In this article we will discuss about:- 1. Tariff and Income Distribution—Stopler-Samuelson Theorem Again 2. The Metzler Paradox 3. The Lerner Symmetry Theorem.

Tariff and Income Distribution—Stopler-Samuelson Theorem Again:

The Stopler-Samuelson Theorem dealt with the change in income distribution on account of international trade. These writers stated that free or unrestricted international trade would benefit the relatively abundant factor and hurt the relatively scarce factor. However, if tariff were imposed upon the imports from abroad, the theorem gave the generalisation quite opposite to the one given in the conditions of free international trade.

According to it, the imposition of tariff would raise the real return to the nation’s scarce factor in the both absolute and relative terms whereas the relatively abundant factor would suffer.

Assumptions:

ADVERTISEMENTS:

The analysis related to the effect of tariff upon income distribution, according to this theorem, rests upon the assumptions given below:

(i) Trade takes place between two countries— the home country A and foreign country B.

(ii) The analysis is attempted from the point of view of home country A.

(iii) The trade is connected with two commodities—cloth and steel.

ADVERTISEMENTS:

(iv) Production of these two commodities involves only two factors of production—labour and capital.

(v) Both the productive factors are fully employed.

(vi) There are perfectly competitive conditions in both commodity and factor markets.

(vii) The production function is the first-degree linear homogeneous production function. It implies that production is governed by constant returns to scale.

ADVERTISEMENTS:

(viii) Cloth is labour-intensive, while steel is capital-intensive

(ix) The supplies of two factors—labour and capital are fixed.

(x) Labour is the abundant and capital is the scarce factor in the home country.

(xi) Cloth is exportable commodity and steel is importable commodity for the home country A.

(xii) The terms of trade between two countries are fixed.

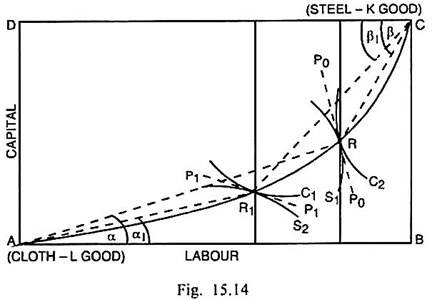

Given the above theoretical structure, the effect of imposition of tariff by the home country upon the income distribution is analysed with the help of Fig. 15.14.

In Fig. 15.14 labour is measured along the horizontal scale whereas capital is measured along the vertical scale. The exportable commodity cloth is labour-intensive or L-good while import-substitute or importable commodity steel is capital-intensive or K-good. A is origin for the commodity cloth and C is the origin for the commodity steel. AC is the non-linear contract curve. The free trade equilibrium situation is R where the isoquant for cloth C2 and the isoquant for steel S1 are tangent to the factor price line P0P0.

K-L Ratio in cloth at R=Slope of Line AR = Tan α

ADVERTISEMENTS:

K-L Ratio in steel at R=Slope of Line CR = Tan β

If country A imposes tariff on importable commodity steel, its domestic price rises. It will discourage import of steel from abroad and induce the home producers to expand the output of steel domestically. It will necessitate the diversion of productive resources from the production of cloth to the production of steel.

Consequently, production of cloth falls while that the steel rises. According to Fig. 15.14, the new trade equilibrium after the equilibrium after the imposition of tariff takes place at R1 where isoquant C1 of cloth and S2 of steel becomes tangent to the new factor price line P1P1.

K-L Ratio in cloth at R1= Slope of Line AR1 = Tan α1

ADVERTISEMENTS:

K-L Ratio in steel at R1 = Slope of Line CR1 = Tan β1

Since Tan α1 < Tan α and Tan β1 < Tan β, there is a fall in K-L ratio in both cloth and steel. Although there is a fall in the K-L ratio in both the commodities, yet the price of scarce factor capital will rise relative to that of the abundant factor labour.

Since there is increased production of capital- intensive commodity steel, the demand for steel rises. Even though reduced output of cloth will release capital to be absorbed in the steel industry, the cloth industry being labour-intensive, the quantity of capital released by it falls short of the additional requirement of it in the steel industry.

As a consequence, the return on the scarce factor capital rises, while the wage rate of labour, the abundant factor, falls. This is also indicated by less steep slope of the factor price line P1P1 after the imposition of tariff. It therefore, follows that tariff is likely to benefit the scarce factor and hurt the abundant factor. It implies that the distribution of income is likely to become more inequitable subsequent to the imposition of tariff.

ADVERTISEMENTS:

Criticism:

The analysis concerning the effect of tariff on the distribution of income has been subjected to criticism by the writers like L.A. Metzler, K. Lancaster, Bo Sodersten and J. Bhagwati on the following grounds:

(i) Neglect of Change in Terms of Trade:

Stopler-Samuelson theorem took the assumption that tariff leaves the terms of trade unchanged. But the imposition of tariff often leads to an improvement in terms of trade for the tariff-imposing country. According to L.A. Metzler, the effect of tariff upon home country’s terms of trade was neglected in the Stopler-Samuelson theorem.

If imposition of tariff leads to an improvement in terms of trade and the export price to import price ratio rises, tariff will make income distribution more equitable and consequently, the Stopler-Samuelson theorem will stand refuted.

(ii) Neglect of Consumption Pattern:

ADVERTISEMENTS:

The inequitable distribution of income after the imposition of tariff has been refuted by K. Lancaster. According to him, the Stopler-Samuelson theory gave that conclusion because of the neglect of consumption pattern of the people in the tariff- imposing country. They may be strongly biased towards the consumption of labour-intensive commodity and make larger import of it.

In such a situation, the imposition of tariff is not likely to benefit the relatively scarce factor but the relatively abundant factor labour. In this connection, Lancaster remarked, “….protection will raise the real wage of labour, if and only if, the country imports the labour- intensive good.”

(iii) Not Universally Valid Generalisation:

The conclusion given by Stopler-Samuelson theorem about the effect of tariff or protection has been attacked by Jagdish Bhagwati as not a universally valid generalization. According to him, there can be three alternative formulations of Stopler- Samuelson theorem concerning the impact of protection on the real wages of factors.

The first formulation is termed as Restrictive Stopler- Samuelson Theorem. It is confined to the case of a prohibitive tariff and excludes non-prohibitive tariff. Given the prohibitive protection, the real wage of the scarce factor will necessarily increase.

The second formulation is referred as General Stopler- Samuelson Theorem. It considers both prohibitive and non-prohibitive tariff. This formulation suggests that protection (prohibitive or otherwise) will necessarily raise the real wage of the scarce factor. The third formulation, called as Stopler-Samuelson- Metzler-Lacaster Theorem gives the conclusion that protection (prohibitive or otherwise) will raise the real wage of the factor in which the imported commodity is relatively more intensive.

ADVERTISEMENTS:

Jagdish Bhagwati formulated the generalisation in these words, “….protection (prohibitive or otherwise) will raise, reduce or leave unchanged the real wage of the factor intensively employed in the production of a good according as protection raises, lowers or leaves unchanged the internal relative price of that good.”

(iv) Neglect of Short Run Effect of Tariff:

The Stopler-Samuelson theorem considers the long run effect of tariff on income distribution, when all factors are mobile between the nation’s industries. In the short run, it is possible that labour is mobile but some capital is specific to the production of cloth (L-good) and some is specific to steel (K-good).

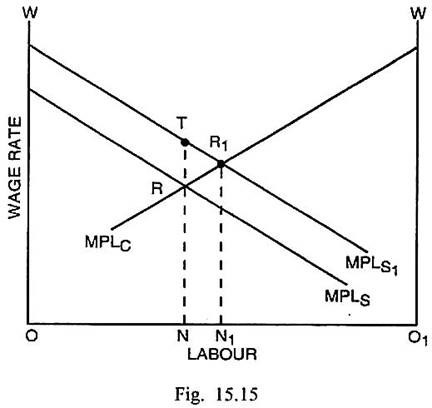

If the home country A is abundant in labour and scarce in capital, the imposition of tariff, given that some capital is specific to products, the real wage is likely to fall in terms of tariff-ridden product steel and to rise in terms of the commodity cloth (intensive in the mobile factor labour). These results are in contradiction to the Stopler-Samuelson theorem. This can be explained through Fig. 15.15.

In Fig. 15.15, OO1 measures the total supply of labour available in country A and the vertical scale measures wage rate. Under free trade, the equilibrium wage rate is RN in both the industries of country A. It is determined by the intersection between the MPL curve related to steel industry (MPLS) and the MPL curve related to cloth industry (MPLC).

ADVERTISEMENTS:

O1N of labour is used in the cloth industry and ON of labour is used in the steel industry. If now country A imposes tariff on the import of steel, its price goes up and the value of MPL rises so that the MPL curve in steel industry shifts upto MPLS1.

The wage rate in steel industry rises from RN to R1N1 and NN1 units of labour are transferred from the production of cloth to that of steel. Since the wage rate rises by less than the increase in the price of steel, wage rate falls in terms of commodity steel and rises in terms of commodity cloth, assuming that price of cloth remains unchanged. Since the specific capital in the production of steel has more labour to work with, the real value of marginal product of capital in steel and rate of interest rise in terms of both the commodities.

On the opposite, since less labour is used with the fixed capital in the production of cloth, the real value of marginal product of capital in cloth and rate of interest fall in terms of commodity steel as well as in terms of cloth. These results are clearly not consistent with the results given by Stopler-Samuelson theorem that the real wage rate falls and the return on capital rises subsequent upon the imposition of import tariff on capital-intensive commodity steel, when labour and capital are both mobile.

Thus Stopler-Samuelson theorem does not take into consideration the short-term effects of tariff.

(v) Possibility of Factor Price Equalisation:

The imposition of tariff can, no doubt, raise the price of imported product. If the tariff-ridden product is intensive in country’s relatively scarce factor such as capital in the less developed countries, tariffs may succeed in creating inflows of scarce factor into the country. The Stopler-Samuelson theorem ignored the effect of tariff upon inflow of factor.

ADVERTISEMENTS:

If there is inflow of the scarce factor, there can be possibility of equalisation of factor prices and the redistributive effect of tariff upon income, as supposed by Stopler and Samuelson, may fail to take place.

(vi) Empirically Not Valid:

The Stopler- Samuelson theorem has not been supported by empirical studies. Some of the prominent studies in this area have been made by the writers like Stephen Magee. William Brock, David Burgess, Cairnes and John Freund.

The Metzler Paradox:

The conclusion given in Stopler-Samuelson theorem that tariff would hurt the abundant factor and benefit the scarce factor was contradicted by L.A. Metzler in his classic article published in 1949. Metzler stated that the imposition of tariff would improve the terms of trade and raise the ratio of price of export good intensive in the abundant factor to the price of import good intensive in scarce factor.

It will raise the price of factor used intensively in the export sector relative to the factor used intensively in import-substitute. Thus Metzler concluded that income distribution will improve in favour of the abundant factor and against the scarce factor. This is known as Metzler Paradox.

According to Metzler, the diversion of productive resources from export industry to import replacement industry, as supposed in Stopler-Samuelson theorem, can take place only if the domestic price of export item falls relative to the import-substitute. However, the imposition of tariff and consequent improvement in terms of trade signifies a rise in the ratio of export price to import price (PX/PM). In such a situation, the price of the abundant factor is likely to rise relative to that of the scarce factor.

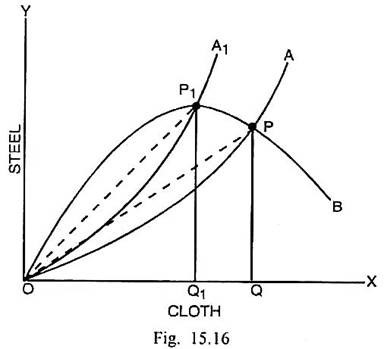

It may lead to the conclusion that the tariff, through improvement in terms of trade will make the income distribution better in the tariff-imposing country. This refutation of Stopler-Samuelson theorem attempted by L.A. Metzler, was called as Metzler’s Paradox. This paradox can be illustrated through Fig. 15.16.

In Fig. 15.16 cloth is the exportable commodity and steel is the importable commodity. OB is the offer curve of the foreign country B. It becomes less elastic and negatively sloped from point P1. In the free trade situation, the exchange takes place at P where OA, the offer curve of the home country A and OB intersect each other. The quantity imported of steel is PQ and that of exportable commodity is OQ.

The terms of trade are measured by (QM/QX) = (PQ/OQ) = Slope of Line OP = Tan α1. The slope of line OP expresses the ratio of price of exportable commodity cloth (PX) to the price of importable commodity steel (PM). When tariff is imposed by country A and its offer curve shifts to the left, the exchange takes place at P1 where the terms of trade are more favourable for the home country. It is measured by PQ/OQ1 slope of line OP1.

The quantity imported has risen after tariff. Since the slope of OP1 is greater than of OP, the ratio of prices of two commodities (PX/PM) is higher after tariff. It implies a rise in wage rate relative to return on capital. Thus tariff benefits the abundant factor labour and hurts the scarce factor capital.

Metzler recognized that expected result from the imposition of tariff was an increase in the price of importable commodity in the home market but the relative price of imports would fall in the home market, when the following condition would apply:

ƞ = (1 – k)

Where η = demand elasticity of country B (foreign country) for the exports of country A (tariff imposing country), (1-k) = The marginal propensity to consume of its exports in country A.

If the demand elasticity of foreign country B for the export of country A is larger than the marginal propensity to consume of the exportables [η < (1-k)], the price of import of country A will rise. If this condition does not apply and [η > (1- k)], the domestic price of imports will instead fall due to tariff. Metzler’s conclusion will hold and Stopler-Samuelson theorem will become invalid.

Larger is the marginal propensity to consume of a country of its exportables, larger will be the amount of its tariff revenues spent on the consumption of exportable good. Thus there will be excess demand for exportable good. Consequently, the price of that good will rise. At the same time, if the foreign country’s demand elasticity for exportable good of tariff-imposing country is low, the demand for this good in that country will fall very slightly despite a rise in its relative price.

So under these circumstances, the excess demand for exportable good due to tariff in the home market will imply a relative fall in the price of imports. If it happens, the return to the factor intensive in the exportable that is abundant factor will rise and the return to scarce factor intensive in the import good will fall. Thus the income distribution, subsequent upon the imposition of tariff, will become favourable to the abundant factor and unfavourable to the scarce factor.

The Lerner Symmetry Theorem:

In this theorem, A.P. Lerner has attempted to explain that ad valorem tax on exports, given a long static equilibrium, has the same effects as an ad valorem tariff on imports set at the same rate. This argument suggests that the effect of the both upon relative price of importables and upon the terms of trade will be the same.

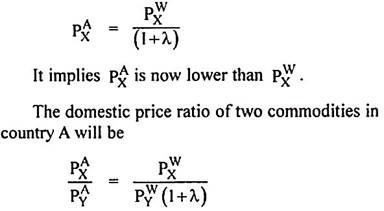

Suppose the home country A exports commodity X and imports commodity Y. It imposes a non-prohibitive tax on export at a rate λ on the commodity X. In this situation, the domestic price of import good, PAY will remain the same as its world price PWY. The domestic price of export good relative to the world price of that good PWX can be expressed through the relation-

Had an ad valorem import tariff at the rate X been imposed on the import of Y, exactly the same result would have followed. The relative price of import good in the domestic market will rise in case of both export tax and an equivalent import tariff. In case the home country was large, the relative price of import good on the world market would have declined.

In case of both export tax and equivalent import tariff, there is a reduction in the volume of international trade. If the revenues from the export tax are spent in the same way as the revenues from import tariff, the two policies must have the same effects.

The symmetry between the export tax and import tariff can be extended also at their respective optimum levels. In this connection, Lerner expressed the opinion that the optimum export tax will also be identical to the optimum import tariff. While the optimum export tax exploits the monopoly power of the country in the export good, the optimum tariff exploits the equivalent monopsony power of the country in the market for import good.

There is similar symmetry between subsidy on exports and equivalent subsidy on imports. These two measures will reduce the relative price of import good in the home market. In case of the both, there will be increase in the volume of exports and imports.

In case the home country is large, each one of the two measures will increase the relative price of the import good on the world market. However, even for a large country subsidies of both types can lead to reduction in the level of welfare. It happens because either of the two subsidies will turn the terms of trade against the home country.