Read this article to learn about the seven major implications and challenges of rational expectations.

(i) Validity of Impotency Result:

The most important implication of the rational expectations model on economics during the last decade or so has been that aggregate demand management designed to lower unemployment will always be ineffective.

The advocate of ‘Ratex’ argue that such a policy is ineffective even in the short run because an accurate understanding of how expectations are formed is difficult during the short period.

In other words, it means that the monetary and fiscal policies are unable to alter the level of employment—this is called ‘policy impotency result of rational expectations’. In this way the theory of rational expectations poses a great challenge to the proposition that any systematic aggregate demand policy can never be effective—if expectations are formed rationally.

ADVERTISEMENTS:

McCallum felt that rational expectations could not stabilize the economy. The question is—do the advocates of ‘Ratex’ have a model to explain and control ‘stagflation’? The advocates of ‘ratex’ feel that ‘stagflation’ has been caused by misguided government intervention policies of ‘fine turning’ the economy; that have not worked, do not work and won’t work in future.

These advocates continue to believe that inflation is a monetary phenomenon and macro policy could not shift the economy to higher levels of employment. They feel that long-run Phillip’s curve is vertical—that means that there exists a natural rate of unemployment.

Government can bring about a change in the short-run only by befooling people but these supporters of ‘ratex’ feel you cannot fool all the people all the time and therefore any systematic policy is ineffective—because people anticipate the effects of new policy— and if that be so—then policies would not cause any increase in employment.

The problem mostly used in economics is the allocation of time between labour and leisure. In deciding how many hours to work this period, an individual must take account of expected future wages and not just the present wage. For example, if the present wage is $ 10 per hour, per week and $ 1 per hour next week, it makes sense to work as much as possible during the week and have same time off next week. Therefore, the number of hours worked in any period, that is, the labour supply, will depend not only on the current real wage but an expected future real wage.

ADVERTISEMENTS:

A rational expectation of real wage will take into account all available information, including the effects of government policy. But the critics argue it is alright that expectations should be based on all the available information including the future impact of government policy—but then how does this theory of rational expectations leads to the conclusion or proves that government policy is ineffective or impotent—as the supporters of ‘Ratex’ try to establish?

It should be realized that the relationship between the level of employment and expectations is logically quite separate from beliefs about how expectations are formed? The conclusion that there is no scope for government policy—the impotence result—depends critically upon or by imposing a special assumption about expectations—that is, rational expectations—upon a special type of macroeconomic model.

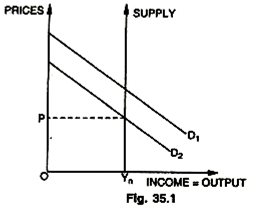

In the diagram, the levels of output and prices are determined by the intersection of ADF and ASF. The ASF (curve) is taken to be vertical, so that output cannot deviate from Yn as a direct result of any change in the level of demand. Thus, the government policies designed to change the level of AD are not likely to be effective. The level Yn is the output associated with equilibrium in the labour market at the natural rate of unemployment so we can call Yn the natural rate of output or income for the economy.

Consider the possibility that the government takes action that may, at first blush, be supposed to increase output. For example, let it act to increase nominal income and aggregate money demand. Money wage rates will tend to rise, and if workers regard this as equivalent to an increase in real wages—employment will increase and output will temporarily rise to a level higher than Yn.

ADVERTISEMENTS:

But if production is carried on subject to diminishing returns to labour, prices will rise relative to nominal wages, and real wages will fall. When workers realize this, employment will fall back to its original position, and output will return to Yn. At this point, nominal wage rates and prices are higher (the nominal demand curve crosses the vertical supply curve at a higher level) but output and employment are back from where they started.

Since the aggregate supply curve had not shifted, the possibility of increasing employment and output arises only as long as people confuse nominal changes in wages (for example) with real changes/wages. This means that government policy will only increase the level of income in real terms if it is able to fool people into confusing nominal changes with real ones.

But the critics argue that rational expectations is not sufficient for policy impotence because our conclusion of this type depends essentially on an economic model in which prices are completely flexible and the supply curve is vertical. When difficulties like rigid prices, capital market and taxation are taken into consideration, different conclusions are bound to follow.

Therefore, critics say that the preposition of ‘policy impotence’ is peculiar to a very special and limited type of economic model. Like the General Theory it stimulated lot of research along new lines. The debate, however, about the rationality of expectation, its treatment in theory, its formulation and its implications for policy still continues. While some of its propositions have been grudgingly accepted, while other more extreme claims have been rejected.

(ii) Unrealistic Elements:

The greatest criticism against rational expectations is that it is unrealistic to say and to assert that individual expectations are essentially the same as the predictions of the relevant economic theory. If it is so, it will mean that individuals not only know the past history of all the relevant variables, but also the structural parameters of the true economic model. The advantage of adaptive expectations was that they provided simple rules which people could follow while making predictions.

In contrast forming rational expectations expects too much from individual knowledge and processing power—it is simply not possible. Information gathering and processing is a very costly affair. If individuals do not or are unable to use all the available information, it is possible that they may go wrong in forming their expectations. This, in turn, allows for effective government demand management policy.

Both the ‘activists’ and ‘passivists’ believe that empirical evidence is important in the assessment of the theory. The advocates of each side use a variety of methods in trying to convince economists of the validity of their propositions. Appeals are made to intuition, logic and algebra, to one’s prejudices and to one’s appreciation, but almost always there is an appeal to data.

ADVERTISEMENTS:

Both accept the formalized testing procedures of econometrics so that the empirical discussions have been important and substantial. When ‘Keynesians’ and ‘Monetarists’ could never agree during the 1960s about the efficacy of fiscal and monetary policy, the main problem seems to have been—that one school thought that the realism of models was the important test of validity ; while the other school thought that the predictions was the key. In the rational expectations theory the predictions criterion has been generally accepted, although the theory has been often criticized for lack of realism.

Again, it is said that if human beings are not born with a comprehensive knowledge of the economy how do they acquire it? Have expectations always been rational? What happens when the structure of the economy changes? How do agents acquire their knowledge of the new structure and what happens to expectations meanwhile?

Moreover even if, it is granted that a model eventually converge on a rational expectations equilibrium, it may take such a long time to do so that meanwhile the structure of the economy changes occasionally—that the economy is never said to be close to a rational expectations equilibrium, so that during this transition period the ‘impotence result’ becomes insignificant and the demand management policy gets an upper hand.

(iii) Flexible Prices and Market Clearing Mechanism:

The most fundamental and most damaging criticism which has been leveled against this model is that its assumptions of flexible prices and continuous market clearing are not sound on account of widespread prevalence of contracts, explicit and implicit, prevalence of quantity rather than price adjustment in the market etc. Moreover, such models based on rational expectations do not take into consideration capital, taxation, inventory, wealth effects and so on.

ADVERTISEMENTS:

It should be noted that the basic impotence result relate only to monetary policy. Fiscal policy, to the extent that it is effective, will be effective, despite, rational expectations because no one denies that the government is able to alter the natural rate of unemployment through certain types of fiscal policies.

Again, rational expectations theory is based on the belief that there is continuous market clearing mechanism and that all markets clear instantaneously. By this we mean that it is assumed that supply is equal to demand in all markets and at all times. This adjustment between supply and demand is brought about by price mechanism. In other words, it is assumed that ‘Walrasian Model operates in the real world.

It is here that the ‘impotence result’ does not follow because the assumption of constantly clearing markets is obviously at variance with the actual world around us. Inventories, queues, backlogs, rationing all belie the existence of clearing markets. The rational expectations model assumed that wages adjust rapidly to equate the supply and demand of labour and therefore all unemployment is voluntary—the unemployed are mistaken about the current market clearing wage.

Yet the long-term contractual nature of the relationship is specially a feature of the labour market all over now-a-days. It is not possible to say that job searchers, factory workers or even the average businessman form their expectations in this manner. They do not know the structural equations, the parameter values and the values of the variables necessary to do the calculations. It is even more difficult to believe that all wise factory workers from Pittsburgh or Schffield were using a monetarist model to predict inflation in the 1950s long before economists had stumbled upon it.

(iv) Non Treatment of Capital and Money:

ADVERTISEMENTS:

Non-treatment of Capital and money is another weak spot of the rational expectations model because they include no assets, no capital accumulation, no inventories, no taxes and no money behaviour. As such, it is essentially a very classical type of model in which there is a sharp division between real and monetary phenomenon. It is a model in which money has no role to play.

Thus, when we introduce money, capital into the model monetary policy can have real effects—it is not impotent as made out by the ‘Ratex’ model. Doubts have also been expressed as to whether the model of rational expectations does really fit the actual world. The fact that the theory is intuitively appealing does little to establish its validity as a description of the real world.

(v) Empirical Validity:

Moreover, there are serious misgivings about the empirical validity on which the ‘impotence policy’ result is based, because arguments in economics are not based only on decisive empirical tests but are conducted on a variety of level. Empirical and statistical evidences are merely a part of a variety of considerations on which one’s faith in a theory depends. We should not expect that a single statistical test or empirical evidence will be decisive in convincing us that rational expectations models are true or false.

Science, especially social science, does not operate in that manner. Rather, the process is cumulative. Evidences and arguments accumulate and economists have to evaluate the conflicting results to decide whether or not rational expectations provide a useful base to study and change the world. The statistical and empirical evidence have to be balanced against considerations of logic, fruitfulness and consistency.

(vi) Property of Un-biasedness:

The rational expectations hypothesis implies that expectations should have certain properties, especially these should be unbiased, predictors of the actual value and should be based on the best possible information available at the time of their formation. But unfortunately expectations are not directly observable. Rational expectations in order to be rational must be unbiased predictions of the relevant variables but un-biasedness is not a sufficient condition for rationality. Doubts have been raised about their being unbiased where information is costly.

To be rational in the sense of Muth—expectations should be based on all the information’s available at the time at which the forecast is made; in other words, it should not be possible to improve on the forecast by utilising additional information. This implies that there should be no statistical relationship between the expectations errors and the information set at the time of forecast. Equally, there should be no statistical relationship between current predictions error and past prediction error. In other words, rationality implies that forecast error must be serially uncorrelated.

(vii) Observed Behaviour:

ADVERTISEMENTS:

Many economists fear that reported expectations do not, in fact, reflect the actual behaviour of economic agents. They have a strong preference for observed behaviour as a source of economic data. Economists strongly feel that observed behaviour provides a better source of explanatory hypothesis than do verbal reports. While the realism of assumptions in all economic theories may be open to question, most of us accept that the models which are able to develop and substantiate empirical hypotheses are preferred to those which cannot. The rational expectations models failed, because they could not attract much empirical evidence in support of their propositions.

Conclusion:

However, the economists and students may learn well, the following from the development of this research programme of rational expectations in the field of macroeconomics theory:

(a) Rational expectations models pose a fundamental challenge to the established orthodoxy that the government can and should utilize a variety of demand management policies to maintain full employment.

(b) Rational expectations have been interpreted to imply that policy makers, cannot even in the short-run, alter the level of unemployment systematically through the management of aggregate demand.

(c) That as a result of this theory private actor will almost certainly change their behaviour in response to a government policy.

(d) That the change may well be predicted by assuming that private actions have rational expectations of government policy.

ADVERTISEMENTS:

(e) That macroeconomic research programme are entities which evolve and interact with one another at the level of ideas and at the level of data.

(f) That the development of rational expectations theory in the field of macroeconomics is at best very useful addition to competitive research programmes at the empirical and statistical level.

As a result of above made observations there are quite a few challenges to the rational expectations theorists.

These relate to:

(a) Validity of the basic model of the economy employed,

(b) To the assumption that people do always have rational expectations,

ADVERTISEMENTS:

(c) To the question of whether they can really have such expectations?

There are two basic questions—what have the rational expectations theorists learnt about their models and methods from the challenges thrown at them. Secondly, what changes to activists type theories seem necessary in the light of the arguments and evidence of rational expectations.

The challenges posed by the rational expectations have caused important reformulation of activists thoughts. The activists school, has after all realized that rational expectations theories are one of the important competing research programme of the 1980s and the economists would do well to understand what they are and what they mean?