Here is a term paper on the ‘Cambridge Quantity Theory of Money’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on the ‘Cambridge Quantity Theory of Money’ especially written for school and college students.

Cambridge Quantity Theory of Money

Term Paper Contents:

- Term Paper on the Features of Cambridge’s Quantity Theory

- Term Paper on the Similarities between Fisher and Cambridge Equation

- Term Paper on the Difference between Fisher and Cambridge Equations

- Term Paper on the Superiority of Cambridge Equation

- Term Paper on the Criticism of Cambridge Equation

Term Paper # 1. Features of Cambridge’s Quantity Theory:

ADVERTISEMENTS:

The Cambridge economists, being dissatisfied with Fisher’s analysis, explained this theory in a new way. The main economists supporting this group are Marshal, Pigou, Cannen, Hartle, Robertson etc.

If Fisher’s ideology is very popular in America, there is more recognition for Cambridge ideology in European countries.

The main features of Cambridge’s Quantity Theory are as follows:

(1) A Part of Income is kept in the Liquid Form:

ADVERTISEMENTS:

Prof. Fisher has considered money only as a medium of exchange while analysing the ‘Quantity Theory of Money.’ In other words, money is demanded to purchase goods and services. But the Cambridge economists do not agree with this view point. They have the opinion that nobody knows what is hidden in future. So everybody wants to keep a part of his present income in the form of cash or liquid so that if there is a sudden need it can be fulfilled.

This is the thought not only of individuals but also commercial institutions and government. Thus, the value of money is determined by the demand of cash remainders kept by the people. So Cambridge Equations are also called cash balance equation. Thus, according to Cambridge Economists, “The amount of money which is kept by the individual, commercial institutions and government to meet their day to day needs is called demand of money.”

The Cambridge Economists have presented separate equations in the favour of cash balance equation.

Marshall’s Equations:

ADVERTISEMENTS:

Prof. Marshall has given his equation in the following way:

M = KY + K’A

Here

M = toted money in circulation and deposits with bank

Y = Total monetary annual income.

K = the part of the income which people keep in liquid form for future use

K’ = the part of property which is kept in the form of money

A = the total value of property

There are two parts of the above equations of Prof. Marshall—”Income part and Property part. However, both part of the equation may be theoretically correct but it is seen in practice that people bring only their income into consumption.”

ADVERTISEMENTS:

Thus, the amended form of this equation was given as follows:

M = KPY

Where,

M = Supply of Money

ADVERTISEMENTS:

P = Price Level

Y = Total Real Income

K = the part of real income which people want to keep with them in the form of cash.

Robertson’s Equation:

ADVERTISEMENTS:

Robertson has given his equation in the following way:

M = PKT

Or P = M/KT

In this equation, the definitions of M, P and T have been taken same as those in Fisher’s equation and K has been taken from Marshall’s equations.

If the value of 1 unit of money is presented in this equation it would be like this:

P = KT/M

ADVERTISEMENTS:

Pigou’s Equation:

Prof. Pigou’s Equation is considered to be the easy form of Prof. Marshall’s equation.

Prof. Pigou’s equation is as follows:

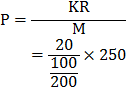

P = KR/M

Where,

P = Common Price level

ADVERTISEMENTS:

M = Total amount of money

R = Total real income of the society.

K = the part of real income which is kept in the form of money.

To present this equation with an example, suppose the total quantity of money in circulation in the country (M) is Rs. 100 crores, total real income of the society or country (R) is Rs. 250 crores and the percentage of keeping cash with people (k) is 20.

In this condition, according to Pigou’s equation:

Thus, the value of one rupee of money will be 1/4 unit which means its value per unit will be Rs. 4.

(2) The Demand of Money Depends on the Liquidity Preferences:

An individual wants to save a part of the amount obtained as his income. He can consume this saved money in many ways. He can invest money in fixed assets by purchasing land, building etc. or he can purchase shares or debentures of any company. They can also keep this sum deposited with banks.

But all these investments are not called liquid. Fixed assets can’t be sold instantly to obtain cash. So it can’t be called liquid money. Shares and debentures can be converted into cash instantly. So these are called liquid money. Similarly, money deposited with banks is called extremely liquid. Thus, more will be liquid preference in people; the more will be demand of money.

(3) Demand of Money is Influenced by Many Factors:

ADVERTISEMENTS:

Demand of money is influenced by many other factors, a few of which are as follows:

(i) The Period of Obtaining Income:

For different persons, the income getting periods are different viz.; daily, weekly, monthly, irregular etc. The more will be the period of income getting for a person, the more will be demand of money for him. On the contrary, the less will be the period of income getting, the less will be demand of money as the person will not keep much money with him for the fulfillment of his requirements.

(ii) Distribution of National Income:

Every individual keep some money with him in a country where there is more equity in the distribution of national income. Thus, there is a higher demand of money in such countries. On the other hand, money is kept only by higher class people in countries with uneven distribution of national income. Thus, there is low demand of money in those countries.

(iii) The Velocity of Circulation of Money:

The nature of liquidity Preference among people is also important for the demand of money. If people give preference to liquidity, it simply means they will use money lesser for exchange due to which the demand of money will increase. On the other hand, if people don’t give preference to liquidity, the velocity of circulation of money will increase due to which more exchanges will be with less money and there will be less demand of money.

(iv) Population:

The more will be population of a country, the more will be demand of money. On the other hand, the less will be population, the less will be demand of money.

(v) Trade Cycle:

There comes the period of both recession and boom in the trade world. During recession, as the profit in trade and industries receded the traders start keeping cash with them and wait for positive opportunities instead of investing their money in trade. Similarly, the consumers also purchase fewer amounts of commodities with the prospect of more fall in price in future.

Thus, every class of people keeps cash with them during depression due to which the demand of money increases. On the contrary, the business class invests more and more money in trade and industries during the boom with prospect of earning more profit. Consumers also start purchasing goods in bigger amount for fear of further rise in prices for future. Thus, people don’t keep cash with them during the boom due to which there is less demand of money.

(vi) Banking Habits:

If banking habits develop among people, more and more payments take place through cheques and drafts. In this situation, there is less demand of money.

Term Paper # 2. Similarities between Fisher and Cambridge Equation:

Despite being many differences in the ideologies of Fisher and Cambridge economists, there are some similarities which are as follows:

(1) Prof. Fisher’s equation is related to a period of time while Cambridge equation associates with point of time.

(2) The conclusion of Fisher and Cambridge ideologies is the same. Both show a direct and proportional relationship between the price level and the amount of money.

(3) The amount of money has been considered an important element of price determination in both the ideologies.

(4) P represents the price level in both the equations.

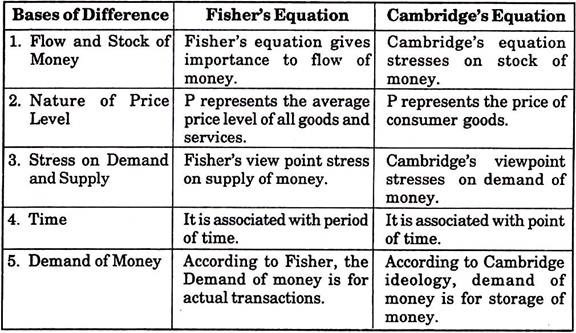

Term Paper # 3. Difference between Fisher and Cambridge Equations:

Differences between Fisher and Cambridge equations can be clear by the following table:

Term Paper # 4. Superiority of Cambridge Equation:

Quantity Theory of Money of Cambridge ideology is superior to transaction ideology of Fisher in the ‘Quality Theory of Money’ for the following reasons:

(1) Liquidity Preference:

Cambridge equation lays emphasis on Liquidity Preference Theory, the basic tendency of human beings in place of supply of money. On this bases ‘Liquidity Preference Theory of Keynes’ developed.

(2) Completeness:

Cambridge equation of ‘Quantity Theory of Money’ can be called a complete theory because in it Liquidity Preference Theory, the basic tendency of value of money is determined through demand and supply.

(3) Simplicity:

In this equation transactions related to only consumer goods are considered while in fisher’s equation all kinds of transactions are included. It is very easy to determine price level in Cambridge equation. So, it can be said an easy equation.

(4) Trade Cycle:

Cambridge equation protects people from trade cycle. People develop the tendency of depositing money in this equation.

(5) Related to Short-Term:

The equation propounded by Prof. Fisher analyses only long-term changes while Cambridge analysis presents the solution of short-term changes also.

(6) Broader Concept:

According to Hicks the real causes of demand of goods have been highlighted in the Cambridge analysis and their affects have also been clarified. With this view, the concept of demand of money is broad in Cambridge equation. Fisher’s viewpoint is inactive in this sense.

(7) Applicable under all Circumstances:

Fisher’s equation is favourable for that economy only which has the condition of full employment, but Cambridge equation is applicable in all circumstances. Thus, it is certainly superior.

Term Paper # 5. Criticism of Cambridge Equation:

It is true that Cambridge equation is superior to Fisher’s equation, but even then it is not flow-less.

The critics have criticised it on the following bases:

(1) Prof. Pigou took wheat as an example in his equation. Thus, this equation shows the demand of money for consumer goods, while in practical life, there is demand of money for many reasons.

(2) Current deposits with banks have been included in the demand of money in this equation. It has been supposed that a current deposit with banks is a part of income. But if a trader takes loan from the bank and then deposits it as current deposit, it is not a part of income.

(3) With current deposits, there are also fixed deposits with bank. But fixed deposit has not been given any place in this equation.

(4) Cambridge equation does not clarify the fact how price level will be changed due to changes in income and saving.

(5) It is also a fault of this theory that it fails to analyse the complex problems of the economy. The increase in production and income can’t be concluded on the bases of this equation.

(6) It has been supposed in this equation that the amount of cash reserve is influenced by K but in reality the amount of money is influenced both by R and K.

(7) Cambridge equation does not pay attention to speculation demand of money while there is demand of money for this also.

Considering the above criticism, Prof. Keynes has presented the amended form of the Cambridge equation as follows:

n = p(k + rk’)

Where,

n = quantity of money

p = general price level

k = units of consumption

r = the ratio of cash kept by banks against their deposits

k’ = the amount of units of consumption for which the purchasing power is kept in the form of credit money.