Strategic planning can be defined as the process of developing and maintaining a strategic fit between the organisation’s goals and capabilities and its changing marketing opportunities.

Strategic planning or strategizing is essentially a task of choice, i.e., to decide what to do and what not to do to achieve organisational goals. Every company has to do strategic planning, although the nature and extent may vary.

Some of the steps and stages of strategic marketing planning process are as follows:-

1. Customer Behaviour Analysis 2. Analysis of External Environment 3. Defining a Clear Company Mission. 4. Setting Supporting Company Objectives. 5. Designing a Sound Business Portfolio

ADVERTISEMENTS:

6. Planning and Coordinating Marketing and other Functional Strategies 7. Inputs 8. Organisational Profile 9. Top Management Orientation. 10. Purpose and Major Objectives.

11. Scanning of Environment 12. Development of Alternative Strategies 13. Evaluation and Choice of Strategies 14. Strategy Formulation 15. Strategy Implementation and a Few Others.

Strategic Marketing Planning Process: Steps, Stages and Phases

Strategic Marketing Planning Process – Steps Needed for Making the Strategic Plans

Plans should be short term and long term. Most firms make annual plans, which are divided into quarterly plans. To be market proactive the plans should be kept flexible to enable firms to alter them to dovetail the changing market environment.

The following steps are needed for making the plans:

ADVERTISEMENTS:

i. Customer behaviour analysis

ii. Analysis of external environment

Let us take a simple customer behaviour pattern.

It includes the following elements of internal information processing, guided by external information and stimuli:

ADVERTISEMENTS:

i. Belief – It is the customer’s conviction and firm opinion of a product/ brand.

ii. Perception – It comes from a customer’s recognition of a product as desirable based on intuition and information gathered at the sensory plane.

iii. Attitude – It is the customer’s way of thinking about the product, his opinion about it.

iv. Preference – Out of his belief, perception and attitude the customer makes his preference of one product over other products, and tries to buy it.

Thus, we can define the multi-attribute decision-making process as one ‘based on concepts Beliefs, Attitudes, Perceptions and Preferences’ from the basis of multi-attribute decision making. It is the notion that objects in a choice-set (product attributes and related benefit) can lead to external behaviour purchase or no purchase. Each object in the set has a value on each attribute used to define the choice-set.

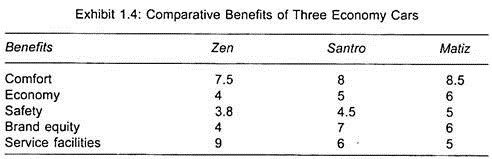

Let us take an example to illustrate the point. The purchase of a car in a family is a major event and the decision-making process is multi-dimensional one. While the affluent buy cars as status symbols, the middle class person buys it as a means of transport. Let us take three cars in the economy segment and plot their benefits to customers. The figures given in Exhibit 1.4 are only arbitrary and not conclusive. The figures are based on a scale of 0-10.

On a different plane another matrix can be made with benefits on one axis and decision-making concepts for each car separately, before the final decision is taken.

The decision-making process, therefore, calls for a four-dimensional matrix.

ADVERTISEMENTS:

This is done in the following way:

1. What attributes are used to define the product? (For example, for a car it could be brand name, comfort or economy. For a house it could be location, construction and area.)

2. How much of the attribute is present in the product? (Is the car more economical than other cars in the same category?) This is really the value of the attribute and its perception in the customer’s mind. Another example could be of airlines, where passenger safety is of prime concern. However, airlines never talk about this aspect as it is taken for granted. They prefer to talk about ease of getting their tickets, food, in-flight service and entertainment and easy check-in. And customers form attitudes on the basis of these attributes.

3. What is the relative importance of each attribute in the overall product performance? For instance, in the airline business is in-flight service more important than ease of getting tickets?

ADVERTISEMENTS:

4. Do customers weigh each of the attributes to reinforce their perception of overall product performance? How much weightage is given to each of the attributes and does it differ from customer to customer, or is it product specific?

At this stage students should do an Attributes-Perception study for different products to find out how customers’ perceptions and preferences are formed.

It will be found that different customers have different yardsticks for measuring the various attributes. They trade off one against the other while making purchase decisions, as can be seen from the following example. Some people buy a car for its brand name, e.g., Mercedes. Some buy car for speed and power, and some due to fuel efficiency. Many look for several of the attributes in some order of importance. This is called the Dictionary Rule.

According to this rule, if a customer finds the first or the most important attribute to be equally present in two products, and then he looks for disparity in the next level attribute. He keeps doing so till he finds on attribute where there is a difference in the two products. (When you look for a word in a dictionary you first match the first letter then the next and so on, till you find the exact word, hence the name.)

ADVERTISEMENTS:

Multi-attribute analysis helps sellers understand customers who represent identifiable segments in terms of their perceptions and preferences.

Let us consider the levels of competition, or competitors’ hierarchy. A competitor can be defined as the seller who competes for the same customer rupee in the widest competition level. Narrowing it down competitors are those who sell the same products from the same industry. Further narrowing the definition would be the market segment competitors.

To clarify the above let us take the banking business. At the first level would be the banking system, which would include banks, financial institutions, non-banking financial institutions, merchant bankers and moneylenders. At the second level would be banks that cater to customers with a few banking products. At the third level would be banks in the same town or the same street.

That competition is becoming diversified can be seen from the following:

1. Banking services have competition from software companies now, as a lot of online Internet banking is being done with the help of software.

2. Used cars compete with new cars.

ADVERTISEMENTS:

It is therefore possible to define competition by analysing customers’ data.

It can be done as given below:

i. Define the product.

ii. Let the prospective customers decide the possible uses and benefits, as many as they can imagine the product to be possessing. Can they think of other ways of getting the same benefits? This way firms can get differential competitive analysis from the customer’s viewpoint.

iii. The customers should determine the products, whose performance is satisfactions, and the benefits which they accrue from the product’s use.

iv. The data thus obtained can be listed as per the priority given by the customers.

ADVERTISEMENTS:

The data will provide the firm with information on the competitors for each product in the same range as the firm itself.

Summarising it can be said that, Competitors’ analysis requires the prudent use of secondary and primary information to determine current and likely strategies. Customers can be used to classify uses and benefits of products and to rank competitors.

Let us see the assets and skills grid for competitors.

These can be divided into two parts:

1. Primary – Product development, product quality, product manufacturing cost, product differentiation, customer satisfaction and market share.

2. Secondary – Flexi-production, financial muscle, sales force, distribution network, brand image/equity, advertising and promotion, quality of service and growth of the market for the product.

Strategic Marketing Planning Process – 4 Important Steps

Strategic planning can be defined as the process of developing and maintaining a strategic fit between the organisation’s goals and capabilities and its changing marketing opportunities.

ADVERTISEMENTS:

Strategic planning sets the stage for the rest of the planning in the firm.

There are four steps to the strategic planning process:

1. Defining a clear company mission.

2. Setting supporting company objectives.

3. Designing a sound business portfolio.

ADVERTISEMENTS:

4. Planning and coordinating marketing and other functional strategies.

Step # 1. Defining the Company’s Business and Mission:

An organisation exists to accomplish something. When management senses that the organisation is drifting, it is time to renew its search for purpose by asking –

a. What is our business?

b. Who is our customer?

c. What do customers value?

d. What should our business be?

According to Peter Drucker, every organisation must ask an important question “What business are we in?” and get the correct and meaningful answer. For example, Indian Railways will make a big mistake if they think they are in the business of moving trains and wagons; whereas they are actually in the business of transportation and material handling system.

The first step in the strategic planning process is defining the company mission.

(i) Mission statement is a statement of the organisation’s purpose – what it wants to accomplish in the larger environment.

(ii) A clear mission statement acts as an “invisible hand” that guides people in the organisation.

(iii) Market definitions of a business are better than product or technological definitions. Products and technologies can become outdated, but basic market needs may last forever.

(iv) A market-oriented mission statement defines the business in terms of satisfying basic customer needs.

The mission statement must avoid being too narrow or too broad.

Mission statements must:

(i) Be realistic

(ii) Be specific

(iii) Fit the market environment

(iv) Indicate distinctive competencies

(v) Be motivating.

A strategic vision is a road map of the company’s future – providing specifics about technology and customer focus, the geographic and product markets to be pursued, the capabilities it plans to develop, and the kind of company that management is trying to create.

An organisation’s Mission states what customers it serves, what needs it satisfies, and what type of product it offers.

A company’s mission statement is typically focused on its present business scope – “who we are and what we do”; mission statements boldly describe an organisation’s present capabilities, customer focus, activities and business makeup.

Some Mission Statements:

i. Unilever – “The mission of our company, as William Hasketh Lever saw it, is to make cleanliness commonplace, to lessen work for women, to foster health, and to contribute to personal attractiveness that life may be more enjoyable for the people who use our products.”

ii. Mckinsey & Co. – “To help Business Corporations and governments to be more successful”.

iii. Cadbury India – “To attain leadership position in the confectionery market and achieve a strong presence in the food drinks sector.”

iv. Reliance Industries – “To become a major player in the global chemicals business and simultaneously grow in other growth industries like infrastructure.”

v. Ranbaxy – “To become a $1 billion research-based global pharmaceuticals company”.

Step # 2. Setting Company Objectives and Goals:

The company’s mission needs to be turned into detailed supporting objectives for each level of management. This second step in the strategic planning process requires the manager to set company goals and objectives and be responsible for achieving them.

i. The mission leads to a hierarchy of objectives including business and marketing objectives.

ii. Objectives should be as specific as possible.

Objectives are an organisation’s performance targets – the results and outcomes it wants to achieve. They function as yardsticks for tracking an organisation’s performance and progress.

Strategic objectives relate to outcomes that strengthen an organisation’s overall business position and competitive vitality; financial objectives relate to the financial performance targets management has established for the organisation to achieve.

Objectives are open-ended attributes that denote the future state or outcomes, whereas goals are close-ended attributes, which are precise and expressed in specific terms.

Role of Objectives:

i. Objectives define the organisation’s relationship with its environment.

ii. Objectives help an organisation pursue its mission and purpose.

iii. Objectives provide the basis for strategic decision making.

iv. Objectives provide the standards for performance appraisal.

Characteristics of Objectives:

i. Objectives should be understandable

ii. Objectives should be concrete and specific

iii. Objectives should be related to a time frame

iv. Objectives should be measurable and controllable

v. Objectives should be challenging

vi. Different objectives should correlate with each other

vii. Objectives should be set within constraints

Key questions for an organisation to answer:

An organisation seeking success in business must answer important questions dealing with the concepts of mission, objective, strategy and tactics.

Step # 3. Designing the Business Portfolio:

The third step in the strategic planning process is designing the business portfolio.

i. The business portfolio is a collection of businesses and products that make up the company.

ii. The best business portfolio is the one that best fits the company’s strengths and weaknesses to opportunities in the environment.

In order to design the business portfolio, the business must:

i. Analyse its current business portfolio and decide which business should receive more, less, or no investment.

ii. Develop growth strategies for adding new products or businesses to the portfolio.

Analysing the Current Business Portfolio:

In order to analyse the current business portfolio, the company must conduct portfolio analysis (a tool by which management identifies and evaluates the various businesses that make up the company).

Two steps are important in this analysis:

(i) The First Step is to identify the key businesses (SBUs). The Strategic Business Unit (SBU) is a unit of the company that has a separate mission and objectives and which can be planned independently from other company businesses. The SBU can be a company division, a product line within a division, or even a single product or brand.

Three characteristics of the SBU:

a. Single business or collection of related businesses that can be planned for separately

b. Has its own set of competitors

c. Has a manager who is responsible for strategic planning and profit

(ii) The Second Step is to assess the attractiveness of its various SBUs and decide how much support each deserves.

The best-known portfolio planning method is the Boston consulting group (BCG) matrix:

a. Using the BCG approach, where a company classifies all its SBUs according to the growth-share matrix.

b. The vertical axis, market growth rate, provides a measure of market attractiveness.

c. The horizontal axis, relative market share, serves as a measure of company strength in the market.

Using the matrix, four types of SBUs can be identified:

a. Stars are high-growth, high-share businesses or products (they need heavy investment to finance their rapid growth potential).

b. Cash Cows are low-growth, high-share businesses or products (they are established, successful, and need less investment to hold share).

c. Question Marks are low-share business units in high-growth markets (they require a lot of cash to hold their share).

d. Dogs are low-growth, low-share businesses and products (they may generate enough cash to maintain themselves, but do not have much future).

Generally, a SBU introduces a new product into a high-growth market, which will obviously have a low market share. The SBU has to do substantial marketing expenditure to increase the product’s market share so that it becomes a “star” product.

When the industry growth rate again declines, the SBU generally stops all marketing expenditure on this product which gives the SBU lot of cash as the expenditure is substantially reduced while the revenue is still very high. This surplus fund generated by “cash cows” are utilised for development of new products and establishing these new products in the market.

Once it has classified its SBUs, a company must determine what role each will play in the future.

The four strategies that can be pursued for each SBU are:

i. Build – Here the objective is to increase market share, if necessary, even foregoing short-term earnings to achieve this objective.

ii. Hold – Here the objective is to preserve market share.

iii. Harvest – Here the objective is to increase short-term cash flow regardless of long-term effect.

iv. Divest – Here the objective is to sell or liquidate the business because resources can be better used elsewhere.

As time passes, SBUs change their positions in the growth-share matrix. Each has its own life-cycle.

The growth-share matrix has done much to help strategic planning study; however, there are problems and limitations with the method.

i. They can be difficult, time-consuming, and costly to implement.

ii. Management may find it difficult to define SBUs and measure market share and growth.

iii. They focus on classifying current businesses but provide little advice for future planning.

iv. They can lead the company to placing too much emphasis on market-share growth or growth through entry into attractive new markets. This can cause unwise expansion into hot, new, risky ventures or giving up on established units too quickly.

In spite of the drawbacks, most firms are still committed to strategic planning.

Developing Growth Strategies:

Companies should always be looking to the future. One useful device for identifying growth opportunities for the future is the product/market expansion grid. The product/market growth matrix (proposed by Igor Ansoff) is a portfolio-planning tool for identifying company growth opportunities through –

(i) Market Penetration – Making more sales to present customers without changing products in any way. Supporting tactics might include greater spending on advertising or personal selling.

(ii) Market Development – A strategy for company growth by identifying and developing new markets for current company products.

(iii) Product Development – A strategy for company growth by offering modified or new products to current markets.

(iv) Diversification – A strategy for company growth by starting up or acquiring businesses outside the company’s current products and markets. This strategy is risky because it does not rely on either the company’s successful product or its position in established markets.

As market conditions change over time, a company may shift product-market growth strategies. For example, when its present market is fully saturated, a company may have no choice other than to pursue new markets.

Step # 4. Planning Marketing and Other Functional Strategies:

The relationship of marketing to the other business functions is often misunderstood.

(i) Marketing alone cannot produce superior value for the consumer. All company departments must work together to accomplish this.

(ii) Each department is a link in the value chain (a major tool for identifying ways to create value for the customer).

(iii) A company’s value chain is only as strong as the weakest link.

(iv) Marketers are challenged to find ways to get all departments to “think customer.”

In its search for competitive advantage, the firm needs to look beyond its own value chain and into the value chains of its suppliers, distributors, and ultimately customers. This “partnering” will produce a value delivery network.

Strategic Marketing Planning Process – 7 Main Elements Required in the Process of Strategic Planning

Strategic planning or strategising is essentially a task of choice, i.e., to decide what to do and what not to do to achieve organisational goals. Every company has to do strategic planning, although the nature and extent may vary.

The process of strategic planning has a series of steps which may vary, although a basic process may be built conceptually around key elements as shown below:

1. Inputs:

The starting point for strategic planning is taking into cognizance the availability of resources. The resource identification would fetch as an input for moving ahead towards developing appropriate strategy. It identifies the premises of action and delineates the arena of operations.

2. Organisational Profile:

Company’s profile basically guides as to what is the current level of the company and where does it want to go. By scanning the existing company profile, top level management primarily wants to have an insight into the current financial position of the company, existing product line, and the domain of its operations and relative competitive position of the company.

3. Top Management Orientation:

Another important input for strategic planning is the attitude of top level management. The onus of strategy formulation lies primarily on top level managers of the company. They are the ones responsible for shaping and carving the future. Thus, what strategy is formulated depends a lot on top management’s values, attitude towards risk, perceptions and farsightedness.

4. Purpose and Major Objectives:

Once a base has been developed in terms of knowing what we have (identification of resources), what we are (company profile) and how we behave (top management orientation), after this, the purpose of an organisation and detailed overall objectives are determined. At this step of strategy formulation, ends towards which all other activities, of an organisation will converge are decided.

5. Scanning of Environment:

Environment scanning refers to the process of monitoring the various factors which may affect the functioning of an organisation.

In other words, environment analysis comprises of:

i. Identification of environmental factors that influences the company individually and collectively;

ii. Determining the potential impact of such factors on the company; and

iii. Identification of consequent problems and opportunities.

George Luffman says, “It is imperative not only to understand the nature of the environment and its dynamics but also to be aware of those environmental variables to which the firm is more sensitive.”

Environment of an organisation can be divided into:

(i) External Environment:

It comprises of all those factors which have a bearing on the functioning of an organisation and are beyond the control of an individual organisation. Both present and future environment scanning is to be done with the end result of identification of opportunities and threats.

External environment analysis is normally called as PEST analysis as it consists of:

a. Political factors;

b. Economic factors;

c. Social factors; and

d. Technological factors.

(ii) Internal Environment:

It comprises of all those factors which affect the functioning of the organisation and are internal and within the control of respective organisation. Internal environment scanning is done for the identification of internal strengths and weaknesses.

Internal environment may comprise of:

a. Production policy;

b. Labour-management relations;

c. Management capability;

d. Nature of R& D initiatives.

6. Development of Alternative Strategies:

Next logical step of strategic planning is to develop the alternative strategies aiming at attainment of organisational objectives. Within the given organisational framework and objectives to be attained, an organisation may adopt various strategies. For example, if a company wants to expand, it may adopt a diversification strategy, growth strategy, or a strategy of going international may be adopted.

7. Evaluation and Choice of Strategies:

The most important and crucial step of strategic planning is the selection of strategy to be adopted. This step requires a very careful and critical evaluation of alternative strategies developed.

According to Donald Harvey, while evaluating strategies, one should avoid committing the following mistakes:

i. Not analysing carefully the impact of decisions on organisation objectives;

ii. Tendency to ignore problems in the hope that they will disappear;

iii. Insufficient evaluation of alternatives; and

iv. Avoidance of risk.

Strategic Marketing Planning Process – 3 Phases of Strategic Planning Process

The strategy planning process encompasses three phases, which together involve a number of systematic steps.

These three phases are:

I. Strategy Formulation

II. Strategy Implementation; and

III. Strategy Evaluation and Control

Phase – I Strategy Formulation:

The different issues involved in strategic planning are:

i. What new business to enter?

ii. What business to abandon?

iii. How to allocate resources?

iv. Whether to enter international markets?

v. Whether to expand operation or diversify?

vi. Whether to merge or form a joint venture?

vii. How to avoid a hostile takeover?

Keeping in mind the different issues strategy formulation involves four important steps.

They are:

1) Determination of mission and objectives.

2) Analysis of strength and weakness, opportunities and threats (SWOT)

3) Generation of alternative strategies, and

4) Choosing the most appropriate strategy.

1) Determination of Mission and Objectives:

The mission defines the broad social purpose and scope of the organization, whereas objectives more specifically define the direction to achieve the mission. Objectives help translate the organizational mission into results. While objectives may be generic in their expression, goals set specific targets to be achieved with a time frame.

2) SWOT Analysis:

Once the mission or the goal is determined strategic planning is concerned with the process as to how the goal is to be achieved. In this regard, the foremost step in the process of adopting any strategy is to assess the present strategy with reference to its strengths and weaknesses.

While assessing the strategy, the strategic policies adopted by competitors in the line should be considered with all seriousness. In strategic planning, the term strategic is used to mean, “Pertaining to the relation between the firm and its environment”. This indicates the role of SWOT in strategic planning.

The strengths and weaknesses of the firm and opportunities and threats in the environment will indicate the portfolio strategy and other strategies it should pursue. An organization should address questions such as – what are the changes, including possible future changes, in the environment which have implications for us and how should we respond to them? How can we mass up our strengths?

3) Strategic Alternatives:

Given the mission and objectives and having analyzed the strengths and weaknesses of the firm and the environmental opportunities & threats, the strategists should proceed to generate possible alternative strategies. The strategic planning should see that the functional operations under any circumstances are not affected.

This object can be fulfilled only when original strategies and alternatives are thought of well in advance. No business problems can be solved exclusively by strategists but the part played by alternative strategies is equally important. From the practical point of view, the original strategies as well as the alternative strategies are equally important.

Whatever be the alternative suggested, they should be evaluated from time to time to judge their effectiveness as a new course of action. While evaluating, the management should bear in mind various factors such as risk, availability of human and financial resources etc.

This will provide an additional opportunity to the strategist to know the exact impact on the operational functions. There are thus, a number of strategic options. It is necessary to consider all possible alternatives to make the base for choice wide.

4) Choosing the Most Appropriate Strategy:

The purpose of considering different strategic options is to adopt the most appropriate strategy. This necessitates the evaluation of the strategic alternatives with reference to certain criteria. Criteria such as suitability, feasibility and acceptability are commonly employed to evaluate the strategic options.

The ultimate aim should be to achieve the goals at minimum cost without any complexities. So, the general practice is to choose a strategy out of alternative strategies, which are likely to give optimum results, and thereby they can be the best net for the organization. No final selection is to be made unless each model of strategies is thoroughly evaluated with reference to the corporate objectives.

Phase II – Strategy Implementation:

Operationalising the strategy requires transcending the various components of the strategy to different levels; mobilization and allocation of resources; structuring authority; responsibility, tasks and information flows; and establishing policies. Implementation of strategy involves a number of administrative and operational decisions.

Characteristics of this stage:

i. Action stage.

ii. Considered to be the most difficult stage and requires personal discipline, commitment and sacrifice.

iii. Depends upon managers’ ability to motivate employees, which is more an art than a science.

iv. Interpersonal skills are especially critical for successful strategy implementation.

Phase – III – Strategy Evaluation and Control:

Evaluation and Control is the last phase of the strategic planning process. The objective is to examine whether the strategy as implemented is meeting its objectives if not to take corrective measures. Continuous monitoring of the environment & implementation of the strategy is essential. The evaluation provides the feedback for modifications.

Three fundamental strategy-evaluation activities are:

i. Reviewing external and internal factors that are the bases for current strategies,

ii. Measuring performance, and

iii. Taking corrective actions.

Strategic Marketing Planning Process – Steps to Provide Focus and Direction to Strategic Marketing Planning (3 Stages)

Follow these steps to provide focus and direction to your marketing planning process:

Stage # 1. Situation Analysis:

A situation analysis, according to the American Marketing Association (AMA), is “the systematic collection and study of past and present data to identify trends, forces, and conditions with the potential to influence the performance of the business and the choice of appropriate strategies.” The situation analysis involves a thorough review of your industry, your market and your competition.

i. Industry Analysis:

What industry does your organization consider itself part of? Are you in the health care industry? The banking industry? The textiles industry? The transportation industry?

What is the status of that industry in terms of its position in the marketplace? The airline industry, for example, has fallen on tough times recently and is struggling to cut costs in a competitive marketplace while retaining and gaining customers. Certain segments of the health care industry, on the other hand, are experiencing high demand from an aging population with growing health care concerns.

Understanding the industry you are in, the history of that industry, its current challenges and the potential for future growth are critical inputs into the marketing planning process.

ii. Market Analysis:

What is a market? It’s the group of people who have purchased or are likely to purchase the product or service you have to offer. Markets are based on customer needs. Those needs are driven by both demographics and psychographics.

Demographics, according to the AMA is, “The study of total size, sex, territorial distribution, age, composition, and other characteristics of human populations; the analysis of changes in the make-up of a population.”

Psychographic analysis, by contrast, is “a technique that investigates how people live, what interests them, and what they like; it is also called life style analysis because it relies on a number of statements about a person’s activities, interests, and opinions.”

By understanding the unique attributes of the market segments you are targeting based on both demographic and psychographic characteristics you are better able to develop messages that are meaningful, relevant and likely to impact behaviour.

In addition, careful analysis of the market helps you to identity ways in which you are most likely to be able to connect with your target audiences through the use of specifically directed media – e.g. younger adults are more likely to watch MTV; older adults may watch VHI or CMT.

Markets shift over time. The 12-year-old boy who is not currently a representative of the market for a sport utility vehicle (SUV), will become part of that market at some future date.

Conversely, the 21-year-old man who used to purchase your Transformers action figures is no longer part of your market.

These are demographic changes that impact the market. There are psychographic factors at play as well. For example, that 21 -year-old man who used to purchase your Transformers, could become part of your market again at some future point where his own children develop an interest in these toys. Similarly, a young woman of 22 who lands her first professional job will become part of a market interested in career clothing.

This interest isn’t based on age or sex (demographic traits) but on lifestyle changes. Other lifestyle changes could include transitioning in or out of college, the birth of a child, illness, etc.

Psychographic attributes also include viewpoints or beliefs – your product might have more appeal, for example, to individuals who are conservative than those who are liberal, or to individuals who enjoy sports as opposed to those who prefer quiet activities like reading.

The more specifically you can define your target market, the more effectively you can communicate value to that market.

iii. Competitive Analysis:

Competitive analysis involves looking at your competition – both direct and indirect. The analysis is designed to help you determine how your organization is doing relative to its competitors, considering a number of factors including- sales and profit figures, price, product attributes, customer service attributes, market position, etc.

You will want to explore your competition’s strengths and weaknesses to determine how you might position your own products and services to compete most effectively.

iv. Internal Analysis:

In addition to looking at external environmental factors that impact your organization, you will also want to explore internal factors and gather information relative to your existing products and services, their sales volumes, profitability, customer mix (who buys which products), data on customer complaints and customer perceptions, etc.

In addition, it can be helpful to meet with or interview key people within the organization – product line managers, customer service department heads, or others who can provide insights related to product/service demand, customer needs and perceptions.

Give adequate time and attention to the situation analysis. The work you do here will provide you with the solid information and background you need to make sound and appropriate decisions about the marketing mix elements that will drive your marketing activities.

Stage # 2. SWOT Analysis:

The information you gather through the situation analysis process is used in the development of a SWOT analysis – a look at your organization’s marketing efforts and the strengths, weaknesses, opportunities and threats that you are facing. The SWOT analysis can be a helpful starting point for the identification of objectives/goals, strategies and tactics.

The first step is to gather the appropriate people – organizational leaders as well as front line managers and staff who have direct knowledge and impact on marketing efforts. Again, remember that “marketing” is an organization-wide function, not just confined to what might be formally called the “marketing department” in your organization.

Set aside ample time – at least four hours – for this process. Your focus should be on identifying the strengths, weaknesses, opportunities and threats of your organization relative to the marketing function from the broadest perspective – product, place, price, and promotion.

Following are some guidelines for conducting the SWOT analysis:

a. Set ground rules – The development of a SWOT analysis follows the same principles as any brainstorming session. Participants must feel free to share their impressions and opinions and not be hampered by strong and sometimes off-the-mark “opinion leaders.” Appropriate ground rules might include, all “hats are left at the door” everybody’s opinion is valued, regardless of formal rank and position; all input will be captured, without editing or debate; nothing is sacred – participants must feel free to express what might be minority opinions or to challenge “sacred cows” without fear of censure or future; one person speaks at a time – the facilitator identifies the speaker.

b. Proceed in an orderly fashion, starting first with strengths (internal), weaknesses (internal), opportunities (external) and threats (external). Capture input until ideas have been exhausted. After the entire list is completed, ask the group to review and consider if any additions have come to mind.

c. Reproduce the list and provide to the group for review. The SWOT analysis is a good tool for identifying the strategic opportunities and challenges that face your organizations. These opportunities and challenges can then be used as the basis for developing specific goals and objectives that will drive the strategies and tactics that become your operational marketing plan.

d. Through the SWOT analysis you’ll identify a list of the opportunities and challenges facing your organization. This list, by the very nature of the brainstorming process, is probably quite long and lacking in focus. Your next step is to use the same brainstorming process to identify and prioritize the most critical strategic marketing opportunities and challenges that impact your organization. Since resources in every organization are limited you will be challenged to keep the list to a manageable number – ultimately no more than 5-7 opportunities and/or challenges that you will tackle.

e. To narrow the list, you might use a simple ranking process to help reach group consensus. One commonly used method is to give each participant a certain number of “dots” that they can use to vote on items on the list (one vote per item). The items that have the highest number of votes then become the top priorities. The group reviews the results and the facilitator asks for consensus about the validity of the rankings. The top 5-7 are then selected for organizational focus.

Stage # 3. Quantifiable Objectives/Goals:

Once your opportunities and challenges have been identified, the next step is to develop objective/goal statements that indicate the “end state” you hope to achieve to address the opportunities and challenges you’ve identified. For example, if one of the challenges you identified was a high number of product returns, your objective might be to reduce that number of returns to some specific point.

If one of the challenges you identified was reducing the level of customer defections, you would need to identify what level of defections would make you feel that you had addressed this challenge.

It’s critical that each of your objectives/goals has a specific, targeted “end point.” This both helps you determine the amount of resources that must be allocated to achieve the goal and also provides an indicator of success. A simple example will illustrate; Your best friend says that this year, she’d like to have more money. You hand her one dollar. She now has more money. Chances are, though, that’s not what she had in mind. When you’re setting goals, state what you do have in mind or you’re likely to underachieve.

Specific, quantifiable goals are critical. Simply wanting “more” sales doesn’t provide enough specific direction to allocate resources – money and effort – appropriately. How much more?

Your goals need to take into consideration where you are today and where you would like to be (specifically!) so you can focus on closing that gap.

Not all goals are profit, volume or dollar related. While you will almost certainly have goals that are expressed in terms of sales volume or market share, you may also have qualitative goals that are equally meaningful. For example, you may wish to increase consumer awareness of products and services or gain “share of mind” among your target audience. You might have a goal related to the development of specific training skills among direct sales staff.

With any of these goals, however, the key is to ensure that your goal statement is expressed in such a way that it is clear what the desired end result is.

A helpful acronym that you can use to evaluate the appropriateness of your objective/goal statements is SMART. The SMART acronym is used to develop goals that are most likely to achieve results – goals that are Specific, Measurable, Attainable, Realistic and Time Framed.

A specific goal is one that clearly identifies an end point. “Raise consumer awareness of our products” is not a specific goal. “Raise consumer awareness from…… to….. by year end” is. Be specific by stating exactly what it is you wish to achieve.

A measurable goal provides a way for you to know if you have hit your target. Sales goals, for example, that clearly specify the unit and dollar volume expected, by product, are measurable.

Goals need to be attainable. Suppose you indicate that you wish to grow market share by 25 percent in the next year. That’s specific. It’s measurable. But, if your market is saturated by significant competitors and growth is limited in terms of new potential customers entering the market, that goal may not be attainable.

Even if your goal is attainable, it may not be realistic. For example, suppose that growth of 25 percent in market share is an attainable goal given your market area, competitive environment and consumer demand, but your product development group is unable to produce enough product to meet that demand even if it is realized. This would not be an attainable goal.

Finally, goals need to be time framed. When will you achieve the goal? This week? Three months? One year? Longer?

Establishing SMART objectives will help to ensure that staff understand what’s expected of them, that the expectations are reasonable and, perhaps most importantly, that they will know when they meet those expectations. An objective of achieving “more” can lead to frustration and the sense of chasing one’s tail to achieve something that seems always beyond reach.

SMART objectives, in addition to helping ensure achievement of goals, also serve to increase employee satisfaction and morale.

Stage # 4. Strategies and Tactics to Meet Objectives/Goals:

Objectives/goals identify the end points you hope to achieve. The next step is to determine how you will achieve those end points. This involves developing strategies and tactics.

Strategies are broad statements of activity. Tactics are more specific statements of activity that are actionable. For example, again looking at the objective of reducing returns, one strategy might be to, “identify and quantify reasons for returns.” Tactics related to that objective might be, “review return data,” or “survey customers who have returned products.”

Based on the information obtained, another strategy might be, “make improvements to product as indicated by customer inputs.” An appropriate tactic could be, “review marketing communications materials to ensure that product descriptions are accurate.”

When identifying strategies and tactics, it’s important to be realistic. There is probably a wide array of activities that you could undertake to achieve your objectives, but those activities may be hampered by budget and staff resources. You may wish to start this process by brainstorming all of the various activities that you might undertake and then go back to review these activities and prioritize them based both on the potential for having the most impact and the availability of resources to accomplish the tasks.

Stage # 5. Responsibility/Accountability for Completing Tactics:

Having a plan is a good first step. Assigning accountability for the accomplishment of that plan is critical. Unless specific areas of the organization – and individuals within those areas – recognize that they are being held responsible and accountable for completing specific tactics that drive your ability to achieve your strategies and objectives, you will not be successful in achieving your marketing goals.

Assigning responsibility involves more than simply putting department names or individual names in your plan. You need to ensure that you have buy-in and commitment from those departments and individuals to the tasks assigned. This may involve discussion at the senior management level of the organization and negotiation between organizational leaders to gain agreement on where the company’s human resources should be focused.

It should also involve, of course, conversation with the department and individuals named to ensure that they understand the expectation, realize the impact their involvement has on the achievement of the marketing plan objectives and are personally committed to helping to achieve those objectives.

Stage # 6. Develop a Budget:

In addition to identifying the people resources needed to achieve your marketing plan, you will also need to address the budget resources needed. There are a couple of different ways that organizations approach the marketing budget process and a certain amount of debate about which methods are most appropriate.

One common method is to allocate marketing budget based on a percentage of revenue. So, for example, if your organization anticipates revenue of $10 million, and allocates 5 percent to marketing expense, you would have a budget of $500,000 for marketing activities. The problem with this approach, of course, is that perhaps if you were to spend $1 million on marketing, you could raise revenues by some additional amount. Critics of this approach suggest that it limits market potential.

Some industries base marketing budgets on industry norms that are available through professional trade groups or other publicly available information. Another approach involves identifying what the competition spends on marketing and then matching or exceeding that amount.

Obviously that can be challenging because it’s difficult to determine how much the competition is spending and there are other operational factors that impact those expenditures (distribution channels, for example). And, again, there are critics of these approaches because they are based on the assumption that the competition knows what it’s doing and should be emulated. Of course, that’s not necessarily true.

Budgets are often established based on historical spending. The marketing budget was X last year, so this year it will be X plus some amount.

Zero-based budgeting is also an option. Basically, this involves starting from scratch and, in looking at the identified objectives/goals, strategies and tactics in the marketing plan determining the budget that will be necessary to accomplish the plan.

The budgeting process clearly involves a combination of science and art. A combination of the above methods is most likely to achieve the best results. Identifying the costs associated with various aspects of the marketing plan can provide you with the basis for a certain level of expenditures, as can a review of past marketing expenses – and results.

The development of creative materials is obviously an area that can involve costs ranging from hundreds to millions of dollars depending on the size of your market and the “production values” required to adequately convey your organization’s desired marker position.

The local car dealer may be able to spend a few hundred dollars to produce a spot locally, but Toyota Corporation is going to spend far more to ensure that it conveys the appropriate image in its national advertising.

Receiving approval for your marketing budget will be based primarily on your ability to justify the expenditures that you’re requesting. That means doing your homework in terms of providing background information that may include details on marketing spending in your industry, by your competitors and by your organization, in addition to information on the actual costs of various activities you intend to engage in.

The ability to provide objective data to support the effectiveness of your marketing efforts (more on this later) will also help to leverage your ability to receive approval for the marketing expense budget.

Stage # 7. Ongoing Monitoring and Adjustment:

The marketing plan should be a “living document” and not “credenza-ware.” The use of a marketing committee or regular meetings with the individuals responsible for achieving the various strategies and tactics in the plan can help to ensure ongoing attention to the plan and its implementation. How will the marketing plan be implemented? Who/what are the resources, people, financial commitments and activities involved in implementing the plan?

Determine how you will monitor and evaluate marketing plan activities, how often you will look for updates and the process required to make any changes in the plan. For example, if the sales department feels that sales objectives are too lofty, what process needs to be undertaken to receive organizational approval to adjust those objectives?

Budgeted goals and activities obviously provide direction to the organization in terms of identifying things that are being done and things that need to be done. By comparing actual and planned results, the marketing team can ensure that it’s on course to meet its objectives and can quickly act to make changes in the plan as evidence suggests that changes need to be made.