The following points highlight the eight major defects of the revealed preference theory. The defects are: 1. Neglects Indifference 2. Not Possible to Separate Substitution Effect 3. Excludes Giffen Paradox 4. Consumer does not choose only one Combination 5. Choice does not reveal Preference 6. Fails to derive Market Demand Curve 7. Not Valid for Game Theory 8. Fails in Risky or Uncertain Situations.

Defect # 1. Neglects Indifference:

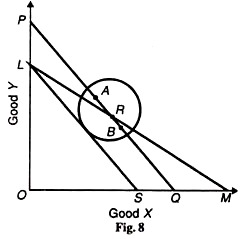

It neglects “indifference” in the consumer behaviour altogether. It is, of course, true that the consumer does not reveal his indifference in a single-valued demand function in or on the budget line when he chooses a particular set of goods at point R on the budget line LM.

But it is possible that there are points like A and В on every side of a given point R, shown within the circle in Figure 8, towards which the consumer is indifferent. If this criticism by Armstrong is accepted, then Samuelson’s fundamental theorem breaks down.

Suppose the price of Arises. As a result, his new budget line is LS. Now give the consumer some extra money to enable him to buy the same combination R on the line PQ. In this new price-income situation, suppose he chooses point В below R towards which he is indifferent.

ADVERTISEMENTS:

This is based on Armstrong’s assumption that the consumer is indifferent between points around the chosen point. But the choice of В on the PQ line means that the consumer buys more of X when its price has risen. This breaks down the Samuelson theorem because with the rise in the price of X, its demand has expanded instead of shrinking.

Defect # 2. Not Possible to Separate Substitution Effect:

Samuelson’s Fundamental Theorem is conditional and not universal. It is based on the postulate that positive income elasticities imply negative price elasticities. Since the price effect consists of the income and substitution effects, it is not possible to isolate the substitution effect from the income effect on the level of observation.

If the g income effect is not positive, price elasticity of demand is indeterminate. On the other hand, if the income elasticity of demand is positive, the substitution effect following a change in price cannot be established. Thus, the substitution effect cannot be distinguished from the income effect in the Samuelsonian Theorem.

Defect # 3. Excludes Giffen Paradox:

ADVERTISEMENTS:

Samuelson’s revealed preference hypothesis excludes the study of the Giffen Paradox, for it considers only positive income elasticity of demand. Like the Marshallian Law of Demand, the Samuelsonian Theorem fails to distinguish between negative income effect of a Giffen good combined with a weak substitution effect and a negative income effect with a powerful substitution effect.

Samuelson’s Fundamental Theorem is, therefore, inferior to and less integrated than the Hicksian price effect which provides an all inclusive explanation of the income effect, the substitution effect and of Giffen’s Paradox.

Defect # 4. Consumer does not Choose Only One Combination:

The assumption that the consumer chooses only one combination on a given price-income situation is incorrect. It implies that the consumer chooses something of everything of both the goods. But it is seldom that anybody purchases something of everything.

Defect # 5. Choice does not Reveal Preference:

The assumption that “choice reveals preference” has also been criticised. Choice always does not reveal preference. Choice requires rational consumer behaviour. Since a consumer does not act rationally at all times, his choice of a particular set of goods may not reveal his preference for that. Thus the theorem is not based on observed consumer behaviour in the market.

Defect # 6. Fails to Derive Market Demand Curve:

ADVERTISEMENTS:

The revealed preference approach is applicable only to an individual consumer. Negatively inclined demand curves can be drawn for each consumer with the help of this approach by assuming ‘other things remaining the same.’ But this technique fails to help in drawing market demand schedules.

Defect # 7. Not Valid for Game Theory:

According to Tapas Majumdar, the revealed preferences hypothesis “is invalid for situations where the individual choosers are known to be capable of employing strategies of a game theory type.”

Defect # 8. Fails in Risky or Uncertain Situations:

The revealed preference theory fails to analysis consumer’s behaviour in choices involving risk or uncertainty. If there are three situations, A, B, and C, the consumer prefers A to В and С to A. Out of these, A is certain but chances of occurring В or С are 50-50. In such a situation, the consumer s preference for С over A cannot be said to be based on his observed market behaviour.

Conclusion:

It appears from the above discussion that the revealed preference approach is in no way an improvement over the indifference curve analysis. It is unable to isolate the substitution effect from the income effect, neglects Giffen’s Paradox and fails to study market demand analysis.