Let us make an in-depth study of Price System of an Economy. After reading this article you will learn about: 1. Meaning of Price System 2. Working of the Price Mechanism 3. Conditions Required 4. Price Mechanism and What, How, and For Whom.

Meaning of Price System:

Market is the essential ingredient of a capitalist economy required for its efficient functioning. That is why a capitalist economy is also called a market economy. Further, since the government does not intervene, such economy is called a free enterprise economy or a laissez-faire economy.

In this market economy, all the decision-takers are free to make their own choices; no one will interfere. In this pursuit of self-interest and general good of all, every economic agent or unit (i.e., households and firms) is guided by a hidden hand or ‘invisible hand’. The ‘invisible hand’ mechanism, as was called by Adam Smith, operates due to the free play of competition.

The price system is one in which all economic decisions are taken through the medium of prices which are, by nature, self- adjusting and self-correcting—though every decision-taker acts selfishly. As there is no central regulating authority, decisions are taken by invisible hand or price system.

ADVERTISEMENTS:

Though millions of people (both households and firms) act selfishly, they are led as if by an ‘invisible hand’ to achieve the best results of the economy. The decisions of WHAT, HOW, and FOR WHOM TO PRODUCE are determined by the demand and supply conditions of commodities and input services.

Thus the price mechanism serves as a connecting or communicating mechanism between two economic agents—households and firms of a capitalist society.

Prices that are determined by the interaction of households and firms in goods market and in factor market are called freely market-determined prices as governmental control is conspicuously absent in a market economy. Changes in prices are caused by changes in demand and supply conditions.

Working of the Price Mechanism:

An economy consisting of households and firms is connected by markets (i.e., both goods market and factor market) in which they exchange goods and input services. For this exchange relationship, both the parties charge a price that reflects the desires of the households and the capacities of producers.

ADVERTISEMENTS:

Thus, prices act as communicating or interacting devices. Price system can now be the result of the behaviour of firms and the behaviour of markets (i.e., goods market and input market). We know that there are millions of people who make independent decisions relating to consumption and production and through the medium of price system.

Firms in a market economy operate in product markets to sell its produces and in factor market to buy or hire input services. “The price system embraces both types of market and broadly operates so as to ensure that resources are allocated in accordance with consumer demand.”

Prices serve messages on demand and production. Suppose, because of flood, the state of West Bengal experiences a fall in the output of onion. This will induce people to reduce their consumption of onion since supplies are inadequate. People may learn from the media that this year fewer onion would be available in the market.

If the information supplied by the media does not reach all onion-buyers of the country, how will they know it? Answer is—the price system.

ADVERTISEMENTS:

Onion-buyers will find a rise in the price of onion in the markets. Thus price, rather than the media, gives effective message to buyers and producers. Buyers are supposed to buy less of it since it is now more scarce. Higher price of onion is an incentive to grow more onions to the farmers in the next year.

A similar question may be raised and answered in the same way.

Why do computer specialists earn more than the physicists? Why is the rate of interest charged by the village moneylenders higher than the rate of interest charged by commercial banks? The simple answer to all these questions relating to the factor market is that price is determined by demand and supply forces. A change in price is also caused by changes in demand and or changes in supply.

Again, price does not only act as a signaling device, but also provides incentives to firms and households to change their production and consumption plans. In this sense, price acts as an incentive-provider. If more of a commodity is demanded (may be due to a rise in income of the consumers, or a fall in output due to recession, or flood, or drought) relative to its supply, its price will rise.

This will cause profits of producers to rise. Profit new acts as an incentive to other firms to join and produce the commodity that gives larger profits.

In addition, firms will divert resources from the production of low- priced commodity to the production of high- priced profit-yielding commodity. As now production and, hence, supply, of the commodity rises its price falls, profit declines and it will continue to fall until demand- supply equality is restored.

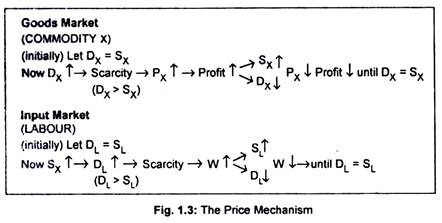

Similar sequence may be obtained if supply falls short of demand for a commodity. In this way, the price system brings together both the goods market and factor market. As these markets are interlinked, each propels the other. This working of the price mechanism has been shown in (Fig. 1.3).

For the sake of simplicity, we consider here only good ‘X’ and one input, ‘labour’. It can be applied to any number of goods and inputs. Here DX represents demand for good X, SX refers to supply of goods X, DL demand for labour, SL supply of labour, W wage or the price of labour.

ADVERTISEMENTS:

Fig 1.3 shows how the price system results in a reallocation of resources in response to signals given by consumers about their changes in the demand for commodity. This, in turn, affects the prices of inputs in the input markets.

Changes in the prices of inputs bring about changes in the prices of product as well as in the demand pattern of consumers through the price system.

“In this way the price system acts, as it were, like a marvellous computer, registering people’s preferences for different goods, transmitting these preferences to firms, moving resources to produce the goods, and deciding who shall obtain the final products.” (Jack Harvey: Modern Economics).

Conditions Required for Price Mechanism to Play its Role:

Price mechanism provides the link between households and firms or provides the focus for interactions between buyers and sellers.

ADVERTISEMENTS:

We have seen that prices provide:

(i) Information, and

(ii) Incentives. However, its efficient functioning is subject to many conditions.

In other words, the price system can allocate resources in an automatic way if the following conditions are fulfilled:

(a) Perfect Competition in Both Product and Factor Markets:

ADVERTISEMENTS:

With perfect competition in product and factor markets, the price system may operate successfully along the lines sketched above. Perfect competition refers to a market situation where there are innumerable numbers of sellers and no single buyer or seller can influence the price of a commodity or input services.

Every buyer and seller behaves as a price-taker. Thus, in perfect markets, price differences are quickly eliminated and the market participants choose on the basis of price.

(b) Perfect Knowledge:

Buyers and sellers have perfect knowledge and information upon which decisions are taken by them. This means that both buyers and sellers know well in advance the prices being charged in the product market and factor market. Based on this knowledge and information, every participant in the markets, i.e., both consumers and firms, make plan accurately.

For instance, if some firms in an industry earn excess profit, not only the existing firms but also the would-be producers know what profits are being earned by the existing firms. Just knowing it is not enough. Having gathered this knowledge, producers can take future plans and programmers.

Whenever these two conditions—perfect markets and perfect knowledge—are met then a single price for both commodities and resources will prevail in the market.

(c) Free Entry:

Successful functioning of price mechanism requires that there must be freedom of entry of new firms into the industry. Whenever some firms get abnormal profit, new firms have the full freedom to enter this business. If it is not allowed, the existing firms may influence the price to suit their own requirements.

ADVERTISEMENTS:

As new firms enter the industry, abnormal profit is eliminated. On the other hand, if the demand for a product declines, some firm might experience loss. The loss will induce marginal firms to leave the industry. Thus, the freedom of entry and exit allows profit motive to function. It is to be kept in mind that such entry and exit can be effective only if there is perfect knowledge.

Let us put this free entry and exit condition in the following way. In an imperfect, market (say, monopoly, monopolistic competition or oligopoly) there are restrictions to enter or leave product markets and factor markets in response to profit opportunities.

Suppose, the market for good X is characterized by monopoly—a market dominated by one seller. A monopolist need not raise output for good X in the midst of a rising demand for it. Rather, he will thus enjoy some abnormal profits. No one is allowed to enter this business.

The monopolist is not required to demand more factor inputs to meet increased consumer demand. All these suggest that the price system cannot work if there are barriers to entry and exit; there may arise a situation of high prices and excess profit thereby leading to the exploitation of buyers of a commodity and suppliers of input services.

(d) Perfect Mobility of Inputs:

Inputs must be perfectly mobile and uniformly available to all firms. If there is a change in the demand for a product and if firms decide to meet the consumers’ demand, they must transfer input resources from this line of production to another line.

If resources are not channelized from the unprofitable lines of production to the profitable ones, it will surely bring losses to the firms. Thus, free entry and perfect mobility of inputs bring markets into equilibrium so that excess profit and losses get eliminated. Not only inputs should be mobile but they should also be available to all firms so that shortages of input services do not stop production.

ADVERTISEMENTS:

Thus, in the absence of individual or government control, price mechanism under perfect competition operates automatically. But we must recognize that this price system is an idealized simplification similar to the concepts of vacua and frictionless motors in physics.

Price Mechanism and What, How, and For Whom:

Now it is time to solve the fundamental economic problems arising out of the scarcity of resources of an economy. Here the solutions to the basic problems will be presented in terms of a free market economy where the price system seems to be the best guide.

The price system is a system when crucial economic decisions of WHAT, HOW, and FOR WHOM to produce are not consciously taken by individual consumers and firms but through the medium of prices.

The decision of WHAT to produce is determined by preferences of the consumers. Information about consumers’ tastes and preferences is signalled to the producers. The price of a commodity provides such information displayed by money ‘votes’. This means that consumers cast their ‘votes’ for commodities by spending their money. Commodities having greater preference must have higher prices.

If consumers prefer to purchase more synthetic cloth instead of cotton cloth, the price of the former will rise. Retail cloth merchants will now place more ‘order’ of synthetic cloth to the wholesalers who will ultimately put their ‘orders’ on the cloth manufactures.

ADVERTISEMENTS:

This sequence of events propelled by the price rise of synthetic cloth will provide a signal to the producers that it is profitable for them to produce more synthetic cloth.

Consequently, producers will shift their resources from cotton cloth production to the synthetic cloth production and will demand more resources required for the synthetic cloth production. Prices of input resources will rise because of the increase in demand for it among producers.

Or to encourage the suppliers of input services, firms will pay higher prices for inputs so that consumers’ demand can be met. Thus, prices act as signal from the consumers to the input suppliers that more synthetic cloth need to be produced. If firms do not respond to consumers’ preferences they will have to suffer losses. Remember that prices are signals that reflect tastes and preferences of the consumer.

The answer to the question HOW goods are produced depends also on the price system. Producers will select a technique of production that yields minimum cost. Obviously, the choice of a technique of production depends on the volume of goods to be produced and on the price of inputs.

An efficient technique of production is that in which costs are the lowest. Costs of production are mainly governed by the prices of input resources which are determined by demand and supply conditions. A shortage of an input causes its price to rise. As capital is scarce its price is high, and, as labour is abundant its price is low.

Thus, producers have an incentive to use low-priced input services. Or firms have the tendency to use more labour and less capital. A different combination of labour-capital will now emerge. It is, thus, the demand for and supply of input resources which determine their prices and, hence, influence the input combinations. It is the price mechanism that helps a society to conserve scarce resources.

ADVERTISEMENTS:

The final question FOR WHOM to produce also depends on prices (or incomes) which are determined by demand for and supply of factors of production. Greater the income, higher is the propensity to consume. We know that households are the input owners.

Those inputs are supplied to the firms to earn incomes.

Obviously, incomes of input owners depend on:

(i) The volume of ownership of factor services, and

(ii) The prices of factors. Assuming the distribution of the ownership of factor services as given, incomes depend on the prices of input services which are determined by demand and supply conditions.

Since the supply of computer engineers is low compared to their demand, computer engineers earn more income than other people. Doctors generally earn more ‘prices’ or incomes as their supplies are less compared with their demands. On the other hand, an unskilled worker earns lower wages since their supplies are high relative to demand.

Factor incomes, in turn, affect consumption demand. People with higher incomes can buy high-priced commodity while people with lower-incomes can afford to buy cheaper varieties of commodities. Thus, factor incomes govern the distribution of commodities among the members of the society.

The interaction between buyers and sellers in the output market and input market determines basic decisions of WHAT, HOW and FOR WHOM. The price system embraces both types of market and functions in such a way that resources arc allocated in accordance with the demands made by consumers.

Thus, it is clear from the foregoing discussion that the price system is an economic system in which prices play a key role in allocating input resources, outputs and incomes. It is the price system that guides the economy’s decision of WHAT, HOW, and FOR WHOM to produce in the absence of any central authority. The interaction of demand and supply forces determines the market price of commodities of all kinds and resources.

Fundamental decisions relating to what, how, and for whom are determined in a market economy by the interaction of buyers and sellers in the product market and in the input market.

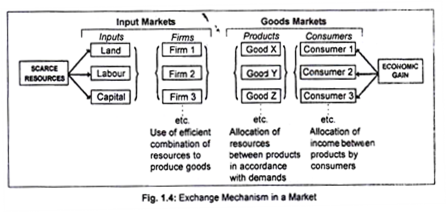

This is shown in Fig. 1.4 where firms act as producing units and operate in the goods market as the sellers of the good, and in the input markets as the buyers of resources. Likewise, consumers act as consuming units and operate in the goods market as the buyers of goods, and in the input markets as the sellers of inputs.

Thus, the price mechanism serves as a connecting or communicating mechanism between private consumers and producers. Such price system has been described by Adam Smith as ‘the invisible hand’ because it coordinates decentralized decision-taking of millions of consumers and producers.

It is because of the crucial function of prices in determining ‘What goods and services are to be produced and in what quantities’, ‘How these goods are to be produced’, and ‘How income is distributed among input suppliers’ that microeconomics is often referred to as ‘price theory’.