

e. Mixed income of the self-employed:

In India as in other developing countries there is fifth category of factor income which is termed as mixed income of self-employed. In India a good number of people are engaged in household industries, in family farms and other un-organised enterprises. Because of self-employment nature of the business it is difficult to separate wages for the work done by the self-employed from the surplus or profits made by them. Therefore, the incomes earned by them are mix of wages, rent, interest and profit and are, therefore, called mixed income of the self-employed.

3. The third step is to measure factor payments. Income paid out by each enterprise can be estimated by gathering information about the number of units of each factor employed and the income paid out to each unit of every factor. Price paid out to each factor multiplied by the number of units of each factor employed would give us the factor’s income.

ADVERTISEMENTS:

4. The adding up of factor payments by all enterprises belonging to an industrial sector would give us the incomes paid out to various factors by a particular industrial sector.

5. By summing up the incomes paid out by all industrial sectors we will obtain domestic factor income which is also called net domestic product at factor cost (NDPFC).

6. Finally, by adding net factor income earned from abroad to domestic factor income or NDPFC we get net national product at factor cost (NNPFC) which is also called national income.

Income approach to measurement of national income is shown through bar diagrams in Figure 6.7.

Precautions:

ADVERTISEMENTS:

While estimating national income through income method the following precautions should be taken:

a. Transfer payments are not included in estimating national income through this method.

b. Imputed rent of self-occupied houses are included in national income as these houses provide services to those who occupy them and its value can be easily estimated from the market value data.

c. Illegal money such as hawala money, money earned through smuggling etc. are not included as they cannot be easily estimated.

d. Windfall gains such as prizes won, lotteries are also not included.

e. Corporate profit tax (that is, tax on income of the companies) should not be separately included as it has already been included as a part of profits.

ADVERTISEMENTS:

f. Death duties, gift tax, wealth tax, tax on lotteries, etc., are paid from past savings or wealth and not from current income. Therefore, they should not be treated as a part of national income of a year.

g. The receipts from the sale of second-hand goods should not be treated as a part of national income. This is because the sale of second-hand goods does not create new flows goods and services in the current year.

h. Income equal to the value of production used for self-consumption should be estimated and included in the measure of national income.

Method 3# Expenditure Method:

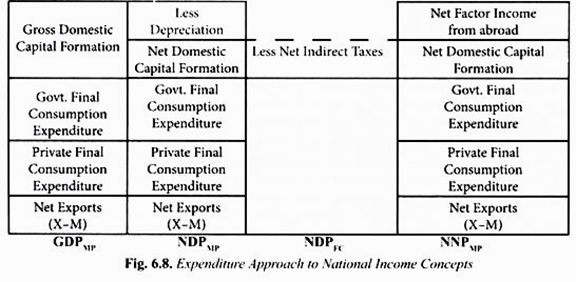

Expenditure method arrives at national income by adding up all expenditures made on goods and services during a year. Income can be spent either on consumer goods or capital goods. Again, expenditure can be made by private individuals and households or by government and business enterprises.

Further, people of foreign countries spend on the goods and services which a country exports to them. Similarly, people of a country spend on imports of goods and services from other countries.

We add up the following types of expenditure by households, government and by productive enterprises to obtain national income:

ADVERTISEMENTS:

a. Expenditure on consumer goods and services by individuals and households. This is called final private consumption expenditure, and is denoted by C.

b. Government’s expenditure on goods and services to satisfy collective wants. This is called government’s final consumption expenditure, and is denoted by G.

c. The expenditure by productive enterprises on capital goods and inventories or stocks. This is called gross domestic capital formation, or gross domestic investment and is denoted by I or GDCF.

Gross domestic capital formation is divided into two parts:

(i) Gross fixed capital formation

(ii) Addition to the stocks or inventories of goods

d. The expenditure made by foreigners on goods and services of a country exported to other countries which are called exports and are denoted by X. We deduct from exports (X) the expenditure by people, enterprises and government of a country on imports (A-/) of goods and services from other countries. That is, we have to estimate net exports (that is, exports -imports) or (X—M).

Thus, we add up the above four types of expenditure to get final expenditure on gross domestic product at market prices (GDPMp). Thus,

GDPmp = Private final consumption expenditure + Government’s final consumption expenditure + Gross domestic capital formation + Exports — Imports or GDPmp = C + G +1 + (X— M) = C+G + I + Xn

On deducting consumption of fixed capital (i.e., depreciation) from gross domestic product at market prices (GDPMp) we get net domestic product at market prices (NDPMp).

In this method, we then subtract net indirect taxes (that is, indirect taxes – subsidies) to arrive at net domestic product at factor cost (NDPFC),

Lastly, we add ‘net factor income from abroad’ to obtain net national product at factor cost (NNPFc), which is called national income. Thus,

NNPfc = GDPMp– Consumption of Fixed capital – Net Indirect taxes + Net Factor Income from Abroad.

Expenditure approach to national income is shown through bar diagram in Figure 6.8.

(Note: To any concept of the domestic product, if we add ‘Net Income from Abroad we will get corresponding National Product)

Precautions:

While estimating Gross Domestic Product through expenditure method or measuring final expenditure on Gross National Product, the following precautions should be taken:

a. Second-hand goods: The expenditure made on second-hand goods should not be included because this does not contribute to the current year production of goods and services.

b. Purchase of shares and bonds. Expenditure on purchase of old shares and bonds from other people and from business enterprises should not be included while estimating Gross Domestic Product through expenditure method. This is because bonds and shares are mere financial claims and do not represent expenditure on currently produced goods and services.

c. Expenditure on transfer payments by government such as unemployment benefits, old-age pension should also not be included because no goods or productive services are produced in exchange by the recipients of these payments.

d. Expenditure on intermediate goods such as fertilisers and seeds by the farmers and wool, cotton and yarn by manufacturers of garments should also be excluded. This is because we have to avoid double counting. Therefore, for estimating Gross Domestic Product we have to include only expenditure on final goods and services.

Difficulties in the Measurement of National Income:

There are many difficulties in measuring national income of a country accurately. The difficulties involved are both conceptual and statistical in nature.

Some of these difficulties or problems involved in the measurement of national income are enumerated below:

(i) Treatment of non-monetary transactions:

The first problem relates to the treatment of non-monetary transactions such as the services of house wives to the members of their families and farm output consumed at home. On this point, the general agreement is to exclude the services of housewives while to include the value of farm output consumed at home in the estimate of national income.

This, however, gives rise to certain anomalies. For example, if a man employs a maid-servant for household work, payment to her will appear as a positive item in national income. If the next day the man were to marry the maid-servant, she would be performing the same services as before but without payments. In this event the value of national income would go down though the real amount of goods and services performed remains the same as before.

(ii) Treatment of Government activities in national income accounts:

The second difficulty arises with regard to the treatment of the government in national income accounts. On this point the general viewpoint is that as regards the administrative functions of the government like justice, administration and defence are concerned they should be treated as giving rise to final consumption of such services by the community as a whole so that contribution of general government activities will be equal to the amount of wages and salaries paid by the government. As regards capital formation by the government, this is treated as par with capital formation by private enterprises.

(iii) Treatment of income generated by foreign firms:

The third major problem arises with regard to the treatment of income arising out of activities of the foreign firms in a country. Should their income form a part of the national income of the country in which they are located or should it belong to the national income of the country owning the firms? On this point, the IMF viewpoint which is generally accepted is that production and income arising from a foreign enterprise should be ascribed to the country in which production takes place. However, profits earned by foreign companies are credited to the parent country.