The below mentioned article provides an overview on Baumol’s Sales or Revenue Maximisation.

Prof. Baumol in his book Business Behaviour, Value and Growth (1967) has presented a managerial theory of the firm based on sales maximisation. He discusses two models of sales maximisation: a static model and a dynamic model. We shall analyse only his static model of sales maximisation with its variants of single product model without advertisement.

Assumptions:

The model is based on the following assumptions:

ADVERTISEMENTS:

1. There is a single period time horizon of the firm.

2. The firm aims at maximising its total sales revenue in the long run subject to a profit constraint.

3. The firm’s minimum profit constraint is set competitively in terms of the current market value of its shares.

4. The firm is oligopolistic whose cost curves are U-shaped and the demand curve is downward sloping. Its total cost and revenue curves are also of the conventional type.

ADVERTISEMENTS:

The Model:

Baumol’s findings of oligopoly firms in America reveal that they follow the sales maximisation objective. According to Baumol, with the separation of ownership and control in modern corporations, managers seek prestige and higher salaries by trying to expand company sales even at the expense of profits.

Being a consultant to a number of firms, Baumol observes that when asked how their business went last year, the business managers often respond, “Our sales were up to three million dollars”. Thus, according to Baumol, revenue or sales maximisation rather than profit maximisation is consistent with the actual behaviour of firms.

Baumol cites evidence to suggest that short-run revenue maximisation may be consistent with long-run profit maximisation. But sales maximisation is regarded as the short-run and long-run goal of the management. Sales maximisation is not only a means but an end in itself.

ADVERTISEMENTS:

He gives a number of arguments in support of his theory.

1. A firm attaches great importance to the magnitude of sales and is much concerned about declining.

2. If the sales of a firm are declining, banks, creditors and the capital market are not prepared to provide finance to it.

3. Its own distributors and dealers might stop taking interest in it.

4. Consumers might not buy its product because of its unpopularity.

5. Firm reduces its managerial and other staff with fall in sales.

6. But if firm’s sales are large, there are economies of scale and the firm expands and earns large profits.

7. Salaries of workers and management also depend to a large extent on more sales and the firm gives them bonus and other facilities.

By sales maximisation, Baumol means maximisation of total revenue. It does not imply the sale of large quantities of output, but refers to the increase in money sales (in rupee, dollar, etc.). Sales can increase up to the point of profit maximization where the marginal cost equals marginal revenue.

ADVERTISEMENTS:

If sales are increased beyond this point money sales may increase at the expense of profits. But the oligopolistic firm wants its money sales to grow even though it earns minimum profits. Minimum profits refer to the amount which is less Quantity than maximum profits. The minimum profits are determined on the basis of firm’s need to maximize sales and also to sustain growth of sales.

Minimum profits are required either in the form of retained earnings or new capital from the market. The firm also needs minimum profits to finance future sales. Further, they are essential for a firm for paying dividends on share capital and for meeting other financial requirements.

Thus minimum profits serve as a constraint on the maximisation of a firm’s revenue. “Maximum revenue will be obtained only” according to Baumol, “at an output at which the elasticity of demand is unity, i.e. at which marginal revenue is zero.”

ADVERTISEMENTS:

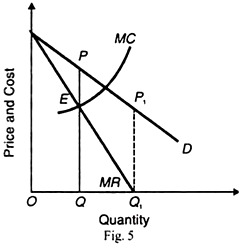

This is the condition which replaces the “marginal cost equals marginal revenue profit maximisation rule.” This is shown in Figure 5 where the profit maximisation firm produces OQ output where MC = MR at point E. But the sales maximisation firm will produce OQ1 output where MR is zero.

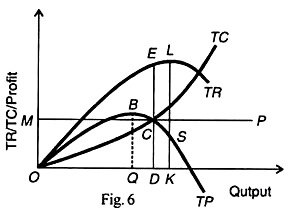

Baumol’s model is illustrated in Figure 6 where TC is the total cost curve, TR the total revenue curve, TP the total profit curve and MP the minimum profit or profit constraint line. The firm maximises its profits at OQ level of output corresponding to the highest point В on the TP curve.

But the aim of the firm is to maximise its sales rather than profits. Its sales maximisation output is OK where the total revenue KL is the maximum at the highest point of TR.

ADVERTISEMENTS:

This sales maximisation output OK is higher than the profit maximisation output OQ. But sales maximisation is subject to minimum profit constraint. Suppose the minimum profit level of the firm is represented by the line MP.

The output OK will not maximise sales as the minimum profits OM are not being covered by total profits KS. For sales maximisation the firm should produce that level of output which not only covers the minimum profits but also gives the highest total revenue consistent with it.

This level is represented by OD level of output where the minimum profits DC (=OM) are consistent with DE amount of total revenue at the price DE/OD, (i.e., total revenue/total output). Baumol’s model of sales maximisation points out that the profit maximisation output OQ will be smaller than the sales maximisation output OD, and price higher than under sales maximisation.

The reason for a lower price under sales maximisation is that both total revenue and total output are equally higher while under profit maximisation total output is much less as compared to total revenue. Imagine if QB is joined to TR in Figure 6. “If at the point of maximum profit”, writes Baumol, “the firm earns more profit than the required minimum, it will pay the sales maximiser to lower his price and increase his physical output.”

Implications or Superiority of the Model:

Baumol’s sales maximisation model has some important implications which make it superior to the profit maximisation model of the firm.

ADVERTISEMENTS:

1. The sales maximising firm prefers larger sales to profits. Since it maximises its revenue when MR is zero, it will charge lower prices than that charged by the profit maximising firm. In Figure 43.5, the sales maximisation price Q1P1 is lower than the profit maximisation price QP which is determined when the MC curve cuts the MR curve at point E.

2. It follows from the above that the sales maximising output will be larger than the profit maximising output. In Figure 43.4, the profit maximisation firm produces OQ output while the sales maximisation firm produces OQ1 output, OQ1 > OQ.

3. The sales maximiser would spend more on advertisement in order to earn larger revenue than the profit maximiser subject to the minimum profit constraint.

4. There may be a conflict between pricing in the short-run and long-run. In the short-run, when output cannot be increased, revenue can be increased by raising the price. But in the long- run, it would in the interest of the sales maximisation firm to keep the price low in order to compete more effectively for a large share of the market to earn more revenue.

5. The profit maximization firm is assumed to act rationally which goes against the actual behaviour of firms. On the other hand, the Baumol firm behaves satisfactorily for the purpose of earning minimum profits at a fair sales maximization output.

ADVERTISEMENTS:

Criticism:

Baumol’s sales maximisation model is not free from certain weaknesses.

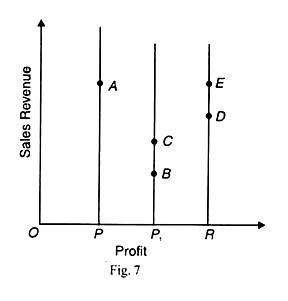

1. Rosenberg has criticised the use of the profit constraint for sales maximisation by Baumol. Rosenberg has shown that it is difficult to specify exactly the relevant profit constraint for a firm. This is explained in Figure 7. Sales revenue of the firm is measured along the vertical axis and profit on the horizontal axis. R refers to the profit constraint. For any two combinations with profits below the constraint, the one with the larger profit will be preferred.

For instance, В on the profit level P is preferred to A at the profit level P since the line P, represents a higher level of profit. Again, of the two combinations В and С lying on the same profit line P , the one with higher sales will be preferred, i.e., С will be preferred to B. Similar is the case with points D and E on the constraint line R where E with higher sales will be preferred to D. Thus it is very difficult to choose the sales maximisation and minimum profit constraint in Baumol’s model.

2. According to Shepherd, under oligopoly a firm faces a kinked demand curve and if the kink is large enough, total revenue and profits would be the maximum at the same level of output. So both the sales maximiser and the profit maximiser would not be producing different levels of output.

3. Hawkins has shown that if the firm is engaged in any form of non-price competition such as good packaging, free service, advertising, etc., Shepherd’s conclusions become invalid. When the sales maximiser spends more on advertising, his output will be more than that of the profit maximiser. This is because the kink of the former’s demand curve will occur to the right of the kink of the profit maximiser.

ADVERTISEMENTS:

4. Hawkins has also shown that Baumols’s conclusion that a sales maximiser will in general produce and advertise more than a profit maximiser, is invalid. According to Hawkins, a sales maximiser “may choose a higher, lower or identical output, and a higher, lower or identical advertising budget. It depends on the responsiveness of demand to advertising rather than price cuts.”

5. In the case of multiproduct, Baumol has argued that revenue and profit maximisation yield the same results. But Williamson has shown that sale maximisation yields different results from profit maximisation.

6. Another weakness of this model is that it ignores the interdependence of the prices of oligopolistic firms.

7. The model fails to explain “observed market situations in which price are kept for considerable time periods in the range of inelastic demand.”

8. The model ignores not only actual competition, but also the threat of potential competition from rival oligopolistic firms.

9. The model does not show how equilibrium in an industry, in which all firms are sales maximisers, will be attained. Baumol does not establish the relationship between the firm and industry.

ADVERTISEMENTS:

10. Prof Hall in his analysis of 500 firms came to the conclusion that firms do not operate in accordance with the object of sales maximisation.

Despite these criticisms, there is no denying the fact that sales maximisation forms an important goal of firms in the present day business world.