Here is a term paper on ‘Capital Formation’. Find paragraphs, long and short term papers on ‘Capital Formation’ especially written for school and college students.

Term Paper on Capital Formation

Term Paper # 1. Meaning of Capital Formation:

Capital formation means the increase in the stock of real capital in a country. In other words, capital formation involves making of more capital goods as machines, tools, factories, transport equipment, materials, electricity, etc., which are all used for further production of goods. Thus, Prof. Gill defines capital accumulation in the following words – “Capital accumulation is the process of adding to our stock of machinery, tools, buildings, and so on, over time. If our stock of capital at the end of the year is larger than it was at the beginning, the difference represents the amount of capital we have accumulated during the year. Another name for this is investment. Annual real investment is the addition to our capital stock over the course of a year”.

Emphasising that for making additions to the stock of capital, saving and investment are essential, Ragnar Nurkse has defined capital formation as follows – “The meaning of ‘Capital Formation’ is that society does not apply the whole of its current productive activity to the needs and desires of immediate consumption, but directs a part of it to the making of capital goods; tools and instruments, machines, and transport facilities, plant and equipment all the various forms of real capital that can so greatly increase the efficacy of productive effort. The essence of the process, then, is the diversion of a part of society’s currently available resources to the purpose of increasing the stock of capital goods so as to make possible an expansion of consumable output in the future.”

Likewise, Professor J.R. Hicks remarks, “The way by which capital equipment is increased is the use of some part of the community’s productive power during a period for the construction of new equipment (investment).” It is thus evident that in order to accumulate capital goods some current consumption has to be sacrificed.

ADVERTISEMENTS:

The greater the extents that people are willing to abstain from present consumption, the greater the extent that society will devote resources to new capital formation. If society consumes all what it produces and saves nothing, future productive capacity of the economy will fall as the present capital equipment wears out.

In other words, if whole of the current productive capacity is used to produce consumer goods and no new capital goods are made, production of consumer goods in the future will greatly decline. To cut down some of the consumption and to wait for more consumption in the future requires foresightedness on the part of the people. There is an old Chinese proverb – “He who cannot see beyond the dawn will have much good wine to drink at noon, much green wine to cure his headache at dusk, and only rain water to drink for the rest of days.”

Term Paper # 2. Widening and Deepening of Capital Formation:

A community could just go on building more transport facilities, more sources of power, more factories of the existing type. This process of duplicating capital of the existing technique is called “widening of capital”, in contrast with “deepening of capital”, which implies use of more capital-intensive techniques. In fact, capital accumulation and technological progress go hand in hand.

ADVERTISEMENTS:

Technological improvement is virtually impossible without capital accumulation. This is because new capital has to be built up according to the new superior techniques of production and since superior techniques are of higher capital intensity, larger investment has to be made. Thus, no nation which is not willing either to save or to get foreign aid for greater investment will enjoy the fruits of the advanced techniques and capital accumulation.

Accumulation of Human Capital:

For a long time in economics, it was thought that it was the physical capital which played a crucial role in expanding production. In recent years, a new concept of ‘human capital’ has been evolved and emphasized. By human capital it is meant that the stock of people equipped with education, skills, good health, etc. It has now been found that the rate of growth achieved in the developed countries cannot be wholly explained by the increases in physical capital and advances in technology.

ADVERTISEMENTS:

A good part of economic growth has occurred due to the accumulation of human capital. It has now been realised that human capital formation is as important in increasing production and productivity as the physical capital formation. An educated, trained and skilled man is much more productive than an uneducated, untrained and unskilled man. Likewise, a person with good health contributes to production to a greater degree than the person with frail and poor health. Since the investment in education, skill and health adds greatly to the productivity of men, investment in human capital has also been called investment in men, or investment in human beings.

Term Paper # 3. Capital Formation and Economic Growth:

Capital plays a vital role in the modern productive system. Production without capital is hard for us even to imagine. Nature cannot furnish goods and materials to man unless he has the tools and machinery for mining, farming, forestry, fishing, etc. If man had to work with his hands on barren soil, productivity would be very low indeed. Even in the primitive stage, man used some tools and implements to assist him in the work of production.

Primitive man made use of elementary tools like bow and arrow for hunting and fishing net for catching fishes. With the growth of technology and specialisation, capital has become more complex and is of superior and advanced type. More goods can be produced with the aid of capital. In fact, greater productivity of the developed economies like that of USA is mainly due to the extensive use of capital, i.e. machinery, tools or implements in the productive process. Capital adds greatly to the productivity of worker and hence of the economy as a whole.

Much economic development is not possible without making and using of industrial machinery, making of agricultural tools and implements, building of dams, bridges, factories, roads, railways, airports, ships, ports, harbours, etc., which are all capital. All these capital goods are man-made instruments of production and increase of the productive capacity of the economy.

Therefore, accumulation of capital goods every year greatly increases the national product or income. Capital accumulation is necessary to provide people with tools and implements of production. If the population goes on increasing and no net capital accumulation takes place, then the growing population would not be able to get necessary tools, instruments, machines and other means of production with the result that their capacity to produce would be seriously affected.

Besides this, capital, accumulation makes possible the use of indirect or roundabout methods of production which greatly increase the productivity of the workers. Under these indirect or roundabout methods of production, workers instead of working with bare hands, work with the aid of more productive tools, instruments and machinery. Under these indirect or roundabout methods some workers and other productive resources are first employed in producing capital goods and then with the help of these capital goods workers produce consumer goods.

The greater the extent to which the methods of production would be indirect or roundabout, the greater their productivity and efficiency. But, as we have seen above, for the use of indirect or roundabout methods of production capital has to be accumulated. Therefore, we see that capital accumulation makes the use of indirect or roundabout methods of production possible and thereby greatly increases the national product and is helpful in bringing about rapid economic growth.

Moreover, productivity of the workers depends upon the amount of capital per worker. The greater the quantity of capital per worker, the greater will be the productivity of the worker. It is not capital accumulation alone that increases the amount of capital per worker. Capital per worker rises when the rate of capital accumulation is greater than the rate of population growth. With the increase in capital per worker, productivity per worker will increase with the result that national product and income will increase. Therefore, capital accumulation, by increasing the productivity of the workers, plays an important role in the growth of the economy.

ADVERTISEMENTS:

From the viewpoint of economic growth capital formation it is also important because it makes large-scale production and greater degree of specialisation possible. Thus, with capital accumulation the advantages of large-scale production and specialisation are obtained. The advantage of large-scale production and specialisation is that they greatly increase output and productivity and thereby bring down the cost of production per unit. Without adequate capital accumulation neither the scale of production can be increased nor greater specialisation and division of labour in the production process is possible. Hence, capital accumulation by enlarging the scale of production and specialisation increases the production and productivity in the economy and thereby promotes economic growth.

Another way in which capital accumulation contributes to growth is that it makes the technological progress of the economy possible. Different technologies need different types of capital goods. Therefore, when new, superior and better technology is discovered, its use can be made for production only if that technology is embodied in capital goods, that is, if capital goods according to that technology are made. Therefore, without capital accumulation, no technical progress can be made. If there is no capital accumulation, then the various new inventions or discoveries will remain unused for production. If is, therefore, clear that capital accumulation promotes technical progress in the country and through this accelerates the economic growth of the country.

Another important economic role of capital formation is the creation of employment opportunities in the country. Capital formation creates employment at two stages. First, when the capital is produced, some workers have to be employed to make capital like machinery, factories, dams, irrigation works, etc. Secondly, more men have to be employed when capital has to be used for producing further goods. In other words, many workers have to be engaged to produce goods with the help of machines, factories, etc.

Thus, one sees that employment will increase as capital formation is stepped up in the economy. Now, if the population grows faster than the increase in the stock of capital, the entire addition to the labour force cannot be absorbed in productive employment because not enough instruments of production will be there to employ them. This results in unemployment. The rate of capital formation must be kept sufficiently high so that employment opportunities are enlarged to absorb the additions to the working force of the country as a result of population growth. In India the stock of capital has not been growing at a fast enough rates so as to keep pace with the growth of population.

ADVERTISEMENTS:

That is why there is huge unemployment and underemployment in both the urban and rural areas. The fundamental solution to this problem of unemployment and underemployment is to speed up the rate of capital formation so as to enlarge employment opportunities.

Role of Capital- Diagrammatic Illustration:

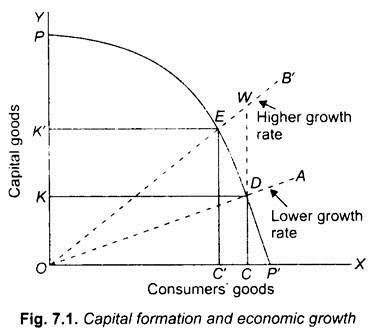

A diagrammatic illustration will make it clear as to how a greater rate of capital accumulation steps up the growth rate and also what it costs to the society. A given amount of resources has to be distributed between the production of consumer goods and capital goods. But, the greater the amount of resources that are invested in production of capital goods, the smaller quantity of resources will be left for the production of consumer goods. Thus, greater accumulation and therefore greater rate of economic growth comes at the cost of present consumption. Of course, with greater rate of growth, the productive capacity and consumption in the future years will increase, but greater capital accumulation means less consumption in the present.

This is what is generally described as “more jam tomorrow means less jam today”. But, as said above, if a poor country wants to raise the standards of living of its people, it must step up its rate of economic growth through greater investment of resources in the production of capital goods. Consider Fig. 7.1 in which the X-axis measures consumers’ goods and the Y-axis measures capital goods. With a given amount of resources we have drawn a production possibility curve PP’.

ADVERTISEMENTS:

Suppose the allocation of resources between the consumers’ goods and capital goods is such that the economy is operating at point D on the production possibility curve so that it can produce OC amount of consumers’ goods and OK amount of capital goods. With the capital accumulation the productive capacity of the economy will increase and as a result the production possibility curve will shift outwards. If the same proportion of resources continues to be allocated to the production of capital goods, the economy will be growing at a certain rate, say 2% as is indicated by the ray OA.

Now, if the economy wants to step up the rate of economic growth, say to 3%, it will have to allocate a greater proportion of its resources towards the production of capital goods than before. Thus when the economy is operating at point D on production possibility curve PP and wants to build up more capital, it will have to allocate more resources to the production of capital goods and less to the production of consumer goods. Suppose the economy reallocates its resources so that it produces OK’ capital goods and OC’ consumer goods on the production possibility curve PP’. It is clear from the figure that with greater capital accumulation, the production of consumer goods has fallen from OC to OC’. Therefore, consumption will have to be cut down for the sake of more capital.

But greater capital accumulation will mean greater growth of productive capacity with the result that production possibility curve will shift outwards more rapidly and if the same higher proportion of resources continues to be allocated, the economy will be having a higher rate of economic growth, say 3%, and will move along the ray OB.

Cost of Capital Formation:

ADVERTISEMENTS:

It is thus clear from above that the process of capital accumulation and economic growth is not a painless job. The price for it has to be paid and this price is paid in terms of the reduction in present consumption. But it should be remembered that greater capital formation will more than compensate this loss of present consumption. Thus, in the figure, when the economy has chosen the growth path of ray OB by having greater capital accumulation, then after some years it will reach point W at which the consumption is OC. Thus, at point W, the previous level of consumption has been restored. As the economy keeps up its higher rate of capital accumulation and moves along the growth path OB beyond W, it will be having higher consumption than along the growth path OA.

Role of Capital – A Dissenting View:

It is generally agreed among economists that capital accumulation rate and economic growth are closely correlated. In Harrod-Domar models of economic growth as well as Lewis’ model of “economic development with unlimited supplies of labour,” capital accumulation plays a crucial role in raising both output and employment. However, some economists have objected to such a great emphasis and importance being given to the physical capital.

Thus, Professor Cairncross remarks, “There is a great danger that the importance of capital in relation to economic progress will be exaggerated than that it will be underrated.” According to Prof. Cairncross, the rate of economic growth achieved in developed countries cannot be wholly explained by increases in labour and physical capital. He points out that technological progress has played a more important role than accumulation of physical capital in the process of economic growth.

According to him, only one quarter of the rate of economic growth can be explained with the accumulation of physical capital. To quote him, “There seems no reason to suppose that capital accumulation does by itself exercise so predominant an influence on economic development. In most industrialized communities the rate of capital accumulation out of savings is equal to about 10 per cent of income”.

If one were to assume that innovation came to a standstill and that additional investment could nevertheless yield an average return of 5 per cent, the consequential rate of increase in the national income would normally be not more than 1/2 per cent per annum. We are told that the national income has in fact been rising in such communities at a rate of 2.3 per cent per annum. On this showing, capital accumulation could account for, at most, one-quarter of the recorded rate of economic progress. Nor were things very different in the nineteenth century.”

ADVERTISEMENTS:

A.K. Cairncross thinks that capital accumulation need not necessarily take place along with technological progress. Technological progress can occur independently of any net capital accumulation. What is needed is that the funds kept for depreciation may be used for building up new assets and capital equipment, embodying new technology. He points out that new capital equipment embodying new advanced technology may even cost less and therefore technological progress is possible even with decline in physical capital.

Moreover, Prof. Cairncross thinks that besides technological progress, improvements in social and economic organisation, trained management, new attitudes, play an important role in raising production and promoting economic growth as the accumulation of physical capital. The process of economic development, according to him, “is a complex situation and it may exist in some underdeveloped countries. But it is by no means obvious that additional capital, whether borrowed from abroad or accumulated through the exertions of surplus labour in the countryside, would by itself suffice to start off a cycle of industrialization. The problem is often one of organisation quite as much as of capital creation – of training management and men, of creating new attitudes towards industrial employment, of taking advantage of innovations that need little capital and using the resulting gains to finance investment elsewhere.”

We agree with Prof. Cairncross that technological progress, human capital, improvements in economic organisation, trained management, etc. are also important factors in economic growth. However, the crucial importance of physical capital also cannot be denied. In our view, both physical and various forms of human capital are important in promoting economic growth.