Here is a compilation of term papers on ‘Money’ for class 9, 10, 11 and 12. Find paragraphs, long and short term papers on ‘Money’ especially written for school and college students.

Term Paper on Money

Term Paper Contents:

- Term Paper on the Origin of Money

- Term Paper on the Definition of Money

- Term Paper on the Functions of Money

- Term Paper on the Nature of Money

- Term Paper on the Importance of Money

- Term Paper on the Role of Money in Economic Life

- Term Paper on the Circular Flow of Money

- Term Paper on the Evils of Money

Term Paper # 1. Origin of Money:

ADVERTISEMENTS:

There is no evidence about the first emergence of money; particularly the time and place concerned. People had very few wants in the beginning of human civilization. There was no need of money as they could meet their needs themselves. As the civilization prospered; people’s needs multiplied, and consequently interdependence for goods and services increased.

Hence, the barter system came into existence to fulfill the initial needs of exchange. But a number of difficulties were observed in this system by the passage of time; for instance— lack of double coincidence of wants, lack of common measure of value, lack of divisibility of commodities, lack of store of value, difficulty in deferred payment, lack of transfer of value etc. In a civilized society, a need was felt that there should be such a system that could save all from these difficulties. Money came into existence in these circumstances.

The term ‘Money’ is derived from the Latin term “Moneta”. It is said that “Moneta” is the other name of Goddess Juno. In the ancient Italy this Goddess was called “The Goddess of Heaven”. Metallic money was coined in the temple of this goddess. As this money was produced in the temple of “The Goddess of Heaven”, one who got it felt the joy of Heaven. So, it is considered that the term ‘Money’ is derived from the term “Moneta”.

On the other hand, some scholars consider the term ‘Pecunia’ as the root of the term ‘Money’. The term ‘Pecunia’ has origined from the term ‘Pecus’ which literally means ‘Live-stock’. This can be held logical as in ancient days livestock and goods were used as money.

ADVERTISEMENTS:

Whatsoever have been the ways of origin of money, it is an ultimate truth that ‘money’ is one of the three greatest inventions of the world. It is worth mentioning here that ‘fire’, ‘wheel’ and ‘money’ are considered to be the three greatest inventions of the world. Money is also used in the sense of ‘seal’ or ‘sign’ in Hindi.

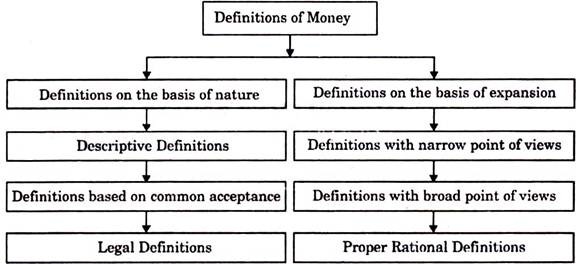

Term Paper # 2. Definition of Money:

There is much difference in opinions of scholars regarding the ‘definition of money’. Someone has based the definition of money on the universal acceptance; whereas someone else has taken its function as the central issue in the definition. So, for the convenience of study, definitions of money can be classified as follows on the basis of their nature.

Definitions Based on the Nature of Money:

ADVERTISEMENTS:

Definitions on the basis of nature of money can be classified into following three groups:

I. Descriptive or Functional Definitions:

This category includes definitions of those scholars who stated functions of money in their definitions.

Some important definitions of this category are given below:

(1) According to Crowther, “Money is anything that is commonly used and generally accepted as means of exchange and at the same time acts as measure and store of value.”

(2) According to Prof. Thomas, “It is a means to an end not for its own sake but as a means of obtaining-other’s articles or commanding the service of others”.

(3) According to Coulborn, “Money may be defined as the means of valuation and payment.”

(4) According to Nogaro, “Money is a commodity which serves as an intermediary in exchange and as a common measure of value.”

ADVERTISEMENTS:

(5) According to Hartle Withers, “Money is what money does.”

(6) According to Whitelesy, “If a particular unit is commonly employed to state values, exchange goods and services or perform other money functions, than it is money whatever its legal or physical characteristics.”

Although the above definitions are practical, they describe money in place of defining it. There is radical difference in ‘description’ and ‘definition’. These definitions don’t claim any universal acceptance or recognition of governments. So even if these definitions are accepted in practice, they can’t be given recognition.

II. Definitions Based on Common Acceptance:

ADVERTISEMENTS:

It is an essential characteristic of money that it is commonly accepted by the common people in return for the goods and services. So, some scholars have defined money on the basis of acceptance.

Some important definitions of this category are given here:

(1) According to Marshal, “Money includes all those things which are at given time or place generally current without doubt or special enquiry as a means of purchasing commodities or services and of defraying expenses.”

(2) According to Robertson, “Money is anything which is widely acceptable in discharge of obligation.”

ADVERTISEMENTS:

(3) According to Seligman, “Money is one thing that possesses general acceptability.”

(4) According to Ely, “Anything that passes freely from hand to hand as a medium of exchange and is generally received in final discharge of debts.”

(5) According to Prof. Keynes, “Money itself is that by delivery of which debt contracts and price contracts are discharged and in the shape of which a store of general purchasing power is held.”

(6) According to G.D.H. Cole, “Money is simply purchasing power— something which buys things, it is anything which is habitually and widely used as a means of payment and is generally acceptable in the settlement of debts.”

(7) According to R.P. Kent. “Money is anything which is commonly used and generally accepted as a medium of exchange or as a standard value.”

It is evident from all above definitions that a common acceptance is a chief characteristic of money. But just describing qualities can’t be a complete definition. On the basis of the above definitions credit instruments can’t be considered as money since they are not accepted everywhere.

ADVERTISEMENTS:

III. Legal Definitions:

Definitions based on state principles have been kept under this category. According to this principle only such a thing can be money which has been declared legally by the government. This category includes ideas of Prof. Knapp from Germany and British Economist Hartle.

(1) According to Knapp, “Anything which is declared money by state becomes money.”

(2) Hartle has also initially accepted the definitions given by Knapp, but he has amended this definition saying, “Money should not be defined only in terms of recognition by the government, but also as a unit of settlement of transactions.”

Definitions given on the Basis of Expansion:

There are three views regarding the meaning of money on the basis of expansion:

ADVERTISEMENTS:

I. Definitions with Narrow Points of View:

The definition given by Robertson is kept in this category. Robertson and his associates held that “A commodity which is used to denote anything which is widely accepted in payment of goods or in discharge of other business obligations.”

If this definition is analysed, gold is the only thing which is acceptable to all countries for replacement. In this condition, money formed from gold or silver alone can be included in the definition of money. So, most of the economists held, the definition given by Robertson to be narrow.

II. Definitions with Broad Points of View:

Definition given by Hartle Withers can be included in this category! According to him, “Money is what money does.”

This definition is descriptive as well as universal. This definition can be termed as ‘everything in something’. According to this definition not only metals or currencies but also cheques, bill of exchanges, hundies and other credit instruments are included in money. But some economists consider that this definition is far more universal (broad) than what is needed. According to this definition credit instruments are also money, but nobody can be compelled to accept it for repayment.

ADVERTISEMENTS:

III. Proper Definition:

On making a careful study of various definitions, we come to find that some economists have centered their attention on the acceptance of money, while some others have based their definitions on functions what it does.

The have to know the form of money, it can be defined as follows:

“Money is something which is accepted freely and widely as a medium of exchange; measuring value; final repayment of loans and accumulating values.”

Definitions Based on Viewpoints of Economists:

Harry G. Johnson has presented four viewpoints regarding the definition of money.

ADVERTISEMENTS:

These include:

(1) Traditional Approach:

According to this viewpoint money is considered according to its function. So, all those things which act as money can be called money. On this basis, currencies and demand deposits are included in money. In this category Hartle Withers, Keynes, Kent, Crowther etc. get place for their definitions.

(2) Chicago Approach:

Economist of Chicago University has made the definition of money universal by accepting the traditional approach and at the same time including fixed term deposits and savings accounts deposits of commercial banks.

According to this approach:

Money = Currency + Demand Deposits + Fixed Deposits + Saving Bank Deposit.

(3) Gurley and Shaw Approach:

This approach includes savings deposits with non-banking financial institutions, debenture and bonds to Chicago approach.

So, according to this approach:

Money = Currency + Demand Deposits + Fixed Deposits + Saving Bank Deposits + Saving Deposits with Non-banking Financial Institutions, shares, debentures and bonds.

(4) Central Bank Approach:

According to this approach all kinds of credits are included in money. That is why; in the monetary policies of the Central Bank the amount of gross credit is considered.

Redcliff has also said, “Money means credits forwarded by various sources.”

Considering all these approaches it is evident that ‘Proper Definition’ which has already been defined is the best.

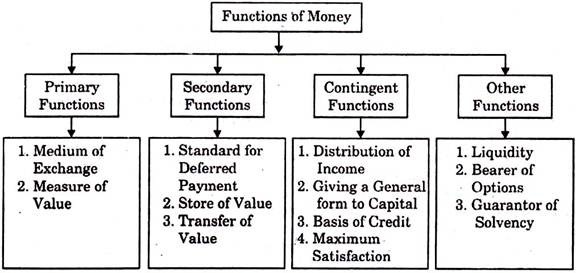

Term Paper # 3. Functions of Money:

Just like the definition, the functions of money have also drawn the economists into confusion.

Prof. Kinley has divided the functions of money into three categories whereas Prof. Chandler has considered the main function of money to ease transactions of goods and services. On the other hand there is an English poem in vogue about the function of money, “Money is a matter of four functions a medium, a measure, a standard, a store.”

But in practice, the functions of money are wide ranging. Considering the convenience of study, functions of money can be classified as follows:

(A) Primary Functions:

Primary functions of money are those functions which are applicable in any country in every time and circumstances.

Following two functions come in this category:

(1) Medium of Exchange:

Once upon a time barter system of exchange was in practice. Many difficulties had to be faced those days. Measuring the value of goods and the need of double coincidence of wants were big difficulties. Exchange has become very easy with the invention of money. Today, any goods or services can be sold in exchange of money and the commodities and services can be purchased with money. Thus money is the convenient means of exchange.

(2) Measure of Value:

It was a problem with the barter system that how many units of a commodity should be given in exchange for a certain units of a certain commodity. Now, every commodity and every service can be measured in money. Being a medium of exchange, money is also a medium of measure of value. It means that money is the only unit of measurement of exchange ratio between two commodities.

But it is also important to note that value of money changes from time to time. Consequently, gross measurement of money is still troublesome. Cloth is measured in meter and the length of meter is fixed and rice is measured in kilogram and kilogram is a fixed quantity. But the value of money is not still and it keeps changing. This creates difficulties in the economy of a country.

(B) Secondary Functions:

Functions which help in the primary functions of money are called secondary functions.

Following functions come in this category:

(1) Standard for Deferred Payments:

The present era is the era of credit. Credit plays an important role in the progress of any business. Credit is a system in which goods and services are exchanged or money is borrowed on the promise of future payments. The use of money has made the credit system quite easy.

In barter system future payments were made in commodities only. The lack of durability in the goods posed many problems in future payments. Money is more durable in comparison to commodities and so it becomes the basis of future payments.

(2) Store of Value:

Nobody knows what the future stores for him/her. So people want to do saving considering the needs to meet the expenses in diseases, marriage, old age etc. In the days of Barter System it was not possible to store commodities for a long period.

But the invention of money has eased the process of storing money or wealth. Banking system also operates using this characteristic of moneys. This feature of money promotes the tendency of saving which leads to capital formation and activates the economic development of a country.

(3) Transfer of Value:

Transfer of value plays an important role in the process of economic development of a country. Today, the scope of exchange is very vast. People are getting success in selling their immovable at a place and purchasing far off. Economic pace has increased due to this function of money.

(C) Contingent Functions:

Kinley has stated that money performs contingent functions besides primary and secondary functions.

Some of such functions are:

(1) Distribution of Income:

The work of production has become wide and complex in the present era. Various sources contribute in the work of production. Sources of production are paid for their contribution after selling the produced goods and getting money. The job of production is possible only due to this role of money. Thus, money is the basis of social distribution of income.

(2) Giving a General Form to Capital:

Money has the maximum liquidity among all forms of capital. That is why a capital in the form of money can be brought into any use. Due to liquidity of money, capital can be drawn from the less productive areas into more productive areas.

(3) Basis of Credit:

Credit instruments are increasingly being used these days. Cheques, bank drafts, bill of exchange, hundi etc. are commonly used for payments. But money is hidden in these credit instruments. Banks issue drafts or allow the use of cheques against liquid money only. Thus, money does the work of credit.

(4) Maximum Satisfaction:

Every consumer wants to get maximum satisfaction. To achieve maximum satisfaction, he wants to spend his income to meet various needs in such a way that he can get equal marginal utility from every commodity. This is possible only through the use of money.

Other Functions:

Besides the functions started above, money does some other functions as well.

A few of these are:

(1) Liquidity:

Money gives liquidity to assets. Due to liquidity, money can be used for any purpose.

(2) Bearer of Option:

We know that money has purchasing power. This purchasing power is of both kinds—present and future. People store money to meet future needs and use that money in future according to their own wishes.

(3) Guarantor of Solvency:

Every person or firm keeps sufficient money in reserve to maintain the ability of solvency. If they don’t have sufficient money for repayment of loans, they lose their ability of solvency and they are declared to be insolvent. Thus, money works as an indicator of guarantee of ability of solvency.

Term Paper # 4. Nature of Money:

It is just a nature of money that serves as means, not as ends. People had been fulfilling their needs through the barter system since ancient times. Invention of money has made this exchange convenient. Today, money plays a crucial role in trade of goods and services, but still it is nothing in itself.

Generally these are misconceptions in the mind of people that having money means having everything. For example, people usually think that if one has eyes, one can see everything. But if somebody is asked in a dark room about the things he is able to see he would answer that he is not able to see anything. It means eyes can see only with the help of light. So, money doesn’t have any value of its own.

Human beings desire to get money as it satisfies various needs. So, it is proved that money is only a means not an end. According to Prof. Pigou, “Money is a garment draped around the body of economic life.” That means money is only a cover (garment), but the main work is done by commodities or services. In other words, money is just a veil, hiding economic strengths.

Term Paper # 5. Importance of Money:

Importance of Money in Modern Economy:

Money plays very important role in the economic life. In today’s world everything whether production, consumption, distribution, saving, investment, employment is influenced by money. According to Prof. Marshall, “Money is a centre around which economic science clusters.”

In fact, he is an owner or a labourer; a teacher or a student; or it is science or literature; employment or saving money is important for everybody and everywhere. Considering the importance of money, Crowther has said, “Money is a basic invention among all the inventions by human beings.”

Money has the following importance in the modern economy:

(1) Basis of Production:

All those sources (or resources) which are used in production are purchased using money. For example, raw materials, machines, labour etc. are obtained after spending money. Again produced goods are sold for money. Without money, raw materials, machines, labour etc., cannot be purchased nor can they be sold. So, money is the basis of production.

(2) Basis of Credit:

It is the era of credit. Credit is also the basis of banking system. Deferred payments are also made using money. If there is no money, the credit system will end.

(3) Capital Formation:

Money helps in capital formation. Everybody earns for livelihood. He also saves some part of his earning for future. When this saving is deposited in any financial institution, it is called investment. This investment is on the basis of capital formation and this capital formation leads to trade and industry development in the economy.

(4) International Co-Operation:

International co-operation in the field of finance, commerce, credit etc. brings economic development. The uses of money also bring closeness among different countries of the world. This strengthens political and cultural relationship. Thus, money plays an important role in promoting international co-operation.

(5) Unit of Account:

Money is a medium to measure the value of any commodity. Thus, it does the function of a unit of book and account. The barter system which existed before the invention of money had no unit of account.

(6) Mobility of Capital:

As a liquid asset, money has the quality of mobility. It can be easily carried from one place to another. A person settling in a place different from his present settlement cannot carry his building or any other immovable assets, but he can sell these assets to acquire money and use that money to purchase the desired assets at the new place.

(7) Mirror of National Progress:

Money market is well developed today. It not only helps in monetary exchange, but also gives so many different indications. A country that has stability in the value of money or least fluctuation is considered to be a developing country. On the contrary, a country is considered to be economically weak if its money has a normal tendency to fall in its value. Thus, money works as the mirror of national progress.

(8) Knowledge about Per Capita Income:

The level of standard of living of citizens of a country is measured on the basis of their per capita income. Now, the per capita income can be measured only in money. It also helps in measuring the prosperity of the country.

(9) Foundation of Capitalism:

It is the era of capitalism. Money is a vital need in such an economy. Financial institutions have taken birth only after the invention of money. It has also led to the availability of capital. So, money is the basis of capitalism.

(10) Freedom from Evils of Barter System:

Barter System gave rise to many difficulties. For example—lack of double coincidence of wants, difficulties in division of goods, difficulties in measuring the value, difficulties in deferred payment, difficulties in storage etc. But money made all exchange easy.

Importance of Money in Planned Economy:

‘Planned Economy’ means predicting the needs of the country for a certain period by the agencies of the country. It is specially taken care in a planned economy that the stability of the value of money is maintained. The reason is simple—if the value of the money drops the investment in planning goes up. In this condition, extra money will be needed to complete the planning. With this, it is also tried that the foreign exchange rate should be stable.

The planned economy can be of two types—’Socialist Economy’ and ‘Mixed Economy’. ‘Socialist Economy’ is the form of economy in which the wages, amount of production, varieties of production, distribution system, prices etc. are controlled by the state. The prime objective of economic activities is not earning profits. So, money doesn’t have an important place in a mixed economy.

Robert Oven has said, “The motive of profit is the prime cause of class- distribution, class-struggle and exploitation in the society and this motive of profit rises due to money. So money should be eliminated”. Simply, Karl Marx has analysed the Theory of Surplus value’ and considered money and cash payment system to be full of drawbacks. According to him, “Money is the main cause of exploitation.”

In his opinion, if money is eliminated, the barter system would automatically come into action. Marx’s opinions about money were decided to be given the practical form after the Bolsheviks came into power in Russia in 1917. He felt that if there is a detailed direct control and distribution of commodities by the government, the use of money could be brought to one end.

But real situations and practical difficulties clarified it within a very short time that these concepts were illusions. Lenin accepted that it was a mistake of Bolsheviks to reject money. Trolsky, too, had accepted the need of money saying that it is essential to speculate the economic planning in commercial terms and for this there is a need of powerful unit of money.

These days, Russia and China come in the category of socialist countries. In these countries the prices are determined by the government, but the prices of goods and rate of exchanges are measured in money only. This proves that the income of money can’t be denied even in a socialist economy.

The main causes behind this situation are:

(1) Difficulty in Making Payment:

In the absence of money, it would be very difficult to pay wages, rents, salaries, dividend etc. If the payments have to be made in goods there would be the need of setting a big network of supply of different commodities under the government control. The number of labourers in a country is very large. So, making payments in goods is impossible.

(2) Difficulty in Money Measurement:

If there would be the barter system in place of money, it would be a big question as to which substance would be the basis of value measurement. If different substances are taken as basis of measurement in different parts of the country, it would cause an economic inequality. Now the important and decisive fact is that if anything has to be used as the basis of value measurement, the best option is money.

(3) Capital Formation:

Even in a capitalist economy, there is a need of huge capital for the foundation of industries and capital formation is impossible without money.

(4) Difficulty in Foreign Trade:

There was a time when international trade was carried by the socialist countries on the basis of bilateral agreements. But it puts a limitation to foreign trade. Now since trade has been globalised, even the socialist countries consider money to be the best option for making payments. Russia, one of the biggest among the socialist countries, is also making payments in money.

As far as the importance of money in the mixed economy is concerned, the first thing to know is that in a mixed economy some production activities are carried by the government and some are in the private hands. Money has the same place in a mixed economy. Most of the countries follow mixed economy in the present era.

The condition is applied to the developed as well as developing or semi-developed countries. The USA and England have mixed economy. India has also adopted the mixed economy to promote the rate of development. Here, the public sector is controlled by the government but the private sector is also encouraged. Money plays an important role in all these activities.

Term Paper # 6. Role of Money in Economic Life:

Money plays a very important role in human life. According to Prof. Marshall, “Money is the pivot around which the whole economic science clusters.” Similarly P. B. Trescott has said, “If money is not the heart of our economic system, it can certainly be considered as its blood stream.”

Money has the following importance in various aspects of Economics:

(1) In the Field of Consumption:

Consumption has the highest place among all economic activities. If there is no consumption the activities of production, demand, supply etc. would come to an end. People use goods and services to fulfill their various needs. Consumers seek maximum satisfaction from their consumption. For this they want to spend their income in various commodities so that they can able to get marginal utility. The concept of Law of Equi-Marginal utility given by Gossen is based on this hypothesis.

Money is the basis of the whole activity of consumption. Income is the basis of consumption and it is indicated in money only. Again the quantity of consumption of a certain goods is determined in money only. Thus money is important with respect to consumption.

(2) In the Field of Production:

Land, capital, labour and organisation are sources of production. These sources can be achieved only with the help of money. The cost of production and selling price are determined in money only. Money encourages savings and savings create capital formation.

The faster process of capital formation in the country is the cause for the higher rate of production because capital plays an important role in setting up of industries. Money is a liquid asset, so it can be made active and hence more productive. The modern division of labour and specialisation are based on money itself. All the factors of production are paid in money only.

(3) In the Field of Exchange:

The production of a commodity is relevant only when it can be sold. The selling price of a commodity depends on its cost of production. In determining the cost of production, some direct expenditure as well as indirect like depreciation, insurance etc., are included.

These expenditures are measured in money only and on the basis of these expenditures the selling price of the commodity is determined. Thus, money plays an important role in the field of exchange. It also promotes international trade. Money is also the basis of credit.

(4) In the Field of Distribution:

Once the production is completed, rent to the landowner, interest to the capital provider, wages for labourer, profit to the entrepreneur etc. have to be distributed i.e., paid in money. The returns for all these are not possible without money. Thus money has a special place in the just distribution of the required national income.

(5) In the Field of Public Finance:

The government plays an important role in the nation’s progress. The government meets the expenditures in the interest of public with public income. The area of public expenditure is very large in any country. Its prediction and expenditure both can be fulfilled by money only. The collections of various kinds of taxes levied by the government are not possible without money. Thus, money has an important place in the field of finance as well.

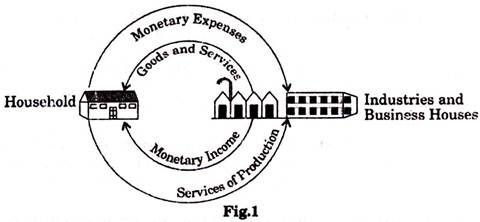

Term Paper # 7. Circular Flow of Money:

There is a circular flow of money in economy. Money that a consumer uses to purchase goods and services reaches to the producer via mediators. Again, from the producer money goes to the consumers by the medium of wages, salaries, rents, profits etc. This cycle moves on.

If a part of wages, salaries, profits etc., goes to the government in the form of taxes, they are spent on the planning of economic welfare. This way money comes back to the consumers.

The above diagram shows clearly that service of production flows from households to industries and business houses where as monetary incomes flow in the opposite direction. Similarly monetary expenses flow from households to workshops and from workshops, goods and services flow towards the households.

On the other hand, services of production are purchased with money and goods as well as services are sold from workshops. As there is circular flow of money in the economy, an economic balance is maintained but a disturbance in the flow of money system leads to economic imbalance.

Out of the investment made in factories and industries if wages, salaries, income, rent etc. which go to the consumers are supposed to be Y and a part of it which the consumer spends is considered to be C (consumption) and the remaining that he saves is considered to be S (savings), we get an equation Y = C + S. Again, if this saving is turned into investment, the equation would be Y = C + I. This sequence in the economy is called the circular flow.

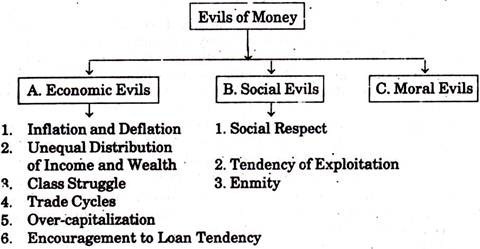

Term Paper # 8. Evils of Money:

Considering the above mentioned importance of money, it can be said that money is the basis of modern economy and it is a boon for human life. But sometimes it becomes a curse for the society as it gives rise to evil practices. Money is also the cause of many evil practices. So keeping in view the evils of money, it has been said, “Money is a good servant but a bad master.”

Evils of money can be classified as follows:

A. Economic Evils:

Economically, money has the following evils:

(1) Inflation and Deflation:

A big problem with money is that its value fluctuates. In this condition, the prices of commodities increase when the value of money reduces. Value of money is inversely proportional to price of commodity i.e. when the value of money increases then the price of the commodity decreases and vice versa. This leads to inflation and deflations. Both of these conditions are not good for the economy.

(2) Unequal Distribution of Income and Wealth:

Inflation and deflation brings profit for a section of the society and loss for other at the same time. Consequently, there is an unequal distribution of income and wealth.

(3) Class Struggle:

Everybody aspires to get money. The rich exploits the poor to get more and more money. As a result, the rich get richer and the poor get poorer. This leads to class struggle in the society. Money is the root of struggle between capital and labour.

(4) Trade Cycles:

Economy addresses ‘booms’ and ‘depressions’ due to inflation and deflation of money. This affects income, employment, prices, savings and investments. Sometimes, this effect is positive and sometimes negative. When the trade cycle is negative, there are many fluctuations in the economy.

(5) Over-Capitalization:

With a rise in the flow of money in the economy, there is an increase in savings and investments. A big part of investment is in the industrial fields. If there are over-investments the return on investment decreases is also a problem of over-production. Over-production, too, leads to depression.

(6) Encouragement to Loan Tendency:

Individuals, society and nations try to show themselves prosperous. Money encourages loan tendency. People try to show themselves rich or prosperous even by taking loans. It is implied to every country.

B. Social Evils:

Money has following social evils:

(1) Social Respect:

It is commonly seen that somebody is considered respectable if he has a lot of money. Due to abundance of money, many of their drawbacks remain hidden. Due to this reason, intellect, labour, honesty etc., don’t get proper place in the society. This reduces social values.

(2) Tendency of Exploitation:

It is commonly seen that a prostitute is condemned for her work, but there are many other contemptible work in the form of various kinds of exploitation in the society. People don’t hesitate to exploit their subordinate in order to get more and more money. Very often voices are raised against exploitation by many organisations.

(3) Enmity:

In most cases, the root cause of enmity is money. There is a common visibility by enmity among brothers or relatives due to money. So, money reduces social peace and affection.

C. Moral Evils:

Money is also the mother of moral evils. It encourages theft, robbery, loot, murder, corruption, prostitution etc.

Conclusion:

On the bases of the above evils of money, it appears in the first glance that money is the root of all evilness, But it is not so in reality. If people control the use of money, it is a boon. That is why it is said, “Money is a good servant, but a bad master.”