The following points highlight the three Economic Policies under Fixed Exchange Rate. The Economic Policies are: 1. Fiscal Policy 2. Monetary Policy 3. Trade Policy.

Economic Policy # 1. Fiscal Policy:

It is interesting to note that, in the Mundell-Fleming model, an expansionary fiscal policy leads to an increase in the domestic money supply. Thus, we find a fiscal-monetary link.

In Fig. 12.8, we see that an expansionary fiscal policy (in the form of an increase in G or a cut in T) shifts the ISN curve to the right. As a result, the exchange rate goes up.

This induces the arbitrageurs to sell foreign currency to the Bank of England. The bank accepts the foreign currency by selling pounds. As a result, domestic money supply goes up, the LM curve shifts to the right and Y increases.

Economic Policy # 2. Monetary Policy:

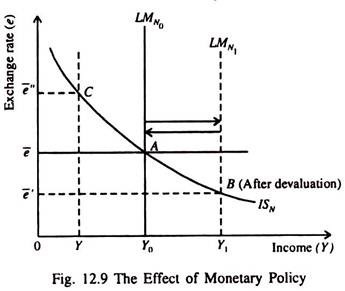

Monetary policy loses its effectiveness under the fixed exchange rate system. The reason is easy to find out. Suppose, under the system, the central bank increases the money supply through open market sale of securities. As a result, the LMN curve shifts to the right and the exchange rate falls.

Now, arbitrageurs start selling the domestic currency to the central bank. This will cause the money supply to fall and the LMN curve to shift back to the original position. Thus, by being committed to maintain the exchange rate at an announced level, the central bank loses its control over the money supply.

A country can, however, adopt a different type of monetary policy under the fixed exchange rate system. In the Mundell-Fleming model, a country can devalue its currency and thus change the level at which the exchange rate is fixed. Note that devaluation refers to an official reduction in the external value of a country’s currency under the fixed exchange rate system.

This amounts to shifting rightward the LMN curve and this is comparable to an increase in the money supply under a floating exchange rate. A devaluation thus expands net exports and income Y, as shown in Fig. 12.9 (a) by the movement from A to B. A revaluation (an increase in the exchange rate) has exactly opposite effects. It reduces Y by reducing NX.

Economic Policy # 3. Trade Policy:

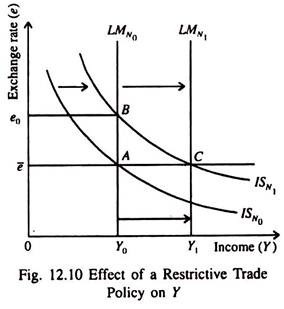

An import tariff or an import quota increases net exports and shifts the IS curve to the right from ISN0 to ISN1 in Fig. 12.10. This will cause the equilibrium exchange rate to move up from e̅ to e0. Now, in order to maintain the exchange rate at the original level (e̅), the central bank has to increase money supply.

So the LM curve now shifts to the right from LMN0 to LMN1 and the exchange rate is back to the original level. However, due to increase in NX, Y increases from Y0 to Y1.

Thus, while under a floating exchange rate system, a trade restriction leads to an appreciation of the exchange rate, under a fixed exchange rate system it leads to an increase in money supply when NX increases. The increase in money supply raises Y. To put it from the other side, when Y increases, S also increase. And we know that NX = S — I.

ADVERTISEMENTS:

So, when S increases — I remaining fixed even at higher level of Y — S — I increases. This amounts to an increase in NX.