An important application of indifference curves is to judge the welfare effects of direct and indirect taxes on the individuals.

In other words, if the Government wants to raise a given amount of revenue whether it will be better to do so by levying a direct tax or an indirect tax from the viewpoint of welfare of the individuals.

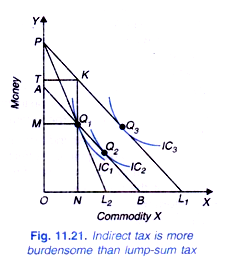

As shall be proved below an indirect tax such as excise duty, sales tax causes ‘excess burden’ on the individuals, that is, indirect tax reduces welfare more than the direct tax, say lump-sum tax, when an equal amount of revenue is raised through them. Consider Figure 11.21 where on the X-axis, good X and on the Y-axis money is measured. With a given income of the individual and the given price of good X, the price line is PL1 which is tangent to indifference curve IC1 at point Q3 where the individual is in equilibrium position.

Suppose now that Government levies an excise duty (an indirect tax) on good X. With the imposition of excise duty, the price of good X will rise. As a result of the rise in price of good X, the price line rotates to a new position PL2 which is tangent to indifference curve IC1 at point Q1.

ADVERTISEMENTS:

It is thus clear that as a result of the imposition of excise duty, the individual has shifted from a higher indifference curve IC3 to a lower one IC1 that is, his level of satisfaction or welfare has declined. It is worth noting that the movement from Q3 on indifference curve IC3 to Q1 on indifference curve IC1 is the combined result of the income effect and substitution effect caused by the excise duty.

It should be further noted that at point Q1 (that is, after the imposition of excise duty), the individual is purchasing ON amount of good X and has paid PM amount of money for it. At the old price (before the excise duty was imposed), that is, with budget line PL1, he could purchase ON quantity of good X for PT amount of money. Thus, the difference TM (or KQ1) between the two is the amount of money which the individual is paying as the excise duty.

Now, suppose that instead of excise duty. Government levies lump-sum tax on the individual when the individual is initially at point Q3 on indifference curve IC3. With the imposition of lump-sum tax, the price line will shift below but will be parallel to the original price line PL1.

ADVERTISEMENTS:

Further, if the same amount of revenue is to be raised through lump-sum tax as with excise duty, then the new price line AB should be drawn at such a distance from the original price line PL1 that it passes through the point Q1. So, it will be seen from Figure 11.21 that with the imposition of lump-sum tax equivalent in terms of revenue raising to the excise duty, we have drawn the budget line AB which is passing through the point Q1.

However, with AB as the price line, individual is in equilibrium at point Q2 indifference curve IC2 which lies at a higher level than IC1. In other words, at point individual’s level of welfare is higher than at Q1,. Lump-sum tax has reduced the individual’s welfare less than that by the excise duty. Thus, indirect tax (excise duty) causes an excess burden on the individual.

Now, the important question is why an indirect tax (an excise duty or a sales tax on a commodity) causes excess burden on the consumer in terms of loss of welfare or satisfaction. The basic reason for this is that whereas both the lump-sum tax (or any other general income tax) and an indirect tax reduce consumer’s income and produce income effect, the indirect tax in addition to the income effect, also raises the relative price of the good on which it is levied and therefore causes substitution effect.

The imposition of a lump-sum tax (or any income tax) does not affect the prices of goods because it is not levied on any saleable goods. Since lump-sum tax or any income tax does not alter the relative prices of goods it will not result in any substitution effect. With the imposition of a lump-sum tax (or any other income tax), a certain income is taken away from the consumer and he is pushed to the lower indifference curve (or a lower level of welfare) but he is free to spend the income he is left with as he likes without forcing him to substitute one commodity for another due to any change in relative prices.

ADVERTISEMENTS:

Thus in Figure 11.21, imposition of an equivalent lump-sum or income tax, the consumer moves from the equilibrium position Q3 on indifference curve IC3 to the new position Q2 on indifference curve IC2 which represents the income effect.

On the other hand, an indirect tax not only reduces the purchasing power or real income of the consumer causing income effect, but also produces price-induced substitution effect and thus forcing him to purchase less of the commodity on which indirect tax has been levied and buy more of the non-taxed commodity. And this later substitution effect caused due to the price-distortion by the indirect tax further reduces his welfare.

As will be seen from Figure 11.21, as a result of income effect of the indirect tax the consumer moves from point Q3 on indifference curve IC3 to point Q2 on lower indifference curve IC2 and as a result of substitution effect he is further pushed to point Q2 on still lower indifference curves IC1.