Study Notes on Economics !

Subject-Matter of Economics:

Economics is too much interesting and it affects almost everything we do, not merely at work or in the shops but in the home as well.

It influences the future we leave for our children the extent to which we care for the disadvantage, and resources we have for enjoying ourselves.

These issues are discussed everyday everywhere. The formal study of economics is exciting as it introduces a tool of analysis that allows a better understanding of the problems we face. This article is designed to provide people with the tools of analysis and give practice in using it. With practice, students will be surprised at how much economic analysis can help our daily living.

ADVERTISEMENTS:

Economics is the study of how society decides what, how and for whom to produce every society must solve three basic problems of living – What goods and services to produce How to produce them, and for whom to produce them.

Goods are physical commodities such as chickens, breads and apples. Services are activities such as massages or living concerts, banking services and so on, consumed or enjoyed only at the instant they are produced.

By emphasizing the role of the society, we place economics within the social sciences that study and explain human behaviour. Economics studies behaviour in the production exchange and use of goods and services.

Society has to reconcile the conflict between unlimited desires for goods and services and the scarcity or resources with which to produce them. Economics analyses these decisions. Its subject matter is human behaviour and its method is to develop theories and test them against facts.

ADVERTISEMENTS:

Although economics is about human behaviour, we describe it as a science. This reflects the method of analysis, not the subject matter of economics. We can afford the necessities of life – food shelter, health, education and some extras such as entertainment and travel We are richer than some people and poorer than others.

Income distribution is closely linked to the what, how and for whom questions.

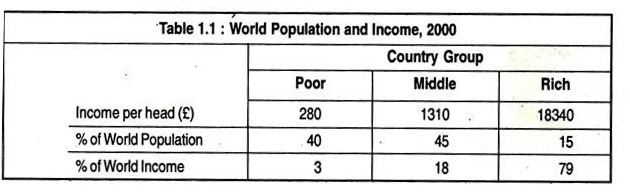

Table 1.1 shows income per person of different group of countries. In poor countries, income per person (in 2000) is only £280 a year. In rich countries income per person is about £18,340 a year, nearly 70 times higher (Table 1.1). For whom does the world economy produce? Mainly, for the 15% of its people in the rich countries. What is produced? What people in those countries want?

Why are there such a big difference in income between group of countries? This reflects how goods are made. Poor countries have little machinery, and their people have less access to health and education. Workers in poor countries are less productive because they work in less favourable conditions.

ADVERTISEMENTS:

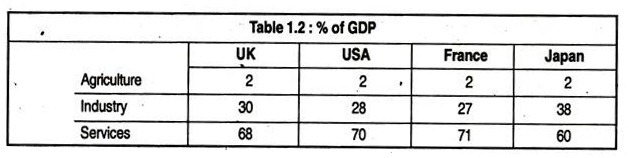

Income is unequally distributed within each country and between countries. The degree to which income is unequally distributed affects what goods and services are to be produced. In developed countries, agriculture is only 2% of GDP and industry is about 30%.

The rest is services, which include banking, transport, entertainment, communication, tourism, and public services (defense, police, education, health, etc.). Most output in those countries is services, and this sector’s share in GDP continues to grow.

Breakdown of different sectors in developed economies are given:

Economics develops theories of human behaviour and test them against the facts. We discuss later the tools economists use and explain the sense in which this approach is scientific. Economics does not ignore people as individuals.

Economic Issues:

Trying to understand what economics is about by studying definition only is like to learn swimming by reading an instruction manual. Formal analysis makes sense only when you have some practical experience. In this study we discuss examples of how society allocates scarce resources between competing uses and see the importance of the questions What, How, and for whom to produce.

Oil Price Shocks:

Oil provides fuel for heating, transport, machinery, etc. Oil prices rose sharply in 1973-74 and again in 1979-80. Until 1973, oil was cheap and its use increased steadily.

ADVERTISEMENTS:

OPEC (Organization of Petroleum Exporting Countries) became active in 1973 and it organized a production cutback by its members, making oil so scarce that the price of oil tripled. Users could not reduce its use in the short-run. Making oil scarce was very profitable for OPEC members, at least in the short-run.

The oil price tripled in 1973-74 and doubled again in 1979-80. High oil prices did not last indefinitely because the market found ways to overcome the oil shortage. Given time, the high oil price induced consumers to use less oil and non-OPEC producers to sell more. These responses, guided by prices, are part of the way many societies determine what, how and for whom to produce. Consider first how things are produced.

When the price of oil increased,’ firms cut their use of oil-based products. Chemical firms developed artificial substitutes for petroleum inputs; airline ordered more fuel-efficient aircrafts; electricity is produced from more gas-fired generators. High oil prices make the economy produce in a way that uses less oil.

How about what is being produced? Households switch to gas-fired central heating and buy smaller cars. High prices choked off the demand for oil-related commodities, but also encouraged consumers to purchase substitute commodities. Higher demand for these commodities bids up their price and encourages their production.

ADVERTISEMENTS:

Thus, for whom question in this example had a clear answer. OPEC revenue from oil sales increased from $36 billion in 1973 to nearly $ 300 billion in 1980. Much of their increased revenue was spent on goods produced in industrialized countries.

In contrast, oil-importing countries had to give up more of their production in exchange for oil imports. In terms of goods as a whole, the rise in oil prices raised the buying power of OPEC and reduced the buying power of oil-importing countries such as Germany and Japan. The world economy was producing more for OPEC and less for Germany and Japan.

Though oil prices fell a lot after 1982, OPEC power diminished as other oil suppliers came in the market, and users developed substitutes. However, OPEC got its act together again in 1999, cut supply, forced up oil prices, and prompted another oil crisis in 2000. A resource is considered scarce if the demand at a zero price would exceed the available supply.

Scarcity and the Competing Use of Resources:

Economics is the study of scarcity. When everything is so abundantly available that we get all we want, we do not need to worry about what, how and for whom it should be produced. In the Sahara there is no need to worry about the production of sand.

ADVERTISEMENTS:

When resources are scarce, society can get more of some commodities only at the cost of other things. We must choose between different commodities, or make trade-offs between them. The opportunity cost of a good is the quantity of other goods sacrificed to get one more unit of this good.

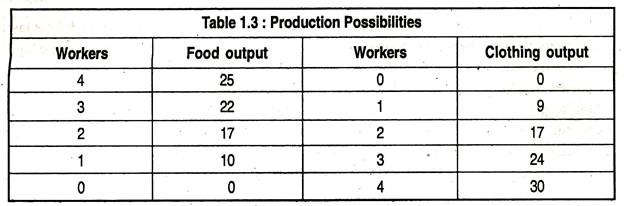

Consider an economy with four workers who can make food or cloths. Table 1.3 shows how much each good can be produced. The answer depends on how workers are allocated between the two industries. In each industry, more workers means more output of the good.

However, the law of diminishing returns says that each extra worker adds less to output than the previous extra worker added. This law applies when one input is varied but other remains fixed. Suppose workers in the cloth industry can use a fixed amount of looms. The first’ worker has sole use of these facilities.

With more workers, these facilities must be shared. Adding extra workers dilutes equipment per worker. Output per worker falls as employment rises. A similar story applies in the food industry. Each industry faces diminishing returns to extra workers.

Table 1.3 shows combinations of food and cloths made if all workers have jobs. By moving workers torn one industry to another, the economy can make more of one good, but less of the other goods. There is a trade-off between food and cloth outputs.

ADVERTISEMENTS:

Table 1.3 also shows the maximum combination of food and cloths output that the economy can produce. Point A plots the first row in Table 1.3, where food is 25 and cloth is zero.

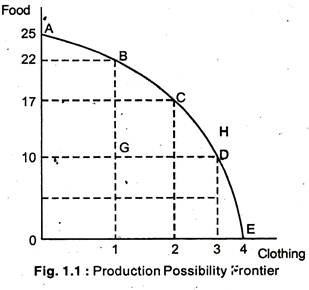

Points B, C, D and E correspond to the other rows of Table 1.3. The curve joining points A to E in Fig. 1.1, is the production possibility frontier or PPF which shows, for each output of one good, the maximum amount of other goods that can be produced.

The frontier curves around the point given by zero output of both goods. This reflects the law of diminishing returns. Movements from A to B to C each transfer a worker from the food industry to the clothing industry. Each transfer reduces output per person in cloth but raises output per person in food. Each transfer yields less additional cloth output and gives up increasing amount of food output.

(The frontier shows the maximum combinations of output that the economy can produce using all available resources. The frontier displays a trade-off more of one commodity implies less of the other. Points above the frontier need more resources than the economy has. Points inside the frontier are inefficient. By fully using available inputs the economy can expand output to the frontier.)

When resources are scarce, society can get more of some things only by having less of other things. We must choose between different outcomes, or make trade-off between them. The slope of PPF tells us the Opportunity Cost of a good how much one good has to be sacrificed to make more of another. The PPF shows the points at which society is producing efficiently.

Points such as G inside the boundary are inefficient because society is wasting resources. At point G, more output of one good would not require less output of another good. There would be no opportunity cost of expanding output of one good. Production efficiency means more output of one good can be obtained only by sacrificing output of the other goods. It does not say which point on the PPF is best.

ADVERTISEMENTS:

Points outside the PPF, such as H in Fig. 1.1, are unattainable with resources available this output combination cannot be made. Scarce resources limit society to a choice of points on the PPF. Society must choose how to allocate these scarce resources between different goods.

How does society decide where to produce on the PPF? The government may take these tough decisions, but markets can also play a key role.

Role of the Market:

A market uses prices to reconcile decisions between consumption and production Prices of goods and resources adjust to ensure that scarce resources are used to make the goods and services that society wants. Markets and prices are one way society can decide what, how and for whom to produce.

Prices guide us to decide to buy a hamburger and McDonald’s decision to sell hamburger and students’ decision to work for McDonald. Thus society allocates resources through the price system. If people hated hamburger, their sales revenue would not cover their costs Society would devote no resources to hamburger production. People’s desire to eat hamburgers guides resources into their production.

Planned or Command Economy:

ADVERTISEMENTS:

How would resources be allocated if market did not exist? In a planned or command economy, government planners decide what, how and for whom to produce. Households firms and workers are told what to do. Central command is difficult and complicated.

No country has ever made all decisions by central command. However, in some countries, there used to be a lot of central direction and planning. The state owned the land and factories and made key decisions about what people should consume, how goods and services should be produced, and how much people should work.

In a market economy, allocation decisions are made every day through the mechanism of markets and prices. The opposite extreme of central planning is a complete reliance on markets in which prices can freely adjust. In 1776, Adam Smith in his famous book. ‘The Wealth of Nations’ argued that people pursuing their self-interest would be led ‘as by an invisible hand’ to do things in the interest of the society as a whole.

Thus, in a free-market economy, prices adjust to reconcile desires and scarcity Markets in which governments do not intervene are called free-market and the invisible hand. In a free market, people pursue their self-interest without government restrictions. In a command or planned economy decisions are taken by the state. Between the two extremes is the mixed economy.

In a mixed economy the government and non-government sectors jointly solve economic problems. The government influences decisions through taxation, subsidies and provision of free-services (public goods) such as defence and police services.

It also regulates the extent to which individuals may pursue their own self-interest. Almost all countries are mixed economies. Some are nearer to planned economies and others are much nearer to the free-market economies.

ADVERTISEMENTS:

Apart from these 3 types of economies, there is another type of economy which exists only in some less developed economies. This is known as traditional economy. A traditional economic system is one in which behaviour is based primarily on tradition, custom and habit. Young men follow their father’s occupation such as hunting, fishing and tool-making.

Similarly, women do typically what their mothers did cooking and housework. There are few changes in the pattern of goods produced from year to year. The techniques of production also follow traditional patterns. The concept of private property is often not well defined, and property is frequently held in common.

Finally, production is allocated among the members of society according to long – established traditions. In short, the answers to the economic questions of what to produce, how to produce, for whom to produce are determined by tradition.

Such a system works best in an age-old unchanging environment. Under static conditions, a system that does not continually require people to make choices can prove effective in meeting economic and social needs.

Traditional systems were common in earlier times. The feudal system under which people lived in medieval Europe was largely a traditional society. Today only a few isolated self-sufficient communities still retain or maintain traditional systems; examples can be found in the Canadian Arctic and the Himalayas and in many of the world’s poor countries of Africa, Asia and S. America.

Economics:

Is economics a science or a study of the behaviour of human beings? In order to understand this question it is necessary to know what is meant by a “Study” and a “Science.” A study gathers facts and sorts out and classifies these into categories, divisions, etc. For instance, data of unemployment in the U.K. is collected and then classified on the basis of age, regions, etc.

A science does more than this. It goes on to build models or theories to explain observations. We will explain such theories. It also uses models or theories to predict what will happen in the future. Can economics explain past events or predict future ones? Some would say — no, because human behaviour is unpredictable and it may not be possible to predict how one housewife will react to a particular sales promotion.

But economists argue that it is possible to predict how one million housewives react to such an event. Evidence suggests that supermarket which cut prices gain greater market share or ceteris paribus — all other things being equal.

Although it may not be possible to predict how one economic unit will react, it may not be impossible to predict the reaction of a large number. Even with large number behaviour may not be entirely predictable, so economics, like other social sciences, deal with probabilities or likelihoods. If this is true, economics can be regarded as an inexact science because, unlike natural sciences, economists will only be able to estimate the probability of a result.

Lastly, Science tests models to see whether they are true or false. Some sciences are “experimental.”

However, all sciences are not experimental. Economists, like astronomers, cannot set up experiments to test their theories because the number of people involved are too large or because it is impossible to keep all other factors constant which would otherwise affect the variable in the experiment, and so on.

Nature of Scientific Theories:

We have evidence that human behaviour does show stable response patterns. Theories grow up in response to questions — why? Some sequence of events is observed in the real world and some ask — why? A theory attempts to explain — why? The main practical consequences of a theory is that it enables us to predict unobserved events.

For example, National Income Theory predict that an increase in tax rates will raise unemployment and increase in government expenditure is likely to reduce it.

Construction of Theories:

A theory consists of a set of assumptions and set of definitions. We must not worry about unrealistic assumptions that we find in economics. It is important to remember, however, that every theory is an abstraction from reality.

“A good theory abstracts from reality in a useful way, a bad theory does not.” To know whether the abstractions of a particular theory are useful or not, we must construct the theories by a process of logical deduction to see what is implied by the assumption of the theory.

For example, if we assume that businessmen wish to maximise profits and if we assume how taxes affect their profits, we would be able to say how they will behave when taxes change. These implications are the predictions of our theory. If the theory is useful, its predictions will be found to be empirically correct.

Scientific Method:

Scientific method begins with the formulation of a theory about human behaviour. For example, we may advance an idea that the demand for a good is a function of price. We may say further that, as the price increases, the demand decreases and, when price decreases, the demand increases. This gives us a hypothesis which may be tested on observed behaviour.

The testing of ideas is known as empiricism, on the basis of our observations we may either:

(a) Confirm the theory, or

(b) Reject the theory, or

(c) Amend it in the light of new evidence.

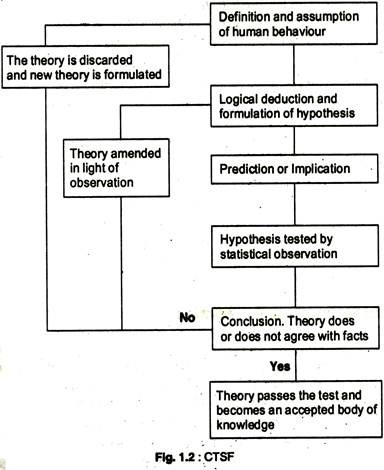

Assumption behind the theory is that “all other things remaining constant or ceteris paribus.” For example, if we wish to examine the effect of price on demand we do not change simultaneously income, prices of other commodities, tastes, etc. Therefore, when formulating economic principles, we are usually careful to state that such and such will happen, ceteris paribus. This process is shown diagrammatically in Fig. 1.2.

Human Behaviour:

Economics is concerned with human behaviour which is, often, unpredictable. We seem to obey Aristotle’s dictum. ‘Man is a reasoning, but not a reasonable animal.’ Naturally, it is impossible to reach any firm conclusions. This may be so if we consider the behaviour, of one person.

However, while individuals are unpredictable, people in large numbers are not. For example, if we increase peoples’ income it may be possible that any particular individual may, or may not, spend more. But what happens to a million people when their income increases? It is possible to conclude that, overall, their expenditure will increase.

Thus, examining a large number of people’s behaviour, it may be possible to take advantage of the law of large numbers. This law predicts that the random behaviour of one person in a large group will be offset by the random behaviour of another, so that it would be possible for us to make definite predictions about the behaviour of the group as a whole.

Economic Goods:

A good produced from scarce resources is also scarce and is called an economic good. Since economic goods are scarce, we are faced with decisions how best to use them. Economic goods are scarce in relation to the demand for them. All goods are not economic goods; some are free.

Free Goods:

Some goods are free. Of course, there are very few free goods in modern society.

We used to call air a free good, but that is really not true today, because in many cities air is polluted. In mountain areas, clear air is still a free good; you can have as much as you want at a zero price. There is no scarcity involved.

Who is interested in free goods? Certainly, not economists, because economists only step in when the problem of scarcity arises and allocation of scarce resources is needed. As population and production increase many free goods become economic goods, such as land, water, air, etc.

Positive and Normative Economics:

Positive economics deals with scientific explanation of how the economy works. Normative economics offers recommendations based on positive value judgements. Positive economics can explain how the economy works and, thus, how it will respond to changes. In positive economics, we aim to act as scientists.

We examine how the society and the economy work. At this stage, there is no scope for personal value judgments. We are concerned with the propositions of the form if this is changed then that is likely to happen. In this sense the positive economics is like a natural science such as physics, chemistry and astronomy.

When a good is taxed, its price will rise. Many propositions in positive economics command general agreement among the economists. As in any physical science, there are some unresolved questions where disagreement persists. Research is needed in some of these issues, but new issues will arise, which provide scope for further research.

Normative economics is based on subjective value judgments, not on the search for any objective truth. Should resources be transferred from education to health? The answer is a subjective value judgment, based on the feeling of the person making the statement.

Economists cannot show that education is more or less desirable than health. However, it may be able to answer the positive question of what quantity of extra education could be achieved by giving up a particular quantity of health, and so on.

Microeconomics and Macroeconomics:

Economics has many branches. Labour economics deals with employment and wages, as monetary economics with interest rates and exchange rates. However, we need not classify branches of economics by subject areas. We can classify branches of economics according to the approach used. The division of approaches into micro and macro cuts across the subject groups cited above.

Microeconomics makes a detailed study of individual and firms’ decisions about particular commodities. For example, we can study why individual households prefer cars to bicycles and how firms decide whether to make cars or bicycles. Comparing the markets for cars and for bicycles, we can study the relative prices of cars and bicycles, and the relative output of these two goods.

The sophisticated branch of microeconomics known as ‘general equilibrium theory’ extends this approach to its logical conclusion. This simultaneously studies every market for every commodity. From this it is hoped to understand the complete pattern of consumption, production and exchange in the whole economy at a point in time.

However, macro is a study of the whole economy, such detailed analysis gets-too complicated to keep track of the behaviour in which we are interested. We need to simplify to keep the analysis manageable, but not distort reality too much”.

Micro offers a detailed treatment of one aspect of economic behaviour but ignore interactions with the rest of the economy in order to keep the analysis manageable. However, if the indirect effects are too important to be swept under the carpet, another simplification must be found.

Macro makes an analysis with the interaction in the economy as a whole. It deliberately simplifies the individual building blocks of the analysis in order to retain a manageable analysis of the whole economic system. Macro rarely divide consumer goods into cars, televisions, bicycles, etc.

Instead, they study a single bundle called ‘consumer good’ because they want to study the interaction between household purchases of consumer goods and firm’s decisions about the purchases of machinery and buildings, and so on. Because macro concepts refer to the whole economy, they get more media coverage than micro concepts, which are chiefly of interest to those in a specific group.

Following are three macro concepts Gross Domestic Product (GDP) is the total value of goods and services produced in an economy in a given period. The aggregate price level measures the average price of goods and services in the economy in a given year compared with the base year. The unemployment rate is the fraction of the labour force out of work in a given period.

Static and Dynamic Model:

Models which have no time element are called static models, whilst dynamic models incorporate a time element. An example of a dynamic model is the accelerator theory. The simple Keynesian model is static. Static models are easier to work with than dynamic model. Dynamic models are likely to be more realistic.

Partial and General Models:

A partial model is one which includes only a few variables. But there is no magic number which distinguishes ‘few’ from ‘many’ variables. For example, a partial model could be the market for council housing and a general model could be the market for all housing.

An Equilibrium:

An equilibrium is a situation where there is no tendency to change. All static models are equilibrium models because they deal with comparisons of two equilibrium situations. A disequilibrium model considers movements from one disequilibrium. In a mountain area, clear air is still a free good; you can have as much as you want at a zero price.

There is no scarcity involved. Who is interested in free goods? Certainly not economists because economists only step in when the problem points to the next. The Cobweb theory is a disequilibrium model because it attempts to chart movements along a disequilibrium path.

Production Choices:

Producers decide what to produce and how to produce it. Production is a complex process in a modem economy. A typical car manufacturer assembles a product out of thousands of individual parts. It makes some of the parts itself.

Most are subcontracted to other parts manufacturers and they, in their turns, subcontract some of their work out to smaller firms. This kind of production displays two characteristics noted by Adam Smith — division of labour and specialization. There is one new characteristic — globalisation.

Specialization:

In ancient hunter-gathering societies, and in subsistence economies, most people make most of the things they need for themselves. However, from the time people first engaged in settled agriculture and some began to live in towns, people have specialized in doing particular jobs.

Artisans, soldiers, priests and government officials were some of the earliest specialized occupations. Economists call this allocation of different jobs to different people specialization of labour. There are two fundamental reasons why specialization is really efficient compared with self-sufficiency.

First, individual abilities differ, and specialization allows each person to do which she or he can do relatively well while leaving everything else to be done by others. Even when people’s abilities are unaffected by the act of specializing, production is greater with specialization than with self-sufficiency.

This is one of the most fundamental principles in economics. It is called the principle of comparative advantage. The second reason concerns changes in people’s attitude because of specialization. A person who concentrates on one activity becomes better at it than a jack-of-all-trade which is known as learning by doing.

The Division of Labour:

In the past each artisan specialized in making the whole of the product. Only since the Industrial Revolution (1760 on) and appearance of factories that many technical advances in methods of production have made it efficient to organize production into large-scale firms through the division of labour. This term refers to specialization within the production process of a particular product.

Mass Production:

In a mass production factory work is divided into specialized tasks using specialized machinery. Each individual repeatedly do one small task that is a fraction of those necessary to produce any one product. This is an extreme case of division of labour.

Globalisation:

Market economies constantly change, largely as a result of the development of new technologies. Many of the recent changes are referred to as globalisation. Globalisation is an old phenomenon.

But the usual pattern over the last two hundred years was that manufactured goods being sent from Europe and North America to the rest of the world, with raw materials and primary products being sent in return. What is new in the last few decades is the globalisation of manufacturing.

Behind this phenomenon lie the rapid reduction in transportation costs and the revolution in information technology. The cost of moving products around the world has fallen drastically in recent decades owing to increase in size of ships. Our ability to transmit and to analyse data has been increasing even more dramatically, while the cost of doing so have been decreasing.

For example, today £1,000 buys a computer that fits into a briefcase and has the same computing power as one that in 1970 cost £5 million and filled a large room.

This revolution in information and communication technology has made it possible to coordinate economic transactions around the world in ways that were costly and difficult 50 years ago, and quite impossible 100 years ago. This, combined with falling costs of transport, has decentralized manufacturing activities. Fifty years ago, if a car is to be assembled in Oxford, all parts have to be made nearby.

Today it is possible to make parts anywhere in the world and get them to Oxford exactly when they are required. As a result, manufacturing, which was formerly concentrated in the advanced industrial countries, now take place all over the world. A typical TV set or car contain components made in, literally, dozens of countries. We still know where a product is assembled, but it is difficult to say where it is made.

Many Markets are Globalizing:

For example, we can see the same designer jeans and leather jackets in virtually all big cities. Many corporations are globalized, as more and more of them become what are called transatlantic. These are massive firms with a physical presence in many countries and increasingly decentralized management structure.

Many brands are practically universal, such as Coca-Cola, Kellogg’s, Sony, etc. Today it is difficult to take an isolationist economic view and like to take part in global economy where an increasing share of jobs and incomes are created.

Markets and Money:

People must satisfy most of their wants by consuming things made by other people. In ancient societies the exchange of goods and services took place by mutual agreement among neighbors. In course of time trading became centred on what is called markets. For example, the French markets or trade fairs of Champagne were well-known throughout Europe as early as the 11th century AD.

Even today many towns in Britain have regular market days. Today the term market has a much broader meaning. We use the term market economy to refer to a society in which people specialize in productive activities and meet most of their material needs through exchanges agreed upon by contracting parties.

Specialization must be accompanied by trade. People who produce only one thing must trade most of it to other things they require. Early trading was by means of barter—the trading of goods for other goods. A successful barter requires what is called double coincidence of wants. Money eliminates the cumbersome system of barter by separating the transactions involved in the exchange of products.

If a farmer has wheat and wants hammer, he does not need to find someone who has a hammer and wants wheat. He has to find someone who wants wheat. The farmer takes money in exchange. He then finds a person who wishes to trade a hammer and gives up the money for hammier. Money greatly facilitates specialization and trade.

Basic Tools of Economic Analysis:

Every discipline has its basic tools of analysis. To analyse economic issues we use both models and data. A model or theory makes assumptions from which it deduces how people will behave. It deliberately simplifies reality to build a model.

Models omit some details of the real world to concentrate on the essentials. From this manageable picture of reality we develop an analysis of how the economy works. An economists uses a model as a tourist uses a map.

A map of London misses out many details traffic lights, roundabouts, etc. but with a careful study of it you get a good idea about the best route to follow. This simplified picture is easy to follow, which also provides a good guide to actual behaviour. Data are pieces of evidence about economic behaviour.

The data or facts interact with model in two ways. First, the data help us quantify theoretical relationships. To choose the best route we need some facts about where delays may occur. The model is useful because it helps us to find out which facts to collect. Bridges are more likely to be congested than motorways.

Second, the data helps us to test our models. Like all scientists, economists must check that their theories square with the relevant facts.

The crucial word is relevant. For example, for several decades the number of Scottish dysentery deaths was closely related to the UK inflation rate. But this was a coincidence, not the key to a theory of inflation.

Without any logical underpinning, the empirical connection was bound to breakdown sooner or later. Paying attention to a freak relationship in the data increases neither our economic understanding nor our ability to predict the future.

The blend of data and model is subtle. The data alert us to logical relationships we had overlooked. And whatever theory we wish to build should certainly be checked against the facts. But only theoretical reasoning can guide an intelligent assessment of what evidence has reasonable relevance.

When a theory that makes sense has for a long time survived exposure to the relevant economic data, we sometimes accord it the status of a law, such as the law of diminishing returns.

A behavioural law is a sensible theoretical relationship not rejected by evidence over a long period.

Next we turn to the representation of economic data and show how an economist might develop a theoretical model of an economic relationship. Finally, we discuss how actual data might be used to test the theory that has been developed.

Economic Data:

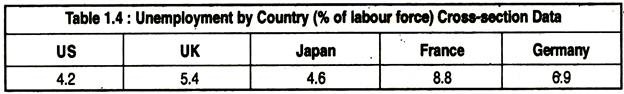

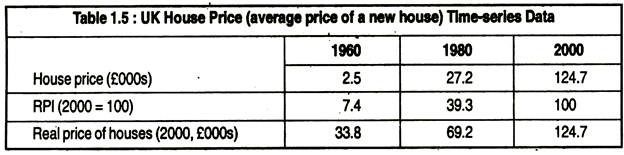

We gather evidence to study changes over time, or changes across groups or regions at the same point in time. Table 1.4 shows a cross-section of unemployment rates in different countries in 2001, and Table 1.5 shows a time-series of UK house prices between 1960 and 2000.

The average price of a new house rose from £2,500 in 1960 to £1, 24,700 in 2000. Are houses really 50 times as expensive as in 1960? No, once we allow for inflation, which also raised incomes and the ability to buy houses. Nominal values are measured in current prices. Real values are adjusted nominal values for changes in the general price level.

In the UK, the retail price index (RPI) measures the price of a basket of goods bought by a typical household. Inflation caused a big rise in the RPI during 1960-2000. Table 1.5 calculates an index of real house prices, expressed in 2000 prices.

An index number expresses data relative to a given base value. For 1960 house prices, we take the nominal price of £2,500 x 100 divided by 7.4 to allow for changes in the retail price index during 1960-2000, yielding £33,800. Comparing 1960 and 2000 but allowing for inflation, real house prices quadrupled, from £33,800 to £1, 24,700. Most of the rise in nominal house prices in the top row of Table 1.5 was actually due to inflation.

Retail Price Index (RPI) and other Indices:

To keep.-track of the prices faced by consumers, countries construct a consumer price index. In the UK this is called RPI (Retail Price Index). The RPI is used to measure changes in the cost of living, the money that must be spent to purchase the typical bundle of goods commanded by a representative household.

The inflation rate is the annual rate of change of the price index. The RPI is constructed in two stages. First, index numbers are calculated for each category of commodity purchased by households. Then the RPI is constructed by taking a weighted average of the different commodity groupings.

Other examples of indices include the index of wages in manufacturing, a weighted average of wages in different manufacturing industries. The FTSE is the Financial Times-Stock Exchange index of share prices quoted on the London Stock Exchange. The index of industrial production is a weighted average of the quantity of goods produced by industry.

The procedure by which the index numbers are calculated is always the same. We choose a base year at which to set the index equal to 100, then calculate other values relative to this base period. Where the index refers to more than one commodity, we have to choose weights by which to average across the different commodities that the index describes.

Real and Relative Prices:

The distinction between nominal and real variables applies to all variables measured in money values. The argument carries over to prices themselves. The nominal price of houses has risen a lot since 1960. To calculate an index of the real price of houses, divide an index of nominal house prices by the retail price index and multiply by 100.

Real prices indicate economic scarcity. They show whether the price of a commodity rose faster than prices in general. Thus, real prices are sometimes called relative prices. Consider the price of televisions over the last 20 years.

TV prices, measured in pounds, have hardly changed. The RPI has risen a lot. The real price of TV has, in fact, fallen. Advances in technology reduced the cost of producing TVs. Because the real price has fallen, many consumers now have several sets. It is misleading to base our analysis on nominal values of variables.

The purchasing power of money:

When the price of goods rises, the purchasing power of money falls because £1 buy fewer goods.

The purchasing power of money is an index of the quantity of goods that can be bought for £1.

To distinguish real and nominal variables we say that real variables measure nominal variables as if the purchasing power of money has remain unchanged. Another way to express this idea is to distinguish nominal variable in current prices and real variable in constant prices.

Measuring Changes in Economic Variables:

The percentage change is the absolute change divided by the original number, then multiplied by 100 % change = Absolute change divided by original number times 100. The growth rate is the % change per period — usually a year. Negative growth rates show % falls. Economists usually take economic growth to mean the % annual change in the national income.

Economic Models:

The London Underground (known as Tube) usually loses money and needs government subsidies. Might different policies help? Suppose we have to set the Tube fare that will raise revenue. How do we analyse the problem?

To build a model, we need to simplify reality, picking out the key elements of the problem. We begin our analysis with the simple equation:

Revenue = Fare times Number of passengers ………….. (1).

Underground authorities can set the fare, but influences the number of passengers only through the fare that it set. The number of passengers may reflect habit, convenience and tradition, and may be unresponsive to changes in fares. This is not the view an economist would take. It is possible to travel by car, bus, taxi or Tube.

Decisions about how to travel will depend on the relative costs of different modes of transport. Equation (1) requires a ‘theory’ or ‘model’ of what determines the number of passengers. We must model the demand for Tube journeys.

First, Tube fare matters. Other things equal, higher Tube fares reduce the quantity of Tube journeys demanded. Second, if there are price rises for competing of journeys such as bus fares and taxi fares, more people will use Tube at any given Tube fares. Third, if passengers have higher income, they would be able to make more Tube journeys at any given fare.

Now we have a bare-bone of the number of Tube passengers:

Number of passengers = f (Tube fare, taxi fare, bus fare, petrol price, passengers’ income………)…….. (2)

The number of passengers is a function of Tube fare, and so on. Tube demand probably depends on the weather as well. If the purpose of our model is to study annual changes in the number of Tube passengers, we can neglect the weather provided weather conditions are broadly the same every year.

Writing down a model forces us to look for all the relevant effects. Combining equations (1) and (2) we find:

Tube revenue = Tube fare x number of passengers = Tube fare x f (Tube fare, bus fare, taxi fare, petrol price, income……..)…… (3)

Models are simply devices to ensure that we think clearly about a problem. Learning use of models is more an art than a science. Too much simplicity will omit a crucial factor from the analysis. Too much complexity will lose any feel for why the answer turns out as it does.

Sometimes data guide us about which factors are crucial and which are not. At other times, as with Tube fares, it is not enough to understand the forces at work. We need to quantify them. For both reasons, we now turn to the interaction of economic models and economic data.

Models and Data:

Equation (3) is our model of determinants of Tube revenue. Higher fares give more revenue per passenger, but reduce the number of passengers. They cannot tell us which effect dominates. This is an empirical issue: How many passengers are put off by higher fares?

Empirical Evidence:

We need some empirical research to establish the facts. Experimental sciences conduct controlled experiments in a laboratory, varying one factor at a time while holding constant all the other relevant factors. Like astronomy, economics is primarily a non- experimental science.

Astronomers cannot suspend the planetary motion to examine the relation between the earth and the sun in isolation; economists cannot suspend the laws of economic activity to conduct controlled experiments.

Most empirical research in economics must deal with data collected over periods in which many of the relevant factors were simultaneously changing. The problem-is how to disentangle the separate influences on observed behaviour.

We approach this in two stages first we proceed by examining the relationship of interest neglecting the possibility that other relevant factors were changing. Then we show how economists deal with the harder problems in which variations in other factors are also included in the analysis.

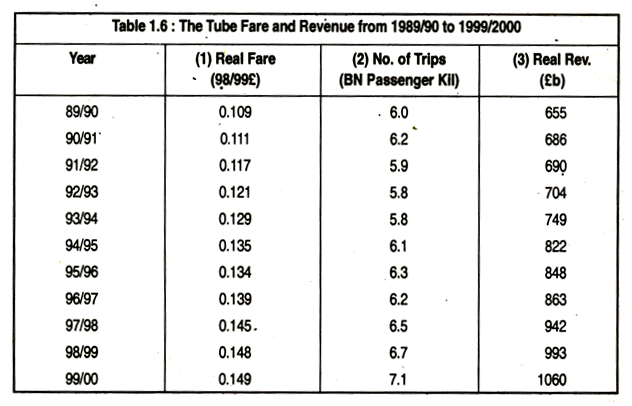

Table 1.6 shows data on Tube fares and passengers. When annual data is measured over overlapping calendar years we show year as 1989/90. Column (1) shows the real Tube fare per passenger kilometer, column (2) shows Tube demand, in billions of passenger kilometer a year and column (3) shows real revenue.

It is useful to present this evidence in a scatter diagram such as Fig. 1.3.

The vertical axis measures col. (1), the real fare per passenger kilometre. The horizontal axis measures col. (3), real revenue in constant billion pounds.

Real revenue is the real fare per passenger kilometers x the number of passenger kilometre travelled.

The years of lowest real revenue are the years in which the real Tube fare are the lowest. Yet the effect of changes in real fares cannot be the whole story. Other things being equal, higher fare reduces the quantity of Tube journeys. In fact, column (2) shows that Tube use rose despite higher Tube fares. Fig. 1.3: Tube Fares and Revenue 1989-2000 Something else must have changed.

Diagrams, Lines and Equations:

A scatter diagram plots pairs of values simultaneously observed for two different variables. If we draw line or curve through all these points, this suggests, but does not prove, an underlying relationship between the two variables.

When the points are plotted, they lie all over the plan, this suggests, but does not prove, no underlying relationships between the two variables. Only if economics were an experimental science, in which we could conduct controlled experiments guaranteeing that all other relevant factors had been held constant, could we interpret scatter diagrams unambiguously. Nevertheless, they provide helpful clues.

Fitting Lines through Scatter Diagrams:

In Fig. 1.3 we could draw a line through the scatter of points we plotted. The line would show the average relation between fares and revenue between 1989/90 and 1999/2000. However, we could quantify the average relation between fares and usage. Given the particular scatter of points, how do we decide where to draw the line, given that it cannot fit all the points exactly?

Econometrics uses mathematical statistics to measure relationships in economic data. Having plotted the points in data, a computer works out where to draw the line to maximise the dispersion of regression points around the line. Fortunately, computers can work in 10 to 20 dimensions at once, even though we cannot imagine what this look like. Conceptually, it is simply an extension of fitting lines through scatter diagrams.

By disentangling separate influences from data where many different things move simultaneously, econometrics conducts empirical research even though economics is not an experimental science like physics or chemistry. Here we are not going to use anything more complicated then two-dimensional diagrams.

Reading Diagrams:

In economics you need to be able to read diagram and understand what it says. Fig. 1.4 shows a hypothetical relationship between two variables: Price and Quantity. The diagram plots Q = f (P). The quantity Q is function of price.

Knowing the value of P tells us the corresponding value of Q. We need to know the value of P to make statements about Q. In Fig. 1.4, Q is the positive function of P. Higher values of P means higher values of Q.

When, as in Fig. 1.4, the function is a straight line, only two pieces of information are required to draw the entire relationship between Q and P. We need the intercept and slope.

The intercept is the height of line when the variable on the horizontal axis is zero. In Fig. 1.4, the Intercept is 100, the value of Q = 100, when P = 0. Lots of different lines could pass this point. The other characteristic is the slope of the line measures its steepness.

The slope tells us Q changes each time P changes by one unit. Here the slope is 100. By definition, a straight line has a constant slope. Q rises by 100 when P changes by one unit. Thus, the figure shows a positive relation between Q and P. Since higher P values are associated with higher Q values, the line slopes upward.

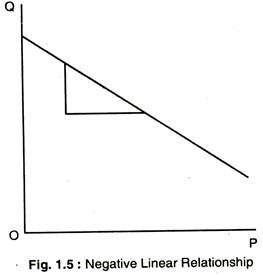

The line has a positive slope. Fig. 1.5 shows a case where Q is a negative function of P. Higher P values has smaller Q values. Thus, the line has a negative slope.

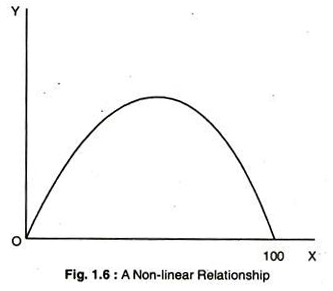

Economic relationship need not always be straight line or linear. Fig. 1.6 shows a non-linear relationship between two variables X and Y. The slope keeps changing. Each time we raise X by 1 unit we get a different rise (or fall) in Y. Consider the relationship between the income tax Rate X and income tax revenue Y. When the tax rate is zero, no revenue is raised. When the tax rate is 100%, revenue, again, is zero.

Beginning from a Tr = 0, rises in Tr initially raise Tax revenue. Beyond some Tr, further rises in tax rate then reduce tax revenue, which becomes zero by the time rate reaches 100%. Diagrams display the essence of real-life problems in tax rates and tax revenue, which becomes zero by the time Tr = 100%, as Fig. 1.6 shows.

Another look at ‘Other Things Equal’ or ‘ceteris paribus’.

Other Things Equal is a device for looking at the relation between two variables, but other variables also matter.

When one of the other things changes, we show this as a shift in the line. We can now draw two-dimensional diagrams without neglecting other determinants. When this change, lines (or curves) shift.

Theories and Evidence:

Economists analyse a problem in three stages as we have seen above. First, a phenomenon is observed and the problem is formulated. By armchair reasoning or a cursory inspection of the data, we decide Tube fare has something to do with Tube revenues. We want to understand what this relationship is and why it exists.

Second, we develop a theory or model to capture the essence of the phenomenon. By thinking about incomes and the decision about which type of transport to use, we identify the things relevant to Tube usage and hence Tube revenue.

Third, we test the predictions of the theory by confronting it with economic data. An econometric examination of the data can quantify the things the model identifies. We can see if, on average, they work on the direction the model suggests.

Indeed, by including in our econometric investigation some extra factors deliberately left out of our model in the quest for simplicity, we can check that the extra influences were sufficiently unimportant that it made sense to omit them from analysis.

Suppose we confront our theory with the data and the two seem compatible. We do not reject our theory. If our model is rejected we have to start again. If our model is not rejected by the data, this does not guarantee that we have found the correct model. There may be a better model that has escaped our attention but would also be compatible with our data.

As time elapses, we acquire new data. We can also use data from other countries. The more we confront our model with different data and they are not rejected, the more confident we become. Relationships in which we have become very confident are sometimes called economic laws.

Static, Comparative Static and Dynamic Analysis:

Static analysis is the branch of economics which studies the properties of position of equilibrium in the economic system. However, it does not concern itself with the time it takes to reach an equilibrium or with the path to follow to reach the equilibrium. This is the concern of dynamic analysis.

Dynamic analysis is necessary for the following reasons. First, dynamic analysis is necessary to consider the stability of the system. An equilibrium is known as stable if any disturbance from the equilibrium brings the system back to the equilibrium again.

For example, if we start from a disequilibria and then want to know whether the system moves towards equilibrium or not we require to analyse the time path of the relevant variable.

This is known as dynamic analysis. Second, since adjustment of one variable take time to cause a change in another variable, there are lags in many functions. The presence of these lags requires dynamic analysis. Third, there are certain variables which depend on the rate of growth of other variables. Such problems also require dynamic analysis.

Stocks and Flows:

Stock and flow variables are an important distinction in economics. A flow variable has a time dimension. It is always measured over a period of time. A stock variable has no time dimension. It is measured at a given point in time. The stock variable is just a number, not rate flow of so much point in time.

For example, the concepts like total money supply, total bank deposit, etc. are stock concepts whereas the concepts like national income, total consumption, etc. are flow concepts. When we measure the national income we consider a period of time, namely one year. Thus, national income is measured as a flow per year.