Hypothesis of Profit-Maximization: Advantages, Disadvantages and Approaches!

Advantages of Profit-Maximization Hypothesis:

1. Prediction:

The profit-maximization hypothesis allows us to predict quite well the behaviour of business firms in the real world. It does not matter that few firms are maximizers in reality.

What matters is that they behave without too much difficulty and with reasonable accuracy. Further Arguments for the Profit-Maximization Hypothesis.

2. Proper Explanation of Business Behaviour:

The economist relies on the profit- maximization hypothesis because it is useful in explaining and predicting business behaviour.

3. Knowledge of Business Firms:

ADVERTISEMENTS:

Profit motive is the most pervasive force that governs the behaviour of business firms. In the case of small firms facing strong competition from others, they are forced to act as profit maximizers. They must do everything possible to increase sales and reduce costs in order to survive in their competitive environment.

4. Simple Working:

The profit-maximization hypothesis is simple, and there are well- developed mathematical tools of analyzing maximization or minimization problems.

5. More Realistic:

Profit maximization is the single best assumption available and introduction of more “realistic” assumptions complicates the analysis considerably without adding much to the predictive power of the model.

Disadvantages of Profit Maximization/Attack on Profit Maximization:

1. Ambiguity in the Concept of Profit:

It has been pointed out that in the assumption of profit maximization; the concept of profit has never been unambiguously stated. Is it rate of profit, total or net profits that a firm tends to maximize? The three concepts have entirely different implications for price theory.

2. Multiplicity of Interests in a Joint Stock Company:

ADVERTISEMENTS:

It is argued that with the ushering in of corporate form of enterprise, profit maximization goal has a considerably reduced edge; other goals have come to the fore.

3. No Compulsion of Competition for a Monopolist:

As far as a monopolist goes he has no compulsions to maximize his profit. Since the monopolist ordinarily earns above-normal returns, why should he maximize? In imperfectly competitive industries where barriers to entry are effective, the firm ordinarily does not have to walk the tightrope of zero economic profits. Instead, the existence of monopoly power provides wider range of various alternatives than order conditions of perfect competition.

4. Separation of Ownership from Control:

Under the impact of managerial revolution, there has been a considerable divorce of ownership and control. In modern, gigantic corporations little attempt is made either by individuals or by the groups to maximize profits.

Generally, the salaried managers cease to look for profits beyond the level which suffices to pay their salaries and keep the shareholders quiet and the owners are powerless to remedy the situation. In a public corporation set up by statute with no share but only loan capital, the divorce of ownership from control is as complete as imaginable.

ADVERTISEMENTS:

In such cases, it may be asked, what replaces profits in the mangers’ mind. In really very large firms, the managers may only try to minimize costs and avoid losses but have no interest in increasing profits.

5. The Principle of Decreasing Power:

Keeping maximum business power is another common craze among organizers. It is seen in many cases that growth of the firm through increased number of owners is profitable. But the existing owners are unwilling to introduce any more partners.

This is because the greater the number of owners, the lesser is the power in each hand. The diminution of power on account of the introduction of new partners is called the Principle of decreasing Power. In this way, most entrepreneurs owning small firms have strong feeling to stick to a small firm and independent and exercise unrestrained power rather than to invite new owners and enlarge their profits.

6. Stress on Efficiency, not Profit:

In particular cases some other motives become more important than profit maximizing. In many industries, the manager’s aim is the attainment of some non-economic ideal of efficiency such as beauty, size, durability, sharpness of product.

Managers pursue it not only for its own sake but for the good professional reputation it gives them in the trade. In large multi-branch firms, the practice is common to encourage the branches to compete both in buying and selling. Therefore, in place of profit, efficiency is given top priority.

7. Tendency of Following One Trade Only:

It is often seen that businessmen refrain from “integration or other forms of expansion not because they have been calculated to be unprofitable but because “jack of all trades, master of none or some such proverbial wisdom is always there.”

8. Conspicuous Consumption:

It should be noted that the firm is not only a producer but a consumer also. Often firms, to impress their clients and various civil servants visiting it, indulge in what may be called Conspicuous consumption. In this regard it may be noted that this kind of consumption does not go against profit-maximization; profits are first maximized and then spent on non-essential goods. But if the firms indulge themselves, their investment policy cannot be said to be dictated by profitability.

9. Legal Restrictions on Profit-Making:

In mixed developing economies like India, there are very many enterprises—public utilities, development institutions etc. that are legally forbidden to maximize their profits.

ADVERTISEMENTS:

Approaches to the Equilibrium of a Profit Maximizing Firm:

A firm is in equilibrium when it finds no advantage in increasing or decreasing its output. In economic theory, it is generally assumed that a firm’s aim is to maximize profit. Thus a firm is in equilibrium when it is getting the maximum profit. When profit is maximum, there is a particular output and particular price of the product. Every firm makes two major decisions about its business.

1. How much output shall be most profitable for it? How much output to produce under the given cost and revenue conditions?

ADVERTISEMENTS:

2. At which price shall the firm sell its product?

These two decisions are inter-related. In determining the profit maximizing output, a firm must know the price of its product. The price at which the product can be sold in the market depends on how much output is to be sold. Therefore, the equilibrium output and the equilibrium price are determined at the same time.

In finding out the equilibrium output and the equilibrium price for a firm we assume:

(1) The firm wants to maximize profit,

ADVERTISEMENTS:

(2) The firm knows the prices or price, at which it can sell different levels of output,

(3) The firm knows the behaviour of its costs as it changes its output, and

(4) There is no uncertainty regarding price or costs.

Approaches to a Firm’s Equilibrium:

Given that a firm wants to maximize profit and select an output and price for itself, there are two approaches to finding out the equilibrium of the firm.

They are:

1. The Total Revenue:

Total cost Approach. The simplest way to calculate the profit of a firm is to find out the difference between the total revenue and total cost at different levels of output. There will be a particular combination of total revenue and total cost at which the firm’s profit shall be the maximum.

ADVERTISEMENTS:

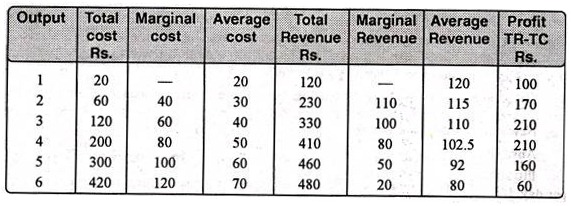

The process of finding out the profit-maximizing output through total revenue and total cost can be explained with the help of a table given below:

2. The Marginal Revenue:

Marginal Cost Approach. Another method of finding out the profit maximizing output and price for a firm is to calculate its marginal revenue and marginal cost at different levels of output. Profit will be maximum at that level of output where marginal cost is equal to marginal revenue.

As long as marginal revenue is greater than marginal cost, it pays to produce more output. On the other hand, if marginal cost is greater than marginal revenue, the firm is suffering a loss. The profit shall be maximum only at that level of output at which marginal cost equals marginal revenue.

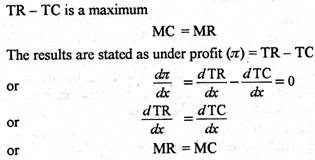

From the above discussion, we can sum up these two approaches of profit-maximization as under:

1. (Total revenue – Total cost) should be the maximum.

ADVERTISEMENTS:

2. Marginal cost Marginal revenue.

In mathematical terms, the two approaches are the same because marginal revenue measures the change in total revenue and marginal cost shows the change in total cost for a given change in output. Where the change in total revenue equals the change in total cost profit is a maximum.

In the table also we have calculated total profit through both the TR — TC approach and the MR = MC approach. Both the approaches give the same profit-maximizing output. It is seen that when the output is four units, the difference between total revenue and total cost is the maximum that is Rs. 210.

At this level of output marginal cost also equals marginal revenue. The marginal cost and marginal revenue are Rs. 80. If output were a unit more, profit would be reduced to Rs. 160. At the level of output of four units, we find that