Here is a compilation of term papers on ‘Central Banks’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on ‘Central Banks’ especially written for school and college students.

Term Paper on the Central Banks

Term Paper Contents:

- Term Paper on the Introduction to Central Bank

- Term Paper on the Definition of Central Bank

- Term Paper on the Importance of Central Bank

- Term Paper on the Need for Central Bank

- Term Paper on the Principles of Central Banking

- Term Paper on the Development of Central Banks

- Term Paper on the Comparison between Central Banking and Commercial Banking

- Term Paper on the Functions of Central Bank

- Term Paper on the Objects of Credit Control by Central Banks

- Term Paper on the Methods of Credit Control by Central Banks

Term Paper # 1. Introduction to Central Bank:

ADVERTISEMENTS:

At its most fundamental level, a central bank is simply a bank which other banks have in common. Small rural banks might each have deposit accounts at a larger urban bank to facilitate their transactions in the city. By this criterion, a financial system might have several central banks. More prosaically, a central bank is usually a government sanctioned bank that has specific duties related to the performance of the macro economy.

Typically, an “official” central bank is charged by a central government to control the money supply for the purpose of promoting economic stability. It may have other duties as well, such as some degree of regulatory power over the financial system, operating a check-clearing system, or to perform general banking services for the central government. Most industrialised economies have a central bank. The Bank of England, the Bank of Japan, the German Bundesbank, and the United States Federal Reserve are all central banks.

Internal stability means keeping the purchasing power of the money in-tact and preventing its deterioration. It has to maintain the rate of inflation within tolerable limits if its curtailment is not feasible altogether. External stability implies keeping of a balance between export and import or prevention of the foreign exchange value of domestic currency from depreciation. As well as low inflation a Central Bank will consider other macro-economic objectives such as economic growth and unemployment.

The development of the economy of a country depends on the banking system of that country to a large extent and there is a central bank or an apex bank at the top of this banking system. This bank controls and regulates other banks of the country. The central or apex bank of a country works as the friend, philosopher and guide, for the other banks of the country.

ADVERTISEMENTS:

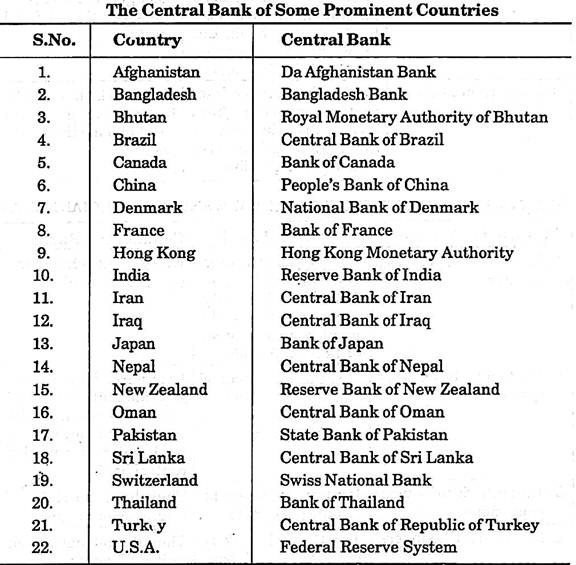

Today almost every leading country has a central bank at the top of its banking system. It is called by different names in different countries. It is called Bank of England in England, Federal Reserve System in the USA, Bank of France in France, Bank of Russia in Russia and Reich’s Bank of Germany in Germany. The apex bank of India is ‘Reserve Bank of India’ which was established in 1935 according to the recommendation of the Hilton Young Commission.

Term Paper # 2. Definition of Central Bank:

The central bank of any country has incomparable economic and financial powers. It has been defined by keeping this point at the centre.

The important definitions of the central bank are as follows:

ADVERTISEMENTS:

(1) According to Hawtray, “Central Bank is the Bank of Banks because it works as a lender of last resort of other Banks.”

(2) According to Prof. Kent, “It may be defined as an institution charged with the responsibility of managing the expansion and contraction of the volume of money in the interest of the general public welfare.”

(3) According to Kisch and Elkin, “A Central Bank is the Bank the essential duty of which is maintenance of stability of the monetary standard.”

(4) According to Vera Smith, “The Central Banking is a banking system in which single bank has either a complete or a residuary monopoly of note issue.”

(5) According to, Samuelson, “A Central Bank is a bank that the Government sets up to handle its transactions, to co-ordinate and control the commercial banks and most important to help and control the nation, money and credit conditions.”

After the study of the above definitions of the Central Bank it becomes clear that the Central Bank is different from other banks.

In the light of the above definitions its appropriate definition can be given as follows:

“The Central or apex bank is organisation which controls and regulates the monetary, banking and credit system of the country so that the proper economic development of the country can be in proper direction.”

In fact, the Central Bank is the bank of banks. It does not work with the objective of earning profits. Its ownership and control lies with the Government.

ADVERTISEMENTS:

It rules over the banking system of the country. It also performs the function of regulation of amount of credit.

Term Paper # 3. Importance of Central Bank:

Central banks are usually given the responsibility to help keep the changes in the money supply of a country reasonable and connected with the economic situation of the country. They can increase the money supply by selling government bonds to specifically chosen banks. These banks have increased deposits to loan out money. They increase loans to the public, other banks, companies, and so on. When an economy is in a recession, then the central banks can inject money into the economy to boost demand by reducing interest rates.

When inflation starts to eat too much into the value of the local currency, then central bankers should start to cut back on the money supply. This will increase interest rates. This increase in interest rates will slow down the increase in prices. If too much currency is taken out of the market, then a country may have deflation. This is when overall prices are going down. Central bankers have to judge what is happening not only in their domestic markets, but also in international markets, especially for those countries that are very much open to international trade and investments, both inward and outward.

ADVERTISEMENTS:

Since central banks play the crucial role of setting interest rates they need to be followed and studied by a fundamental (and even technical) Forex trader. Central banks want to achieve financial stability of their currency (i.e. battle inflation) and maintain overall economic growth in their country. Central banks act in ways to lessen the effects of inflation on an economy. Inflation refers to a rise in price levels which causes a fall in the purchasing power of a currency. Inflation accounts for an entire basket of goods and services, not just an increase in the price of one item.

Monitoring prices of a particular basket is known as indexing and provides a reliable method of tracking inflationary movement. Inflation interestingly, inflation can be set off by the increase in price of just one crucial item as well. The higher interest rate will cause the currency to appreciate in the eyes of investors, both domestic and foreign, as they will benefit from a higher yield on the country’s assets. If the currency is now appreciating relative to other currencies, then Forex traders will buy into it in order to trade with the trend, sending even more money towards that economy.

Term Paper # 4. Need for Central Bank:

There is a need of Central Bank in any country for the following reasons:

ADVERTISEMENTS:

(1) For Issue of Paper Currency:

There is a need of Central Bank for the control, regulation and uniformity of paper money throughout the country. Before the establishment of the central bank, paper notes were issued by different banks. So, there was not uniformity of paper money.

At the same time surplus paper money was issued in the absence of proper control and regulation. Consequently, there was a fear of inflation in the economy. So, there was a need of a Central bank for the issuing, regulation and control of paper money.

(2) For Credit Control:

The present time is the era of credit. The commercial banks create credit. But they work with the objective of earning profit. In this situation, there is a fear that if these banks create surplus credit with the objective of earning more profit, there will be a crisis before economy. There is a control on commercial banks in the process of credit control by the central bank. Thus, there is a need of central bank for the control of credit.

(3) For the Implementation of Monetary Policy:

ADVERTISEMENTS:

For being the banker of the Government, the Central Bank performs the task of determining the monetary policy. So, for controlling the banking system and economy there is a need of central bank so that the monetary policy can be implemented in the interest of the nation.

(4) For Organising and Regulating the Banking System:

For the systematic management of the banking system of the country there is the need of a regulatory bank. The central bank performs this task according to its principle. So, there is the need of a central bank for this purpose.

(5) For Providing Economic Assistance to Commercial Banks:

When the commercial banks do not get credit from elsewhere, they get it from the Central bank. Thus, there is the need of a central bank for providing economic assistance to commercial banks.

Term Paper # 5. Principles of Central Banking:

ADVERTISEMENTS:

The Central Bank has its certain principles.

These are as follows:

(1) The Attitude of National Welfare:

The prime objective of the central bank is not earning profit. On the other hand, the commercial banks have the intention of earning profit.

(2) Monetary and Financial Stability:

It is an important principle of the central bank to bring monetary and financial stability in the banking system of the country. The central bank takes certain measures to fulfill this theory.

ADVERTISEMENTS:

(3) Free from Political Affect:

There can be mismanagement in the banking system of the country due to the impact of the national politics on the central bank. So, there should not be the influence of any political party on the central bank. The government and the central bank should be co-operative in the development of the nation.

Term Paper # 6. Development of the Central Banks:

The first central bank of the world is the Risk Bank of Sweden which was founded in 1668. But the real credit of the development of central banking goes to Bank of England founded in 1694. It is called the Mother of Central Banks. It performed the task of issuing notes at the time of its foundation but gradually it started performing other important task of Central Bank and emerged as the most powerful bank of the world.

After this, the Central Banks were established in many countries of the world, following this example Bank of France was established in France in 1800 and Bank of Netherlands in Holland in 1814, National Bank of Denmark in Denmark in 1818, Bank of Spain in Spain.in 1856, Bank of Russia in Russia in 1860 and Reich’s Bank of Germany in 1875 (Now it is the Deutsche Bundesbank) were setup.

Similarly the Central Banks were started setting up in other countries as well. But the central banks established in the 19th century did not have any particular principle. These mainly worked as the government’s banker and issued paper notes. But the central bank really developed in 20th century. Federal Reserve System was set up in the USA in 1914. It is a federation of 12 Federal Reserve Banks. Reserve Bank of India was setup as the central bank in India in 1935.

Term Paper # 7. Comparison between Central Banking and Commercial Banking:

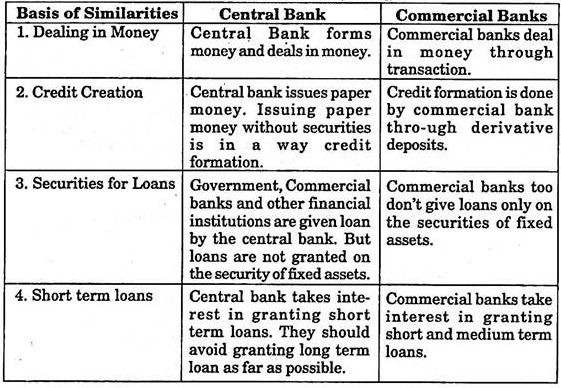

We can find some similarities and differences on making a comparative study of the Centred Banking and Commercial Banking.

These are described ahead in separate columns:

Similarities between Central Banking and Commercial Banking

Term Paper # 8. Functions of Central Bank:

Followings are the functions of Central Bank according to M.H.D. Coke:

(1) Monopoly of Note Issue:

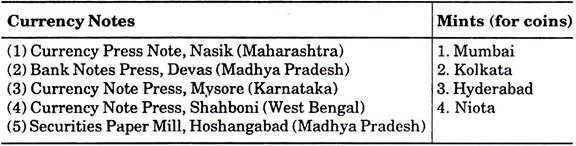

Central Bank retains the monopoly of issuing notes. It has an issuing department which issues notes and coins to commercial banks. Coins are coined in the government mint but they are issued through central bank. Before the establishment of central bank, the task of issuing notes was performed by commercial banks or state, but both proved inefficient. The complete authority of issuing notes was given to central Bank after the establishment of central bank.

Paper Notes and coins are prepared in India at following places:

There is uniformity in notes if these are issued by the central bank. It facilitates exchange within the country. As the central bank retains the patronage of the government, notes issued by it win over the faith of people. There is flexibility in the monetary system due to monopoly in the note issuing system. It means that its amount can be changed according to needs. Central bank can control the credit by using this monopoly and the same time the government policy is followed.

(2) Government’s Banker, Agent and Advisor:

In every country, the Central bank works as the Government’s Banker, Agent and Advisor. As Government’s Banker it keeps with it non-interest deposits of the central and state government. It sells and purchases the foreign securities and currencies on behalf of the government and also keeps the gold reserve of the government.

As the agent of the government, it gives a loan for a maximum period of 90 days on government securities and treasury bills. As the advisor of the government, it gives proper suggestions to government in economic and financial matters. The government determines the important economic policies according to the suggestion of Central Bank.

(3) Custodian of Cash Reserves of Commercial Banks:

According to the Banking laws it is mandatory for every commercial bank to keep a certain part of their deposits with the central bank. In the initial days, it depended on the will of commercial banks but now it has become essential for every commercial bank according to the banking laws. Thus, the central bank serves as the custodian of the funds of commercial banks. There are many benefits of keeping cash reserves with central bank.

Some examples are:

(i) The economic strength of the country increases by centralising and there can be proper use of this fund at the time of national crisis.

(ii) It creates elasticity on credit system.

(iii) By bringing change in the case reserve ratio, the central bank can control the credit formation of commercial banks

(iv) Central bank can provide some extra fund to commercial bank at the time of their crisis.

(v) The mutual transaction of commercial banks becomes easy through the central bank.

(4) Clearing House for Transfer and Settlement:

Clearing house is such an arrangement in the banking system in which the mutual transaction of various banks is done by making necessary entries in account only. The task of clearing house is an important work of the central bank. The commercial bank performs this task by keeping a certain fund with the central bank. When a customer makes a payment through cheque, it is not necessary that the receiver of the cheque should obtain cash payment from the concerned bank.

He deposits that cheque in his account in any other bank. The bank receives the cheque from the depositor for the guarantee collection of that cheque from the concerned bank. Thus, the adjustment of the cheque of various banks is done in the clearing house. As there are accounts of commercial banks in the central bank and a certain amount is deposited in these. This facilitates transactions among banks without the direct use of cash.

(5) Controller of Credit:

A proper credit regulation is essential for stabilising the price level in the country. Formation of credit more or less than the need is bad for the economy. So, it is essential that the amount of credit should be maintained fixed and within a proper limit. Central bank regulates the economy by creating a proper and balanced credit.

(6) Lender of Last Resort:

When the commercial banks don’t have sufficient liquid fund to meet the cash demands of the customers, they demand help from the central bank. The central bank can assist commercial banks in two ways in this situation. First, through the discounting of excellent trade bills, and second, through loans on the collateral of the first class securities. Thus, the central bank is a major source of cash as the lender of the last resort.

(7) Custodian of Foreign Exchange Reserve:

The government authorises the central bank for keeping gold and foreign money. The central bank performs the task of foreign transactions for being the member of the International Monetary Fund. If there is fluctuation in foreign exchange rates, it sells and purchases foreign currencies.

Besides these functions, the working area of the central bank is being expanded. Particularly in developing countries, the central bank is being given more responsibilities. It takes steps for the expansion and regulation of commercial banks to meet the increasing need of agriculture, industries, trade and commerce.

Prohibited Functions of Central Bank:

Some functions are prohibited for central bank.

These are as follows:

(i) It cannot set up any industries and trade.

(ii) It cannot purchase shares of any bank or company.

(iii) It cannot give loan on the collateral of fixed assets.

(iv) It cannot give loan without collateral.

(v) It cannot give interest on deposits.

(vi) It can neither write fixed term bills nor can accept these.

Credit Control by Central Bank:

The central bank regulates credit for controlling the process of inflation and deflation. The use of credit money has increased very much in modern period. The central bank balances the economy by expanding or contracting the credit money according to the commercial needs of the country. Prof. Shave has considered the task of credit control to be the most important function of the central bank.

Term Paper # 9. Objects of Credit Control by Central Banks:

The main objects of credit control are as follows:

(1) To Stabilise the Price Level:

One important object of credit control is to stabilise the price level. There is an adverse effect on the economy due to frequent fluctuation in prices. If the amount of credit in any country is less than the commercial needs of the country, there is a decline in the price level. On the other hand if the amount of credit is more than the commercial needs, there will be an increase in the price level. So, credit control is essential for stabilising the prices.

(2) To Stabilize Foreign Exchange Level:

Those countries which have a lot of foreign trade have it much important to stabilise the foreign exchange level because the change in exchange rate greatly affects the import and export. When the prices are low, there is more export and less import. As a result the demand of domestic currency increases in the foreign market.

This increase the, rate of exchange. Opposite to it, when there is a rise in prices, there is less export and more import. Consequently, there is an increase in foreign currency and the exchange rate of domestic currency falls.

(3) To Protect the Outflow of Gold:

When there is an expansion of bank credit, the prices go up and as a result the import increase and the export decreases. Its bad effect is that a negative system of balance of payment is created. To overcome this situation, there arises the need of exporting gold from the country. Thus, the central bank has to control credit to stop the flow of gold to other countries.

(4) Economic Development:

The objective of credit control is also bringing economic development with stability. In the modern time it is expected from the central banks of every developing country that they should assist in the economic development.

(5) To Control Business Cycle:

Some Economists considered that the objective of the central bank is also to regulate the trade cycles. Particularly in the capitalist countries, the trade cycle is a normal phenomenon but if it is not regulated, it is not in the interest of the nation. So, one objective of the central bank is regulating the trade cycle.

Term Paper # 10. Methods of Credit Control by Central Banks:

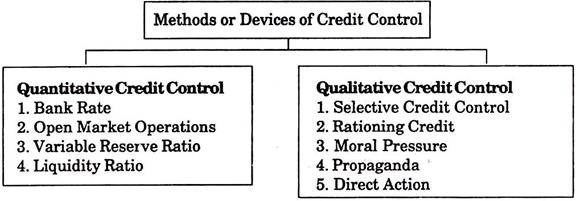

Central Bank adopts two methods of credit control:

i. Quantitative, and

ii. Qualitative.

Under quantitative measures the changes in the bank rate, open market operations, regulating the cost and amount of credit by bringing change in variable reserve ratio and liquidity ratio. On the other hand, under the qualitative measures the use and direction of credit are regulated.

A. Quantitative Credit Controls:

Following devices are adopted for quantitative or numeric credit control:

(1) Bank Rate:

Bank rate refers to that rate at which central bank gives credit to commercial banks and does the discounting of their first class bills. Some countries give more importance to the discounting of bills, so this rate in those countries is called the Discount Rate. The central bank regulates credit by bringing change in the bank rate from time to time.

Relation between Bank Rate and the Market Rate:

There is a difference between the bank rate and the market rate. Market Rate is that rate at which the commercial banks and other financial institutions are ready to give loans. In other language, Bank Rate is the rate of discounting by the central bank while the market rate is rate of discounting by the commercial banks. But there is a close relationship between the bank rate and market rate.

When the bank rate is increased, the market rate also increases and when the bank rate is decreased, the market rate also decreases. Bank rate is generally higher than the market rate. The reason is that the central bank is the lender of the ultimate resort for the commercial banks. The commercial banks demand loan from the central bank only when they are not able to get it from anywhere else. In this situation the central bank demands a higher interest from them.

Objective of Changing the Bank Rate:

The central bank changes the bank rate from time to time.

The objectives of these changes are as follows:

(i) Improvement in the Exchange Rate:

When the exchange rate is adverse for the country, the central bank increases the bank rate to make it positive for the country. This draws the foreign capital towards that country. Consequently, there is an increase in demand for the domestic currency and the exchange rate becomes favourable for the country.

(ii) Protection of Gold Reserve:

When a big amount of gold starts going out of the country, the bank rate is increased to stop it or decrease the export.

(iii) Control on Speculation:

When the speculation business increases in the country there is an economic loss. The speculators start taking loans in huge amount to run their operations. To meet this demand of loans, the commercial banks demand loans from the central bank. The central bank increases the bank rate to check the speculation business. Consequently the speculators have to take loan on high interest and it discourages the speculation business.

(iv) Flow of Wealth in Money Market:

If there is a reduction in the flow of wealth in the money market, the central bank decreases the bank rate. Its consequence is that there is an expansion of credit by the commercial banks and its leads to the flow of a sufficient amount of wealth in the money market.

(v) Reducing the Import of Foreign Capital:

The import of foreign capital is not in the interest of the nation. So if there is an import of foreign capital in a great amount, the central bank reduces the bank rate to discourage it.

Effects of Variation in Bank Rate:

The important effects of variation in the bank rate are as follows:

(a) Expansion and Contraction of Credit:

The Bank Rate is increased or decreased to regulate the amount of credit. As it has been clarified earlier too, if the credit has to be expanded, the bank rate is reduced and if the amount of credit has to be contracted, the bank rate is increased.

(b) Effect on the Internal Price level:

The bank rate affects the price level and wages in the country. If the bank rate is lowered, there is an expansion of credit. Consequently, there is a promotion to trade and industries in the country because the traders get loans from the banks at lower interest rate. This lowers the internal price level. On the contrary, if the bank rate is increased, there is a contraction in the credit. Consequently the trade and industries are discouraged and the price level and wages increase.

(c) Effect on the Flow of Capital:

Changes in the bank rate also influence the flow of foreign capital. There is a close relation between the bank rate and the interest rate. The interest rate is not affected by the change in the bank rate. So, when the bank rate is increased the foreign capital gets attracted towards the country. On the contrary, when the bank rate is lowered, there is a flow of capital from the country towards foreign countries.

(d) Effects of Foreign Exchange Rates:

An increase in bank rate increases other rates of interest and the foreign capital comes into the country to take its advantages. This makes the balance of payment favourable and the foreign exchange rate also becomes favourable.

On the contrary, a decrease in the bank rate lowers other rates of interest. This checks the flow of foreign capital into the country and as a result the domestic capital directs towards the foreign countries. As a result the balance of payment becomes negative and the exchange rate also gets adverse.

Limitations of Bank Rate Policy:

There are some limits of the success of the Bank Rate Policy.

Its main limitations are as follows:

(i) No Equal Change in the Interest Rate:

The Bank Rate Policy is considered successful in the change in the other interest rates. But it is not so in reality. So, when the money market of the country is not organised, the change in the bank rate does not regulate the credit.

(ii) The Non-Co-Operation of Commercial Banks with the Central Bank:

It is essential for the success of the bank rate that the commercial banks should have cooperation with the central bank. If the central bank increases the bank rate and the commercial banks start taking loans from other places, it would be non-co-operation. It will not be helpful in the success of the bank rate policy.

(iii) Optimism and Pessimism:

When the condition of trade is good in the country, even an increase in the bank rate does not lower the demand of loans by the traders because they are optimistic. On the other hand, during the depression even if the bank rate is lowered and the loans are available at the cheap interest rates, it does not increase the demand of loan because the traders are pessimistic.

(iv) Non-Flexibility of Economy:

Flexibility of economy is essential for success of bank rate. If there is a lack of flexibility in the economy the change in the bank rate does not affect the prices and wages. It will lead to the failure of Bank Rate Policy.

(v) The Rate of Change in the Bank Rate:

The central bank brings a change in the bank rate for normalising the economy. But it is difficult to imagine that how much a change would be there in the amount of credit by bringing a definite change in the bank rate. So, the central bank just imagines and it is not necessary that this imagination should always come true.

On the basis of these facts, the economists opine that the bank rate policy is a weak instrument.

(2) Open Market Operations:

Open Market Operations are also a device of credit control. This instrument is being adopted these days for the credit control due to the incomplete success of the Bank Rate Policy. The use of open market operations is done in two senses.

Clarifying these two senses D. Coke has said, “In the wider sense, open market operation may be held to cover purchase or sale by the Central Bank in the market of any kind of paper in which it deals whether Government Securities or other securities, but in the narrow sense, open market operations has come to be applied only to the purchase or sale of Government Securities both long term and short term.”

Thus, when the central bank realises that there is a large scale expansion of credit in the market and there is a need of putting a check, it starts selling government securities to the commercial banks. This causes the flow of money from the commercial to the central bank and there is shortage of liquid money with the commercial bank. Consequently, their ability of granting loans decrease and there is a balance in credit.

On the contrary, when the central bank sees that there has been an excess contraction of credit in the market and there is a need of credit expansion, it starts purchasing government securities. By doing so, the liquid money starts flowing from the central bank to the commercial banks. This increases the cash strength of the commercial banks and there is an increase in credit.

Thus, through open market operations, the central bank influences the cash reserve of the commercial banks and consequently there is an expansion or contraction of credit.

Objectives of Open Market Operations:

Open market operations are adopted to meet the following objectives:

(1) Removing the lacking of Money in the Money Market:

Sometimes, there is a lack of money in the money market and it negatively influences the trade of the country. In this situation, the central bank removes this lacking of money in the money market by purchasing the securities.

(2) Stabilising the Prices of Government Securities:

When the prices of government securities fall in the market, it becomes the responsibility of the central bank to stabilise or raise it. In this situation, the central bank starts purchasing the government securities. As a result the prices of these securities rise or become stable.

(3) Bringing Success to Bank Rate Policy:

The Bank rate policy alone is not successful as a device of credit control. Thus, the economy can be balanced by adopting the open market operation with it. For this, the central bank takes into notice that if the commercial banks do not lower their interest rates despite the increase in the bank rate. In this situation it reduces their monetary strength by selling securities.

(4) Retaining the Faith of the People:

Sometimes, rumours spread among the people about the banks and people rush to bank to withdraw their deposits. This situation is very dangerous for banks. Many banks may face failure in this situation. When the central bank sees this situation arising it starts purchasing securities on a large scale. Consequently, there is a large flow of fund towards the commercial banks and with the help of it, they become able to pay the liabilities to their customers and the public faith in banks is retained.

(5) Checking the Import and Export of Gold:

When there is export of gold from the country under the gold standard policy there is a decrease in the amount of money and credit. If the central bank sees that the fall in the price level is not in the interest of the nation, it purchases the securities and reduced the lacking of money and credit in the money market.

On the contrary when there is import of gold under the Gold standard policy the amount of money and credit increases in the market and there is a rise in the price level. If the central bank finds this rise in the price against the interest of the nation, it starts selling the securities. As a result the amount of credit and money contracts in the country. This balances the economy.

(6) Checking the Export of Capital:

The export of capital up to a certain limit is proper but on a large scale it is not in the interest of nation. When there is export of capital on a large scale, the central bank draws cash money towards itself by selling securities.

Limitation of Open Market Operations:

Some of the limitations of open market operations are mentioned below:

(1) Demand and Supply of Securities:

It is essential for the success of open market operations that there should be the presence of demand and supply of securities in the market. If there is no demand of securities in the money market there will be no purchaser of these even when the central bank sell these. Similarly, if there is no supply of securities in the market, there would be no purchaser even if the central bank proposes to buy these.

(2) There should be an Effect on Cash Reserve of Banks:

For the success of open market operations, it is essential that when the central bank sells securities, there should be dearth of cash reserves with the commercial banks and when it purchases securities, there should be a surplus of cash reserves. If it is not so, this may won’t be very successful.

(3) The Loan Policy of Banks should is Unchangeable:

There should be no change in the loan policy of the banks for the success of this policy. If there are frequent changes in the loan policy, the policy of open market operations will not be successful.

(4) Development of Money Market:

It is essential for the success of open market operations that the money market should be developed and organised. By a developed and well organised money market, it is meant that there should be a close relationship between the central bank and other credit institutions and the bill market should be developed. But the money market is generally not so developed in the underdeveloped countries due to which the policy of open market operations does not become completely successful.

(5) The Central Bank should have Unlimited Power of Selling and Purchasing Securities:

For the success of the open market operation it is essential that the central bank should have sufficient securities for sale and it should have enough funds for purchasing securities. If the central bank wants to purchase securities in greater amount and there are no proper funds with it, there will be no success in this attempt. Consequently, there would be no expansion of credit in the money market.

(6) There should be Change in the Demand of Loans with the Change in Cash Reserve of Banks:

When there is expansion of credit by banks, it means there has been an increase in cash with the banks. In this situation when the demand of loans by customers increases, it will lead to the success of open market operations.

But in developing countries, the demands of loans generally don’t depend on the funds of banks but it depends on the possibility of future profits. So, it is said that however the open market operations controls the expansions of credit but it can’t get the economy recovered from the recession through the expansion of credit.

(3) Variable Reserve Ratio:

Variable Reserve Ratio is also a device of credit regulation. The first suggestion to adopt it had come from Prof. Keynes in his book “Treaties on Money” in 1930 and the Federal Reserve System of the USA adopted it in 1935.

As it has been cleared earlier also that the commercial banks have to keep a certain part of their deposits with Reserve Bank. It is determined by the central bank that what percent of the deposits of commercial banks should be with the central bank. The central bank makes change in this ratio from time to time. If the central bank realises that the credit formation is getting more than the requirement, it increases this ratio and there is a decline in the cash reserve.

On the contrary, if the central bank realises that the formation of credit is less that requirement, then it reduces this ratio of commercial banks. In other words it can be said that the greater will be the required reserve ratio; the lower will be the credit formation ability of banks. On the other hand, the lower will be required reserve ratio; the higher will be credit formation ability of banks. The central bank should use this policy carefully as it influences all commercial banks.

(4) Liquidity Ratio:

Liquidity ratio policy was invented dining World War II for credit regulation. According to this policy, every bank has to keep a certain part of their deposits in the form of cash and government securities. By doing this, the credit creation ability of banks reduces to a certain limit. This ratio is also changed from time to time.

B. Quantitative Credit Control:

Following devices are included this title:

I. Selective Credit Control:

Selective credit control regulates the cost and amount of credit.

This system has following forms in vogue:

(1) Difference in the Interest Rate or Rate of Discounting:

The central bank determines different discounting rates for different bills so that the amount of loans for certain sector can be regulated.

(2) Control on Obtaining Loans:

A certain limit is fixed for the sectors where the credit has to be restricted. It means that a ban is put on granting loans beyond a certain limit.

(3) Deposit before Import:

When the government wants to discourage it makes such a law that the importers have to deposit a certain percent of import sum with an authorised institutions while giving applications for the license for the import. No interest is paid on the deposited sum.

(4) Regulation of Consumer Credit:

Its main objective is to control the demand of consumer goods. In this the maximum payment period is determined in the installment system so that the consumer should repay their loans. This system is adopted with the objective of controlling the prices of commodities so that the consumer should purchase fewer goods and banks should give credit only up to a certain limit.

II. Credit Rationing:

Under this system of credit control, the central bank does the rationing of credit when it is not able to meet the credit demands of commercial banks completely as the lender of the last resort. It means it is fixed for every bank as to what part of the amount demanded by them would be granted as loans.

The central bank does the rationing of credit in following ways:

Some examples are:

i. Completely ending the facility of discounting the bills for any bank.

ii. Completely limiting the facility of discounting the bills for any banks.

iii. Limiting the loan obtaining capacity from the central bank for some banks.

iv. Determining the credit related quotas for various functions of bank.

This method of credit control is very effective, but the central bank has to face many difficulties in implementing this. So, for implementing it the central bank should make all predictions properly.

III. Moral Suasion:

Moral Suasion is that measure which the central bank adopts generally to request, persuade, suggest and counsel. According to it, the central bank studies the financial conditions of the commercial banks and gives them proper suggestions accordingly.

In this method, the central bank does not put any pressure on the commercial banks, but it suggest from time to time as to when the credit should be expanded and when to be contracted. The central bank can do so only when it gets co-operation from other banks and the money market of the country should be developed and well organised.

IV. Propaganda:

The central bank uses propaganda as a device of credit regulation. Through these measures the central bank informs people about the assets and liabilities of commercial banks by publishing these in the form of weekly or monthly idea of the views of the central bank through these publications.

V. Direct Actions:

The central bank generally retains the right that it should face other banks to adopt its policies. If the commercial banks do not follow these policies, the direct action is taken against them. According to this action the facility of discounting of the bills of the faulty bank is stopped or any other action is taken. But in practical terms there is the feeling of dictatorship in this method. The commercial banks should strive that such situation should not come.

Conclusion:

Which device of credit control among these is more suitable and difficult to say? A device may be suitable for one country and some other device may be suitable for some other country. So, the central bank uses the proper device according to the economic condition. If there is the target of planned development of the country, generally qualitative credit control measures are adopted. Similarly, when there is a need of controlling inflation or deflation the quantitative credit control measures are adopted.