Classical Theory or Real Interest Rate Determination Theory:

Regarding the nature of interest, classicists were not unanimous. They regarded the nature and the determinants of the rate of interest in terms of a more complex pattern. Some classical economists like A. Marshall, N. W. Senior, E. Bohm-Bawerk, I. Fisher, etc., viewed interest from the supply side of capital, i.e., savings.

On the other hand, economists like J. B. Clark explained the nature of interest from the viewpoint of the demand for capital i.e., investment. Since demand for and supply of capital are composed of real factors, classical theory is regarded as the real interest rate theory.

(a) Supply of Capital or Saving:

According to N. W. Senior, saving involves a sacrifice. People abstain from consumption. Since abstinence involves a sacrifice of current consumption, savers must be rewarded in the form of interest. This is called abstinence theory of interest. Because of criticism made by Karl Marx against the concept of abstinence, Marshall substituted the term ‘waiting’ for abstinence.

Marshall’s theory is regarded as the waiting theory of interest. According to this theory, whenever money is lent by an individual he has to wait to get back his money. As he ‘waits’ for future he has to be given interest. Thus, interest is the price for waiting. Higher the interest, higher is the period of waiting. In other words, people will save more if they are rewarded more. Thus, supply of capital comes from saving.

ADVERTISEMENTS:

Bohm-Bawerk, Fisher, etc., provided another theory that also governs the supply of capital. Their theories are popularly known as ‘time preference theory of interest.’ According to them, as people prefer current consumption over future consumption they become impatient to spend money now. To make future consumption more profitable, an individual must be given inducement in the form of interest income.

Thus, supply of capital is dependent on real or psychological factors like:

(i) abstinence

(ii) waiting

ADVERTISEMENTS:

(iii) time preference.

Obviously, higher the rate of interest, greater is the volume of savings. In other words, saving or supply of capital is directly related to the rate of interest.

Thus, the saving function becomes:

S = f(r)

(b) Demand for Capital or Investment:

ADVERTISEMENTS:

The principle of marginal productivity can be employed in determining the volume of investment. Like other inputs, capital has marginal productivity. According to the marginal productivity theory of capital which is a part of marginal productivity theory of distribution—price of capital is determined in accordance with the marginal revenue product.

Marginal revenue product of capital—or demand for capital or investment—will rise if the rate of interest declines. Investment demand is inversely related to the rate of interest.

Thus, investment function becomes:

I = f (r)

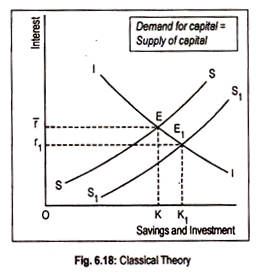

Since supply of capital or saving function is positively related to interest, the saving curve SS has been drawn upward-sloping in Fig. 6.18. Investment curve II has been drawn downward sloping. Equilibrium rate of interest is determined at point E—the point at which investment and saving curves intersect each other.

Or is the equilibrium rate of interest which brings savings (OK) into balance with investment (OK). If saving increases, SS curve would shift to the right (S1S1) and the new equilibrium (E1) would be achieved at a lower rate of interest. This would increase investment.

It is thus clear that just as the price of a commodity is determined where its demand is equal to the supply, the rate of interest is likewise settled by the market forces of supply of capital (or saving) and demand for capital (or investment).

Criticisms of Classical Theory of Interest Rate Determination:

Classical theory of interest rate determination has come in for sharp criticisms:

ADVERTISEMENTS:

i. This theory is based on full employment assumption. But what we find in reality is the unemployment or underemployment of resources. Classical theory does not work below full employment.

ii. Keynes charged the classical theory as an indeterminate one. According to Keynes, saving depends on income level. There will be different saving schedules at different income levels. As income rises, saving curve shifts upward. Thus, we cannot know the position of the saving curve unless we know the level of income and, if we do not know the volume of savings, we cannot determine interest rate.

Thus, interest rate remains indeterminate if the level of income is not known. But we do not know the level of income without knowing the interest rate because it is the rate of interest that brings about a change in investment and income level. Hence the indeterminacy in the interest rate. This indeterminacy is implicitly attributed to the constancy of the level of income.

iii. Finally, according to Keynes, rate of interest should be determined by the monetary factors rather than by real factors.