Read this article to learn useful notes on Balance of Payments!

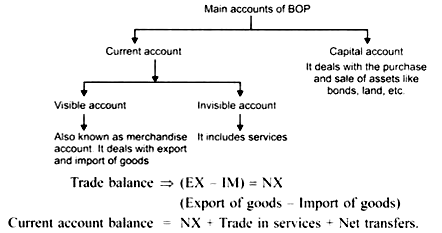

Balance of Payment (BOP) is statistical statement of transactions of the residents of the country with the rest-of-the-world over a given period of time.

Capital account surplus is called net capital inflow.

Capital account surplus is when the receipts from the sale of stock, bonds and other assets is greater than the payment for our own purchase of foreign asset.

ADVERTISEMENTS:

If there is a deficit in current account it is met by:

(i) Selling assets or

(ii) By borrowing from abroad or

ADVERTISEMENTS:

(iii) By selling the foreign currency in the FOREX market.

(i) If there is a deficit in both the current and capital account, then the overall BOP is in deficit.

(ii) If there is a surplus in one account and deficit in the other account to same extent then BOP equals Zero, that is, there is neither a surplus nor a deficit.

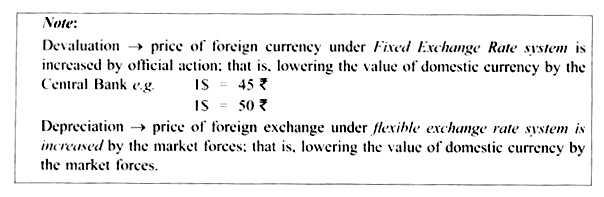

The Central Bank solves the problem of BOP surplus and deficit through exchange rate.

ADVERTISEMENTS:

Fixed Exchange Rate or Pegged Exchange Rate:

BOP measures the amount of foreign exchange intervention needed by the Central Bank to keep the exchange rate stable. The Central Bank brings stability in the exchange rate through buying and selling of dollars at a predetermined price. To intervene in the Forex market to bring the exchange rate stability, it will have to keep necessary reserves.