This article will guide you about how price discrimination takes place under dumping.

Price discrimination is said to occur when goods are sold at a higher price in the home market but at a lower price in the foreign market. This sort of the international price discrimination is often referred to as ‘dumping’.

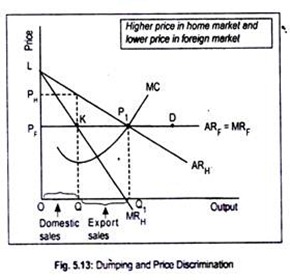

We are considering a situation in which a producer exercises monopoly power in the domestic market (Fig. 5.13). Because of this monopoly position, AR curve lies above the MR curve. These curves have been labeled ARH and MRH.

Again, this producer faces keen competition in the foreign market. As a result, average revenue coincides with marginal revenue. These curves have been labelled ARF = MRF. Equilibrium of the firm is established at that point where MC equals MR.

MR curves in these two separate markets have different slopes—downward sloping for the home market and horizontal for the foreign market. Combined MR is the sum of MRs of these two markets.

It is given by LKP1D curve. Since equilibrium occurs at P1 (where MC = MRF), total output produced is OQ1. This output has to be distributed in both the domestic market and foreign market in such a way that MR of these two markets must be equal, and equal to MC.

Since the firm enjoys monopoly power in the domestic market, it will supply OQ output and sell it at a price OPH. This is because at this output level MR (i.e., QK) equals MC (i.e., Q1P1). On the other hand, QQ1 output will be sold at the price Q1P1 (= OPF) in the foreign market where the monopoly firm faces competition.

Note that goods are sold in the foreign market at a price below that charged in the home market (OPF < OPH). This practice is called dumping which is regarded as an unfair practice and countries often take action against this sort of price discrimination.