The Union Government’s budget has two broad components, viz;

(a) a revenue budget which shows estimated revenues and disbursements on revenue (current) account,

(b) capital budget, which is an estimate of receipts and disbursements on capital account. The estimated receipts on revenue account fall into two broad groups, viz. tax revenue and non-tax revenue.

Tax revenue is derived from the following three sources:

ADVERTISEMENTS:

(i) Taxes on incomes,

(ii) Taxes on property and capital transactions, and

(iii) Taxes on commodities and services.

Non-tax revenue is derived from the following sources:

ADVERTISEMENTS:

(i) Fiscal and other services,

(ii) Interest receipts,

(iii) Profits and dividends of public sector enterprises, and

(iv) General services.

ADVERTISEMENTS:

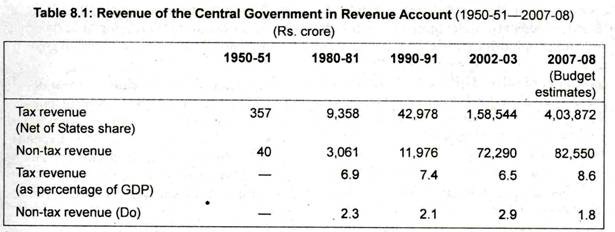

Table 8.1 shows the main trends in the revenue of Central Government for selected years:

From a mere Rs. 397 crore in 1950-51, the Central Government’s revenue has increased to Rs. 4,03,872 crore in 2007-08. In fact, during the last 17 years (1990-91 and 2007-8) tax revenue has increased by almost 10 times.

Further, tax revenue as a percentage of GDP showed a consistent rise from 7.4 p.c. to 8.6 p.c. between 1990-91 and 2007-08. Despite tax reform measures introduced step by step since 1991, tax revenue as per cent of GDP showed a decline between 1990-91 and 2002-03. There has also been an improvement in non-tax revenue between 1990-91 and 2002-03 with ups and downs in in-between years. It declined to 1.8 p.c. by 2007-08.

The phenomenal increase in the revenue of the Central Government is attributable to three factors:

(i) Introduction of new taxes

(ii) Raising the rates of existing taxes,

(iii) Greater realisation of tax revenue,

(iv) Widening of the tax base and improving tax compliance, and

ADVERTISEMENTS:

(v) Price inflation.

More and more commodities have been brought under the excise duty and/or sales tax/VAT. Moreover, rates of such taxes have been increased (although the rates of direct taxes have been lowered and more and more exemptions have been given to certain categories of people). Higher growth in revenues relative to the growth in revenue expenditures has resulted in a decline in revenue deficit of both the Governments—Central and State.

Non-tax Revenue:

The non-tax revenue of the Government has increased from Rs. 40 crore in 1950-51 to Rs. 82,250 crore in 2007- 2008. As a percentage of GDP, it has fallen from 2.1 p.c. in 1990-91 to 1.8 p.c. in 2007-08.