The following points highlights the top three theories of profit.

Theory # 1. Profit as a Reward for Innovation:

We can speak of some other types of changes as well in a dynamic economy.

They can be classified into two major types:

(i) Exogenous changes and

ADVERTISEMENTS:

(ii) Innovations.

Some common examples of exogenous changes are earthquake, famine, inflationary situation, unpredictable changes in business conditions, etc., and “windfall profits” may arise on these grounds.

Innovation theory of profit has been popularised by Joseph Schumpeter (1883, 1950). In essence, Schumpeter sees profits as a reward earned by those firms which innovate.

In truth, the real world is far from being perfect. There is need to look into the future and guess the probable level of demand for TV sets or cotton cloth or the price of wheat. One who makes these forecasts is called the entrepreneur. And the major function of the entrepreneur is innovation. And in a dynamic world, there is a fair chance for somebody (the entrepreneur) to develop and promote a new product or find a way to lower costs on an old one. Many try; but few succeed.

ADVERTISEMENTS:

Write Lowes and Sparkes, “Firms which identify new market opportunities, develop new products, or introduce new cost-reducing production processes gain an advantage over competitors, and earn profits, until the advantage is taken over by new firms attracted into the market and competitors imitating the innovation.” So profit is basically a transitory phenomenon. It lasts as long as companies stay one step ahead of their competitors. Profit-earning firms are those that at best are sensing future trends and adapting to change.

According to Schumpeter profit must be regarded as the return to innovators. Furthermore, continuous emergence of profit is a precondition for successful innovation because it acts as incentive and, in that sense, profit is the cause of innovation.

Innovation can be divided into two broad categories:

(i) Cost-reducing innovation like introduction of a new machinery, cheaper process of production, discovery of new sources of raw materials, etc.;

ADVERTISEMENTS:

(ii) Demand-generating innovation like introduction of a new product, superior method of advertisement, discovery of new markets, etc.

In a perfectly competitive economy without patent laws, etc., this profit would be soon competed away because, in the language of Schumpeter – “Imitators are many while innovators are few”.

Therefore, profit can be protected if we can:

(1) Introduce patent laws to protect the advantageous position of the entrepreneur, and

(2) Ensure repeated innovations so that profits continue emerging out them for a long time.

So, according to this view, profits are net wages of management. Profit is taken to be the temporary excess return to innovators or entrepreneurs.

Theory # 2. The ‘Uncertainty-Bearing’ Theory:

According to Knight, the main function of the entrepreneur is to act in anticipation of future events. He produces goods in anticipation of demand and purchases goods in anticipation of resale. Some future events can be insured against, e.g., fire and accident but others are completely uncertain and cannot be insured against, e.g., changes of fashion or taste.

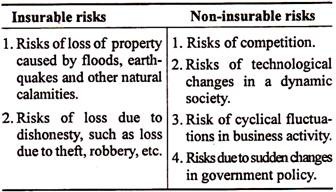

The term Risk covers the first type of events (insurable events) and the term Uncertainty covers the second type (non-insurable events). Knight argues that risk-taking cannot produce profits because the entrepreneur can guard himself against risks by taking out a suitable insurance policy. But uncertain events cannot be guarded against in that way. When an entrepreneur takes upon himself the burden of facing a (non-insurable) uncertain event, like the future demand for a commodity, he expects a remuneration. The remuneration is profit.

According to Knight’s theory, uncertainty- bearing is essential to production; therefore, it is a factor of production and the reward for it is part of the normal cost of production. Also, uncertainty-bearing will be undertaken only if money is earned for it. Therefore, it has a supply price. Profit is the reward for bearing non-insurable risks or uncertainties and the amount of profit earned depends upon the degree of uncertainty-bearing.

ADVERTISEMENTS:

We may now classify the various types of risk as in the Table 16.1:

Table 16.1: Classification of Entrepreneurial Risks

Criticisms:

ADVERTISEMENTS:

The theory is an improvement upon the risk theory. But it is not a satisfactory explanation of profits because of the following reasons:

1. Uncertainty-bearing is only a part of the duties of the entrepreneur. He has other duties also, e.g., organisation and bargaining.

2. Uncertainty-bearing is a psychological concept (like abstinence or waiting) which can be considered a part of the real cost of production. The supply of a factor of production does not depend on real costs but on opportunity costs. Hence, uncertainty-bearing does not determine the supply price of business ability.

3. A part of profit arises from imperfections of competition. Thus, if there are obstacles to the entry of new firms into an industry, the existing firms will earn additional incomes. Such incomes are not due to uncertainty although they are commonly included within the term profits. Monopoly profits come within this category.

ADVERTISEMENTS:

4. It has not been found possible to measure uncertainty in concrete terms. Therefore, the Uncertainty-bearing Theory cannot explain the quantum of profits except in a vague and general way.

Conclusion:

The Uncertainty-bearing Theory does not explain all the elements of profits. But there is no theory of profits which does so. The current trend in economic thinking is to look upon the Uncertainty-bearing Theory as the least unsatisfactory of all profit theories. Therefore, many economists believe in it.

In fact, there are three causes of profits in the long run:

(i) Some entrepreneurs are protected from competition by barriers created by law or otherwise,

(ii) Some are similarly protected by indivisibilities of plants and processes.

ADVERTISEMENTS:

(iii) All entrepreneurs are not equally uncertain about the future.

Profits explained by (i) and (ii) are of the nature of economic rent. Those explained by (iii) are pure profits.

Theory # 3. Profit as Monopoly Return:

A firm under perfect market condition maximises profit in the short run when price becomes equal to marginal cost for its product. But, in the long run, due to the unbridled free entry, profit is competed away and the firm earns only normal profit, that is, wages of routine management which is included in the cost of production.

In the language of W. J .L. Ryan:

“Profits are absent in the state of perfect competition because each entrepreneur has equal opportunities and equal capacities to exploit them.” But, since perfect competition refers to an unreal situation, a brief sketch of profit theory may begin with its elimination. For example, we may mention monopoly revenue although economic usage calls it profit.

Modern business revenue devices may make it possible to prolong the temporary gains of a quasi- monopolistic firm accruing from successful innovations. Moreover, other factor like barriers to entry, product differentiation, etc., may result in the existence of pure profit, both in the short run and in the long run under imperfect competition.

ADVERTISEMENTS:

Many people regard profit a necessary evil but it is the earning of monopoly.

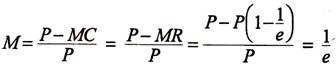

A. P. Lerner has developed a measure conveniently called “degree of monopoly power” which is defined as the excess of price over marginal cost, divided by the original price.

In symbol,

Where M stands for monopoly profit, and other symbols have their usual meanings.

Thus, the more inelastic the demand for a commodity is, the greater will be the scope of exploitation by the monopolist and the greater will thus be the volume of monopoly profit. As Lowes and Sparkes put it: “Profits accrue to companies as a result of the monopoly power which they possess in their markets, which allows them to raise price by restricting output.”

ADVERTISEMENTS:

According to Paul Samuelson profit occurs due to ‘contrived’ or artificial scarcities — a surplus return.