Read this article to learn about the top twenty-two frequently asked questions on the Determination of Income and Employment.

Q.1. What are the causes of ‘Excess demand’ or ‘Inflation’?

Ans. Excess demand or inflation is caused by:

(i) Increase in household consumption expenditure due to rise in propensity to consume.

ADVERTISEMENTS:

(ii) Rise in government expenditure

(iii) Rise in private investment demand

(iv) Rise in black money in the economy

(v) Rise in deficit financing

ADVERTISEMENTS:

(vi) Surplus in balance of payment

Q.2. What are the effects of excess demand?

Ans. Effects of excess demand are as follows:

(i) It leads to continuous increase of prices in the economy.

ADVERTISEMENTS:

(ii) The producers start earning abnormal profits.

(iii) With the rise in prices, the purchasing power of consumers goes down, thus they are adversely affected.

(iv) The prices and wages start chasing each other. With the rise in prices the real wages go down, producers are forced by unions to increase the wages which increases the cost of production and further leads to the rise in prices.

(v) It leads to increase in employment if there is some unemployment.

(vi) It results in boom conditions in the trade cycles of the economy.

Q.3. What monetary measures should be taken to correct deficient demand? Explain.

Ans. The monetary measures to be taken to correct deficient demand are as follows:

(i) Bank Rate Policy:

In situation of deficient demand, bank rate is lowered by RBI, which makes the credit cheaper. The fall in rate of interest will increase the investment demand.

ADVERTISEMENTS:

(ii) Open Market Operations:

To encourage investment activities, RBI repurchases securities from commercial bank. With increase in cash, commercial banks are able to extend more credit. Thus the investment activities increase.

(iii) Varying Reserve Ratio:

Both Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) are reduced by RBI which enable the banks to extend more credit.

ADVERTISEMENTS:

(iv) Margin Requirement:

In situation of deficient demand, margin requirements are reduced, thus borrowers are able to get more credit against their securities.

(v) Moral Suasion:

RBI instructs member banks to increase the availability of credit and also to give loans for non essential purposes too.

ADVERTISEMENTS:

Q.4. What fiscal measures should be taken to correct the deficient demand?

Ans. Revenue and expenditure policy of the government is called fiscal policy. The fiscal measures through which deficient demand can be corrected are as under:

(i) Revenue Policy:

In case of deficient demand, the taxes should be reduced by the government. The purchasing power of the people will increase and they will spend more on consumption of goods and services. Thus reduction in taxes by the government will increase the aggregate demand.

(ii) Expenditure Policy:

The government should increase its expenditure on economic activities like building of roads, bridges etc. With the increase in government expenditure, the employment will increase. Increase in wages will increase the purchasing power. Thus, increase in government expenditure will also raise the aggregate demand.

ADVERTISEMENTS:

(iii) Deficit Financing:

To increase the demand the government should take resort to deficit financing. Printing of new notes will increase the purchasing power in the economy.

Q.5. What monetary measures should be taken by RBI to correct excess demand?

Ans. In case of excess demand:

Reserve Bank of India takes the following quantitative monetary measures to restrict the availability of credit.

(i) Bank Rate:

ADVERTISEMENTS:

In case of excess demand, RBI increases the bank rate. The credit becomes costlier, which discourages borrowing. People prefer to deposit in bank. Thus the aggregate demand is reduced.

(ii) Open Market Operations:

In the situation of excess demand. Reserve Bank sells its securities to commercial banks. The cash with commercial banks gets reduced as a result they are forced to advance lesser amount of loans. Open market operations thus also can be an instrument to restrict the availability of credit.

(iii) Varying Reserve Ratios:

In the situation of excess demand, RBI raises the Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR). The cash reserves of the banks get reduced as they are required to keep more cash with RBI, thus they are able to give lesser amount of credit. Increase in SLR also reduces the availability of cash with banks as they will be required to keep more liquid assets than before, and hence will be forced to give lesser credit. Increase in CRR and SLR thus reduces credit in the economy.

The qualitative measures taken by RBI in the situation of excess demand are:

ADVERTISEMENTS:

(i) Margin Requirement:

RBI increases the margin requirement, so that the borrowers become eligible for a lesser amount of credit against their securities. Volume of credit is thus restricted by increasing margin requirements.

(ii) Moral Suasion:

RBI issues letters to banks to restrict credit for essential purposes only and not to lend for speculative purposes. It is also a useful and effective method of restricting availability of credit in the situation of excess demand.

Q.6. What fiscal measures should be adopted in case of excess demand to reduce the budget deficit?

Ans. The fiscal measures used to control excess demand are:

ADVERTISEMENTS:

(i) Revenue Policy:

Taxes are the main source of revenue for the government. In case of excess demand, government raises the tax rates and/or imposes new taxes. The purchasing power of people get reduced. The consumption and investment expenditure is reduced. Increase in taxes increases the government revenue and reduces the aggregate demand.

(ii) Expenditure Policy:

Public expenditure is incurred by the government to improve the quality of life of people. In the situation of excess demand, government reduces its public expenditure. The fall in demand for goods and services by the government will reduce the aggregate demand in the economy.

(iii) Deficit financing:

To correct the excess demand, government reduces deficit financing. Introduction of deficit financing usually fuels the inflation, therefore reducing it helps to pull back excess demand.

Q.7. State the causes of deficient demand.

Ans. The causes of deficient demand are:

(i) Fall in the household consumption expenditure

(ii) Fall in demand for private investment

(iii) Fall in expenditure of the government

(iv) Decrease in money supply or deficit financing

(v) Reduced level of black money in the economy

(vi) Fall in balance of payment

Q.8. Define aggregate demand. What are its components?

Ans. Aggregate demand is the total demand of goods and services in an economy in a year.

The components of aggregate demand are:

(i) Household Consumption Expenditure:

Consumption expenditure of households depends upon the level of disposable income. It includes total expenditure on goods and services by all the households of the country.

(ii) Government Demand for Goods and Services:

It refers to the expenditure by the government on purchase of various goods and services to meet the public needs relating to schools, hospitals, transport, communication, defence etc. Government expenditure depends upon the policies of the government; it is not guided by the profit motive.

(iii) Private Investment Demand:

It refers to the total expenditure on capital goods. It depends upon rate of interest and marginal efficiency of capital.

(iv) Net Exports:

Net exports means demand for country’s goods and services in foreign countries less country’s demand for foreign goods and services.

Net Exports = Exports (X) – Imports (M)

Net export demand depends upon terms of trade, foreign exchange rates, trade policy, balance of payment position etc.

Q.9. What are the determinants of investment? Explain

Ans. Firms invest only when they expect that their investments will be profitable. Factors determining investment demand are:

(i) Revenues from investment:

Revenue is the money receipt from sale of products in the market. Investment is made only when it increases the revenue of the firm.

(ii) Cost of Investment:

Firms generally borrow to make investments. Cost of borrowing funds is the interest which has to be paid on borrowed funds.

(iii) Business Expectations:

Entrepreneurial expectation of the future also determines investment demand. Firms invest only when they expect that their revenue will be more than the cost of investment. Thus firms do assess the future before deciding whether to invest or not.

Q.10. Distinguish between APS and MPS. Which one of these can be negative and when?

Ans. Average propensity to save (APS) is the ratio of total savings and total income.

APS = S/Y

Marginal propensity to save (MPS) is the ratio of change in savings to change in income.

MPS = ∆S/∆Y

Yes, APS can be negative when the consumption expenditure is more than the income.

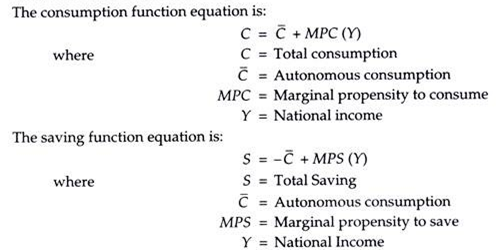

Q.11. What is consumption function? Explain.

Ans. Keynes stated the relation between consumption and income as consumption function. Symbolically,

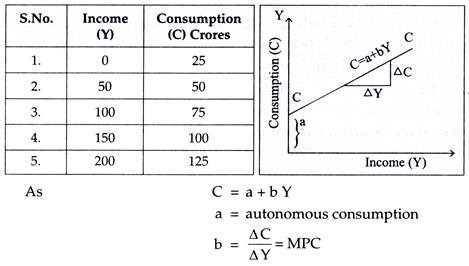

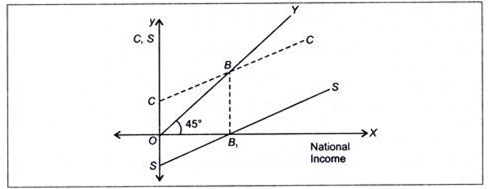

There is a positive or same direction relation between consumption and income. As the level of income changes, consumption also changes. Moreover, the change in consumption is of lesser degree as compared to income, though in the same direction. The concept of consumption function can better be understood by the following schedule and a diagram.

The above diagram states that as the income increases, the level of consumption also increases. The rate of change in consumption is of lesser degree as compared to income. Moreover, there is some consumption even at zero level of income. This is known as autonomous level of consumption which is required to keep one alive.

Q.12. Distinguish between APC and MFC. The value of which of these can be greater than one and when?

Ans. APC and MFC both the measures are derived out of consumption function. One is used as an absolute measure whereas the other is used as relative measure.

The difference between the two can be seen as under:

(a) Average propensity to consume:

This is the ratio of consumption and income. This states the level of consumption w. r .t. the level of income in an economy at a point of time

APC = C/Y

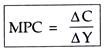

(b) Marginal propensity to consume:

MPC= ∆C/∆Y

This is the ratio of change in consumption and change in income in an economy. This undertakes to explain if there is any change in consumption with the change in income. If yes, then in what measure?

The value of APC can be greater than one. The situation arises when the consumption is more than the income or C >Y. This can be due to some specific reasons as govt., expenditure in developing economies is more than income

Q.13. Give meaning of (i) involuntary unemployment (ii) Full employment and (iii) under employment equilibrium.

Ans. The meanings of the said concepts can be put as under:

(i) Involuntary unemployment:

This is a condition in which people are willing to work at the given wage rate but do not get work. They remain unemployed against their will. Keynes used the word and explained its reason as deficient demand.

(ii) Full Employment:

This is a situation where all the people, except those who are not willing to work, get employment. According to Keynes, structural and voluntary unemployment can occur even at this level.

(iii) Under employment equilibrium:

The word was used by Keynes, as equilibrium can occur even below the level of full employment. This is due to less use of resources i.e., under utilization.

Q.14. Explain the distinction between voluntary and involuntary unemployment.

Ans. Voluntary unemployment is that part of the working force not willing to engage itself in gainful occupation whereas involuntary unemployment is that part of the labour force which is willing and able to work at the prevailing wage rate but is out of work.

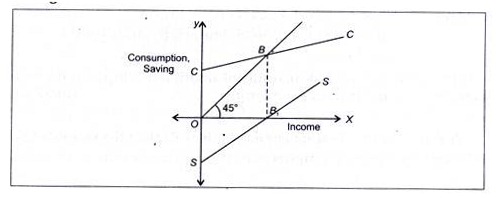

Q.15. Outline the steps taken in deriving saving curve from the consumption curve. Use diagram.

Ans. Steps:

1. Take OS (= OC)

2. Take B1, right below B on the X axis

3. Join S and B1

Q.16. Distinguish between consumption function equation and saving function equation.

Ans.

Q.17. Outline the steps taken in deriving consumption curve from saving curve. Use diagram.

Ans. Steps:

1. Given S curve, take OC as equal to OS.

2. Take a point B1 on the 45° line exactly above point B

3. Join C and B1

Q.18. What is meant by investment multiplier? Explain, the relationship between MPS and investment multiplier.

OR

What is meant by ‘investment multiplier? Explain the relationship between MPC and investment multiplier.

Ans. As per Keynes, the change in investment in an economy results in the change in the income. But this change in income will be in the multiples of the change in investment. Hence, the word investment multiplier.

Multiplier (K)= ∆Y /∆I

if ∆Y= Rs 500 crores and ∆I = Rs 100 crores

K= 500/100 = 5

Relation between multiplier and MPC

K= ∆Y//∆I

But Y= C+ I

∆Y = ∆C+ ∆I

∆I = ∆Y- ∆C

Putting 2 in equation1

K= ∆Y/ ∆Y – ∆C

Divided 3 by ∆ Y upon numerator & denominator

K= ∆Y/∆Y/ ∆Y//∆Y -∆C/∆Y

K= 1/1-MPC (... as MPC= ∆C/∆Y

Or K= 1/MPC (... MPC+ MPS+ 1)

Thus, the value of multiplier will change with the change in MPC. As MPC will increase, the multiplier will also increase and vice versa. On the other hand, MPS has an inverse relation with multiplier i.e. lower the MPS, higher will be the multiplier and vice versa.

Q. 19. Explain the relationship between investment multiplier and marginal propensity to consume.

Ans. Investment multiplier equals = 1/ 1-MPC It shows a direct relationship between MPC and the value of multiplier. Higher the proportion of increased income spend on consumption, higher will be value of investment multiplier.

Q.20. Explain the meaning of investment multiplier? What can be its minimum value and why?

Ans. Investment multiplier was explained by Keynes as the ratio of change in income due to change in investment.

Symbolically, K= 1/ 1- MPC

From the above formula K= 1/1-0 (IF MPC= 0)

K= 1

Thus, the minimum value of multiplier is one

Q.21. A Rs 200 Crore increase in investment leads to a rise in national income by 1,000 crores. Find out marginal propensity to consume.

Ans. Here,

∆Y = 1000 Cr., ∆I = 200 Cr.

By formula K = ∆Y/∆I

K=1000/200 = 5

K= 5

But K = 1/ 1-MFC

5-5 MFC = 1

4=5 MFC

MFC = 4/5 = 0.8 5

So K = 5 and MFC = 0.8

Q.22. Find national income from the following:

Autonomous consumption = Rs 100

Marginal propensity to consume = 0.80

Investment = Rs 50

Ans. y = C + MFC (Y) + I

= 100 + 0.8 Y + 50

0.2Y = 150

Y = 750