In this report we will discuss about:- 1. Meaning of Inflation 2. Types of Inflation 3. Causes 4. Measures to Control 5. Effects.

Project Report # Meaning of Inflation:

To the neo-classicals and their followers at the University of Chicago, inflation is fundamentally a monetary phenomenon. In the words of Friedman, “Inflation is always and everywhere a monetary phenomenon…and can be produced only by a more rapid increase in the quantity of money than out- put,” But economists do not agree that money supply alone is the cause of inflation.

As pointed out by Hicks, “Our present troubles are not of a monetary character.” Economists, therefore, define inflation in terms of a continuous rise in prices. Johnson defines “inflation as a sustained rise” in prices. Brooman defines it as “a continuing increase in the general price level.”

Shapiro also defines inflation in a similar vein “as a persistent and appreciable rise in the general level of prices.” Dernberg and McDougall are more explicit when they write that “the term usually refers to a continuing rise in prices as measured by an index such as the consumer price index (CPI) or by the implicit price deflator for gross national product.”

ADVERTISEMENTS:

However, it is essential to understand that a sustained rise in prices may be of various magnitudes. Accordingly, different names have been given to inflation depending upon the rate of rise in prices.

1. Creeping Inflation:

When the rise in prices is very slow like that of a snail or creeper, it is called creeping inflation. In terms of speed, a sustained rise in prices of annual increase of less than 3 per cent per annum is characterised as creeping inflation. Such an increase in prices is regarded safe and essential for economic growth.

2. Walking or Trotting Inflation:

When prices rise moderately and the annual inflation rate is a single digit. In other words, the rate of rise in prices is in the intermediate range of 3 to 6 per cent per annum or less than 10 per cent. Inflation at this rate is a warning signal for the government to control it before it turns into running inflation.

3. Running Inflation:

When prices rise rapidly like the running of a horse at a rate or speed of 10 to 20 per cent per annum, it is called running inflation. Such an inflation affects the poor and middle classes adversely. Its control requires strong monetary and fiscal measures, otherwise it leads to hyperinflation.

4. Hyperinflation:

ADVERTISEMENTS:

When prices rise very fast at double or triple digit rates from more than 20 to 100 per cent per annum or more, it is usually called runaway or galloping inflation. It is also characterised as hyperinflation by certain economists.

In reality, hyperinflation is a situation when the rate of inflation becomes immeasurable and absolutely uncontrollable. Prices rise many times every day. Such a situation brings a total collapse of monetary system because of the continuous fall in the purchasing power of money.

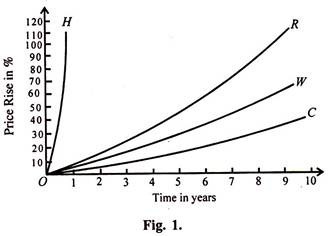

The speed with which prices tend to rise is illustrated in Figure 1. The curve C shows creeping inflation when within a period of ten years the price level has been shown to have risen by about 30 per cent.

The curve W depicts walking inflation when the price level rises by more than 50 per cent during ten years. The curve R illustrates running inflation showing a rise of about 100 per cent in ten years. The steep curve H shows the path of hyperinflation when prices rise by more than 120 per cent in less than one year.

5. Semi-Inflation:

According to Keynes, so long as there are unemployed resources, the general price level will not rise as output increases. But a large increase in aggregate expenditure will face shortages of supplies of some factors which may not be substitutable. This may lead to increase in costs, and prices start rising. This is known as semi-inflation or bottleneck inflation because of the bottlenecks in supplies of some factors.

6. True Inflation:

According to Keynes, when the economy reaches the level of full employment, any increase in aggregate expenditure will raise the price level in the same proportion. This is because it is not possible to increase the supply of factors of production and hence of output after the level of full employment. This is called true inflation.

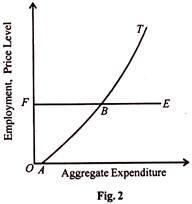

The Keynesian semi-inflation and true inflation situations are illustrated in Figure.2.

Employment and price level are taken on vertical axis and aggregate expenditure on horizontal axis. FE is the full employment curve. When with the increase in aggregate expenditure, the price level rises slowly from A to the full employment level B, this is semi-inflation. But when the aggregate expenditure increases beyond point B the price level rises from B to T in proportion to the increase in aggregate expenditure. This is true inflation.

7. Open Inflation:

Inflation is open when “markets for goods or factors of production are allowed to function freely, setting prices of goods and factors without normal interference by the authorities.” Thus open inflation is the result of the uninterrupted operation of the market mechanism.

There are no checks or controls on the distribution of commodities by the government. Increase in demand and shortage of supplies persist which tend to lead to open inflation. Unchecked open inflation ultimately leads to hyperinflation.

8. Suppressed Inflation:

When the government imposes physical and monetary controls to check open inflation, it is known as repressed or suppressed inflation. The market mechanism is not allowed to function normally by the use of licensing, price controls and rationing in order to suppress extensive rise in prices.

So long as such controls exist, the present demand is postponed and there is diversion of demand from controlled to uncontrolled commodities. But as soon as these controls are removed, there is open inflation.

ADVERTISEMENTS:

Moreover, suppressed inflation adversely affects the economy. When the distribution of commodities is controlled, the prices of uncontrolled commodities rise very high. Suppressed inflation reduces the incentive to work because people do not get the commodities which they want to have.

Controlled distribution of goods also leads to mal-allocation of resources. This results in the diversion of productive resources from essential to non-essential industries. Lastly, suppressed inflation leads to black marketing, corruption, hoarding and profiteering.

9. Stagflation:

Stagflation is a new term which has been added to economic literature in the 1970s. It is a paradoxical phenomenon where the economy experiences stagnation as well as inflation. The word stagflation is the combination of ‘stag’ plus ‘flation’ taking ‘stag’ from stagnation and ‘flation’ from inflation.

Stagflation is a situation when recession is accompanied by a high rate of inflation. It is, therefore, also called inflationary recession. The principal cause of this phenomenon has been excessive demand in commodity markets, thereby causing prices to rise, and at the same time the demand for labour is deficient, thereby creating unemployment in the economy.

ADVERTISEMENTS:

Three factors have been responsible for the existence of stagflation in the advanced countries since 1972. First, rise in oil prices and other commodity prices along with adverse changes in the terms of trade; second, the steady and substantial growth of the labour force; and third, rigidities in the wage structure due to strong trade unions.

10. Mark-up Inflation. The concept of mark-up inflation is closely related to the price-push problem. Modern labour organisations possess substantial monopoly power. They, therefore, set prices and wages on the basis of mark-up over costs and relative incomes.

Firms possessing monopoly power have control over the prices charged by them. So they have administered prices which increase their profit margin. This sets off an inflationary rise in prices. Similarly, when strong trade unions are successful in raising the wages of workers, this contributes to inflation.

11. Ratchet Inflation:

A ratchet is a toothed wheel provided with a catch that prevents the ratchet wheel from moving backward. The same is the case under ratchet inflation when despite down-ward pressures in the economy, prices do not fall. In an economy having price, wage and cost inflations, aggregate demand falls below full employment level due to the deficiency of demand in some sectors of the economy.

ADVERTISEMENTS:

But wage, cost and price structures are inflexible downward because large business firms and labour organisations possess monopoly power. Consequently, the fall in demand may not lower prices significantly. In such a situation, prices will have an upward ratchet effect, and this is known as “ratchet inflation.”

12. Sectoral Inflation:

Sectoral inflation arises initially out of excess demand in particular industries. But it leads to a general price rise because prices do not fall in the deficient demand sectors.

13. Reflation:

Reflation is a situation when prices are raised deliberately in order to encourage economic activity. When there is depression and prices fall abnormally low, the monetary authority adopts measures to put more money in circulation so that prices rise. This is called reflation.

Project Report # Types of Inflation:

1. Demand-Pull Inflation:

Demand-Pull or excess demand inflation is a situation often described as “too much money chasing too few goods.” According to this theory, an excess of aggregate demand over aggregate supply will generate inflationary rise in prices. Its earliest explanation is to be found in the simple quantity theory of money. The theory states that prices rise in proportion to the increase in the money supply.

Given the full employment level of output, doubling the money supply will double the price level. So inflation proceeds at the same rate at which the money supply expands. In this analysis, the aggregate supply is assumed to be fixed and there is always full employment in the economy. Naturally, when the money supply increases it creates more demand for goods but the supply of goods cannot be increased due to the full employment of resources. This leads to rise in prices.

Modern quantity theorists led by Friedman hold that “inflation is always and everywhere a monetary phenomenon.” The higher the growth rate of the nominal money supply, the higher the rate of inflation. When the money supply increases, people spend more in relation to the available supply of goods and services. This bids prices up. Modern quantity theorists neither assume full employment as a normal situation nor a stable velocity of money. Still they regard inflation as the result of excessive increase in the money supply.

ADVERTISEMENTS:

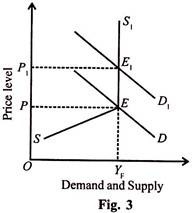

The quantity theory version of the demand-pull inflation is illustrated in Figure 3. Suppose the money supply is increased at a given price level OP as determined by the demand and supply curves D and S S1 respectively. The initial full employment situation OYF at this price level is shown by the interaction of these curves at point E.

Now with the increase in the quantity of money, the aggregate demand increases which shifts the demand curve D to D, to the right. The aggregate supply being fixed, as shown by the vertical portion of the supply curve S S1 the D1 curve intersects it at point E1. This raises the price level to OP1.

The Keynesian theory on demand-pull inflation is based on the argument that so long as there are unemployed resources in the economy, an increase in investment expenditure will lead to increase in employment, income and output. Once full employment is reached and bottlenecks appear, further increase in expenditure will lead to excess demand because output ceases to rise, thereby leading to inflation.

The Keynesian theory of demand-pull inflation is explained diagrammatically in Figure 3. Suppose the economy is in equilibrium at E where the SS1 and D curves intersect with full employment income

level OYF. The price level is OP.

Now the government increases its expenditure. The increase in government expenditure implies an increase in aggregate demand which is shown by the upward shift of the D curve to D, in the figure. This tends to raise the price level to OP1, as aggregate supply of output cannot be increased after the full employment level.

2. Cost-Push Inflation:

ADVERTISEMENTS:

Cost-push inflation is caused by wage increases enforced by unions and profit increases by employers. This type of inflation has not been a new phenomenon and was found even during the medieval period. But it was revived in the 1950s and again in the 1970s as the principal cause of inflation. It also came to be known as the “New Inflation.”

Cost-push inflation is caused by wage-push and profit-push to prices for the following reasons:

1. Rise in Wages:

The basis cause of cost-push inflation is the rise in money wages more rapidly than the productivity of labour. In advanced countries, trade unions are very powerful. They press employers to grant wage increases considerably in excess of increases in the productivity of labour, thereby raising the cost of production of commodities.

Employers, in turn, raise prices of their products. Higher wages enable workers to buy as much as before, in spite of higher prices. On the other hand, the increase in prices induces unions to demand still higher wages. In this way, the wage-cost spiral continues, thereby leading to cost-push or wage-push inflation. Cost-push inflation may be further aggravated by upward adjustment of wages to compensate for rise in the cost of living index.

2. Sectoral Rise in Prices:

ADVERTISEMENTS:

Again, a few sectors of the economy may be affected by money wage increases and prices of their products may be rising. In many cases, their production such as steel, raw materials, etc. are used as inputs for the production of commodities in other sectors.

As a result, the production cost of other sectors will rise and thereby push up the prices of their products. Thus wage- push inflation in a few sectors of the economy may soon lead to inflationary rise in prices in the entire economy.

3. Rise in Prices of Imported Raw Materials:

An increase in the prices of imported raw materials may lead to cost- push inflation. Since raw materials are used as inputs by the manufacturers of the finished goods, they enter into the cost of production of the latter. Thus a continuous rise in the prices of raw materials tends to sets off a cost-price-wage spiral.

4. Profit-Push Inflation:

Oligopolist and monopolist firms raise the prices of their products to offset the rise in labour and production costs so as to earn higher profits. There being imperfect competition in the case of such firms, they are able to “administer prices” of their products.

ADVERTISEMENTS:

“In an economy in which so called administered prices abound there is at least the possibility that these prices may be administered upward faster than cost in an attempt to earn greater profits. To the extent such a process is wide-spread profit-push inflation will result.” Profit-push inflation is, therefore, also called administered-price theory of inflation or price-push inflation or sellers’ inflation or market-power inflation.

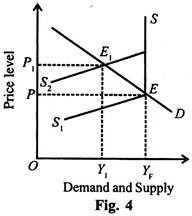

Cost-push inflation is illustrated in Figure 4. where S1S is the supply curve and D is the demand curve. Both intersect at E which is the full employment level OYF, and the price level OP is determined. Given the demand, as shown by the D curve, the supply curve S1, is shown to shift to S2 as a result of cost-push factors.

Consequently, it intersects the D curve at showing rise in the price level from OP to OP1 and fall in aggregate output from OYF to OY1 level. Any further shift in the supply curve will shift and tend to raise the price level and decrease aggregate output further.

Project Report # Causes of Inflation:

Inflation is caused when the aggregate demand exceeds the aggregate supply of goods and services. We analyse the factors which lead to increase in demand and the shortage of supply.

Factors Affecting Demand:

Both Keynesians and monetarists believe that inflation is caused by increase in the aggregate demand.

They point towards the following factors which raise it:

1. Increase in Money Supply:

Inflation is caused by an increase in the supply of money which leads to increase in aggregate demand. The higher the growth rate of the nominal money supply, the higher is the rate of inflation. Modern quantity theorists do not believe that true inflation starts after the full employment level. This view is realistic because all advanced countries are faced with high levels of unemployment and high rates of inflation.

2. Increase in Disposable Income:

When the disposable income of the people increases, it raises their demand for goods and services. Disposable income may increase with the rise in national income or reduction in taxes or reduction in the saving of the people.

3. Increase in Public Expenditure:

Government activities have been expanding much with the result that government expenditure has also been increasing at a phenomenal rate, thereby raising aggregate demand for goods and services. Governments of both developed and developing countries are providing more facilities under public utilities and social services, and also nationalising industries and starting public enterprises with the result that they help in increasing aggregate demand.

4. Increase in Consumer Spending:

The demand for goods and services increases when consumer expenditure increases. Consumers may spend more due to conspicuous consumption or demonstration effect. They may also spend more whey they are given credit facilities to buy goods on hire-purchase and instalment basis.

5. Cheap Monetary Policy:

Cheap monetary policy or the policy of credit expansion also leads to increase in the money supply which raises the demand for goods and services in the economy. When credit expands, it raises the money income of the borrowers which, in turn, raises aggregate demand relative to supply, thereby leading to inflation. This is also known as credit-induced inflation.

6. Deficit Financing:

In order to meet its mounting expenses, the government resorts to deficit financing by borrowing from the public and even by printing more notes. This raises aggregate demand in relation to aggregate supply, thereby leading to inflationary rise in prices. This is also known as deficit-induced inflation.

7. Expansion of the Private Sector:

The expansion of the private sector also tends to raise the aggregate demand. For huge investments increase employment and income, thereby creating more demand for goods and services. But it takes time for the output to enter the market.

8. Black Money:

The existence of black money in all countries due to corruption, tax evasion etc. increases the aggregate demand. People spend such unearned money extravagantly, thereby creating unnecessary demand for commodities. This tends to raise the price level further.

9. Repayment of Public Debt:

Whenever the government repays its past internal debt to the public, it leads to increase in the money supply with the public. This tends to raise the aggregate demand for goods and services.

10. Increase in Exports:

When the demand for domestically produced goods increases in foreign countries, this raises the earnings of industries producing export commodities. These, in turn, create more demand for goods and services within the economy.

Project Report # Factors Affecting Supply:

There are also certain factors which operate on the opposite side and tend to reduce the aggregate supply.

Some of the factors are as follows:

1. Shortage of Factors of Production:

One of the important causes affecting the supplies of goods is the shortage of such factors as labour, raw materials, power supply, capital, etc. They lead to excess capacity and reduction in industrial production.

2. Industrial Disputes:

In countries where trade unions are powerful, they also help in curtailing production. Trade unions resort to strikes and if they happen to be unreasonable from the employers’ viewpoint and are prolonged, they force the employers to declare lock-outs.

In both cases, industrial production falls, thereby reducing supplies of goods. If the unions succeed in raising money wages of their members to a very high level than the productivity of labour, this also tends to reduce production and supplies of goods.

3. Natural Calamities:

Drought or floods is a factor which adversely affects the supplies of agricultural products. The latter, in turn, create shortages of food products and raw materials, thereby helping inflationary pressures.

4. Artificial Scarcities:

Artificial scarcities are created by hoarders and speculators who indulge in black marketing. Thus they are instrumental in reducing supplies of goods and raising their prices.

5. Increase in Exports:

When the country produces more goods for export than for domestic consumption, this creates shortages of goods in the domestic market. This leads to inflation in the economy.

6. Lop-sided Production:

If the stress is on the production of comforts, luxuries, or basic products to the neglect of essential consumer goods in the country, this creates shortages of consumer goods. This again causes inflation.

7. Law of Diminishing Returns:

If industries in the country are using old machines and outmoded methods of production, the law of diminishing returns operates. This raises cost per unit of production, thereby raising the prices of products.

8. International Factors:

In modern times, inflation is a worldwide phenomenon. When prices rise in major industrial countries, their effects spread to almost all countries with which they have trade relations. Often the rise in the price of a basic raw material like petrol in the international market leads to rise in the price of all related commodities in a country.

Project Report # Measures to Control Inflation:

We have studied above that inflation is caused by the failure of aggregate supply to equal the increase in aggregate demand. Inflation can, therefore, be controlled by increasing the supplies and reducing money incomes in order to control aggregate demand. The various methods are usually grouped under three heads: monetary measures, fiscal measures and other measures.

1. Monetary Measures:

Monetary measures aim at reducing money incomes.

(a) Credit Control:

One of the important monetary measures is monetary policy. The central bank of the country adopts a number of methods to control the quantity and quality of credit. For this purpose, it raises the bank rates, sells securities in the open market, raises the reserved ratio, and adopts a number of selective credit control measures, such as raising margin requirements and regulating consumer credit.

Monetary policy may not be effective in controlling inflation, if inflation is due to cost-push factors. Monetary policy can only be helpful in controlling inflation due to demand-pull factors.

(b) Demonetisation of Currency:

However, one of the monetary measures is to demonetise currency of higher denominations. Such a measure is usually adopted when there is abundance of black money in the country.

(c) Issue of New Currency:

The most extreme monetary measure is the issue of new currency in place of the old currency. Under this system, one new note is exchanged for a number of notes of the old currency. The value of bank deposits is also fixed accordingly. Such a measure is adopted when there is an excessive issue of notes and there is hyperinflation in the country. It is a very effective measure. But is inequitable for it hurts the small depositors the most.

2. Fiscal Measures:

Monetary policy alone is incapable of controlling inflation. It should, therefore, be supplemented by fiscal measures. Fiscal measures are highly effective for controlling government expenditure, personal consumption expenditure, and private and public investment.

The principal fiscal measures are the following:

(a) Reduction in Unnecessary Expenditure:

The government should reduce unnecessary expenditure on non-development activities in order to curb inflation. This will also put a check on private expenditure which is dependent upon government demand for goods and services.

But it is not easy to cut government expenditure. Though economy measures are always welcome but it becomes difficult to distinguish between essential and non-essential expenditure. Therefore, this measure should be supplemented by taxation.

(b) Increase in Taxes:

To cut personal consumption expenditure, the rates of personal, corporate and commodity taxes should be raised and even new taxes should be levied, but the rates of taxes should not be so high as to discourage saving, investment and production. Rather, the tax system should provide larger incentives to those who save, invest and produce more.

Further, to bring more revenue into the tax-net, the government should penalise the tax evaders by imposing heavy fines. Such measures are bound to be effective in controlling inflation. To increase the supply of goods within the country, the government should reduce import duties and increase export duties.

(c) Increase in Savings:

Another measure is to increase savings on the part of the people. This will tend to reduce disposable income with the people, and hence personal consumption expenditure. But due to the rising cost of living, people are not in a position to save much voluntarily. Keynes, therefore, advocated compulsory savings or what he called ‘deferred payment’ where the saver gets his money back after some years.

For this purpose, the government should float public loans carrying high rates of interest, start saving schemes with prize money, or lottery for long periods, etc. It should also introduce compulsory provident fund, provident fund-cum-pension schemes, etc. compulsorily. All such measures to increase savings are likely to be effective in controlling inflation.

(d) Surplus Budgets:

An important measure is to adopt anti-inflationary budgetary policy. For this purpose, the government should give up deficit financing and instead have surplus budgets. It means collecting more in revenues and spending less.

(e) Public Debt:

At the same time, it should stop repayment of public debt and postpone it to some future date till inflationary pressures are controlled within the economy. Instead, the government should borrow more to reduce money supply with the public.

Like the monetary measures, fiscal measures alone cannot help in controlling inflation. They should be supplemented by monetary, non-monetary and non-fiscal measures.

3. Other Measures:

The other types of measures are those which aim at increasing aggregate supply and reducing aggregate demand directly.

(a) To Increase Production:

The following measures should be adopted to increase production:

(i) One of the foremost measures to control inflation is to increase the production of essential consumer goods like food, clothing, kerosene oil, sugar, vegetable oils, etc.

(ii) If there is need, raw materials for such products may be imported on preferential basis to increase the production of essential commodities.

(iii) Efforts should also be made to increase productivity. For this purpose, industrial peace should be maintained through agreements with trade unions, binding them not to resort to strikes for some time.

(iv) The policy of rationalisation of industries should be adopted as a long-term measure. Rationalisation increases productivity and production of industries through the use of brain, brawn and bullion.

(v) All possible help in the form of latest technology, raw materials, financial help, subsidies, etc. should be provided to different consumer goods sectors to increase production.

(b) Rational Wage Policy:

Another important measure is to adopt a rational wage and income policy. Under hyperinflation, there is a wage-price spiral. To control this, the government should freeze wages, incomes, profits, dividends, bonus, etc.

But such a drastic measure can only be adopted for a short period and by antagonising both workers and industrialists. Therefore, the best course is to link increase in wages to increase in productivity. This will have a dual effect. It will control wages and at the same time increase productivity, and hence increase production of goods in the economy.

(c) Price Control:

Price control and rationing is another measure of direct control to check inflation. Price control means fixing an upper limit for the prices of essential consumer goods. They are the maximum prices fixed by law and anybody charging more than these prices is punished by law. But it is difficult to administer price control.

(d) Rationing:

Rationing aims at distributing consumption of scarce goods so as to make them available to a large number of consumers. It is applied to essential consumer goods such as wheat, rice, sugar, kerosene oil, etc.

It is meant to stabilise the prices of necessaries and assure distributive justice. But it is very inconvenient for consumers because it leads to queues, artificial shortages, corruption and black marketing. Keynes did not favour rationing for it “involves a great deal of waste, both of resources and of employment.”

Conclusion:

From the various monetary, fiscal and other measures discussed above, it becomes clear that to control inflation, the government should adopt all measures simultaneously. Inflation is like a hydra- headed monster which should be fought by using all the weapons at the command of the government.

Project Report # Effects of Inflation:

Inflation affects different people differently. This is because of the fall in the value of money. When prices rise or the value of money falls, some groups of the society gain, some lose and some stand in between. Broadly speaking, there are two economic groups in every society, the fixed income group and the flexible income group. People belonging to the first group lose and those belonging to the second group gain.

The reason is that price movements in the case of different goods, services, assets, etc. are not uniform. When there is inflation, most prices are rising, but the rates of increase of individual prices differ much. Prices of some goods and services rise faster, of others slowly, and of still others remain unchanged. We discuss below the effects of inflation on redistribution of income and wealth, production, and on the society as a whole.

1. Effects on Redistribution of Income and Wealth:

There are two ways to measure the effects of inflation on the redistribution of income and wealth in a society.

First, on the basis of the change in the real value of such factor incomes as wages, salaries, rents, interest, dividends and profits.

Second, on the basis of the size distribution of income over time as a result of inflation, i.e. whether the incomes of the rich have increased and that of the middle and poor classes have declined with inflation. Inflation brings about shifts in the distribution of real income from those whose money incomes are relatively inflexible to those whose money incomes are relatively flexible.

The poor and middle classes suffer because their wages and salaries are more or less fixed but the prices of commodities continue to rise. They become more impoverished. On the other hand, businessmen, industrialists, traders, real’s estate holders, speculators, and others with variable incomes gain during rising prices.

The latter category of persons become rich at the cost of the former group. There is unjustified transfer of income and wealth from the poor to the rich. As a result, the rich roll in wealth and indulge in conspicuous consumption, while the poor and middle classes live in abject misery and poverty.

But which income group of society gains or losses from inflation depends on who anticipates inflation and who does not. Those who correctly anticipate inflation, they can adjust their present earnings, buying, borrowing, and lending activities against the loss of income and wealth due to inflation. They, therefore, do not get hurt by the inflation.

Failure to anticipate inflation correctly leads to redistribution of income and wealth. In practice, all persons are unable to anticipate and predict the rate of inflation correctly so that they cannot adjust their economic behaviour accordingly. As a result, some persons gain while others lose. The net result is redistribution of income and wealth.

The effects of inflation on different groups of society are discussed below:

(1) Debtors and Creditors:

During periods of rising prices, debtors gain and creditors lose. When prices rise, the value of money falls. Though debtors return the same amount of money, but they pay less in terms of goods and services. This is because the value of money is less than when they borrowed the money. Thus the burden of the debt is reduced and debtors gain. On the other hand, creditors lose.

Although they get back the same amount of money which they lent, they receive less in real terms because the value of money falls. Thus inflation brings about a redistribution of real wealth in favour of debtors at the cost of creditors.

(2) Salaried Persons:

Salaried workers such as clerks, teachers, and other white collar persons lose when there is inflation. The reason is that their salaries are slow to adjust when prices are rising.

(3) Wage Earners:

Wage earners may gain or lose depending upon the speed with which their wages adjust to rising prices. If their unions are strong, they may get their wages linked to the cost of living index. In this way, they may be able to protect themselves from the bad effects of inflation. But the problem is that there is often a time lag between the raising of wages by employees and the rise in prices.

So workers lose because by the time wages are raised, the cost of living index may have increased further. But where the unions have entered into contractual wages for a fixed period, the workers lose when prices continue to rise during the period of contract. On the whole, the wage earners are in the same position as the white collar persons.

(4) Fixed Income Group:

The recipients of transfer payments such as pensions, unemployment insurance, social security, etc. and recipients of interest and rent live on fixed incomes. Pensioners get fixed pensions. Similarly the rentier class consisting of interest and rent receivers get fixed payments. The same is the case with the holders of fixed interest bearing securities, debentures and deposits.

All such persons lose because they receive fixed payments, while the value of money continues to fall with rising prices. Among these groups, the recipients of transfer payments belong to the lower income group and the rentier class to the upper income group. Inflation redistributes income from these two groups towards the middle income group comprising traders and businessmen.

(5) Equity Holders or Investors:

Persons who hold shares or stocks of companies gain during inflation. For when prices are rising, business activities expand which increase profits of companies. As profits increase, dividends on equities also increase at a faster rate than prices. But those who invest in debentures, securities, bonds, etc. which carry a fixed interest rate lose during inflation because they receive a fixed sum while the purchasing power is falling.

(6) Businessmen:

Businessmen of all types, such as producers, traders and real estate holders gain during periods of rising prices. Take producers first. When prices are rising, the value of their inventories rise in the same proportion. So they profit more when they sell their stored commodities. The same is the case with traders in the short run. But producers profit more in another way.

Their costs do not rise to the extent of the rise in the prices of their goods. This is because prices of raw materials and other inputs and wages do not rise immediately to the level of the price rise. The holders of real estates also profit during inflation because the prices of landed property increase much faster than the general price level.

(7) Agriculturists:

Agriculturists are of three types: landlords, peasant proprietors, and landless agricultural workers. Landlords lose during rising prices because they get fixed rents. But peasant proprietors who own and cultivate their farms gain. Prices of farm products increase more than the cost of production. For prices of inputs and land revenue do not rise to the same extent as the rise in the prices of farm products.

On the other hand, the landless agricultural workers are hit hard by rising prices. Their wages are not raised by the farm owners because trade unionism is absent among them. But the prices of consumer goods rise rapidly. So landless agricultural workers are losers.

(8) Government:

The government as a debtor gains at the expense of households who are its principal creditors. This is because interest rates on government bonds are fixed and are not raised to offset expected rise in prices. The government, in turn, levies less taxes to service and retire its debt. With inflation, even the real value of taxes in reduced.

Thus redistribution of wealth in favour of the government accrues as a benefit to the tax-payers. Since the tax-payers of the government are high- income groups, they are also the creditors of the government because it is they who hold government bonds.

As creditors, the real value of their assets declines and as tax-payers, the real value of their liabilities also declines during inflation. The extent to which they will be gainers or losers on the whole is a very complicated calculation.

Conclusion:

Thus inflation redistributes income from wage earners and fixed income groups to profit recipients, and from creditors to debtors. In so far as wealth redistributions are concerned, the very poor and the very rich are more likely to lose than middle income groups.

This is because the poor hold what little wealth they have in monetary form and have few debts, whereas the very rich hold a substantial part of their wealth in bonds and have relatively few debts. On the other hand, the middle income groups are likely to be heavily in debt and hold some wealth in common stock as well as in real assets.

2. Effects on Production:

When prices start rising, production is encouraged. Producers earn wind-fall profits in the future. They invest more in anticipation of higher profits in the future. This tends to increase employment, production and income.

But this is only possible up to the full employment level. Further increase in investment beyond this level will lead to severe inflationary pressures within the economy because prices rise more than production as the resources are fully employed. So inflation adversely affects production after the level of full employment.

The adverse effects of inflation on production are discussed below:

(1) Misallocation of Resources:

Inflation causes misallocation of resources when producers divert resources from the production of essential to non-essential goods from which they expect higher profits.

(2) Changes in the System of Transactions:

Inflation leads to changes in transactions pattern of producers. They hold a smaller stock of real money holdings against unexpected contingencies than before. They devote more time and attention to converting money into inventories or other financial or real assets. It means that time and energy are diverted from the production of goods and services and some resources are used wastefully.

(3) Reduction in Production:

Inflation adversely affects the volume of production because the expectation of rising prices along with rising costs of inputs brings uncertainty. This reduces production.

(4) Fall in Quality:

Continuous rise in prices creates a seller’s market. In such a situation, producers produce and sell sub-standard commodities in order to earn higher profits. They also indulge in adulteration of commodities.

(5) Hoarding and Black-marketing:

To profit more from rising prices, producers hoard stocks of their commodities. Consequently, an artificial scarcity of commodities is created in the market. Then the producers sell their products in the black market which increase inflationary pressures.

(6) Reduction in Saving:

When prices rise rapidly, the propensity to save declines because more money is needed to buy goods and services than before. Reduced saving adversely affects investment and capital formation. As a result, production is hindered.

(7) Hinders Foreign Capital:

Inflation hinders the inflow of foreign capital because the rising costs of materials and other inputs make foreign investment less profitable.

(8) Encourages Speculation:

Rapidly rising prices create uncertainty among producers who indulge in speculative activities in order to make quick profits. Instead of engaging themselves in productive activities, they speculate in various types of raw materials required in production.

3. Other Effects:

Inflation leads to a number of other effects which are discussed as under:

(1) Government:

Inflation affects the government in various ways. It helps the government in financing its activities through inflationary finance. As the money income of the people increases, the government collects that in the form of taxes on incomes and commodities. So the revenues of the government increase during rising prices.

Moreover, the real burden of the public debt decreases when prices are rising. But the government expenses also increase with rising production costs of public projects and enterprises and increase in administrative expenses as prices and wages rise. On the whole, the government gains under inflation because rising wages and profits spread an illusion of prosperity within the country.

(2) Balance of Payments:

Inflation involves the sacrificing of the advantages of international specialisation and division of labour. It adversely affects the balance of payments of a country. When prices rise more rapidly in the home country than in foreign countries, domestic products become costlier compared to foreign products.

This tends to increase imports and reduce exports, thereby making the balance of payments unfavourable for the country. This happens only when the country follows a fixed exchange rate policy. But there is no adverse impact on the balance of payments if the country is on the flexible exchange rate system.

(3) Exchange Rate:

When prices rise more rapidly in the home country than in foreign countries, it lowers the exchange rate in relation to foreign currencies.

(4) Collapse of the Monetary System:

If hyperinflation persists and the value of money continues to fall many times in a day, it ultimately leads to the collapse of the monetary system, as happened in Germany after World War I.

(5) Social:

Inflation is socially harmful. By widening the gulf between the rich and the poor, rising prices create discontentment among the masses. Pressed by the rising cost of living, workers resort to strikes which lead to loss in production. Lured by profit, people resort to hoarding, black-marketing, adulteration, manufacture of substandard commodities, speculation, etc. Corruption spreads in every walk of life. All this reduces the efficiency of the economy.

(6) Political:

Rising prices also encourage agitations and protests by political parties opposed to the government. And if they gather momentum and become unhandy they may bring the downfall of the government. Many governments have been sacrificed at the altar of inflation.