Read this article to learn about the concept and features of social accounts in economics.

Since the publication of the General Theory national income accounting has become an official job, statistics of national income reflect changes in the economic health of the economy.

They indicate the performance of the economy; the fluctuations in economic activity. As a result, many new concepts have come to be associated with the study of national income and social accounts.

These concepts have become popular after Keynes. A grasp of the general concepts of social accounting is essential to the understanding of macroeconomic theory because the macroeconomic truisms like Y = C + I + G or S = I are generally derived from the social accounts.

ADVERTISEMENTS:

Accounts maintained by private individuals are called ‘Private Accounting’ whereas the account of the entire economy is called ‘Social Accounting’. Thus, the term social accounting is sometimes used for that part of descriptive economics which relates to the production and distribution of the national income. In order to have an accurate idea of the economic progress in different sectors and sub-sectors of an economy, it is but essential to maintain social or national accounts.

‘Social Accounting’ is a wider concept and embraces ‘national income accounting’; as such it is concerned with the statistical classification of the activities of human beings and institutions in ways which help us to understand the operation and the working of the economy as a whole. It also includes the application of the information thus gathered to the investigation of the operation of the economic system.

In other words, national income and social accounts are no more than measurements of production and investment arranged in such a way as to stress the distinction between the decisions of people concerned with, on the one hand, the production of commodities, and on the other the consumption of what has been produced. All types of transactions, real or financial, national or international, big or small that take place in the economy are properly recorded in the system of social accounts.

Such a system of social accounts gives a summary in a purposeful way of the manifold and diverse transactions that take place in the various sectors and sub-sectors of the economy. From these accounts it is always possible to derive important aggregates like income, consumption, investment, saving, imports, exports, taxes, government expenditure etc. National income accounting is a very practical method of collecting factual information about the performance and structure of the economy.

ADVERTISEMENTS:

Although we are not unaware of earlier attempts in this direction, specially in U.K. and U.S.A., yet the real impetus to the preparation of social accounts was provided by the depression of 1929-32. Depression meant heavy losses, steep fall in the purchasing power and large scale unemployment of human and capital resources. As a result, it was necessary to devise a system which could properly measure these structural changes so that the necessary policy measures could be adopted in the field of taxation, expenditure, borrowing (fiscal measures) and money supply, rate of interest (monetary measure) to overcome the situation.

It was done through the preparation of national income and social accounts. World War II also established the necessity of the preparation of such accounts because it is during wars and emergencies that nations are required to take stock of their total resources and to mobilise them in the best interest of the economy. It was realised in India also after the Chinese attack of 1962. A debate had started in the country between ‘defence’ and ‘development’.

The resources being scarce—were these to be employed for defence or development? It was found that despite scarcity of resources both defence and development were necessary and could go side by side because there cannot be any defence without development or development without defence. What became necessary was their proper distribution between defence and development after collecting true facts through social accounts. Defence does not mean production of more arms; the production of war materials has to be adjusted and coordinated with a certain amount of minimum level of consumption of goods and services by the community.

Then, there is also the problem of financing the war effort, i.e., the extent of taxes that could be imposed and other financial resources that could be mobilised or the curtailment of civilian consumption that could take place. Under such conditions, it becomes necessary, therefore, to have a comprehensive statistical framework (Social Accounts) concerning the distribution of manpower and other resources amongst defence and other development industries and to investigate the interrelationship, amongst competing or alternative uses.

ADVERTISEMENTS:

There were, then, the circumstances that led to the preparation of detailed system of social accounts in U.S.A. and other European countries including India. The formation and use of social accounting is still in an experimental stage in several countries, despite, it is far superior method than mere observation of past events or guesswork.

The preparation of social accounts is by no means an easy task, as there is good deal of dependence on statistical data. Such bodies of data, treating different aspects of the nation’s economic activity are the national income and product accounts, the input-output table, the flow of funds statements, the balance of payments and the national balance sheets.

Thus, the term “National Income Accounts” is used to refer a number of bodies of systematically arranged statistical data, which have as their focus the economic activities taking place within a nation. In other words, these variety of bodies which are nothing but systematically arranged data measure the various aspects of nation’s economic activity. There are mainly five such bodies of data, treating different aspects of the nation’s economic activity.

These are:

(i) National Income and Product Accounts.

(ii) input-output Tables.

(iii) The Flow of Funds Statements.

(iv) The Balance of Payments.

(v) The National Balance Sheets.

ADVERTISEMENTS:

(i) The ‘National Income and Product Accounts’ are concerned with income and product transactions. They are designed to show in one return the current productive activity of the economy, distinguishing the current income and outlay associated with specific kinds of economic activity— production, consumption and investment. National Income and Product Accounts is a statistical statement of national output or receipts, such as gross national product, net national product, personal income and disposable income.

These accounts seek to show the sources and disposition of income for the domestic economy’s major sectors, namely, households, enterprises and government units.

These accounts consist of the following:

(a) A national income and product account, showing totals of income and output resulting from productive activity during a given period;

ADVERTISEMENTS:

(b) A personal income and expenditure account—showing total income and expenditures of households in the economy;

(c) A government receipts and expenditures accounts—showing total receipts and expenditures by all governmental units in the economy;

(d) Rest of the world or a foreign transactions account—showing purchases by foreign nations and purchases from foreign nations and a gross saving and investment account showing the saving of the whole economy and its disposal.

(ii) Input-output Tables’ are concerned with the current productive activity of the economy, they focus on inter-industry relationships. Its other name is inter-industry analysis. It is a systemic method of analyzing in great detail, the interrelationships between an industry’s or an economy’s output of goods and services and the volume of goods and services needed to achieve a given volume of production. It shows the How of goods and services—represented by their money value—during a given period (say a year) between number of sectors (generally called industry). Its alternate name is inter-industry analysis.

ADVERTISEMENTS:

The input-output analysis and construction of input-output tables are an elaboration and refinement of national income and product accounting. These tables concern themselves with current productive activities of the economy in much the same manner as national income and product accounts, but they focus attention on inter-industry relationships by measuring the flow of output between the major industrial sub-divisions of the economy.

The input-output analysis was developed by Wassily Leontief in his book, ‘The Structure of American Economy 1919-1939’. It won for him the ‘Noble Prize’ in Economics in 1973. In actual economy there are several sectors in production like raw materials sector, labour sector, capital sector, finance sector which provide inputs for the manufacture of the final commodity.

This input-output analysis helps us to separate the flow of goods and services between one sector and another and between one industry and another. The Perspective Planning, Division of Planning Commission has worked out such input-output tables for the Indian economy. It shows that industries sell to one another and also to households. For example, agricultural sector may sell mangoes directly to consumers, in which case it is final output or it may sell to manufacturers for bottling mango juice, in which case it will be input for manufacturing industry.

The input-output analysis are based on a number of assumptions like constant returns to scale in industries, absence of joint products, absence of technological change, constant stock flow relationship etc. One great limitation of this analysis is that it does not show the relationship between stocks and flows. For example, in the short period increase in inputs can be effected by diverting the stocks rather than by increasing actual supplies.

Peacock and Dosser while mentioning the limitations of input- output analysis in underdeveloped countries point out that there is very little inter-dependence amongst the sectors in highly underdeveloped countries. Their findings have been supported by the work of Dudley Seers. They point out that output of most of the industries in such economies is oriented to meet the final demand and their inputs contain primary products and Imports to a large extent.

There are in-fact, a few inter-industry relations. Again, the non-existence and the unreliability of statistics in such countries stand in the way of comprehensive input-output tables. Parmeet Singh is also not in favour of constructing a multi-industry input-output tables for underdeveloped countries because of the concentration of production in a relatively few establishments and because of limited amount of inter-sectoral interaction. The immediate attempts in these countries should be in the direction of collecting reliable and relevant statistics.

ADVERTISEMENTS:

However, in spite of these limitations input-output tables and relationships are being used in the assessment of the requirement of resources. If in a programme of planned industrial development, the cement, steel, transport, power or agriculture are to be developed accurate assessment of the requirements of different types of materials, resources and services that go into their production can be made only on the basis of detailed input-output table or matrix. Similarly, in the preparation of defence mobilization plan, if we have a list of goods required for defence purposes, this technique can help us in determining how much raw material, manpower and other resources or services would be needed.

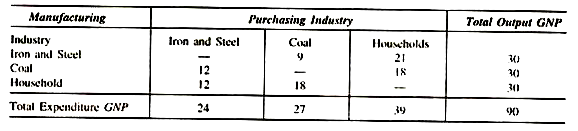

A simple input-output matrix is shown in the table given below:

Input-Output Matrix (in Rs.)

This input-output table shows three industries as manufacturers or producers and as purchases. These are Iron and Steel, Coal and Households. The production or output of iron and steel industry is worth Rs. 30, out of this, the produce worth Rs. 9 is sold to coal industry and worth Rs. 21 to the households. Again, coal industry’s output is worth Rs. 30 out of which, it sells coal worth Rs. 12 to iron and steel industry and worth Rs. 18 to the households. Further, households provide services worth Rs. 12 to iron and steel industry and worth Rs. 18 to coal industry.

Thus, the input-output coefficient for steel industry are 12/30 with respect to coal and also 12/30 with respect to households. The input- output coefficient, for coal industry in relation to the iron and steel and households respectively are 9/30 and 18/30 and the coefficients for household services (industry ) in relation to iron and steel and coal industries respectively are 21/30 and 18/30.

ADVERTISEMENTS:

The practical utility of such input-output table or matrix is seen from the fact that given the input-output coefficients, it is possible to determine not only the level of outputs in various industries for specific levels of inputs but also the probable changes in output caused by the changes in consumer demand or technology. For example, if the households decide to take iron and steel worth Rs. 27 and coal worth Rs. 12, then the production of iron and steel will increase and that of coal will decline.

(iii) Flow of Funds Accounts are relatively of recent development. They cover all money and credit transactions in the economy. They provide information on the creation of bank credit purchase of securities and other changes in the assets and liabilities of the different sectors of the economy. Flow of funds accounts are broader in scope than national income and product accounts because they embrace not only income and product transactions, but also purely financial transaction, such as the purchase and sale of various kinds of securities and the expansion and contraction of bank credit. Such accounts are greatly helpful in analysing the impact of monetary policies that these policies are expected to have on the general functioning of the constituent sectors as well as the entire economic system.

The flow of funds accounts of India were presented, for the first time, in a memorandum by H.W. Arndt—who visited India in early 1959. The main object was to show as to how and in what forms domestic savings had become available to government for financing its expenditure. The focus of the accounts was on borrowings and tending’s. The Central Statistical Organisation published a report on the flow of funds accounts in 1963.

The Reserve Bank of India is also doing useful work in publishing a series of financial flows statement. But even these flow of funds accounts have not been found very useful and relevant for underdeveloped countries. For these accounts do not give a complete picture of the sectoral sources and sectoral uses on account of prevailing financial dualism in underdeveloped countries and on account of the existence of non-money transactions prevailing in these countries.

(iv) ‘Balance of Payments Tables’ include on the one hand the international trade statistics (showing the country of origin, destination of the commodity) and on the other hand, foreign financial transaction. These accounts record the outcome of all transactions—income and product as well as financial—between the residents of one country and the residents of the rest of the world. Balance of payments accounting includes all international transactions, including those that are of a purely financial character. In this respect it is similar lo flow of funds accounting, except that it is limited to transactions between nations rather than within nations.

(v) ‘National Balance Sheet’ shows the assets and liabilities of different sectors of the economy, they are closely related to flow of funds statements, except that they deal with stocks rather than flows. They are concerned with both the tangible and intangible assets of the economy and the liabilities. This is the direction in which national income and social accounting are moving. A complete and a unified system for the presentation of a balance sheet for the economy as a whole have not been perfected.