Quasi-Rent in Economics:

The concept of economic rent has arisen because the supply of factors of production is not perfectly elastic.

The more inelastic the supply of a factor, the greater will be the element of economic rent in the income earned that factor.

Ricardo discussed the concept of economic rent in relation to land because land, in total, has the unique characteristic of being fixed in supply, both in the short-run and in the long run. The concept can, however, be applied to any factor of production because, in the short run, all factors are fixed in supply and may, therefore, receive a payment in the nature of economic rent, i.e., quasi-rent.

The supply of a particular factor may be inelastic only for a temporary period. In such a case the economic rent paid will also be a temporary feature. If, for example, there is a great increase in demand for heart surgeons, it will take time before the supply of heart surgeons can be increased to meet this demand.

The new surgeons must first be trained and this will take years. In the meantime, existing qualified heart surgeons will find their earnings increasing. When the additional surgeons have been trained, the extra earnings being made by existing surgeons will be reduced.

During the period when additional people were being trained, the qualified surgeons earned economic rent, but when the additional surgeons came on to the market this rent disappeared. In cases where rent is a temporary phenomenon. Alfred Marshall called it ‘quasi-rent’.

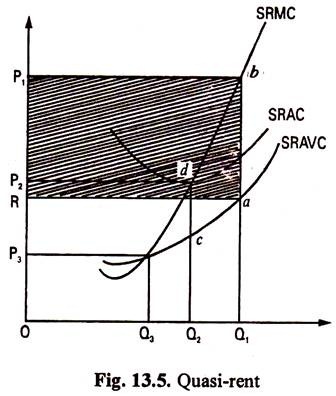

In Fig. 13.5 at OP1 price per unit the quasi-rent is ab, at OP2 price it is cd, but at OP3 price it is nil because here price is equal to average variable cost.

The figure also illustrates that at OP1 price the total quasi-rent is abP1R area. It is also stated in this concept that so long as the firm can earn quasi-rent in the short run, it would continue to produce. In fact, Marshall used the term quasi-rent to refer to the earnings of capital, the supply of which is fixed in the short run. It is the excess made in the short run by a firm from the difference between the selling price and the prime cost of the product.

ADVERTISEMENTS:

Suppose a firm can make pens at a cost of 10 p in labour and raw materials, and can sell them at 40 p. A quasi- rent of 30 p is earned; this is not, however, the profit of the firm, because there are costs of other fixed inputs which have to be covered by sales, even though they don’t add to the cost of making extra pens. Even a loss- making firm can earn a quasi-rent.

Quasi-rent is analogous to economic rent, because it represents a return in excess of that necessary to keep the firm in production— whenever price exceeds avoidable costs. It differs from economic rent, however, in that it is a temporary phenomenon. It can exist because, in the short run, price may differ from marginal cost, because firms take time to enter an industry and reduce excess profits.

Thus, at any time, the supply of labour is fixed, but, if labour is occupationally mobile the amount that it must earn to retain it in its present occupation is a form of transfer earning. Any payment above this amount which accrues because the demand for labour services is high relative to its supply is in the nature of economic rent. The supply of some specialised kind of labours with extra-special talents, e.g., super-stars and some barristers and surgeons, is extremely limited and the earnings of such persons are almost wholly rent.

The same principle applies of the earnings of capital. Its supply is fixed at any one time, but, in the long run, it can be increased or decreased. Thus, an increase in the price of the product—that a particular type of capital is used to produce—raises the earnings of the capital. Any earnings in excess of the supply price is a surplus, which may be partly transfer earnings and partly economic rent.

ADVERTISEMENTS:

Transfer earnings arise if the capital is capable of being used for more than one use so that some payment must be made to prevent it transferring to an alternative use. However, most capital is capable of one use only, e.g., a blast furnace; it is specific to a particular type of production. In this situation there is no question of a payment to prevent it transferring to some other use; a blast furnace can be used to smelt iron or it has only scrap value.

The earnings of such capital in the short run are, therefore, wholly rent which tends to be high when the price of what it produces is high, or it may approach zero or even be negative when the demand for and price of what it produces is low. In the latter case the capital will not be replaced when it wears out because it is not earning its supply price.

Thus, in the short run, its earnings are in the nature of rent (quasi-rent), but in the long run it must earn an amount sufficient to ensure its replacement; this amount is a transfer earning. Thus, quasi- rent is a short-term or a temporary phenomenon.

There are two reasons for these:

(a) Scarcity Rent:

Prima facie, rent arises due to inelasticity of supply of factors. As the supply of a factor becomes more and more elastic with the passage of time the portion of total income — called transfer income — rises and the residue, called economic rent (which is a surplus), gradually disappears.

Ultimately, when the supply curve of a resource becomes completely elastic in the long run, temporary excess return, called quasi-rent, disappears completely, Secondly, what is surplus income in the short run is very much a necessary income in the long run. A firm under perfect competition, for instance, will carry on production in the short run if P > AVC. So the difference between P and AVC is a surplus income or rent. But, in the long run, P = ATC = AFC + AVC. This means that there is no surplus income or rent. A firm must be able to cover all costs and make only normal profit which is included in total cost. So if P – AVC > 0, there will be a surplus income in the short run, called quasi-rent, but this will be very much a necessary income in the long run. This means that quasi-rent is a short-run or a temporary phenomenon.

Thus, the conclusion is that quasi-rent is earned during the time it takes for the supply of a factor to be increased. Pure economic rent is earned where supply cannot be increased, i.e., when supply is fixed.

(b) Differential Rent also Arises due Situational Differences:

The difference in the situation of the different plots of land may give rise to situation rent to lands which are favourably situated. Suppose there are two plots of land having the same degree of fertility, but the one near the market and the second one far away from the market. In the case of the latter the transport cost of bringing the produce to the market is Rs. 5 but in the case of the former it is Rs. 2. As the market price covers all costs, the former gets a surplus of Rs. 3 over the latter and the surplus represents the rent of the former. This rent is also known as situation rent.