This article justifies that saving is a private virtue of an individual.

It may be understood that Keynesian economics is macroeconomics, and savings, according to Keynes, imply collective or aggregate savings of the community.

According to classicals, saving was a great private virtue as every individual must save something against the rainy day.

Increased savings on the part of different individuals, according to classicals, led to increased savings of the community. In the microeconomic analysis, saving is a virtue, when an individual’s thriftiness increases he accumulates a fortune by maximising earnings and minimising expenditures on consumption.

ADVERTISEMENTS:

Classicals thought that an all-round increase in individual saving will ultimately lead to national savings so very essential for economic development. Under the assumption of Say’s law of market classical theory regarded saving as investment and not as a distinct or separate process.

Under-consumption economists like J.A. Hobson, Aftalion attacked the classical view and held there was no virtue in an act of saving, rather this led to under-consumption. To Keynes, this was a wrong approach because saving depends upon income and increased savings in the community are possible only when the total (national) income of the community increases.

Since one man’s expenditure is another man’s income, increased savings on the part of some individuals leads to a decline in the incomes and expenditures of certain other individuals. Moreover, increased savings in the community mean less of expenditure and hence less of effective demand resulting in less of output and employment. It is on this ground that Keynes thought of savings as a big social vice.

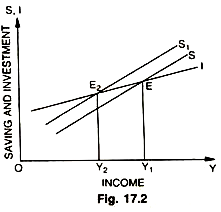

He regarded saving as neither desirable nor undesirable, for it all depends on the use to which savings may be put, if savings are invested, there will be no decrease in effective demand, if however, savings are hoarded, it may reduce the aggregate demand depressing income, output and employment. The depressing effects of increased saving on income are shown in the Fig. 17.2.

The original Y and I curves intersect at E and give us the equilibrium level of income OY1 which S and I are equal ( = EY1). Now suppose savings in the community increase shifting the S curve upwards to S1 intersecting the old I curve at E2 as a result of which there is contraction of income from OY1 and OY2 to the extent of Y1Y2. Thus, we find that out of decreased income OY2, decreased savings E2Y2 flow. Hence, the community’s efforts to save more have actually resulted in a decline in income as well as in savings. It is on account of this that Keynes called savings as a social vice because they result in the decline in income, output and employment.

It may, however, be noted that Keynes did not condemn all types of savings, specially that part of these which ate invested. In his view, one who tries to save, destroys tire real capital only if one is unwise enough to hoard one’s savings and does not make it available for investment. In so far as saving is invested, it is not a public vice, it becomes so only when it is hoarded.