The below mentioned article provides study notes on Quasi-Rent.

The term quasi-rent was coined by Alfred Marshall. Economic rent, as defined by Ricardo and modern economists, is a long run reward to any input, including land. In the short run, some inputs are fixed and some are variable. But in the long run all inputs are variable.

Economic rent persists in the long run while quasi-rent arises in the short run. Fixed inputs in the short period receive a quasi-rent. It evaporates in the long run because in the long period there are no fixed inputs. Marshall argued that quasi-rent arises in the case of man-made inputs (like machines, buildings, etc.) whose supplies are inelastic.

Since the supplies of these inputs are variable or elastic in the long run, quasi- rent disappears. Thus, quasi-rent is an ephemeral reward; it is of a temporary nature. As it is not a true rent it is called quasi-rent. True rent or long run rent refers only to those factors which are fixed in supply.

ADVERTISEMENTS:

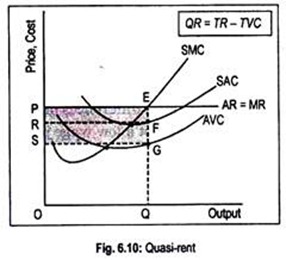

Quasi-rent (QR) may be defined as the difference between total revenue and total variable cost, i.e.,

Quasi-rent = TR – TVC

Since in the long run all costs are variable and total revenue equals total variable costs, quasi-rent vanishes in the long run. Thus, quasi-rent is the reward of man-made inputs whose supplies Eire fixed in the short run. We can explain quasi-rent in terms of Fig. 6.10.

At a price OP, the firm is in equilibrium at point E. It thus produces OQ units of output. Total revenue is OPEQ while return to the variable input is OSGQ. Thus, quasi- rent is OPEQ – OSGQ = SGEP. At output OQ, since the firm incurs a fixed cost of RFGS, it enjoys profit of RFEP amount. This excess profit is the difference between quasi- rent and total fixed cost i.e.,

ADVERTISEMENTS:

QR = TFC + excess profit

Or, QR = SGFR + RFEP

In the long run, the firm earns only normal profit and quasi-rent then becomes zero.