Cartels Types: Joint profit Maximisation and Market-Sharing Cartel!

A cartel is an association of independent firms within the same industry.

The cartel follows common policies relating to prices, outputs, sales and profit maximization and distribution of products.

Cartels may be voluntary or compulsory and open or secret depending upon the policy of the government with regard to their formation. They are of many forms and use many devices in order to follow varied common policies depending upon the type of the cartel.

ADVERTISEMENTS:

Here, we discuss two most common types of cartels:

(1) Joint profit maximisation or perfect cartel; and

(2) Market-sharing cartel.

1. Joint Profit Maximisation Cartel under Perfect Collusion:

The uncertainty is found in an oligopolistic market which provides an incentive to rival firms to form a perfect cartel. Perfect cartel is an extreme form of perfect collusion. Under it, firms producing a homogeneous product form a centralized cartel board in the industry.

ADVERTISEMENTS:

The individual firms surrender their price-output decisions to this central board. The board determines for its members the output, quotes the price to be charged and the distribution of industry profits. The central board acts like a single monopoly whose main aim is to maximize the joint profits of the oligopolistic industry.

Assumptions:

The analysis of joint profit maximisation cartel is based on the following assumptions:

1. Only two firms A and B are assumed in the oligopolistic industry that form the cartel.

2. Each firm produces and sells a homogeneous product that is a perfect substitute for each other.

ADVERTISEMENTS:

3. The market demand curve for the product is given and is known to the cartel.

4. The number of buyers is large.

5. The price of the product determines the policy of the cartel.

6. The cost curves of the firm’s are different but are known to the cartel.

7. The cartel aims at joint profit maximisation.

Joint Profit Maximisation Solution:

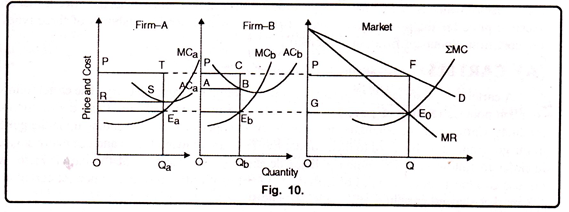

Given these assumptions, and given the market demand curve and its corresponding MR curve, joint profits will be maximized when the industry MR equals the industry’s MC. Figure 10 shows the situation where D is the market (or cartel) demand curve and MR is its corresponding marginal revenue curve. The aggregate marginal cost curve of the industry ΣMC is drawn by the lateral summation of the MC curves of firms A and B, so the ΣMC = MCa + MCb,.

The cartel solution-that maximizes joint profit is determined at point Σ where the Σ MC curve intersects the industry MR curve. Consequently, the total output is OQ which will be sold at OP = (QF) price. As under monopoly, the cartel board will allocate the industry output by equating the industry MR to the marginal cost of each firm. The share of each firm in the industry output is obtained by drawing a straight line from E0 to the vertical axis which passes through the curves MCb, and MCa of firms B and A at points Eb, and Ea respectively.

Thus the share of firm A is OQa and that of firm B is OQb which equal the total output OQ (= OQb + OQA). The price OP and the output OQ distributed between A and B firms in the ratio of OQa: OQb, is the monopoly solution.

ADVERTISEMENTS:

Firm A with the lower costs sells a larger output OQb than the firm B with higher costs so that OQa > OQb,. But this does not mean that A will be getting more profit than B. The joint maximum profit is the sum of RSTP and ABCP earned by A and B respectively. It will be pooled into a fund and distributed by the cartel board according to the agreement arrived at by the two firms at the time of the formation of the cartel.

Advantages:

Perfect collusion by oligopolistic firms in the form of a cartel has many advantages. It avoids price wars among rivals. The firms forming a cartel gain at the expense of customers who are charged a high price for the product. The cartel operates like a monopoly organization which maximizes the joint profit of firms. Generally, joint profits are high than the total profits earned by them if they were to work independently.

Problems of a Cartel:

The problems of cartels are stated below:

ADVERTISEMENTS:

1. It is difficult to make an accurate estimate of the market demand curve.

2. The estimation of the market MC curve may be inaccurate because of the supply of wrong data about their MC by individual firms to the cartel.

3. The formation of a cartel is a slow process which takes a long time for the agreement to arrive at by firms especially if their number is very large.

4. The larger the number of firms in a cartel, the less is its chances of survival for long because of the distrust. The cartel will, therefore, break down.

ADVERTISEMENTS:

5. In theory, the cartel-members agree on joint profit maximisation. But in practice, the seldom agree on profit distribution.

6. The price of the product fixed by the cartel cannot be changed even if the market conditions require it to be changed. This is because it takes a long time for the members to arrive at an agreed price.

7. Prices tackiness gives rise to ‘chislers’ who scarcely cut the price or violate the quota agreement.

8. Unless all member firms in the cartel are strongly committed to cooperation, outside disturbances, such as a sharp fall in demand, may lead to the breakdown of the cartel.

9. Some high-cost uneconomic firms may refuse to shut down or leave the cartel despite the cartel board’s request.

2. Market-Sharing Cartel:

Another type of perfect collusion in an oligopolistic market is found in practice which relates to market-sharing by the member firms of a cartel.

ADVERTISEMENTS:

There are two main methods of market-sharing:

(a) Non-price competition; and

(b) Quota system.

They are discussed as under:

(a) Non-Price Competition Cartel:

The non-price competition agreement among oligopolistic firms is a loose form of cartel. Under this type of cartel, the low-cost firms press for a low price and the high-cost firms for a high price. But ultimately, they agree upon a common price below which they will not sell. Such a price must allow them some profits. The firms can compete with one another on a non-price basis by varying the colour, design, shape packing etc. of their product and having their own different advertising and other selling activities. Thus each firm shares the market on a non-prices basis while selling the product at the agreed common price.

ADVERTISEMENTS:

(b) Market Sharing by Quota Agreement:

The second method of market sharing is the quota agreement among firms. (All firms in an oligopolistic industry enter into collusion for charging an agreed uniform price. But the main agreement relates to the sharing of the market equally among member firms so that each firm gets profits on its sales.

Assumptions:

This analysis is based on the understated assumptions:

1. Only two firms can enter into market-sharing agreement on the basis of the quota system.

2. Each firm produces and sells a homogeneous product.

3. The number of buyers is large.

ADVERTISEMENTS:

4. The market demand curve for the product is given and known to the cartel.

5. Each firm has its own demand curve having the same elasticity as that of the market demand curve.

6. Both firms share the market equally.

7. Cost curves of the two firms are identical.

8. There is no threat of entry by new firms.

9. Each sells the product at the agreed uniform price.

Market-Sharing Solution:

ADVERTISEMENTS:

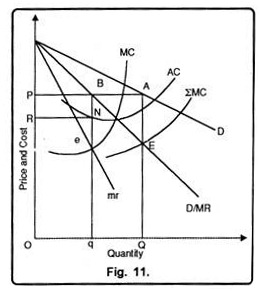

With these assumptions, the equal market sharing between the two firms is explained in Figure 11 where D is the market demand curve and rf/MR is its corresponding MR curve. ZMC is the aggregate MC curve of the industry. The ZMC curve intersects the rf/MR curve at point E which determines QA (= OP) price and total output OQ for the industry. This is the monopoly solution in the market-sharing cartel.

How will the industry output be shared equally between the two firms? Let us assume that the d/MR is the demand curve of each firm and mr is its corresponding MR curve. AC and MC are their identical cost curves. The MC curve intersects the mr curve at point e so that the profit maximization output of cache firm is Oq. Since the total output of the industry is OQ which is equal to 2 x Oq = (OQ = 20q), it is equally shared by the two firms as per the quota agreement. Thus cache sells Oq output at the same price qB (= OP) and earns RP per unit profit. The total profit earned by each firm is RP x Oq and by both is RP x 20q or RP x OQ.

In practice, there are more than two firms in an oligopolistic industry which do not share the market equally. Moreover, their cost curves are also not identical. In case their cost curves differ, their market shares will also differ. Each firm will charge an independent price in accordance with its own MC and MR curves.

They may not sell the same quantity at the agreed common price. They may be charging a price slightly above or below the profit maximisation price depending upon its cost conditions. But cache will try to be nearest the profit maximisation price. This will lead to the breaking up of the market sharing agreement.

With Threat of Entry:

Suppose there is a constant threat of entry into the oligopolistic industry. In that case if the firms agree on the price OP, new firms will enter the industry, reduce their sales and profits. This may ultimately lead to excess capacity and uneconomic firms in the industry. The existence of excess capacity and uneconomic firms will raise the average costs and the firms will be earning only normal profits.

If the existing oligopolists are wiser, they may forestall entry by charging a price lower than the profit maximisation price OP. In this way the collusive oligopolists by charging a lower price will be earning larger profits in the long-run, and continue their exclusive control over the market by keeping the new entrants out for ever.

Therefore, we can conclude that under perfect collusive oligopoly pricing has not any set pattern of price behaviour. The resultant price and output will depend upon the reaction of the collusive oligopolists towards the profit maximisation price and their attitude towards the existing and potential rivals.

Imperfect Collusion in Oligopoly:

The eases of perfect collusion (centralized cartel and Market- Sharing cartel) do not exist in the real world. The case of a perfect collusion stands as a polar extreme where the maximisation of joint profits is emphasized. But mutual distrust among member firms and their unwillingness to give up all of their sovereignty make it most unlikely that eases of perfect collusion could long endure.

In fact, collusion is always imperfect. The eases of imperfect collusion also try to raise prices and profits, but they never assume the position of monopoly. We may find a number of cases of imperfect collusion, but in the present section, we shall discuss the important ease of price leadership.