Here is a term paper on ‘Investment Avenues’. Find paragraphs, long and short term paper on ‘Investment Avenues’ especially written for school and college students.

Term Paper on Investment Avenues

Term Paper Contents:

- Term Paper on the Introduction to Investment Avenues

- Term Paper on the Goals of Investors in Investment Avenues

- Term Paper on the Characteristics of Investment Avenues

- Term Paper on the Classes of Investment Avenues Instruments

- Term Paper on the Types of Investment Avenues

- Term Paper on the Tax Benefits of Investments Avenues

Term Paper # 1. Introduction to Investment Avenues:

Investment refers to acquisition of some assets. It also means the conversion of money into claims on money and use of funds for productive and income earning assets. In essence, it means the use of funds for productive purposes, for securing some objectives like income, appreciation of capital or capital gains, or for further production of goods and services with the objective of securing profits.

ADVERTISEMENTS:

Investment Activity involves the use of funds or savings for further creation of assets or acquisition of existing assets.

All investments are risky, as the investor parts with his money. An efficient investor with proper training can reduce the risk and maximise returns. He can avoid pitfalls and protect his interests.

Companies and Governments and P.S.Us sell securities, either for equity capital or debt capital. These securities may be in the form of Shares, Debentures, and Bonds etc., which are marketable. They have different degrees of risk and return, varying with the instrument. Some instruments of investment are non-marketable and they are more risky and may become sometimes waste paper. The management of risk and return requires expertise. Investment is both an Art and Science.

The performance of companies and changes in share prices are all based on some fundamental principles, sentiment and psychological expectations. As such, investor has to use his discretion, which is an art to acquire by learning and experience. Principles of Investment and the Art of the Management of Investment are basic requirements for a successful investor.

ADVERTISEMENTS:

Although anybody can be a saver, anybody cannot be an Investor in the Financial Markets particularly in the Stock Market. It is not like purchasing a lottery ticket or betting on horses, which mostly depend on luck. Investment in financial market is not a gamble and speculation which some Investors indulge in and it is highly risky. Investors should be those who invest with the objective of receiving some income, share in the prosperity of the company and gain capital appreciation in a longer time span. Investors in the wider sense include speculators, institutions, companies and even banks.

Financial Position:

Money and information are the basis and the first requirement of investment is the availability of money or savings. But, money is not enough, as investments are generally made on the basis of information of the companies, instruments, industry, and economy. Both money and information flow to help making investment management. No investor should enter into the stock and capital market, before making provisions and investments in housing, insurance, P.F. and pension funds etc., as the investments in stock and capital markets are most risky.

Term Paper # 2.

Goals of Investors in Investment Avenues:

ADVERTISEMENTS:

The investor has various alternative avenues of investment for his savings to flow in accordance with his preferences. Saving flow into investment for a return, but savings kept as cash are barren and do not earn anything. Saving are invested in assets depending on their risk and return characteristics. But a minimum amount of cash is always kept in hand for transactions and contingencies. Any rational investor knows that money is losing its value by extent of the rise in prices.

If money lent cannot earn as much as rise in prices or inflation, the real rate of return is negative. Thus, if inflation is at an average annual rate of 10%, then the return should be 10% or above to induce savings to flow into investment. Thus, if an investment, then the rate of interest is around 8% to 12%. As the risk of loss of money is almost negligible in such cases, this rate can be called risk-free return. All investment involve some risk or uncertainty. The objective of the investor is to minimise the risk involved in investment and maximise the return.

The other goals are income, capital gains, hedge against inflation, and speculative gains etc. Programming investment on the basis of mix of goals is a method adopted by some.

Term Paper # 3.

Characteristics of Investment Avenues:

1. Risk:

The risk depends on the following factors:

i. The longer the maturity period, the larger is the risk. Thus deposits of two years carry a higher rate than one-year deposits.

ii. The more the creditworthiness of the borrower or agency issuing securities, the less is the risk. Thus the risk of loss of interest and principal is less with the Government or semi-Government bodies than with the private corporate units.

iii. The nature of instrument, namely, the debt instrument or fixed deposit or ownership instrument like equity or preference share, also determines risk. The risk of loss of money is less in the case of debt instruments like debentures, as these are secured and fixed interest is payable on them. In the case of ownership instruments, the risk of loss is more due to their unsecured nature and variability of their return and ownership character which burdens them with all the risks connected with the enterprise.

ADVERTISEMENTS:

iv. The risk of variability of returns is more in the case of ownership capital as the return varies with the net profits after all commitments are met. As such, equity and preference shares of companies are more risky than debentures or bonds. Among the ownership instruments, equity is more risky than preference shares or other forms of ownership instruments such as partly or fully convertible debentures, convertible and cumulative preference shares, as equity holders are residual owners of the firm.

v. The nature of tax liability on the instruments — the tax provisions would influence the return as the net effective return for a tax-payer would be higher for tax-free instruments as in the case of NSS, NSC (VI or VII Series) or those whose interest income is tax-free up to a limit as in the case of UTI dividends or interest on bank deposits. The net return on such instruments is higher by different degree to the tax-payers, depending upon the income tax brackets into which they fall. Thus tax implications of investment are an important factor in considering the return on investment. Besides risk, investment decisions are based upon return, safety, liquidity, marketability, etc.

2. Return:

A major factor influencing the pattern of investment is its return, which is the yield plus capital appreciation, if any. The difference between the purchase price and the sale price is capital appreciation and the yield is the interest or dividend divided by its purchase price. Thus if Rs. 25 is the dividend on a share of the face value of Rs. 100 but purchased at Rs. 150, then the return is 25/150 = 16.6%. Suppose, there is capital appreciation also in a year, say, Rs. 10 on the purchase price of Rs. 150, then the total return is (25 +10)/150, which is 23.3% per annum.

ADVERTISEMENTS:

Safety:

The safety of capital is the certainty of return on capital without loss of money or time involved. In all cases of money lent, some transaction costs and time are involved in getting the funds back. But leaving aside such general costs like stamp duty, postal charges, etc., the time involved is also an important factor. If money is returnable not on the same day but after a lapse of time, then the loss of liquidity is involved and if the time of return of funds is not certain and if costs of selling or realisation of proceeds are involved, then the safety of funds is also not perfect. Thus if safety of capital is to be assured, then riskless return as in the case of Government bonds is to be chosen. If the return is higher, as in the case of private securities, then the degree of safety is less.

Liquidity:

If a capital asset is easily realisable, saleable or marketable, then it is said to be liquid. If an investment can be encased with a time lag as in the case of equity shares or with loss of money as in the case of bank fixed deposits, then they are less liquid. If, on the other hand, there is a good market for the capital asset and no risk of loss of money or capital and no uncertainty of time involved, then the liquidity of the asset is good. If liquidity is high, then the return may be low as in the case of bank saving deposits or UTI units, or liquid fund schemes of mutual funds.

ADVERTISEMENTS:

An investor generally prefers liquidity for his investments, safety of his funds, a good return with a minimum risk or minimisation of risk and maximisation of return (dividend plus capital appreciation).

Risk-Return Relationships:

i. Risk:

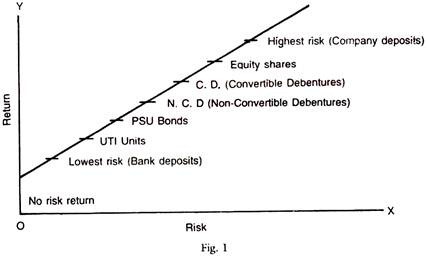

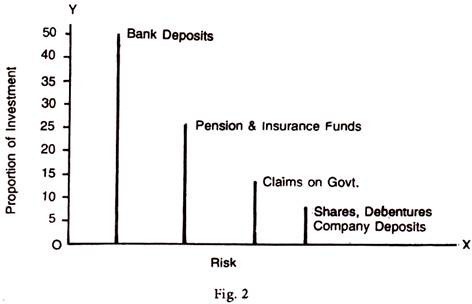

Risk is inherent in any investment. This risk may relate to loss or delay in repayment of the principal capital or loss or non-payment of interest or variability of returns. While some investments are almost riskless like Government securities or bank deposits, others are more risky. There are differences in risk as between instruments, which can be represented as a spectrum of risk, as in Fig. 1.

ii. Return:

ADVERTISEMENTS:

Yield or return differs from the nature of the instruments, maturity period and the creditor or debtor nature of the instrument and a host of other factors. The most important factor influencing return is risk. Normally, the higher the risk, the higher is the return. The return is the income plus capital appreciation in the case of ownership instruments and only yield or interest in the case of debt instruments like debentures or bonds.

Term Paper # 4.

Classes of Investment Avenues Instruments:

Instruments traded can be classified on the following criteria:

1. By ownership or debt nature of instruments.

2. By term period to maturity — short-term, medium-term and long-term.

3. By the issuer’s creditworthiness, say, Government securities or private securities or PO certificates, etc.

ADVERTISEMENTS:

Ownership category instruments are- equity, preference shares, deferred shares, non-cumulative preferred shares, cumulative preferred shares, etc. Debt category assets are debentures, bonds, deposits with banks and companies, etc.

The term period of a security or the maturity period also varies from security to security and with the time of purchase. Barring the equity shares, other securities have some maturity period and redemption. Thus the debentures may be up to 7 years and preference shares up to 12 years. Fixed deposits may vary from 1 to 5 years. Almost all the debt instruments have a maturity period.

The creditworthiness of the issuer of securities will determine the risk involved in the payment of interest and repayment of principal. If the issuer is the Government the risk is the least as the Government does not default. There is no uncertainty in respect of these instruments.

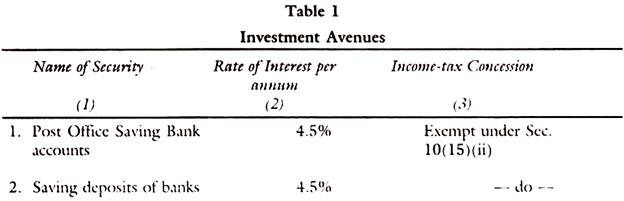

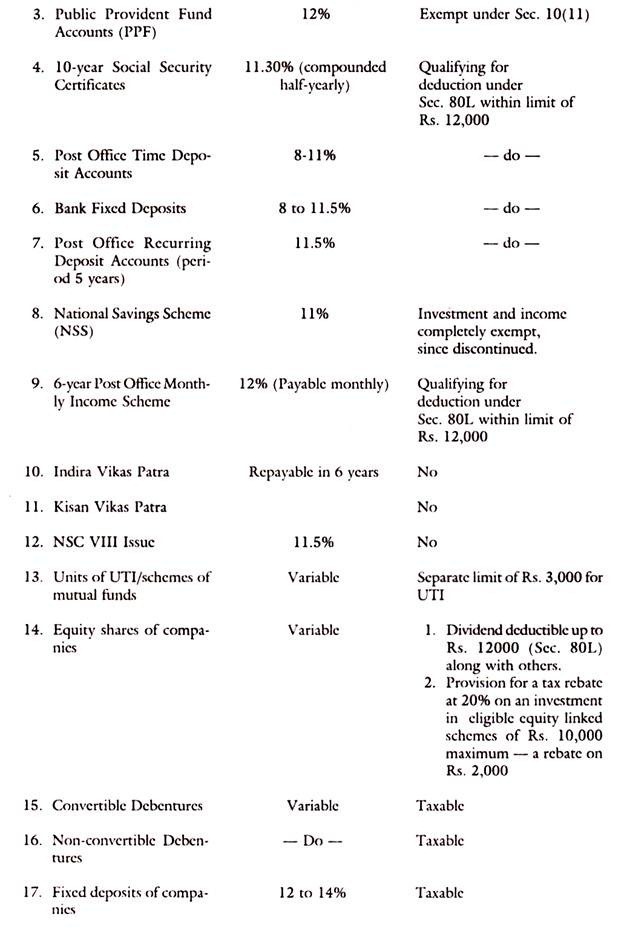

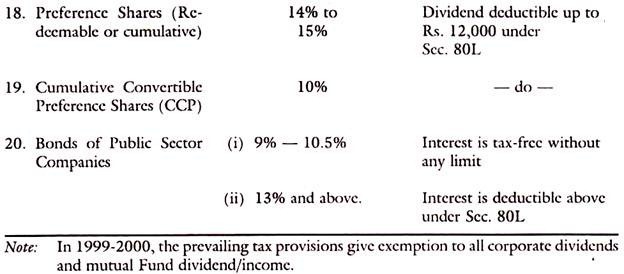

The data in Table 1 presented below show that the various instruments can be classified by risk-return characteristics and that the returns are variable on these instruments as also the tax treatment given by the government in respect of these instruments.

Investment Profile of Average Household:

The asset preferences of an average Indian household can be analysed from the data on the savings estimates of CSO and RBI. The data of RBI provide in particular the pattern of assets in financial form of the household sector in India.

If an average Indian saves Rs. 100, nearly Rs. 40 is set apart for investment in physical assets like consumer durables, housing, real estate, gold, silver, etc. The remaining Rs. 60 flows into various forms of financial assets.

Taking savings in the financial form, the preferences of the Indian household are such that the investor keeps 7 to 11% of it in cash and currency and 36% to 46% in bank deposits, which are both riskless assets but with nil return or low returns (0- 11.5 per cent). There is also a category of contractual savings in the form of insurance, PF and pension funds, whose return is also small or moderate, but are based on the requirements of insurance coverage, contingency and precautionary requirements of individual savers. The investment in this category is 25-27% of total financial savings.

The relatively less risky but voluntary investments relate to UTI units whose return is about 10-12%. The investment in this category is about 1 to 5% of the financial savings of the household sector and these enjoy some tax benefits.

Another category of less risky return with tax concessions is that of investment in Government scurrilities, P.O. savings media, PSU bonds, etc. The return on these investments vary widely from 9-14% depending on income-tax concessions. About 12% of the financial savings are invested in this category. Among the categories most risky investments are that of deposits with companies (3-4% financial savings) and of shares and debentures (2 to 10%).

ADVERTISEMENTS:

If all the above investments are arranged in the order of riskiness to get a picture of the risk aversion of the average Indian investor, we notice that only about 10% of savings are attracted by the high return/high risk profiles, 25% flow in the form of contractual savings and 50 to 55% as currency and bank deposits. Moderately risky or less risky investments like P.O. instruments. Government bonds. UTI units, etc. attract only 14-15% of the total savings in financial form (as their returns vary around 9-12%).

If investment in public securities and private securities are taken to represent respectively, the less risky and more risky investments, the proportion of financial savings in the form of the former is as high as 80%, and the latter 10%, which clearly evidences the risk aversion of average household in India. Besides, a proportion of 7-11% of savings is held in the form of currency, which has a negative real return.

Leaving aside the currency holdings, the other financial assets held by the household sector are shown in the above diagram. Bulk of the investments in the public sector is indirect investment. Thus Bank deposits, UTI units, PF and pension funds, etc. all find their way into investments in private and public securities. Leaving aside a proportion of statutory investments in Government, semi-Government and Trustee securities, the rest is invested in new issues of companies, shares and debentures of existing companies, deposits with companies, etc.

Thus, although only about 5 to 10% of the direct investments of the households flow into shares, debentures and company deposits, etc. as shown in Fig. 2 above, there is a large component of indirect investments by the households in the private corporate sector through their bank deposits, PF, insurance, pension funds, UTI units, Mutual Funds, etc.

Term Paper # 5.

Types of Investment Avenues:

i. Non-Corporate Investments:

In addition to securities of the corporate sector into which savings of the households flow to a minor extent, there are a number of other avenues for investment such as deposits with commercial and cooperative banks, post office savings banks, National Savings Certificates, Provident fund and pension fund contributions, insurance, deposits with companies, purchase of real estate, gold and silver etc. There are other lines of investment, more frequently resorted to by companies, financial institutions etc. such as securities of the Government and semi- Government bodies, viz., Treasury bills, Government bonds, public sector unit bonds, Government securities, etc.

These investments are of many types and can be classified as follows:

1. Marketable and Non-Marketable:

Real estate, gold, silver, etc., are marketable and are most popular among the households. Treasury bills, bonds and Government securities are also marketable but are popular only with financial institutions and banks. Some of these like UTI units, tax-free bonds, etc. which enjoy a number of tax benefits are also popular with individuals, companies and institutions. The investments in the nature of deposits with banks, companies, National Savings Certificates, etc. are not marketable as they are not transferable by endorsement.

2. Interest Payable Regularly or Reinvested:

Some investment media like bank deposits pay interest quarterly or half-yearly. Some investments will have annual interest or dividends paid as in the case of UTI units or half yearly on P.O. savings certificates. Some media will have the interest reinvested as in P.O. cumulative time deposits etc. Repayments can also take the form of annuity, that is, to say, a payment combining interest with principal.

3. Payment Linked to an Event:

In the case of life insurance, payment is at the event of death, accident-insurance, at the occurrence of an accident, provident fund at the time of retirement etc. Payment out of pension funds, or out of annuities, will be spread over a number of years.

4. Regular Savings Media of Investment Vs. Lump Sum Investment at a Time:

Some investment media like LIC insurance premium or contributions to PF and insurance are regular monthly savings either voluntarily or compulsorily. Similarly, contributions to the recurring deposit schemes of banks and post offices are regular monthly savings media. On the other hand, purchase of NSC or a fixed deposit with a notice period or for a fixed period of time are examples of the lumpsum investments at a time.

ii. Corporate Investments:

The major avenues of investment among corporate securities are equity shares, rights and preference shares, which are of ownership category and debentures and fixed deposits from the public, which are of debt category. Of these, preference shares debentures and deposits are having a fixed interest while equity shares are of variable dividend. The risk is high in the case of fixed deposits of companies as they are unsecured, while equity shares are of high risk and high return category.

Deposits with Banks:

Among the non-corporate investments, the most popular are deposits with banks such as current accounts, savings accounts and fixed deposits. On current account deposits, no interest is paid as these arc meant for regular transactions by businessmen and companies. Savings deposits are those on which interest is paid at 4.5%, which is the lowest among the various categories of investments. There is also the category of fixed deposits, which has varying characteristics.

Thus fixed deposits may be recurring deposits wherein savings are deposited at regular intervals or fixed deposits of varying maturities or with varying notice period such as 7 days, 15 days, etc. The interest rates on these deposits vary depending upon the maturity period, from 9% to 12% at present. Banks are permitted to offer rates higher than 12% for maturities above 2 years from October 1, 1995.

The banks also provide other varieties of schemes for savings and for raising deposits from the public. The rates on them are freed from control of R BI. The interest on these deposits is payable half- yearly or quarterly calculated on the basis of simple interest. Some of the banks have reinvestment plans wherein the interest is reinvested as is accrued and paid at the end of the fixed period, say, of 1 to 5 years. The principal and the accumulated interest are paid to the investor on maturity.

Instruments of Post Offices:

The investment avenues provided by the post offices are generally non-marketable, as they are the savings media. The only exception is Indira Vikas Patra, which are bearer bonds transferable by delivery. The major instruments of P.O. enjoy tax concessions such as exemption of investment contribution from tax or interest income from tax or both up to certain limits.

1. Saving Deposits:

These are savings deposited by public up to a maximum of Rs. 50,000 in individual account and Rs. 1 lakh in joint account. They carry interest at 4.5% which is tax free totally. Just as the savings deposits of commercial and cooperative banks, these accounts are operated subject to certain conditions.

2. Fixed Deposits:

These accounts are open to individuals either separately or jointly for varying fixed periods of time, say 1 to 5 years. The interest rates vary from 8% for one year deposits to 11.5% for 3-year deposits. The interest is payable half- yearly and interest income is tax exempt up to a limit of Rs. 12,000 per annum at present.

3. Recurring Deposits for 5 Years:

This is an instrument of regular monthly savings. The account-holder has to save and deposit every month a fixed amount of Rs. 5 or in multiple of Rs. 5 for 60 months. This account carries a rate 11.5% on the balance to the account, compounded quarterly and payable at maturity at the end of 5 years. If has its own rules of nomination, withdrawal, income and wealth tax exemption etc.

4. Fixed Investment with Monthly Income:

Under this scheme, an individual can invest from a minimum of Rs. 5,000 to Rs. 1 lakh lumpsum for a period of six years. Interest at 12% is payable monthly and bonus of 10% at the end of maturity. Income up to Rs. 12,000 per annum is tax free.

5. Six-Years National Savings Certificates (Savings Certificate VI and VII Issues):

There are various series of this issue with slight changes with regard to payment of interest rate. These investments, as in the case of some other instruments, are exempt from income accrued up to a limit under Section 80L. The interest payable is 11% compounded half-yearly. The interest along with the principal is payable at the time of maturity; interest accrued is deemed to have been reinvested in the case of VI series, while the same is paid half-yearly in the case of VII series.

6. Six-Years National Savings Certificates (VIII Series):

This is slightly different from other NSCs. The rate of interest payable is 11% compounded half-yearly payable at maturity. Accrued interest is reinvested but is eligible for tax rebate under Section 88 of I.T. Act.

There are a number of other avenues of savings with POs which are tax havens such as PPF and NSS, whose details vary from scheme to scheme.

i. Public Provident Fund:

The PPF deposits can be made in monthly installments with a minimum of Rs. 100 and a maximum of Rs. 60,000 per annum. These deposits carry cumulative interest of 12% credited to the account. The account has a maturity period of 15 years. It is not transferable, but has nomination facility. One withdrawal per financial year can be made any time after 5 years from the end of the year in which the subscription is made. Withdrawal is limited to 50% of the balance at the end of the fourth year. All subscriptions to PPF are completely tax free and the balances in PPF are not taken into account for wealth tax purposes.

ii. NSS:

Deposits made in NSS were completely tax exempt under Section 80CCA of I.T. act but income, however, is taxable at the time of withdrawal. Interest is credited to the account at the end of each month at the rate of 11% per annum. The number of deposits that can be made are only 12 in a year and the deposits have to be in multiples of Rs. 100 and not exceeding Rs. 40,000 per annum.

Only one withdrawal can be made in a year up to the maximum of the balance outstanding at the end of the fourth preceding financial year. The account can also be closed at the end of three years from the end of the year in which the last deposit is made. A passbook is given with a nomination facility. The scheme was withdrawn in 1992- 93 Budget and a new NSS 1992 was introduced with slight variations.

iii. 10-Years Social Security Certificate:

These certificates are in denominations of Rs. 500 and Rs. 1,000 and mature at the end of 10 years. The maturity value of the certificate is triple the face value, giving a compound rate of interest of 11.3%. A special feature of this is life insurance coverage. In the event of death by accident or natural cause after two years from the date of purchase, the nominee or legal heirs receive the full maturity value immediately. This certificate can be purchased by individuals between 18 and 45 years of age only.

iv. Indira Vikas Patra:

These are bearer bonds in denominations of Rs. 200, Rs. 500, Rs. 1,000 and Rs. 5,000 sold at half the face value. These have a maturity period of 6 years, carrying a compound interest of around 13%. These are freely transferable by delivery as these are bearer bonds.

v. Kisan Vikas Patra:

These are certificates in denomination of Rs. 1,000, Rs. 5,000 and Rs, 10,000, which will double in 6 years giving a compound rate of interest around 13%. These can be encased after 2-1/2 years for specified amounts of money. This has nomination facility but is not transferable.

vi. Public Sector Bonds:

There are two categories of these bonds, namely, tax-free and taxable. The tax- free bonds are 9 or 10% bonds issued for Rs. 1,000; interest compounded half- yearly and payable half-yearly. They have a maturity period of 7 to 10 years with the facility for buy-back sometimes provided to small investors up to certain limits. The taxable bonds yield 13% or above, compounded half-yearly and payable half-yearly. They have normally a face value of Rs. 1,000 and have buy-back facilities similar to taxable bonds. Income from these bonds is tax exempt upto Rs. 12,000 under Section 80L.

vii. Drought Relief Bonds (Relief Patra):

These are comparable to tax-free bonds. These carry 9% interest compounded annually with a face value of Rs. 1000 and maturity period of 5 years. These investments are completely tax-free, both for wealth and income tax purposes.

Interest income, either payable or re-investible, is also tax free. This has also nomination facility. A new series of tax free bonds with 10% return was announced by the Govt. in 1995. There are also 10.5% Tax free PSU bonds for investment by public.

Conclusion:

There are a large number of investment avenues for savers in India. Some of them are marketable and liquid while others are more risky and less safe. Risk and return are the major characteristics which an investor has to face and handle.

The investment avenues can be broadly categorised under the following heads:

(1) Corporate Shares, Debentures, etc.

(2) Bank deposits.

(3) UTI and Mutual Fund Schemes.

(4) P.O. Deposits/Certificates, etc.

(5) Government and semi-government bonds/securities.

The investor has to choose proper avenues from among them depending on his preferences, needs and abilities to take the minimum risk and maximise the returns. To enable investors to know the degree of risk on debt instruments credit rating is now made compulsory for them.

Term Paper # 6. Tax Benefits of Investments Avenues:

Some instruments floated by the Government and semi-Government bodies enjoy tax benefits and hence their net return is higher. Thus in India, P.O. deposits, bank deposits, Government securities, etc., are exempt from income tax either in part or in full. Under Section 80L of IT Act, the income emanating from certain investments like bank deposits, NSC, P.O. deposits, etc. and in respect of an income from UTI units is exempt up to Rs. 15,000.

There is a separate exemption limit of Rs. 3,000 for UTI dividend income. The other forms of tax benefits are the exemption or rebate with respect to wealth tax or capital gains tax. The investments made in specified instruments of Government and Semi-Government securities, NSS, PPF, etc. are fully exempt from income tax. Exemption of original investment as also the income from it is granted in the case of PPF and NSS, subject to certain conditions.

Marketability and Liquidity:

Some Instruments are not marketable like company and bank deposits, P.O. deposits, NSC, NSS, etc. Only advances can be secured against bank deposits and NSC subject to margins from banks. Some instruments like preference shares and debentures are marketable but there are no buyers is many cases and hence liquidity is negligible in respect of these instruments. Liquidity arises from the availability of marketing and trading facilities as also buyers and sellers.

Safety Vs. Riskiness:

Safety is another feature which the investor desires for investments. Normally, savers invest only in safe or risk-free investments. Only a few opt for risky investments for which the returns would also be higher. Thus a higher return of 15% is available for three-year deposits of companies which are most risky. Besides, there are debentures of companies whose yield may be more than 15%, if they are purchased at a discount in the market.

But debentures and bonds carry a coupon rate of 12½%- 15% or even more as there is no ceiling on this rate. Some of the equity shares might give a better return but the general average yield rate on equities is lower than on other types of securities available for investment. But equities are chosen more for their capital appreciation rather than dividend yield.

The maturity period of the instrument, the creditworthiness of the issuer and the nature of the instrument, whether debt or ownership instrument would all influence the risk, return and other features of the instrument. The Government policy or tax treatment of the instrument, etc. would also determine the yield on the instruments.

The marketability and liquidity of funds depend on the tradability of the instruments of investment. In India, although there is a wide variety of an instrument, the marketability is limited to a few assets only.

Thus the assets tradable in the money and capital markets in which individuals do invest may be set out as follows:

(a) UTI units, master shares, etc.

(b) Units/shares of mutual funds, if they are quoted on the stock markets.

(c) Debentures of companies and bonds of public sector units, in which there is a limited market.

(d) Equity shares, rights, and bonus shares of companies listed on the stock exchanges.

(e) Government securities, capital investment bonds, rural investment bonds, shares of P. S.Us etc.

There are a host of other investments made by individuals and households, which are not easily marketable. These are not quoted on the stock markets as in the case of those issued by private limited companies. In the case of Government securities, PSU bonds and debentures of companies, the public interest is less but quoted on the stock markets, and they are traded by banks, financial institutions, etc.

The assets not quoted and are not marketable are not securities, namely:

(a) Bank deposits

(b) Company deposits

(c) P.O. deposits, NSC,

(d) PF and pension funds, and

(e) Insurance policies of LIC, GIC, etc.

Some of the above assets can be used for securing loans from banks, if liquidity is required. The investments in PF, pension, insurance, etc. are contractual forms of saving and not regular tradable assets as such. Thus nearly a third of the household sector savings in the financial form is flowing into the contractual forms of investment. They are meant to protect the future contingencies, retirement, accident and other unexpected possibilities.

These contractual savings are thus not voluntary investment avenues and have to be treated on a separate footing. They are not the usual investment assets, either marketable or tradable. The assets which are voluntary in nature but not tradable are deposits with banks, PO, NSCs and instruments of savings with banks and POs and investments in chit funds, investment/finance companies, etc.