Let us learn about Non-Price Competition under Oligopoly.

One of the main features of the oligopolistic markets is interdependence among few sellers. Further, oligopoly market is also characterized by the absence of price competition. Absence of price competition stems from product differentiation.

In the case of a differentiated oligopoly, one finds non-price competition. W.J. Baumol, in his sales maximization theory, argues that in the real world non-price competition is the typical form of competition in oligopoly market.

Sellers often compete with each other by constantly changing their product style so that more consumers are attracted.

ADVERTISEMENTS:

The important forms of non-price competition are:

(i) Variation in design, style, service, quality of the product

(ii) Advertising.

Baumol treats explicitly the advertising form of non-price competition.

ADVERTISEMENTS:

Thus, oligopoly firms are interested not in price wars but in non-price competition to boost sales. Non-price competition under oligopoly can be explained in terms of sales revenue maximization subject to a minimum profit constraint. The effect of price cut on total revenue, according to Baumol, is uncertain. This is because of the fact that a cut in price, in all probabilities, will increase total revenue.

But a rise in price will definitely reduce total revenue or sales. For obvious reasons, thus, the effect on profit consequent upon a price reduction is more uncertain. In contrast to this price competition, the effect of advertising—a means of non-price competition—on sales is not uncertain.

Baumol argues that “the effect of advertising, improved services, etc., on sales is fairly sure while, very often, their profitability may be quite doubtful. Thus, sales maximization makes for greater presumption that the businessman will consider non-price competition a more advantageous alternative.”

Baumol’s sales maximization model, as contrasted to profit-maximization model, is a managerial theory of an oligopolistic firm. It is argued that firm managers are interested more in maximizing sales rather than profit.

ADVERTISEMENTS:

In particular, Baumol is concerned with maximization of sales value, rather volume, subject to a profit constraint. Baumol argues that some profit is necessary for survival. Managers can be seen to be operating with a profit constraint which would be just enough to keep the shareholders happy.

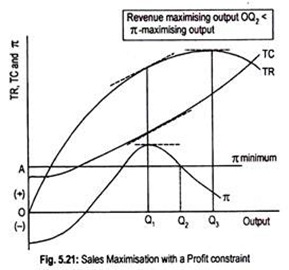

Baumol’s model suggests that, under sales revenue maximization subject to a minimum profit constraint, output will be larger than under profit maximization. In Fig. 5.21 at OQ3 output level, TR curve reaches the peak (i.e., MR = 0 and e = 1). However, profit is maximized at that volume of output when the difference between TR and TC is the greatest or the slopes of TR and TC are equal (i.e., MR = MC).

At OQ1 output, profit is maximum. On the other hand, if the basic goal of the firm is revenue maximization, equilibrium would occur at Q3 output, since, at this output level, total revenue is the largest. Note that sales revenue maximization objective provides a higher output and a lower price than under profit maximization.

The effect of the minimum profit constraint has also been shown in Fig. 5.21. Assume that the minimum acceptable profit is 7t, irrespective of the volume of output.

Fig. 5.21 suggests that OQ3 is the sales revenue maximizing output without a profit constraint. But if the minimum profit constraint is OA then the firm will have to reduce output to OQ2 in order to meet the constraint.

Any output greater than OQ2 subject to minimum profit constraint, will give a profit less than OA. (Note that, at OQ3 output profit curve, π, is below the profit constraint). Any output smaller than OQ2 yields as much revenue as output OQ2. Anyway, OQ2 output is larger than profit- maximizing output OQ1.

Unfortunately, its empirical validity is yet to be established. Empirical studies that have been made so far have failed to provide a conclusive verdict. In view of this, Baumol’s model, although possibly applicable to some corporate behaviour at least in the short run, cannot be thought of as an alternative to the profit maximization model.