Non-collusive models of oligopoly explain the price and output determination in an oligopolistic market.

Suppose Chamberlin’s model of oligopoly consisting of an “small group” of firms and Sweezy’s Kinked demand curve models are regarded as most important models of this category.

Equilibrium under Independent Action:

In 1939, Prof. Sweezy presented the kinked demand curve analysis to explain price rigidities in oligopolistic markets. Sweezy found that if the oligopolistic firm lowers its price, its rivals will lower the price in order to avoid losing their customers. Thus the firm lowering the price will not be able to increase its demand much. This portion of its demand curve is relatively inelastic.

On the other hand, if the oligopolistic firm increases its price, its rivals will not follow it and change their prices. Thus the quantity demanded of this firm will fall considerably. This portion of the demand curve is relatively elastic. In these two situations, the demand curve of the oligopolistic firm has a Kink at the prevailing market price which explains price rigidity.

Assumptions:

ADVERTISEMENTS:

The kinked demand curve hypothesis of price rigidity is based on the following assumptions:

1. There are few firms in the oligopolistic market.

2. The product produced by one firm is a close substitute for the other firms.

3. The product is of the same quality. There is no product differentiation.

ADVERTISEMENTS:

4. No advertising expenditures.

5. There is an established or prevailing market price for the product at which all the sellers are satisfied.

6. Each seller’s attitude depends on the attitude of his rivals.

7. Any attempt on the part of a seller to push up his sales by reducing the price of his product will be counteracted by other sellers who will follow his move.

ADVERTISEMENTS:

8. If he raises the price others will not follow him, rather they will stick to the prevailing price and cater to the customers, leaving the price-raising seller behind.

9. The marginal cost curve passes through the dotted portion of the marginal revenue curve so that changes in marginal cost do not affect output and price.

Explanation:

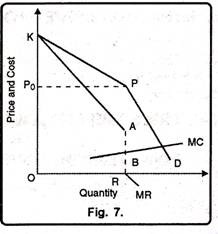

Following these assumptions, the price-output relationship in the oligopolist market is given in Figure 7. In this figure, KPD is the kinked demand curve and OP0 the prevailing price in the oligopoly market for the OR product of one seller. Starting from point P, corresponding to the current price OP (OP0) any increase in price above it will considerably reduce his sales, for his rivals are not expected to follow his price increase.

This is because the KP portion of the kinked demand curve is elastic, and the corresponding portion KA of the MR curve is positive. Therefore, any price-increase will not only reduce his total sales but also his total revenue and profit.

On the contrary, if the seller reduces the price of the product below OP0 (or P), his rivals will also reduce their prices. Though he will increase his sales, his profit would be less than before. The reason is that the PD portion of the kinked demand curve below P is less elastic and the corresponding part of marginal revenue curve below R is negative. Thus in both the price- raising and price-reducing situations the seller will be a loser.

He would stick to the prevailing market price OP0 which remains rigid. In order to understand the working of the kinked demand curve, let us analyze the effect of changes in cost and demand conditions on price stability in the oligopolistic market.

Changes in Costs:

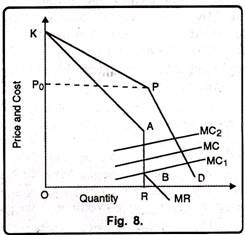

In oligopoly under the kinked demand curve analysis changes in costs within a certain range do not affect the prevailing price. Let us suppose the cost of production falls so that the new MC curve is MC1 to the right, as in Figure 8.

It cuts the MR curve in the gap AB so that the profit- maximizing output is OR which can be sold at OP0 price.

It should be noted that with any cost reduction the new MC curve will always cut the MR curve in the gap because as costs fall, the gap AB continues to widen due to two reasons:

(1) As costs fall, the upper portion KP of the demand curve becomes more elastic because of the greater certainty that a price rise by one seller will not be followed by rivals and his sales would be considerably reduced.

(2) With the reduction in costs the lower portion PD of the kinked curve becomes more inelastic, because of the greater certainty that a price reduction by one seller will be followed by the other rivals.

ADVERTISEMENTS:

Thus the angle KPD tends to be a right angle at P and the gap AB widens so that any MC curve below point A will cut the marginal revenue curve inside the gap. As a result there is the same output OR at the same price OP0 and large profits for the oligopolistic sellers.

In case the cost of production rises the marginal cost curve will shift to the left of the old curve MC as MC2. So long as the higher MC curve intersects the MR curve within the gap up to point A, the price situation will be rigid.

However, with the rise in costs the price is not likely to remain stable indefinitely and if the MC curve rises above point A, it will intersect the MC curve in the portion KA so that a lesser quantity is sold at a higher price.

Thus there may be price stability under oligopoly even when costs change so long as the MC curve cuts the MR curve in its discontinuous portion. Therefore, chances of the existence of price-rigidity are greater where there is a reduction in costs than there is a rise in costs.

ADVERTISEMENTS:

Changes in Demand:

We now explain price rigidity where there is a change in demand with the help of Figure 9. D2 is the original demand curve. MR2 is its corresponding marginal revenue curve and MC is the marginal cost curve. Suppose there is a decrease in demand shown by D1 curve and MR1 is its marginal revenue curve. When demand decreases, a price-reduction move by one seller will be followed by other rivals.

This will make LD1, the lower portion of the new demand curve, more inelastic than the lower portion HD2 of the old demand curve. This will tend to make the angle at L approach a right angle.

As a result, the gap EF in MR1 curve is likely to be wider than the gap AB of the MR2 curve. The marginal cost curve MC will, therefore, intersect the lower marginal revenue curve MR1 inside the gap EF, thus showing a stable price for the oligopolistic industry.

Since the level of the kinks H and L of the two demand curves remains the same, the same price OP is maintained after the decrease in demand. But the output level falls from OQ2 to OQ1. This case can be reversed to show increase in demand by taking D1 and MR1 as the original demand and marginal revenue curves and D2 and MR2 as the higher demand and marginal revenue curves respectively.

ADVERTISEMENTS:

The price OP is maintained but the output rises from OQ1 to OQ2. So long as the MC curve continues to intersect the MR curve in the discontinuous portion, there will be price rigidity.

However, if demand increases, it may lead to a higher price. When demand increases, a seller would like to raise the price of the product and others are expected to follow him.

This will tend to make the upper portion MH of the new demand curve elastic than the NL portion of the old curve. Thus the angle at H becomes obtuse, away from the right angle.

The gap AB in the MR2 curve becomes smaller and the MC curve intersects the MR2 curve above the gap, indicating a higher price and lower output. If, however, the marginal cost curve passes through the gap of MR2, there is price stability.

The whole analysis of the kinked demand curve points out that price rigidity in oligopolistic markets is likely to prevail if there is a price reduction move on the part of all sellers. Changes in costs and demand also lead to price stability under normal conditions so long as the MC curve intersects the MR curve in its discontinuous portion. But price increase rather than price rigidity may be found in response to rising cost or increased demand.

Reasons for Price Stability:

There are a number of reasons for price rigidity in certain oligopoly markets:

ADVERTISEMENTS:

(i) Individual sellers in an oligopolistic industry might have learnt through experience the futility of price wars and thus prefer price stability.

(ii) They may be content with the current prices, outputs and profits and avoid any involvement in unnecessary insecurity and uncertainty,

(iii) They may also prefer to stick to the present price level to prevent new firms from entering the industry.

(iv) The sellers may intensify their sales promoting efforts at the current price instead of reducing it. They may view non-price competition better than price rivalry,

(v) After spending a lot of money on advertising his product, a seller may not like to raise its price to deprive himself of the fruits of his hard labour. Naturally, he would stick to the on-going price of the product.

(vi) If a stable price has been set through agreement or collusion, no seller would like to disturb it, for fear of unleashing a price war and thus engulfing himself into an era of uncertainty and insecurity.

ADVERTISEMENTS:

(vii) Lastly, it is the kinked demand curve analysis which is responsible for price rigidity in oligopolistic markets.

Criticism:

Kinked demand curve given by Prof. Sweezy has been criticised on the following grounds:

1. Not Proper Explanation of Price Determination:

The Kinked Demand Curve is criticised on the ground that it does not explain how the prevailing price is determined. It

merely helps to explain why oligopolistis will not change the prevailing price if it yields them reasonable profit.

According to Prof. Baumol, “the kinked demand curve theory is not designed to deal with oligopolistic price and output determination. Rather, it seeks to explain why, once a price quantity combination has been decided upon, it will not readily change.” Therefore, the kinked demand curve only explains price rigidity but not price itself.

2. Wrong Assumptions:

ADVERTISEMENTS:

The theory of kinked demand curve is based on the assumption that other firms will follow price decrease but not price increase. The said assumption of Kinked Demand Theory could not be proved empirically. Oligopoly prices are not as rigid particularly in an upward direction as the kinked demand theory implies. According to Prof. Stigler, “There is little historical basis for a firm to believe that price increases will not be matched by rivals and that price decreases will be matched.”

3. It Ignores Non-Price Competition:

The price rigidity theory given by Prof. Sweezy does not take into consideration non-price competition. The oligopolist may charge the prevailing price but at the same time allow several concessions to the customers. It makes the real price flexible even if money price remains rigid. Moreover, Swcezy model ignores, credit facilities, concessions and other promotional facilities given to the customers.

4. It Fails to Consider Competitive Reaction:

The Kinked Demand Curve of Prof. Sweezy fails to consider competitive reaction patterns. Prof. Baumol found that the Kinky demand curve does not show how the oligopolistic firm’s view of competitive reaction patterns can affect the change ability of whatever prices it charges from the consumer.